|

시장보고서

상품코드

1689784

고유량 인공호흡기 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)High Flow Ventilators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

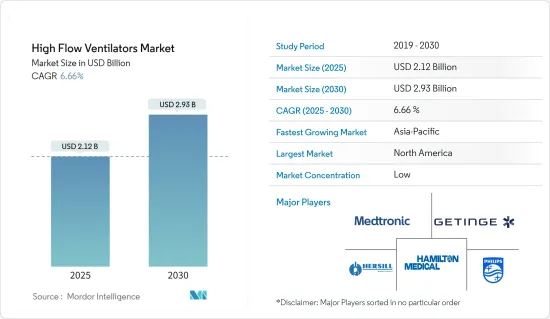

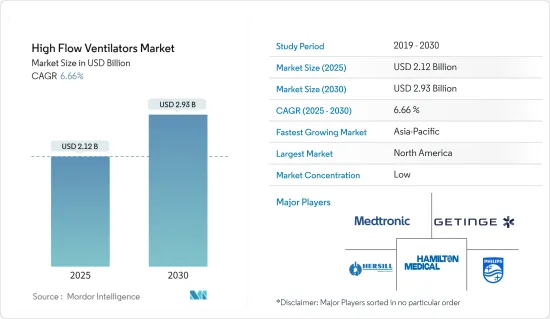

세계의 고유량 인공호흡기 시장 규모는 2025년 21억 2,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 6.66%로 확대되어, 2030년에는 29억 3,000만 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹의 출현은 세계경제와 의료시스템에 악영향을 미쳤습니다. 2021년 4월 National Libray of Medicine에 게재된 조사 결과에 따르면 천식 환자에서 COVID-19의 중증화 위험은 비교적 작았지만, 만성 폐색성 폐 질환(COPD)과 간질성 폐 질환 환자는 COVID-19에 의한 중증화 위험이 소폭 상승한 것으로 보입니다. 고유량 인공호흡기 시장은 COVID-19의 유행성 발병과 함께 세계에서 크게 성장했지만, 세계적으로 COVID-19의 증례가 감소함에 따라 하강 성장을 나타내며 다른 호흡기 질환에 의해 COVID-19의 영향이 감소한 후에도 특정 지역에서는 천천히 안정된 성장을 보인다고 앞서 말했습니다.

현재 호흡기 질환의 유병률과 발생률은 상승하고 있으며, 세계 유병률도 후세로 성장할 것으로 예상됩니다. 2021년 12월 Lung India 잡지에 게재된 연구에 따르면 인도에서는 COPD의 유병률은 7.4%로 추정되고 있습니다. Allergology International에 발표된 연구에 따르면 천식은 폐의 만성 염증성 질환으로 기도 수축과 과민 반응, 천명과 기침을 일으킵니다. 따라서 호흡기 질환의 유병률이 높기 때문에 고유량 인공호흡기 수요가 증가할 것으로 예상되며, 이는 조사 시장의 성장을 밀어 올릴 것으로 예상됩니다.

또한 2021년 11월에 Jama Network에 게재된 기사에 따르면 만성하부호흡기질환(CLRD)은 미국의 사인 중 4위이며 약 1,480만명이 만성폐쇄성폐질환(COPD)으로 진단되고, 2,500만명 이상이 최근 천식을 앓고 따라서 호흡기 질환의 유병률이 증가하여 환자에게 산소 요법을 제공하고 호흡 문제를 극복하는 데 사용되는 고유량 인공호흡기 수요를 촉진하고 있습니다.

예를 들어, 2021년 10월, 호흡 요법 기업인 Movair는 침습적 환기와 비침습적 환기 모두에서 가정, 시설, 병원 또는 휴대용 응용 분야에서 사용하기 위한 고급 인공 호흡기인 Luisa를 출시했습니다.

그러나 호흡기 질환은 경제에 큰 영향을 미치므로 조사 기간 동안 고유량 인공호흡기의 세계 수요를 방해할 수 있습니다.

고유량 인공호흡기 시장 동향

예측 기간 동안 휴대용 고유량 인공 호흡기 부문이 시장에서 큰 점유율을 차지할 전망

휴대용 고유량 인공호흡기 부문은 예측기간을 통해 시장에서 큰 점유율을 차지할 것으로 예상됩니다. 띠형 고유량 인공호흡기는 소형, 휴대성, 사용 용이성, 다용도성, 배터리 수명의 연장에 의해 인공 호흡 케어에 변혁을 가져옵니다 가격은 다른 ICU용 인공 호흡기의 3분의 1 정도로, 침습적 및 비침습적 기능을 모두 갖추고 있기 때문에 위치나 중증도에 관계없이 이상적으로 사용할 수 있습니다.

다양한 병태에서 휴대용 고유량 인공호흡기 사용의 이점을 입증하는 연구는 시장 성장을 뒷받침합니다. 2021년 12월 발표된 Karger Journal 기사에서는 고유량 경비산소(HFNO)가 만성 폐색성 폐 질환(COPD) 환자의 운동 능력, 산소 포화도, 증상을 개선하는 것이 보고되고 있습니다.

시장 진출기업의 제품 출시도 이 부문의 성장을 뒷받침하고 있습니다. 2021년 10월, Movair는 미국에서 Luisa를 발매했습니다. 이것은 가정, 시설, 병원, 또는 침습 및 비침습 환기용 포터블 용도로의 사용을 의도한 선진적인 인공호흡기입니다. 포터블로 컴팩트한 가정용 인공호흡기이며, 미국에서 처음으로 고유량 산소 요법을 가능하게 했습니다.

이와 같이, 상기 요인으로부터, 휴대용 고 유량 인공 호흡기 부문은 예측 기간 동안 성장할 것으로 예상됩니다.

북미가 시장에서 큰 점유율을 차지하고 예측 기간 동안에도 마찬가지다.

북미는 시장에서 큰 점유율을 차지하고 있으며 예측 기간 동안에도 그 우위성을 유지할 것으로 예측됩니다. 연령대 증가와 호흡기 질환 증가입니다. 따라서 호흡기 질환 환자는 치료 목적으로 고유량의 인공호흡기를 필요로 하는 경우가 많아 인공호흡기의 성장 기회를 만들어 시장 성장을 뒷받침하고 있습니다.

게다가 이 지역에서의 제휴, 파트너십, 제품 발표 등 시장 진출기업에 의한 다양한 사업 전략의 채용이 증가하고 있는 것도 시장 확대에 기여하고 있습니다. 2021년 8월, Max Ventilator는 동사의 새로운 인공호흡기 카테고리에 High Flow oxygen Therapy(HFOT) 장치와 WeanX의 발매를 보고했습니다. HFOT 장치는 기존의 인공호흡기보다 적은 운용 비용으로 거의 100%의 생존 확률을 실현해, 부활한 COVID-19 바이러스와의 진행중의 싸움에 힘과 힘을 가할 것입니다.

고 유량 인공 호흡기 산업 개요

조사한 시장은 세분화되어 있으며 경쟁은 중간 정도입니다. 시장의 주요 기업은 Getinge AB, Hamilton Medical, HERSILL, Koninklijke Philips NV, Medtronic, ResMed, VYAIRE, and Asahi Kasei (ZOLL Medical Corporation) 등이 있습니다. 이들 기업은 시장에서의 지위를 유지하기 위해 제품의 혁신과 기술의 진보에 적극적으로 임하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 호흡기 질환의 유병률 증가

- 중환자 치료에 있어서의 하이엔드 기술의 채용 증가

- 노인 증가

- 시장 성장 억제요인

- 호흡기 질환의 경제적 영향

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 모달리티별

- 휴대용 고유량 인공호흡기

- 트롤리 탑재형 고유량 인공호흡기

- 최종 사용자별

- 병원

- 외래수술센터(ASC)

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Getinge AB

- Hamilton Medical

- HERSILL

- Koninklijke Philips NV

- Medtronic PLC

- Movair

- VYAIRE

- Asahi Kasei(ZOLL Medical Corporation)

제7장 시장 기회와 앞으로의 동향

JHS 25.05.07The High Flow Ventilators Market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 2.93 billion by 2030, at a CAGR of 6.66% during the forecast period (2025-2030).

The emergence of the COVID-19 pandemic had an adverse effect on the world economy and the healthcare system. The lockdown all over the globe affected the supply chain of pharmaceuticals, medical devices, and biotechnological products. The severe impact of the SARS-CoV-2 virus on people with existing respiratory diseases/disorders further increased the risk for the target population. For instance, as per the research study published in the National Libray of Medicine in April 2021, the risk of severe COVID-19 in people with asthma was relatively small but people with Chronic obstructive pulmonary disease (COPD) and interstitial lung disease appeared to have a modestly increased risk of severe disease due to COVID-19. This was expected to increase the market growth for high-flow ventilators. Therefore, the above-mentioned stated that the high flow ventilators market grew significantly around the world with the emergence of the COVID-19 pandemic, but it would see a downward growth with the decreasing cases of COVID-19 globally, and slowly the market would show steady growth in certain geographies even after the reduction in the impact of the COVID-19 due to other respiratory diseases.

The prevalence and incidence of respiratory illness is rising currently and the global prevalence of the diseases is expected to grow in posterity. People who work in drug manufacturing, and antibiotics manufacturing factories complain about breathing issues and work-related asthma is becoming more prevalent among this target population. For instance, according to the study published in the Lung India in December 2021, COPD is estimated to be 7.4% prevalent in India. COPD was found to be prevalent in 11 percent of urban areas and 5.6 percent of rural areas. Moreover, as per the study published in Allergology International in January 2022, Asthma is a chronic inflammatory disease of the lungs that causes airway constriction and hyperresponsiveness, as well as wheezing and coughing. Approximately 1,177,000 people in Japan are being treated for asthma. Hence, owing to the high prevalence of respiratory diseases, the demand for high-flow ventilators is expected to increase which is expected to boost the growth of the studied market.

Moreover, the article published in Jama Network in November 2021 stated that chronic lower respiratory disease (CLRD) is the fourth leading cause of death in the United States, and approximately 14.8 million people have been diagnosed with chronic obstructive pulmonary disease (COPD) and more than 25 million people have asthma recently. Therefore, the growing prevalence of respiratory diseases is driving the demand for high-flow ventilators used for providing oxygen therapy to patients and overcoming breathing issues. Thereby, driving the growth of the studied market.

Technological advancement in the ventilators product by the market players is expected to boost the market over the forecast period.For instance, in October 2021, Movair, a respiratory therapy company launched Luisa, an advanced ventilator intended for use in homes, institutions, hospitals or portable applications for both invasive and non-invasive ventilation.

However, respiratory diseases have a high impact on the economy, and this may hamper the global demand for high-flow ventilators in the studied period.

High Flow Ventilators Market Trends

The Portable High Flow Ventilators Segment is Expected to Hold Significant Share in the Market Over the Forecast Period

The portable high-flow ventilators segment is expected to hold a significant share in the studied market through the forecast period. This can be attributed to the rising adoption of these ventilators, due to integrated gaussmeter, superior monitoring capabilities, and advanced modes. The transport of patients within a hospital setting is a common event that exposes patients to risks normally not encountered in a stationary environment. Moreover, portable high-flow ventilators transform ventilatory care through their small size, portability, ease of use, versatility, and extended battery life. By costing as little as a third of other ICU ventilators and offering both invasive and noninvasive capabilities, they are ideally suited, no matter what their location or severity. These factors are expected to impel the segment's development in the forecasted period.

The studies demonstrating the benefits of the usage of portable high-flow ventilators in different disease conditions are also boosting the growth of the market. For instance, a Karger Journal article published in December 2021 reported that High-flow Nasal Oxygen (HFNO) improves exercise capacity, oxygen saturation, and symptoms in patients with chronic obstructive pulmonary disease (COPD). It also concluded that in patients with Chronic obstructive pulmonary disease, there is severe exercise limitation, and HFNO delivered by a battery-supplied portable device was more effective in improving walking distance than usual oxygen supplementation. Such studies suggest the usage of portable high-flow ventilators is beneficial in reducing symptoms and daily activities and thus expected to drive the segment's growth in the given timeframe.

The launch of products by the market players is also propelling the growth of the segment. For instance, in October 2021, Movairlaunched Luisa in the United States. It is an advanced ventilator intended for use in homes, institutions, hospitals, or portable applications for both invasive and non-invasive ventilation. Luisa is a portable and compact home ventilator now available in the United States and one of the first with the added benefit of high-flow oxygen therapy. Such launches are propelling the growth of the segment.

Thus, owing to the abovementioned factors, the portable high-flow ventilators segment is expected to show growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America accounted for a significant market share, and it is estimated to maintain its dominance over the forecast period. The United States is a hub for technological advancements and has a well-established healthcare infrastructure. The key factors driving the market are the increasing geriatric population and the growing number of respiratory diseases in the country. For instance, according to the Asthma and Allergy Foundation of America (AAFA), in April 2022, roughly 1 in 13 Americans had asthma, which is about 25 million people. As per the same source, about 5.1 million American children have asthma under the age of 18. The Asthma and Allergy Foundation of America (AAFA) stated that asthma is more common in female adults than in male adults. Around 9.8% of female adults have asthma, compared to 6.1% of male adults. Thus, patients with respiratory illness often require high-flow ventilators for treatment purposes, creating opportunities for the ventilators, and thereby boosting the market growth.

Furthermore, the increasing adoption of various business strategies by the market players such as collaborations, partnerships, and product launches in the region is also contributing to the market expansion. For instance, in August 2021, Max Ventilator reported the launch of the High Flow oxygen Therapy (HFOT) device and WeanX in its new ventilator range category. The HFOT device gives nearly 100 percent chances of survival with less operating costs than a traditional ventilator, adding force and strength to the ongoing battle against a resurgent COVID-19 virus. Thus, the aforementioned factors are expected to drive market growth in the region during the forecast period.

High Flow Ventilators Industry Overview

The studied market is fragmented and moderately competitive. Some of the key players in the market include companies, such as Getinge AB, Hamilton Medical, HERSILL, Koninklijke Philips NV, Medtronic, ResMed, VYAIRE, and Asahi Kasei (ZOLL Medical Corporation). These companies are actively involved in product innovations and technological advancements to sustain their positions in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Respiratory Diseases

- 4.2.2 Increasing Adoption of High-end Technologies in Critical Care

- 4.2.3 Increasing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Economic Impact of Respiratory Disorders

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Modality

- 5.1.1 Portable High Flow Ventilators

- 5.1.2 Trolley Mounted High Flow Ventilators

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Getinge AB

- 6.1.2 Hamilton Medical

- 6.1.3 HERSILL

- 6.1.4 Koninklijke Philips NV

- 6.1.5 Medtronic PLC

- 6.1.6 Movair

- 6.1.7 VYAIRE

- 6.1.8 Asahi Kasei (ZOLL Medical Corporation)