|

시장보고서

상품코드

1689815

아쿠아포닉스 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Aquaponics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

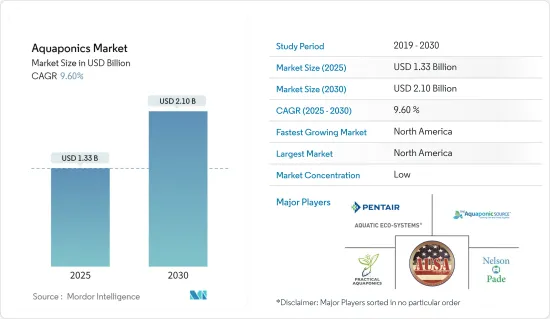

세계의 아쿠아포닉스 시장 규모는 2025년에 13억 3,000만 달러로 추정되며, 예측기간 중(2025-2030년) CAGR은 9.6%로, 2030년에는 21억 달러에 달할 것으로 예측되고 있습니다.

COVID-19 팬데믹은 아쿠아포닉스 시장공급망에 큰 영향을 미쳤습니다.

2021년 북미가 아쿠아포닉스 시장에서 가장 큰 점유율을 차지했습니다. 아쿠아포닉스는 이 지역에서는 소규모이지만 급격히 성장 중인 산업이며, 교육 및 연구기관과 비공개회사간에 몇가지 제휴가 이루어지고 있습니다. 하지만 Superior Fresh와 Ouroboros Farms와 같은 농장이 상업적인 아쿠아포닉스 생산의 최전선에 있지만, 이 지역에서는 아쿠아포닉스 작물의 대량 생산은 아직 형성되지 않았습니다.

아쿠아포닉스 시장 동향

유기농산물에 대한 큰 수요가 시장을 견인

아쿠아포닉스는 화학비료나 작물보호화학제품을 사용하지 않고 물고기의 배설물이 식물의 주요 영양소로 작용하기 때문에 유기재배작물에 대한 수요는 높은 가능성을 지니고 있으며, 신흥 아쿠아포닉 농장과 아쿠아포닉 시스템 제공업체에게 미개척의 공간이 되고 있습니다. Organic Trade Association(Organic Trade Association)의 보고서에 따르면 유기농 과일 및 채소 매출은 전년 164억 2,000만 달러에서 2018년에는 5.6% 증가한 174억 달러였습니다. 이와 같이 미국은 유기농 과일 및 채소의 주요 시장 중 하나가 되었습니다. 유기농 산물 산업에서 아쿠아 포닉 농업의 기초 범위의 결과로 유럽이 자금을 제공 한 COST Action FA1305 "EU 아쿠아포닉스 허브 - EU 테이너블 생선과 야채의 통합 생산 실현은 연구자와 민간 기업 간의 네트워크를 강화했습니다.

북미가 시장을 독점

북미에서는 아직 작은 산업이지만, 아쿠아포닉스 농업은 향후 수년간 비약적인 성장이 전망될 예정입니다. 또한, 아쿠아포닉스는 미국의 수산 양식업의 재건에도 도움이 될 것으로 기대되고 있습니다. 위스콘신주에서는 최근 양식장의 수가 2,300에서 2,800곳으로 증가했으며, 2018년 America Conference에서 밝혀진 바와 같이 500개의 새로운 농장 중 300개가 아쿠아포닉스 농장이었습니다. 현재 미국은 연간 소비하는 수산물의 80.0% 이상을 수입하고 있습니다.

아쿠아포닉스 산업 개요

아쿠아포닉스 시장은 주로 시장의 발전적 성질 때문에 매우 세분화되어 있습니다. 가장 활발한 아쿠아포닉스 농장에는 Superior Fresh, Ouroboros Farms, Garden City Aquaponics Inc., BIGH, Deep Water Farms, Madhavi Farms 등이 있습니다. 아쿠아포닉스 투입자재를 공급하는 주요 기업에는 Aquatic Eco-System Inc. (PAES), Nelson & Pade Aquaponics, Practical Aquaponics, Aquaponics USA, The Aquaponic Source 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 성장 시스템

- 미디어 충전 침대

- 콘스턴트 플로우

- 간만류(홍수와 배수)

- 영양막법(NFT)

- 래프트 또는 심해배양(DWC)

- 미디어 충전 침대

- 시설 유형

- 폴리 또는 유리 온실

- 실내 수직 농장

- 기타 시설 유형

- 물고기 유형

- 틸라피아

- 메기

- 잉어

- 송어

- 관상어

- 기타 물고기

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 영국

- 프랑스

- 독일

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 말레이시아

- 인도네시아

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 아쿠아포닉스 자재 공급자

- 아쿠아포닉스 팜

- 시장 점유율 분석

- 아쿠아포닉스 자재 공급자

- 아쿠아포닉스 팜

- 기업 프로파일 - 아쿠아포닉스 자재 공급자

- Pentair Aquatic Eco-System Inc.(PAES)

- Nelson & Pade Aquaponics

- Practical Aquaponics

- Aquaponics USA

- The Aquaponic Source

- 기업 프로파일 - 아쿠아포닉스 팜

- Superior Fresh

- Ouroboros Farms

- Garden City Aquaponics Inc.

- BIGH

- Deep Water Farms

- Madhavi Farms

- ECF Farm Berlin

제7장 시장 기회와 앞으로의 동향

제8장 시장에 대한 COVID-19의 영향 평가

JHS 25.05.07The Aquaponics Market size is estimated at USD 1.33 billion in 2025, and is expected to reach USD 2.10 billion by 2030, at a CAGR of 9.6% during the forecast period (2025-2030).

The COVID-19 pandemic majorly impacted the supply chain of the aquaponics market. Supply chain disruptions amid the pandemic led farmers to rear many live fishes and other aquatic species, which negatively impacted the farmers' cost, expenditure, and risk.

In 2021, North America occupied the largest share in the aquaponics market. The United States contributed the largest share in the region, followed by Canada. Aquaponic is a small but rapidly growing industry in the region, with several partnerships among educational and research institutions and private companies. This factor played a pivotal role in establishing and increasing awareness about aquaponic farms. However, mass-scale production of aquaponic crops is yet to take form in the region, although farms such as Superior Fresh and Ouroboros Farms are at the forefront of commercial aquaponics production.

Aquaponics Market Trends

Substantial Demand for Organic Produce Driving the Market

As aquaponics are free from chemical fertilizers and crop protection chemicals, with fish waste serving as the prime nutrients for plants, the demand for organically grown crops holds high potential and an untapped space for emerging aquaponic farms and aquaponic system providers. As reported by the Organic Trade Association, sales of organic fruits and vegetables rose by 5.6% to USD 17.40 billion in 2018 from USD 16.42 billion in the previous year. Thus, the United States became one of the leading markets for organically grown fruits and vegetables. Moreover, Europe holds one of the largest organic farmland areas globally, with Spain accounting for the largest share with 2,246,475.0 ha of the area under organic farming. As a result of the underlying scope for aquaponic farming in the organic produce industry, the European-funded COST Action FA1305, 'The European Union Aquaponics Hub-Realising Sustainable Integrated Fish and Vegetable Production for the EU', strengthened the network between researchers and private players. Therefore, the demand for organically grown produce is expected to drive the global aquaponics industry during the forecast period.

North America Dominates the Market

Although still a small industry in North America, aquaponic farming is expected to witness exponential growth in the coming years. In 2014, the University of Wisconsin - Stevens Point and Nelson and Pade Aquaponics entered a Public-Private Partnership (PPP) to establish an Aquaponics Innovation Center as part of the UW-System Economic Development Incentive Grant. Such initiatives have played a pivotal role in raising awareness about sustainable farming alternatives, such as aquaponics, in the region. Additionally, aquaponics is expected to help rebuild the aquaculture industry in the United States. In Wisconsin, the number of aquaculture farms recently rose from 2,300 to 2,800, with 300 out of the 500 new farms being aquaponic farms, as revealed at the Aquaculture America Conference in 2018. Currently, the United States imports more than 80.0% of the seafood it consumes annually. The rising number of aquaponic farms in the country may help it reduce its seafood import over time.

Aquaponics Industry Overview

The aquaponics market is highly fragmented, primarily due to the evolving nature of the market. Some of the most active aquaponic farms are Superior Fresh, Ouroboros Farms, Garden City Aquaponics Inc., BIGH, Deep Water Farms, and Madhavi Farms. Some major aquaponic input providers are Pentair Aquatic Eco-System Inc. (PAES), Nelson & Pade Aquaponics, Practical Aquaponics, Aquaponics USA, and The Aquaponic Source. As the market is still expanding, emerging players are strategizing product launches and capacity expansions to secure a substantial share in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Growing System

- 5.1.1 Media Filled Beds

- 5.1.1.1 Constant Flow

- 5.1.1.2 Ebb and Flow (Flood and Drain)

- 5.1.2 Nutrient Film Technique (NFT)

- 5.1.3 Raft or Deep Water Culture (DWC)

- 5.1.1 Media Filled Beds

- 5.2 Facility Type

- 5.2.1 Poly or Glass Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Other Facility Types

- 5.3 Fish Type

- 5.3.1 Tilapia

- 5.3.2 Catfish

- 5.3.3 Carp

- 5.3.4 Trout

- 5.3.5 Ornamental Fish

- 5.3.6 Other Fish Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Malaysia

- 5.4.3.4 Indonesia

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.1.1 Aquaponics Input Providers

- 6.1.2 Aquaponic Farms

- 6.2 Market Share Analysis

- 6.2.1 Aquaponics Input Providers

- 6.2.2 Aquaponic Farms

- 6.3 Company Profiles - Aquaponics Input Providers

- 6.3.1 Pentair Aquatic Eco-System Inc. (PAES)

- 6.3.2 Nelson & Pade Aquaponics

- 6.3.3 Practical Aquaponics

- 6.3.4 Aquaponics USA

- 6.3.5 The Aquaponic Source

- 6.4 Company Profile - Aquaponic Farms

- 6.4.1 Superior Fresh

- 6.4.2 Ouroboros Farms

- 6.4.3 Garden City Aquaponics Inc.

- 6.4.4 BIGH

- 6.4.5 Deep Water Farms

- 6.4.6 Madhavi Farms

- 6.4.7 ECF Farm Berlin