|

시장보고서

상품코드

1689861

망막 초자체 수술 기기 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Vitreoretinal Surgery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

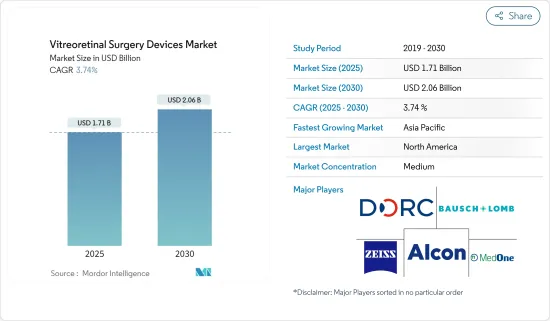

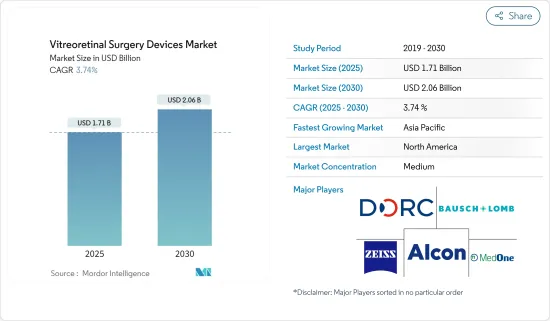

망막 초자체 수술 기기 시장 규모는 2025년에 17억 1,000만 달러로 추정·예측되며, 예측 기간(2025-2030년)의 CAGR은 3.74%로, 2030년에는 20억 6,000만 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 전례 없는 건강 문제로 다양한 수술에 부정적인 영향을 미쳤습니다. 긴급하지 않은 수술은 하지 말라는 규제 당국의 엄격한 지침으로 인해 전염병 기간 중 수술 건수는 급격히 감소했습니다. 예를 들어 2021년 9월 PubMed Central이 발표한 연구에 따르면 COVID-19는 초기 단계의 당뇨병성 망막증의 임상 치료에 큰 영향을 미쳤다고 합니다. 따라서 COVID-19는 연구 시장에 영향을 미쳤습니다. 그러나 COVID-19 확진자 수가 감소하고 광범위한 백신 접종 프로그램이 시행됨에 따라 향후 수년간 조사 시장은 COVID-19 이전 수준의 잠재력을 회복할 것으로 예상했습니다.

당뇨병성 망막증 및 황반원공과 같은 안과 질환의 발생률 증가와 노령 인구 증가는 예측 기간 중 연구 시장의 성장을 가속할 것으로 예측됩니다. 예를 들어 2021년 5월 국립의학도서관이 발표한 연구에 따르면 당뇨병성 망막증은 여전히 당뇨병의 흔한 합병증이며, 성인 노동 인구에서 예방 가능한 실명의 주요 원인으로 나타났습니다. 당뇨병 환자 중 당뇨병성 망막증 유병률은 22.27%, 시력을 위협하는 당뇨병(VTDR)은 6.17%, 임상적으로 중요한 황반부종(CSME)은 4.07%였습니다.

대부분의 안질환은 황반변성과 같이 노화와 관련된 질환입니다. 전 세계 노령 인구가 증가함에 따라 안과 질환의 부담은 증가할 것으로 예상되며, 이는 조사 대상 시장의 성장을 증가시킬 가능성이 높습니다. 예를 들어 World Population Aging Highlights United Nations 2022 보고서에 따르면 2022년에는 전 세계 65세 이상 인구가 7억 7,100만 명에 달할 것으로 예측됩니다. 노인 인구는 2030년에는 9억 9,400만 명, 2050년에는 16억 명에 달할 것으로 예측됩니다. 노인들은 당뇨망막병증, 황반원공 등의 안질환을 동반하는 경우가 많기 때문에 노인 인구 증가로 인해 이러한 질환을 치료하는 망막유리체 수술 장비의 채택이 늘어날 것으로 예측됩니다.

각 업체들은 발자취를 넓히기 위해 신제품 출시 및 제휴에 적극적으로 나서고 있습니다. 예를 들어 DORC는 2021년 1월 TissueBlue for Staining of the ILM During Vitreoretinal Surgery(망막유리체 수술 중 ILM 염색용 TissueBlue)의 캐나다 보건부 승인을 획득했습니다. 경계막(ILM)을 선택적으로 염색하여 안과 수술을 지원하기 위해 캐나다 보건부가 승인한 최초의 염료입니다. 이러한 개발은 예측 기간 중 시장 성장을 가속할 것으로 예측됩니다.

따라서 황반변성, 당뇨망막병증, 황반원공과 같은 안질환의 발생률 증가와 노령 인구 증가 등의 요인으로 인해 망막유리체 수술 장비 시장은 예측 기간 중 성장할 것으로 예측됩니다. 그러나 수술로 인한 부작용이 예측 기간 중 시장 성장을 억제할 것으로 예측됩니다.

망막 초자체 수술 기기 시장 동향

망막 후유리체 수술은 예측 기간 중 큰 시장 점유율을 차지할 것으로 예측됩니다.

망막후면유리체수술(Pars plana vitrectomy: PPV)은 망막박리, 유리체출혈, 안구내염, 황반원공 등의 병태를 통제된 폐쇄시스템으로 치료하기 위해 후안부에 접근할 수 있는 망막유리체수술에서 일반적으로 채택되고 있는 수술법입니다. 당뇨병성 망막증, 후방 유리체 박리 등 안구 후방과 관련된 질환/장애의 높은 유병률은 후방 유리체 수술(망막 및 유리체 관련 질환의 치료에 사용되는 외과적 시술)에 대한 수요를 촉진하고 있으며, 이는 망막 유리체 후방 수술 부문의 성장에 큰 영향을 미칠 것으로 예측됩니다.

예를 들어 2021년 8월 PLOS ONE에 발표된 논문에 따르면 당뇨병성 망막증(DR)은 당뇨병의 가장 흔한 심각한 합병증 중 하나라고 합니다. 이는 고혈당으로 인한 눈의 혈관 손상으로 정의됩니다. 이 정보원은 또한 독일에서 이 합병증의 유병률은 의료 부문에 따라 다르지만 약 10%에서 30%에 달한다고 밝혔습니다. 따라서 당뇨병성 망막증의 높은 유병률은 해당 부문의 성장을 가속할 것으로 예측됩니다.

또한 2021년 7월 WebMD가 발표한 기사에 따르면 망막박리의 연간 발생률은 약 10,000명 중 1명, 평생 약 300명 중 1명이라고 합니다. 따라서 망막 후유리체 수술 분야는 망막 유리체 수술 장비 시장에서 큰 비중을 차지할 것으로 예측됩니다. 또한 이러한 질환은 노년층과 관련된 경우가 많기 때문에 노인 인구 증가도 시장 성장을 가속할 것으로 예측됩니다.

따라서 당뇨병성 망막증, 후방 유리체 박리 등 안구 후방 관련 질환/장애의 높은 유병률 등의 요인으로 인해 망막 유리체 후방 수술 분야는 예측 기간 중 큰 시장 점유율을 차지할 것으로 예측됩니다.

예측 기간 중 북미가 큰 시장 점유율을 차지할 것으로 예측됩니다.

북미는 망막 유리체 수술 장비 시장에서 큰 비중을 차지할 것으로 예측됩니다. 이 지역은 안질환의 유병률과 부담이 높고, 노령 인구가 증가함에 따라 예측 기간 중에도 비슷한 추세를 보일 것으로 예측됩니다. 예를 들어 2022년 5월 BMC Ophthalmology에서 발표한 논문에 따르면 당뇨병성 망막증(DR)은 당뇨병의 실명 가능성이 있는 합병증으로 간주되며, 미국에서는 매년 당뇨병 환자의 약 28%가 앓고 있다고 합니다. 당뇨망막병증은 보통 연 1회 검진을 통해 발견할 수 있지만, 당뇨병을 앓고 있는 많은 미국인들은 시각 장애나 실명을 예방하기 위한 정기적인 검진을 받지 않고 있습니다. 당뇨병성 망막증은 특히 병원 환경에서 발견되지 않는 경우가 많은데, 당뇨병 입원 환자의 약 44%의 유병률이 있는 것으로 추정되며, 그 중 절반 이상이 지금까지 진단되지 않은 것으로 알려져 있습니다.

또한 망막 유리체 수술은 주로 노인에게 발병하는 안질환의 치료에 권장되는 경우가 많기 때문에 국내 노인 인구 증가도 시장 성장을 가속할 것으로 예측됩니다. 예를 들어 유엔인구기금 대시보드가 2022년에 업데이트한 데이터에 따르면 2022년에는 캐나다 전체 인구의 19%가 65세 이상이 될 것으로 추정됩니다.

각 회사는 발자취를 넓히기 위해 제품 출시 개발, 기술 혁신, 제휴, 협력에 적극 나서고 있습니다. 예를 들어 2022년 3월 칼자이스 메디텍(Carl Zeiss Meditec AG)은 미국 식품의약국(FDA)으로부터 백내장 유화제거 및 전안부 유리체 수술에 사용되는 QUATERA 700 장비에 대한 510(k) 시판 전 승인을 획득했습니다. 이러한 개발은 예측 기간 중 시장 성장을 가속할 것으로 예측됩니다.

따라서 이 지역의 높은 안질환 유병률과 부담, 노인 인구 증가 등의 요인이 예측 기간 중 시장 성장을 가속할 것으로 예측됩니다.

망막 초자체 수술 기기 산업 개요

망막 유리체 수술 장비 시장은 세계 및 지역적으로 사업을 전개하는 기업이 존재하므로 중간 규모 시장입니다. 경쟁 구도에는 Dutch Ophthalmic Research Center International BV, Bausch &Lomb Inc., OCULUS Optikgerate GmbH, MedOne Surgical Inc. 등 시장 점유율을 가지고 인지도가 높은 기업의 제품 발매, 인수, 제휴, 계약에 기반한 분석이 포함됩니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 안질환의 발생률 증가

- 노년 인구의 증가

- 시장 성장 억제요인

- 시술에 의한 부작용

- Porter's Five Forces 분석

- 신규 진출업체의 위협

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

제5장 시장 세분화

- 제품 유형별

- 퍼플루오로 카본 액체

- 내시경용 기구

- 망막 초자체용 프리필드 실리콘 오일 시린지

- 정맥 절개 시스템

- 기타 제품 유형

- 수술 유형별

- 망막 전부 초자체 수술

- 망막 후 초자체 수술

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Dutch Ophthalmic Research Center International BV

- Bausch & Lomb Inc.

- OCULUS Optikgerete GmbH

- BVI

- MedOne Surgical Inc.

- Alcon

- Carl Zeiss

- Topcon Corporation

- Hoya Corporation

- GEUDER AG

제7장 시장 기회와 향후 동향

KSA 25.05.14The Vitreoretinal Surgery Devices Market size is estimated at USD 1.71 billion in 2025, and is expected to reach USD 2.06 billion by 2030, at a CAGR of 3.74% during the forecast period (2025-2030).

The COVID-19 pandemic was an unprecedented health concern and adversely affected various surgical procedures. Due to regulatory authorities' strict guidance to prevent any non-emergent surgeries, the volume of surgeries drastically decreased throughout the pandemic. For instance, as per the research study published by PubMed Central in September 2021, the COVID-19 pandemic significantly impacted the clinical care for diabetic retinopathy during the early phase. Thus, COVID-19 had an impact on the studied market. However, with the decreasing number of COVID-19 cases and wide-scale vaccination programs, the studied market was expected to regain its pre-COVID-19 level potential over the coming years.

The increasing incidence of eye disorders such as diabetic retinopathy and macular holes and the increasing geriatric population is attributed to driving the growth of the studied market over the forecast period. For instance, according to the research study published in May 2021 by the National Library of Medicine, diabetic retinopathy remained a common complication of diabetes mellitus and a leading cause of preventable blindness in the adult working population. Among the people with diabetes mellitus, the prevalence of diabetic retinopathy was 22.27%, 6.17% for vision-threatening diabetes mellitus (VTDR), and 4.07% for clinically significant macular edema (CSME).

Many eye disorders are age-associated, like macular degeneration. With the growing global geriatric population, the burden of eye diseases is expected to increase, which is likely to augment the growth of the studied market. For instance, according to World Population Aging Highlights United Nations 2022 report, it was found that in 2022 there were 771 million people aged 65 years or over globally. The older population is projected to reach 994 million by 2030 and 1.6 billion by 2050. As older adults are often associated with eye disorders such as diabetic retinopathy and macular holes, the rising geriatric population is expected to enhance the adoption of vitreoretinal surgery devices to treat such diseases.

The companies are actively involved in new product launch developments and collaborations to expand their footprint. For instance, in January 2021, DORC received Health Canada approval of TissueBlue for Staining of the ILM During Vitreoretinal Surgery. TissueBlue is the first dye approved by Health Canada to aid in ophthalmic surgery by selectively staining the internal limiting membrane (ILM). Such development is expected to drive the market's growth over the forecast period.

Hence, owing to the factors such as the increasing incidence of eye disorders such as macular degeneration, diabetic retinopathy, and macular holes and the increasing geriatric population, the vitreoretinal surgery devices market is expected to grow over the forecast period. However, the side effects of the procedures are expected to restrain the market's growth during the forecast period.

Vitreoretinal Surgery Devices Market Trends

Posterior Vitreoretinal Surgery is Expected to Hold a Significant Market Share Over the Forecast Period

Pars plana vitrectomy (PPV) is a commonly employed technique in vitreoretinal surgery that enables access to the posterior segment for treating conditions such as retinal detachments, vitreous hemorrhage, endophthalmitis, and macular holes in a controlled, closed system. The high prevalence of diseases/disorders associated with the posterior segment of the eye, such as diabetic retinopathy and posterior vitreous detachment, is driving the demand for posterior vitrectomy (surgical procedures used to treat diseases associated with retina and vitreous), which is expected to have a significant impact on the growth of posterior vitreoretinal surgery segment.

For instance, according to an article published by PLOS ONE in August 2021, diabetic retinopathy (DR) is said to be one of the most common serious complications of diabetes mellitus. It is defined as damage to the blood vessels of the eyes caused by high blood glucose levels. The source also stated that the pooled prevalence of this complication in Germany ranges from about 10% to 30%, depending on the healthcare sector. Thus, the high prevalence of diabetic retinopathy is expected to drive segmental growth.

Additionally, according to an article published by WebMD in July 2021, the annual incidence of retinal detachment is approximately one in 10,000 or about 1 in 300 over a lifetime. Hence, the posterior vitreoretinal surgery segment is expected to have a major share of the vitreoretinal surgery devices market. Moreover, as these diseases are often associated with older adults, the rising geriatric population is also expected to enhance market growth.

Therefore, due to the factors such as the high prevalence of diseases/disorders associated with the posterior segment of the eye, such as diabetic retinopathy and posterior vitreous detachment, the posterior vitreoretinal surgery segment is expected to have a significant market share over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America will hold a significant share of the vitreoretinal surgery devices market. It is expected to show a similar trend over the forecast period, owing to the region's high prevalence and burden of eye diseases and the increasing geriatric population. For instance, according to the article published by BMC Ophthalmology in May 2022, diabetic retinopathy (DR) is considered a potentially blinding complication of diabetes mellitus that affects almost about 28% of diabetics in the United States every year. Diabetic retinopathy can typically be detected with annual screening, but many Americans with diabetes mellitus do not receive routine surveillance to prevent visual impairment or blindness. The source also stated that undetected diabetic retinopathy might be particularly prevalent in hospital settings, where it is estimated to have a prevalence of around 44% among diabetic inpatients, out of which over half were previously undiagnosed.

Moreover, The rising geriatric population in the country is also expected to enhance the market growth as vitreoretinal surgeries are often recommended to treat eye disorders that mainly occur in older people. For instance, according to the data updated by the United Nations Population Fund dashboard in 2022, an estimated 19% of Canada's total population was 65 years or older in 2022.

The companies are actively involved in product launch developments, innovation, partnerships, and collaborations to expand their footprint. For instance, in March 2022, Carl Zeiss MeditecAG received 510(k) premarket approval from the United States Food and Drug Administration (FDA) for their QUATERA 700 device, which is indicated for the emulsification and removal of cataracts and anterior segment vitrectomy. Such development is expected to drive the market's growth over the forecast period.

Therefore, the factors such as the high prevalence and burden of eye diseases in the region and the increasing geriatric population are expected to drive market growth during the forecast period.

Vitreoretinal Surgery Devices Industry Overview

The Vitreoretinal Surgery Devices Market is moderate due to the presence of companies operating globally and regionally. The competitive landscape includes analysis of companies based on product launches, acquisitions, collaboration, and agreements that hold the market shares and are well known, including Dutch Ophthalmic Research Center International BV, Bausch & Lomb Inc., OCULUS Optikgerate GmbH, and MedOne Surgical Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Eye Disorders

- 4.2.2 Increasing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Side Effects of the Procedures

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Perfluoro Carbon Liquids

- 5.1.2 Endoillumination Instruments

- 5.1.3 Vitreoretinal Prefilled Silicone Oil Syringes

- 5.1.4 Virectomy System

- 5.1.5 Other Product Types

- 5.2 By Surgery Type

- 5.2.1 Anterior Vitreoretinal Surgery

- 5.2.2 Posterior Vitreoretinal Surgery

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dutch Ophthalmic Research Center International BV

- 6.1.2 Bausch & Lomb Inc.

- 6.1.3 OCULUS Optikgerete GmbH

- 6.1.4 BVI

- 6.1.5 MedOne Surgical Inc.

- 6.1.6 Alcon

- 6.1.7 Carl Zeiss

- 6.1.8 Topcon Corporation

- 6.1.9 Hoya Corporation

- 6.1.10 GEUDER AG