|

시장보고서

상품코드

1689888

러기드 디스플레이 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Rugged Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

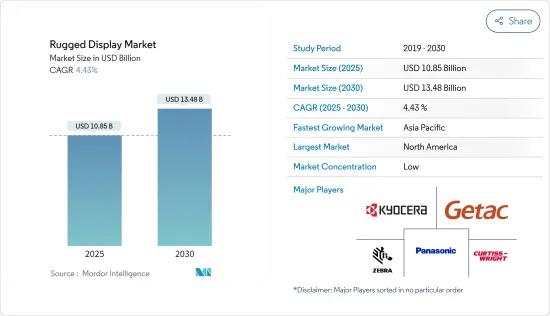

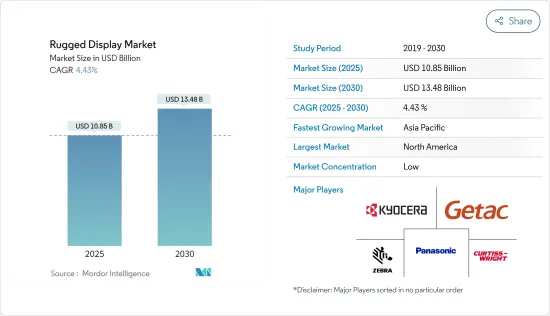

세계의 러기드 디스플레이 시장 규모는 2025년 108억 5,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 4.43%를 나타낼 전망이며, 2030년에는 134억 8,000만 달러에 달할 것으로 예측됩니다.

다양한 최종사용자 산업 수요 증가로 인해 예측 기간 동안 시장은 흥미로운 성장을 이룰 것으로 예상됩니다.

주요 하이라이트

- 예를 들어, 석유 및 가스 회사는 육해상의 광대한 토지를 커버하는 자산을 감시 및 보수할 필요가 있습니다. 이러한 기업은 자산의 무결성을 보장하고 신속하고 효과적인 방식으로 잠재적인 문제를 사전에 발견하고 관리해야 합니다. 이는 가동 중지 시간을 최소화하고 생산성을 극대화하며 지속적인 운영을 보장하는 데 필요하므로 러기드 디스플레이 장치가 필요합니다.

- 러기드 디스플레이 디바이스는 내충격성, 내구성, 방진 및 방습성, 가독성, 넓은 온도 범위, 명암비 향상, 디스플레이 휘도 향상, 저전력 소비 등 다양한 첨단 기능을 갖추고 있어 세계 시장에 긍정적인 영향을 미칠 수 있습니다.

- 시장 성장의 주요 촉진요인은 가혹한 환경 하에서 소비자 등급 장치와 비교할 때 고내구성 제품이 제공하는 총 소유 비용(TCO)을 줄이고 다양한 산업 분야에서 HMI 및 IoT 수요의 급성장입니다.

- 그러나 COVID-19는 여러 산업의 비즈니스에 영향을 미치며 자동화와 산업 공정 제어를 방해합니다. 이것은 HMI, SCADA, 분산 제어 시스템의 사용에 영향을 미칩니다. 이 산업용 제어 시스템의 생태계에 대한 COVID-19의 영향은 견고한 산업용 디스플레이 시장에 도전하고 있습니다.

러기드 디스플레이 시장 동향

러기드 태블릿이 주요 점유율을 차지할 전망

- 러기드 태블릿은 가혹한 환경을 견딜 수 있는 특별히 설계된 컴퓨터로, 극한 온도, 강한 진동, 건조한 상태 및 젖은 상태와 같은 가혹한 조건에서도 쉽게 작동할 수 있습니다. 진정한 러기드 태블릿은 내부가 견고하게 만들어져 모래, 먼지, 얼룩, 얼음, 물 및 기타 극한 상태를 견딜 수있는 능력이 있습니다.

- 직사광선에서의 가독성, 먼지 및 액체의 침입을 제한하는 완전 밀봉 키워드, 강도, 내구성, 다양한 자동차 및 방어 기계에 쉽게 설치하는 등 많은 이점이 있기 때문에 방위, 건강 관리, 운송, 소매, 농업 등의 분야에서 러기드 태블릿 구매가 크게 증가하고 있습니다.

- 풀 러기드 태블릿은 세 가지 유형 중에서 가장 많이 판매되는 러기드 태블릿입니다. 그러나 높은 비용과 치열한 경쟁 증가는 러기드 태블릿의 성장을 제한하는 장애 중 일부입니다.

- 러기드 태블릿 세계 시장에서 미국은 압도적인 점유율을 차지합니다. Zebra와 Panasonic은 미국에서 인기 있고 가장 생산적인 두 브랜드입니다. 2019년 7월, Zebra Technologies Corporation은 Zebra의 정부 및 기업용 태블릿의 광범위한 포트폴리오의 일부로, 엄격한 창고, 제조, 건설, 현장 작업 환경의 엄격함에 대응하는 목적별 모바일 컴퓨터로 새로운 고성능 L10 Android 슈퍼 러기드 태블릿을 발표했습니다.

아시아태평양이 가장 성장하는 시장이 될 전망

- 이 지역의 스마트 시티와 같은 인프라의 현대화와 개발, 정부, 방위, 운송, 석유 및 가스 산업의 미개척 러기드 디스플레이 장치 용도는 이 지역에서 러기드 디스플레이 성장을 가속하고 있습니다. 게다가 최근 자동차, 운송, 제조 부문의 현저한 성장도 시장 성장을 뒷받침하고 있습니다.

- 중국과 인도와 같은 국가의 방위 예산 증가는 아시아태평양 항공우주 및 방위 산업 시장 성장을 더욱 촉진하고 있습니다. 예를 들어 인도 공군은 신형 항공기 조달에 엄청난 투자를 하고 있으며 시장 성장에 긍정적인 영향을 미칠 수 있습니다.

- 또한 일본은 재고 관리, 프로세스 모니터링, 제어 등에 관한 과제를 극복하기 위해 견고한 장치를 채용하는 자동차 제조업체와 공급업체가 증가하고 있습니다.

러기드 디스플레이 산업 개요

러기드 디스플레이 시장은 경쟁이 치열하며 여러 선도 기업들로 구성되어 있습니다. 시장 점유율에서 이러한 기업 중 몇 일부가 시장을 독점하고 있습니다. 디스플레이 기술의 급속한 개발 속도와 러기드 디스플레이 시장에서 혁신적인 솔루션 개발을 목표로 하는 R&D 활동에 주력하고 있는 여러 기업의 존재로 인해 시장은 지난 몇 년간 경쟁이 치열해지고 있습니다.

- 2019년 4월, DT Research는 DT380CR과 DT380Q로 명명된 두 개의 새로운 러기드 태블릿을 출시했습니다. 이 태블릿은 군사 용도를 위해 특별히 설계되었으며 대형 화면과 고휘도를 갖춘 무게 2파운드 미만의 제품입니다.

- 2019년 2월, Trimble Inc.는 Trimble T17로 명명된 새로운 러기드 태블릿 출시를 발표했습니다. 이 태블릿은 태양 아래에서의 가시성, 줌 용이성, 64비트 쿼드 코어 프로세서, 리튬 이온 배터리 등 다양한 이점을 제공합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트·지원

목차

제1장 서론

- 주요 조사의 성과와 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

- 시장 성장 촉진요인

- 총소유비용(TCO) 삭감

- 다양한 산업에서 HMI와 IoT 수요 증가

- 시장 성장 억제요인

- 산업 용도에 소비자 등급 디바이스 채용

- COVID-19의 산업에 대한 영향 평가

제5장 시장 세분화

- 제품 유형

- 스마트폰 및 핸드헬드 컴퓨터

- 태블릿 PC

- 노트북 PC

- 항공전자기기 디스플레이

- 자동차 컴퓨터

- 패널 PC 및 미션 크리티컬 디스플레이

- 견고성 레벨

- 세미러기드

- 풀 러기드

- 울트라러기드

- 운영체제

- Android

- Windows

- 기타 운영체제

- 최종 사용자

- 석유 및 가스

- 정부, 방위, 항공우주

- 산업

- 자동차 및 운수

- 헬스케어

- 기타 최종 사용자

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 프로파일

- Curtiss-Wright Corp.

- General Dynamics Corp.

- L3 Technologies Inc.

- Esterline Technologies Corp.

- Xplore Technologies Corp.

- Beijer Electronics AB

- Kyocera Corp.

- Sparton Corp.

- Panasonic Corporation

- Zebra Technologies Corp.

- Getac Technology Corp.

- Dell Inc.

제7장 투자 분석

제8장 시장 동향과 장래 기회

JHS 25.04.07The Rugged Display Market size is estimated at USD 10.85 billion in 2025, and is expected to reach USD 13.48 billion by 2030, at a CAGR of 4.43% during the forecast period (2025-2030).

The market is anticipated to witness a stimulating growth during the forecast period, owing to an increasing demand from various end-user industries.

Key Highlights

- For instance, oil and gas companies need to monitor and maintain assets that cover vast tracts of land both onshore and offshore. These companies need to guarantee asset integrity and proactively spot and manage potential issues in a fast and effective manner. This is required to minimize downtime and maximize productivity, ensuring continuous operation, thus, needs rugged display devices.

- Rugged display devices come with various advance features, such as improved impact resistance, durability, dust and moisture resistance, readability, wide temperature range, improved contrast ratio, higher display brightness, and low-power consumption, which may positively impact the global market.

- The key drivers that have driven the market growth are cut in the total cost of ownership (TCO) offered by ruggedized products, when compared to consumer-grade devices in rough environments and rapid growth in the demand for HMI and IoT in different industrial sectors.

- However, COVID-19 has impacted businesses of several industries, hampering automation and industrial process control. This has impacted the use of HMI, SCADA, and distributed control systems. The impact of COVID-19 on this ecosystem of industrial control systems has challenged the rugged industrial displays market.

Rugged Display Market Trends

Rugged Tablets are Expected to Hold Major Share

- Rugged tablets are specially designed computers that can sustain harsh environments and can be easily operated in rough conditions, such as extreme temperatures, strong vibrations, dry or wet conditions. True rugged tablets are built sturdy inside out, therefore, have the ability to withstand sand, dust, dirt, ice, water, and other extremities.

- Owing to many advantages, such as readability in direct sun, fully sealed keywords to restrict intrusion of dust or any liquids, strength, durability, along with easy installations in various automotive and defense machinery, there is a substantial increase in the purchase for rugged tablets in sectors, such as defense, healthcare, transportation, retail, agriculture.

- Fully rugged tablets are the highest selling rugged tablets among the three types. However, high costs and increasing cut-throat competition are a few of the obstacles, which are restricting the growth of rugged tablets.

- America is the dominating player in the global market for rugged tablets. Zebra and Panasonic are the two popular and highest manufacturing brands in the United States. In July 2019, Zebra Technologies Corporation introduced its new high-performance L10 Android ultra-rugged tablet as a part of Zebra's extensive portfolio of government and enterprise tablets as well as purpose-built mobile computers for the rigors of challenging warehouse, manufacturing, construction, and field operations environments.

Asia Pacific is Expected to be The Highest Growing Market

- The modernization and development of infrastructure, such as smart cities, across the region and the untapped rugged display device applications in government, defense, transportation, and oil and gas industries are driving the growth of rugged displays in this region. In addition, the significant growth of the automotive, transportation, and manufacturing sectors in recent years is also driving the growth of the market.

- The increasing defense budgets in countries, such as China and India, further drive the growth of the market for the aerospace and defense industry in Asia-Pacific. For instance, the Indian Air Force is making huge investments in the procurement of new aircraft, which may positively impact the growth of the market.

- Moreover, Japan has the majority of automotive manufacturers and suppliers who are increasingly adopting rugged devices to overcome the challenges regarding inventory management, process monitoring, and control, etc.

Rugged Display Industry Overview

The rugged display market is highly competitive and consists of several major players. In terms of market share, several of these players majorly control the market. The market has become highly competitive in the past few years, owing to the rapid pace of development of display technologies and the presence of several companies that are focused on R&D efforts aimed at the development of innovative solutions in the rugged display market.

- In April 2019, DT Research launched two new rugged tablets named DT380CR and DT380Q, specially designed for military applications and weigh less than two pounds with large screens and high brightness.

- In February 2019, Trimble Inc. announced the launch of a new rugged tablet named Trimble T17, specifically designed to work in harsh conditions. The tablet offers various benefits, such as readability in sun, easy to zoom, 64-bit quad-core processor, and a lithium-ion battery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Key Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Reduced Total Cost of Ownership (TCO)

- 4.4.2 Rising Demand for HMI and IoT in Various Industries

- 4.5 Market Restraints

- 4.5.1 Adoption of Consumer-grade Devices for Industrial Applications

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Smartphone and Handheld Computer

- 5.1.2 Tablet PC

- 5.1.3 Laptop and Notebook

- 5.1.4 Avionics Display

- 5.1.5 Vehicle-mounted Computer

- 5.1.6 Panel PC and Mission-critical Display

- 5.2 Level of Ruggedness

- 5.2.1 Semi-rugged

- 5.2.2 Fully-rugged

- 5.2.3 Ultra-rugged

- 5.3 Operating System

- 5.3.1 Android

- 5.3.2 Windows

- 5.3.3 Other Operating Systems

- 5.4 End User

- 5.4.1 Oil and Gas

- 5.4.2 Government, Defense, and Aerospace

- 5.4.3 Industrial

- 5.4.4 Automotive and Transportation

- 5.4.5 Healthcare

- 5.4.6 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Curtiss-Wright Corp.

- 6.1.2 General Dynamics Corp.

- 6.1.3 L3 Technologies Inc.

- 6.1.4 Esterline Technologies Corp.

- 6.1.5 Xplore Technologies Corp.

- 6.1.6 Beijer Electronics AB

- 6.1.7 Kyocera Corp.

- 6.1.8 Sparton Corp.

- 6.1.9 Panasonic Corporation

- 6.1.10 Zebra Technologies Corp.

- 6.1.11 Getac Technology Corp.

- 6.1.12 Dell Inc.