|

시장보고서

상품코드

1689780

비뇨기과 레이저 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Urology Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

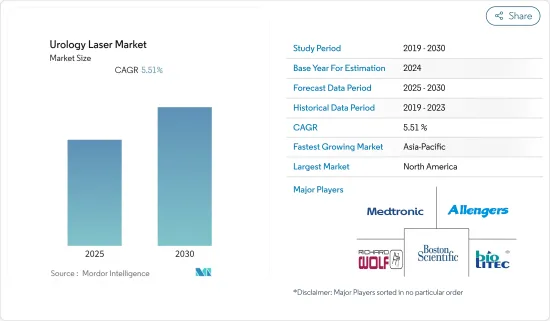

세계의 비뇨기과 레이저 시장은 예측 기간 동안 CAGR 5.51%를 기록할 전망입니다.

COVID-19 팬데믹은 시장 성장에 큰 영향을 미칠 것으로 예상됩니다. 수술실과 마취기는 질병 부담이 큰 지역에서는 일시적으로 호흡 보조 장치로 변경되고 있습니다. Global Predictive Modeling to Inform Surgical Recovery Plans』(2020년 5월 발표)에 따르면, COVID-19 팬데믹의 피크시에 약 250만건의 비뇨기과 양성 수술이 취소되었다고 보고되고 있습니다. 따라서 의료 자원의 낭비를 피하기 위해 트리아지 전략을 채택해야 합니다. 또한 COVID-19 환자에 대응할 때 감염을 방지하기 위한 적절한 보호 시책을 지지해야 합니다.

시장을 견인하는 주요 요인 중 하나는 비뇨기 질환의 높은 유병률입니다. Global Forum on Incontinence, 2020에 따르면 요실금은 인구의 4-8%, 즉 세계에서 약 4억명의 생활에 영향을 미치고 있습니다. 홀뮴 시스템과 톨륨 레이저 치료 시스템에서의 저침슴 외과 처치 채용의 증가가, 비뇨기과 레이저 시장을 촉진하는 주요 요인 중 하나입니다. 이 시스템은 더 높은 효율성, 안전성, 신속한 회복 등 몇 가지 장점을 제공하고 있으며, 그 결과 툴륨 시스템과 홀뮴 시스템 수요가 증가하고 있습니다.

또한, 레이저 수술은 회복 속도, 입원 기간 단축, 출혈량 감소로 인한 전신 통증 완화 등의 이점이 있습니다. 또한 시장의 주요 참여 기업은 빈번한 시장 개척과 승인에 주력하고 있으며, 이것이 예측 기간 동안 시장을 크게 견인한다고 보여지고 있습니다.

비뇨기과 레이저 시장 동향

전립선 비대증(BPH)이 비뇨기과 레이저 시장의 응용 분야에서 가장 높은 수익을 창출할 것으로 예측

전립선 비대증은 전립선의 비대를 수반하는 병리이며 남성에게 많이 보입니다.

전립선 비대증 환자의 대부분은 고령자이며, 고령자 증가에 따라, 이 질환의 부담도 증가하고 있어, 이 부문에 있어서의 레이저 치료 수요를 밀어 올리고 있습니다. 동아시아와 동남아시아는 다른 어느 지역보다 앞으로 수년간 약 3억1,200만명 증가가 전망되고 있습니다. 또한, 고령자의 사이에서 리스크가 높은 방광암의 부담이 세계적으로 증가하고 있는 것도 시장 성장을 촉진할 것으로 예상됩니다.

게다가 2020년 5월에 발표된 「The Prevalence and Associated Factors of Lower Urinary Tract Symptoms Suggestive of Benign Prostatic Hyperplasia in Aging Males(노인 남성에서 전립선 비대증을 시사하는 하부 요로 증상의 유병률과 관련 요인)」이라는 제목의 연구에 따르면, 질병의 유병률은 고령자(70세 이상)에서 가장 높았으며, 약 22.7%에 달했습니다. 2020년 12월에는 호주 St Vincent's Private Hospital의 외과의사 그룹은 가상 바구니 기술에 근거하여 이탈리아에서 설계된 152와트의 레이저를 이용하여 전립선 비대증의 치료에 임하고 있었습니다.

게다가 COVID-19 이후의 대유행이 점차 재개됨에 따라, 의료 제공업체는 BPH 치료에 중점을 두고 있으며, BPH 치료를 위한 적극적인 협력에 대한 낙관적인 접근이 예상됩니다.

예측기간 중 북미가 큰 시장 점유율을 차지할 전망

북미는 현재 비뇨기과 레이저 기기 시장을 독점하고 있으며 요로결석증, BPH, 기타 비뇨기과 관련 질환의 유병률이 증가함에 따라 그 아성은 앞으로 수년은 계속될 것으로 보입니다. 암이나 요실금 등 비뇨기과 질환의 유병률 증가와 수술 시간 단축과 합병증 감소로 인한 저침습 수술에 대한 취향 증가로 북미에서 가장 큰 비뇨기과 레이저 시장이 될 것으로 예상되고 있습니다.

새로운 기술의 출현과 그 채용이 미국에서 조사된 시장의 성장을 뒷받침하고 있습니다. 연간 미국인에 있어서의 방광암의 추정 신규 증례 수는 약 81,400명(남성:6만 2,100명, 여성: 1만 9,300명)으로, 미국에서는 약 17,980명이 방광암으로 인해 사망하고 있습니다.

미국 인구조사국 2019년 추정에 따르면 65세 이상의 인구는 2018-2019년까지 3.2% 증가했으며, 2020년 약 5,600만 명에서 2060년까지 9,400만 명으로 증가할 것으로 예상되고 있습니다. 따라서, 상기 요인이 이 지역의 비뇨기과 레이저 시장의 성장에 기여할 것으로 기대되고 있습니다.

비뇨기과 레이저 산업 개요

비뇨기과 레이저 시장은 적당한 경쟁을 갖고 있으며, 여러 대형 기업으로 구성되어 있습니다. 현재 시장을 독점하고 있는 기업에는 Olympus Corporation, Boston Scientific Corporation, Richard Wolf GmbH, Cook Group, Medtronic, Biolitec AG, Lumenis Ltd 등이 있습니다. 주요 기업은 세계 시장에서의 지위를 유지하기 위해 인수, 제휴, 신제품 출시 등 다양한 전략적 제휴를 실시했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 비뇨기 질환의 유병률 증가

- 기술의 진보

- 낮은 침습 수술에 대한 수요 증가

- 시장 성장 억제요인

- 레이저 시스템의 고비용

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 레이저 유형별

- 홀뮴 레이저 시스템

- 다이오드 레이저 시스템

- 툴륨 레이저 시스템

- 기타 레이저 유형

- 용도별

- 전립선 비대증

- 요로 결석증

- 비근육 침윤성 방광암

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Allengers

- Biolitec AG

- Boston Scientific Corporation

- Cook Group

- El.En. Group

- Lumenis

- Medtronic

- Olympus Corporation

- OmniGuide Holdings Inc.

- Richard Wolf GmbH

- Surgical Lasers Inc.

- Dornier MedTech

제7장 시장 기회와 앞으로의 동향

JHS 25.05.07The Urology Laser Market is expected to register a CAGR of 5.51% during the forecast period.

The COVID-19 pandemic is expected to significantly impact the market's growth. In addition to the effects of the coronavirus on public health, there has been the collateral effect of nearuniversal disruption and cancelation of surgical services, which had unprecedented implications for surgical services and patients with surgical conditions. Operating theaters and anesthesia machines are being temporarily converted to respiratory support units in regions with a high disease burden. Additionally, as per the study titled, 'Elective Surgery Cancellations due to the COVID-19 Pandemic: Global Predictive Modeling to Inform Surgical Recovery Plans,' published in May 2020, approximately 2.5 million urological benign surgeries were reported to have been canceled during the peak disruption of the COVID-19 pandemic. Over the coming weeks, healthcare workers, including urologists, may face increasingly complex challenges. Thus, they should adopt the triage strategy to avoid wasting medical resources. They should also endorse good protection policies to guard against infection when dealing with COVID-19 patients. Owing to the abovementioned factors, the pandemic is likely to have a short-term negative impact on the market studied due to the postponed elective surgeries.

One of the major factors driving the market studied is the high prevalence of urologic conditions worldwide. The prevalence of urinary incontinence is higher in women than in men. According to the Global Forum on Incontinence, 2020, urinary incontinence affects between 4-8% of the population or the lives of almost 400 million people worldwide. Also, the rising adoption of minimally invasive surgical procedures in holmium systems and thulium laser treatment systems is one of the major factors propelling the market for urology lasers. These systems offer several benefits, such as greater efficiency, safety, and rapid recovery, resulting in increased demand for thulium and holmium systems.

Furthermore, laser procedures provide benefits such as faster recovery, shorter hospital stays, decreased blood loss, and lower overall body pain resulting from smaller incisions. Hence, these systems' reliability and safety features are expected to drive market growth. Additionally, key players in the market studied are focusing on frequent product developments and approvals, which is expected to substantially drive the market during the forecast period. For instance, in June 2020, Olympus launched its new Soltive SuperPulsed Laser System (Soltive Laser System), a new application of thulium fiber laser technology designed for stone lithotripsy and soft tissue applications. Thus, such factors are likely to drive the market's growth during the forecast period.

Urology Laser Market Trends

Benign Prostatic Hyperplasia (BPH) Expected to Generate Highest Revenue in the Application Segment of the Urology Laser Market

Benign prostatic hyperplasia is a medical condition involving the enlargement of the prostate gland, and it is highly prevalent in males. It is a non-cancerous growth of the prostate gland originating from the uncontrolled expansion of prostate cells. The common symptoms associated with BPH include frequent urination, urine initiation difficulties, a weak urinary system, and the inability to empty the urinary bladder.

The majority of the benign prostatic hyperplasia patient population is elderly, and as the geriatric population is growing, the burden of this disease is also increasing, boosting the demand for laser treatment in this segment. According to the World Ageing Population report, in 2020, around 727 million people aged 65 years and above were living across the world. Over the next three decades, this older population is expected to increase steadily and more than double, to reach over 1.5 billion by 2050. Eastern and South-eastern Asia are expected to observe the highest increase by about 312 million in the coming years compared to any other region. Moreover, the growing burden of bladder cancer globally, whose risk is higher among the elderly population, is also expected to boost the market growth.

Furthermore, according to the study titled, 'The Prevalence and Associated Factors of Lower Urinary Tract Symptoms Suggestive of Benign Prostatic Hyperplasia in Aging Males,' published in May 2020, disease prevalence was the highest in elderly patients (aged 70 years and above), amounting to about 22.7%. Several new laser treatments are also being studied to improve patient outcomes. For instance, in December 2020, a group of surgeons from St Vincent's Private Hospital, Australia, were working with a 152-watt laser based on virtual basket technology and designed in Italy to treat benign prostatic hyperplasia. Such instances are expected to support market growth.

Additionally, as the post-COVID-19 pandemic is gradually resuming, healthcare providers are shifting their focus toward BPH treatment, and an optimistic approach toward active collaboration for BPH treatments is expected. This will boost the market studied. Hence, positive growth is expected in this segment over the forecast period.

North America Expected to Hold Significant Market Share in the Forecast Period

North America currently dominates the market for urology laser devices and is expected to continue its stronghold for a few more years owing to the increasing prevalence of urolithiasis, BPH, and other urology-related disorders. The US is expected to be the largest market for urology lasers in the North American region owing to the increasing prevalence of urological disorders, such as bladder cancer and urinary incontinence, and the growing preference for minimally invasive procedures due to less operative time and fewer complications.

The emergence of novel technologies and their adoption is helping the market studied to grow in the US. Rising healthcare expenditure is the primary factor responsible for the growth of the healthcare sector in the country. According to the American Cancer Society, the estimated new cases of bladder cancer in Americans in 2020 were around 81,400 (men: 62,100, women: 19,300) and about 17,980 deaths occurred due to it in the US.

According to the US Census Bureau 2019 estimates, the population aged 65 years and above increased by 3.2% from 2018 to 2019, and it is expected to rise from around 56 million in 2020 to 94 million by 2060. The older population is often susceptible to urological diseases, especially urinary incontinence, which is propelling the market growth. Laser therapy seems to be a promising alternative approach to urinary incontinence in women. The country has well-established companies that are continuously engaged in developing new products. In October 2020, Olympus launched the Soltive SuperPulsed Laser System (Soltive Laser System) for the application of thulium fiber laser technology designed for stone lithotripsy and soft tissue applications. Hence, the aforementioned factors are expected to contribute to the growth of the urology laser market in the region.

Urology Laser Industry Overview

The urology laser market is moderately competitive and consists of several major players. In terms of market share, a few major players are currently dominating the market. Some of the companies currently dominating the market are Olympus Corporation, Boston Scientific Corporation, Richard Wolf GmbH, Cook Group, Medtronic, Biolitec AG, and Lumenis Ltd. The key players are involved in various strategic alliances such as acquisitions, collaborations, and new product launches to withstand their position in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Prevalence of Urological Disorders

- 4.2.2 Technological Advancements

- 4.2.3 Rising Demand for Minimally Invasive Surgical Procedures

- 4.3 Market Restraints

- 4.3.1 High Cost of Laser Systems

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Laser Type

- 5.1.1 Holmium Laser System

- 5.1.2 Diode Laser Systems

- 5.1.3 Thulium Laser System

- 5.1.4 Other Laser Types

- 5.2 By Application

- 5.2.1 Benign Prostatic Hyperplasia

- 5.2.2 Urolithiasis

- 5.2.3 Non-Muscle-Invasive Bladder Cancer

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allengers

- 6.1.2 Biolitec AG

- 6.1.3 Boston Scientific Corporation

- 6.1.4 Cook Group

- 6.1.5 El.En. Group

- 6.1.6 Lumenis

- 6.1.7 Medtronic

- 6.1.8 Olympus Corporation

- 6.1.9 OmniGuide Holdings Inc.

- 6.1.10 Richard Wolf GmbH

- 6.1.11 Surgical Lasers Inc.

- 6.1.12 Dornier MedTech