|

시장보고서

상품코드

1689938

전도성 실리콘 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Conductive Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

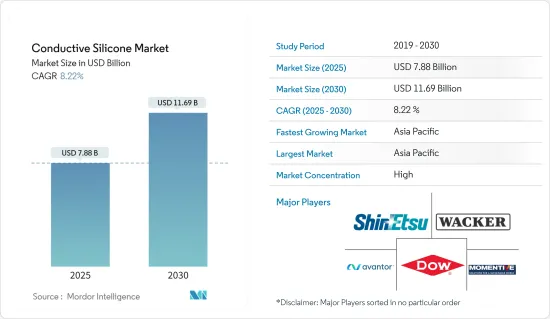

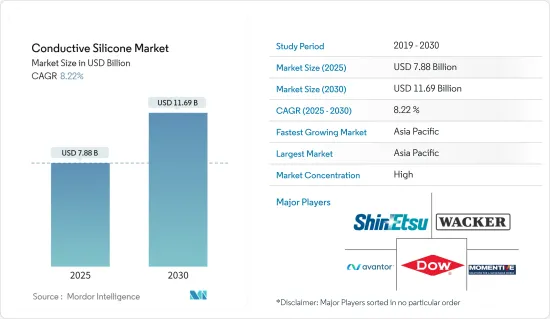

전도성 실리콘 시장 규모는 2025년에 78억 8,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 8.22%로 성장할 전망이며, 2030년에는 116억 9,000만 달러에 달할 것으로 예측되고 있습니다.

COVID-19의 발생은 초기에 전도성 실리콘 공급망을 혼란시켰습니다. 그 후 급속한 디지털화, 원격 학습 및 원격 근무의 도입으로 전자 기기 수요가 급증했습니다. 그러므로 전도성 실리콘 시장은 쉽게 팬데믹 이전 단계로 회복되었습니다.

주요 하이라이트

- 전자기기의 전도성 실리콘 수요 증가와 태양전지 산업의 전도성 실리콘 사용량 증가가 전도성 실리콘 시장 수요를 높일 것으로 예상됩니다.

- 한편, EMI 실드에서 전도성 실리콘의 대체품은 예측 기간 동안 시장 성장을 억제할 것으로 예상됩니다.

- 마이크로플루이딕스 장치와 같은 의료기기 기술의 진보는 시장에 새로운 잠재력을 가져오고 있습니다.

- 아시아태평양은 자동차, 전자, 통신 산업 수요 증가로 전도성 실리콘 시장을 독점하고 있습니다.

전도성 실리콘 시장 동향

전자 분야의 성장으로 수요 증가

- 전도성 실리콘은 전도성, 열전도성, 유연성, 내식성 등의 우수한 특성을 가지므로 전기 및 전자 용도에 널리 사용되고 있습니다.

- 전도성 실리콘의 사용과 관련된 우수한 전도성은 전기 장비에 이상적인 재료입니다. 실리콘의 전도성 입자는 전류의 전달을 가능하게 하고, 신호, 데이터 및 힘의 전달을 요구하는 적용을 위해 이를 유용하게 만듭니다.

- 중국은 세계 최대의 전자 기기 생산 기지입니다. 스마트폰, TV, 기타 개인용 전자기기 등의 전자제품은 전자 분야에서 가장 높은 성장을 기록했습니다.

- 이 나라는 전자제품에 대한 수요가 큽니다. 이러한 광범위한 수요로부터 이익을 얻기 위해 중국은 '메이드 인 차이나 2025' 계획과 같은 전략적 이니셔티브에 착수했습니다. 이 계획에 따라 중국 정부는 2030년까지 생산량 3,050억 달러를 달성하고 국내 수요의 80%를 충족하는 목표를 발표했습니다. 또한 중국은 스마트폰 생산기지로 전도성 실리콘 수요를 크게 밀어 올리고 있습니다.

- 일본전자정보기술산업협회(JEITA)가 발표한 데이터에 따르면, 2022년 일본의 일렉트로닉스 산업의 총 생산액은 약 11조 1,243억 엔(843억 4,000만 달러)에 달했고, 전년보다 8% 가까이 증가했습니다.

- 독일은 유럽에서 가장 큰 전자 산업 국가입니다. 독일 시장은 유럽 최대, 세계 5위의 전기 및 전자 시장입니다. 독일 전기전자협회에 따르면 2022년에는 2,200억 유로(2,348억 4,000만 달러) 이상을 기록했습니다.

- 독일의 전기 및 전자 관련 기업은 국내외에서 160만 명 이상의 직원을 고용하고 있습니다. 또한 국내 연구개발 직원의 30%가 전자 및 마이크로 기술 분야에서 일하고 있습니다.

- 또한 전자는 독일 수출 전체의 13%를 차지합니다. 독일 전자 및 디지털 산업의 명목 수출은 연률 7.0%의 성장을 기록하고 2023년 4월에는 190억 유로(209억 3,000만 달러)에 이르렀습니다. 올해 1-4월 동부문의 해외납입액은 전년 동기 대비 10.7% 증가한 842억 유로(927억 5,000만 달러)에 달했습니다.

- 프랑스 2030 투자 계획의 일환으로 프랑스 정부는 2030년까지 다양한 전자기술 개발을 위한 학술연구 생태계를 지원하기 위해 약 8억 유로(8억 8,000만 달러)의 투자를 계획하고 있습니다.

- 따라서 앞서 언급한 요인은 가까운 미래에 전도성 실리콘 수요를 끌어올릴 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양은 전도성 실리콘의 가장 크고 급성장 시장입니다. 일렉트로닉스, 자동차, 발전 산업에서의 이용이 증가하고 있는 것 등이 아시아태평양의 전도성 실리콘 수요를 견인하고 있습니다.

- 중국, 인도, 일본, 인도네시아, 베트남 등 이 지역의 국가들은 발전 프로젝트에 대한 투자가 증가하고 있으며, 전도성 실리콘 시장 성장을 가속하고 있습니다.

- 또, 대전방지 포장의 중요성이 높아지고 있으며, 대전시의 먼지 대책이나 전기 및 전자 기기의 기능성 및 장수명 유지를 위해서, 전자 기기에서 전도성 실리콘의 이용이 증가할 것으로 예상됩니다. 아시아는 전기 및 전자기기의 최대 생산국으로 중국, 일본, 인도, ASEAN 국가 등이 생산을 선도하고 있습니다.

- 중국은 세계에서 가장 광범위한 전자 기기 생산의 거점입니다. 스마트폰, 텔레비전 및 기타 개인 기기와 같은 전자 제품이 가장 높은 성장을 기록했습니다.

- 공식 데이터에 따르면, 2023년 Huahong Group의 무석은 65/55-40nm를 커버하는 공정 등급,월생산 능력 83,000개의 12인치 특수 공정 생산 라인의 건설을 계획하고 있습니다.

- 또한 Nexchip Semiconductor Corporation은 2023년 12인치 웨이퍼 제조 프로젝트에 약 29억 달러를 투자했습니다.

- 최근 중국은 에너지 수요가 증가함에 따라 다양한 신재생 에너지 프로젝트에 투자하고 있습니다. 2023년 11월, 중국 정부는 230GW의 풍력과 태양광 발전 용량의 도입을 계획했습니다. 이 나라는 2060년의 탄소 중립 목표 달성을 목표로, 2023년에 다양한 풍력 및 태양광 프로젝트에 총액 1,400억 달러를 투자했습니다.

- 2021년부터 2025년까지 송전망에 대한 투자 예산은 4,550억 달러로 지난 10년간 60% 증가했습니다. 또한 2020년부터 계통연계 축전용량을 배증시켜 2023년에는 67GW에 달했습니다.

- 따라서, 상기 요인은 예측 기간 동안 이 지역에서 전도성 실리콘 수요를 촉진할 것으로 예상됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 조사 범위

- 조사 범위

- 조사 전제조건 및 시장 정의

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 전자기기 산업에서 수요 증가

- 태양전지 산업에서 용도 확대

- 성장 억제요인

- EMI 실드에 있어서 전도성 실리콘의 대체품

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 제품 유형별

- 엘라스토머

- 수지

- 겔

- 기타 제품 유형(페이스트, 갭 필러, 접착제, 그리스)

- 용도별

- 접착제 및 실란트

- 열 인터페이스 재료

- 밀봉제 및 포팅 컴파운드

- 컨포멀 코팅

- 기타 용도(바이오메디컬, 광촉매)

- 최종 사용자 산업별

- 자동차

- 건설

- 발전

- 전기 및 전자

- 기타 최종 사용자 산업(산업기계, 소비재, 항공우주)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 터키

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 카타르

- 아랍에미리트(UAE)

- 나이지리아

- 이집트

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- 3M

- Avantor Inc.

- CHT Germany GmbH

- Dongguan City Betterly New Materials Co. Ltd

- Dow

- Elkem ASA

- Euro Technologies

- Henkel AG & Co. Kgaa

- Momentive

- Parker Hannifin Corporation

- Polymax Ltd

- Shin-Etsu Chemical Co. Ltd

- Silicone Solutions

- Soliani Emc Srl

- Specialty Silicone Products Inc.

- Wacker Chemie AG

제7장 시장 기회 및 향후 동향

- 의료기기에 있어서 새로운 기술 개발

The Conductive Silicone Market size is estimated at USD 7.88 billion in 2025, and is expected to reach USD 11.69 billion by 2030, at a CAGR of 8.22% during the forecast period (2025-2030).

The COVID-19 outbreak initially disrupted the conductive silicone supply chain. Later on, demand for electronics surged due to rapid digitization and the adoption of distance learning and remote work. Thus, the conductive silicone market readily recovered to its pre-pandemic stage.

Key Highlights

- The increasing demand for conductive silicone in electronic devices and its increasing usage in the solar industry are expected to raise the market demand for conductive silicone.

- On the other hand, the alternative to conductive silicone in EMI shielding is anticipated to restrain market growth during the forecast period.

- Advancements in medical device technology, such as microfluidic devices, are opening up new possibilities within the market.

- The Asia-Pacific region dominates the conductive silicone market, owing to rising demand from the automotive, electronics, and telecommunications industries.

Conductive Silicone Market Trends

Growth in the Electronics Segment to Augment the Demand

- Conductive silicone is extensively used in electrical and electronics applications because of its superior properties such as electrical conductivity, thermal conductivity, flexibility, and corrosion resistance.

- The superior electrical conductivity associated with the use of conductive silicone makes it the ideal material for electric devices. Silicone's conductive particles enable the transfer of electrical current, making it useful for applications that require the transmission of signals, data, and power.

- China is the largest base for electronics production in the world. Electronic products such as smartphones, TVs, and other personal electronic devices recorded the highest growth in the electronics segment.

- The country has a large demand for electronic products. To benefit from this extensive demand, China has embarked on strategic initiatives like the "Made in China 2025" plan. Under this plan, the Chinese government has announced its goal to reach an output of USD 305 billion by 2030 and, therefore, meet 80% of its domestic demand. Moreover, China is an industrial hub for smartphone production, significantly boosting the demand for conductive silicone.

- According to the data released by the Japan Electronics and Information Technology Industries Association (JEITA), in 2022, the total production value of the electronics industry in Japan amounted to around JPY 11,124.3 billion (USD 84.34 billion), showcasing a rise of nearly 8% from the previous year.

- Germany has the largest electronic industry in Europe. The German market is Europe's largest and the world's fifth-largest electrical and electronics market. It had registered more than EUR 220 billion (USD 234.84 billion) in 2022, according to the Germany Electrical and Electronics Association.

- Electrical and electronic companies in Germany employ a workforce of more than 1.6 million at home and abroad. Also, 30% of all R&D employees in the country are working in the field of electronics and microtechnology.

- Additionally, electronics constitute up to 13% of the country's overall exports. The nominal exports of the German electro and digital industry witnessed an annual growth of 7.0% to reach EUR 19.0 billion (USD 20.93 billion) in April 2023. In the first four months of this year, the sector's aggregated deliveries abroad experienced a Y-o-Y growth of 10.7%, reaching a value of EUR 84.2 billion (USD 92.75 billion).

- As part of the France 2030 investment plan, the French government plans to invest nearly EUR 800 million (USD 880 million) to support the academic research ecosystem for the development of various electronic technologies by 2030.

- Therefore, the aforementioned factors are projected to boost the demand for conductive silicone in the near future.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region stands to be the largest and fastest-growing market for conductive silicone. Factors such as the increasing utilization in the electronics, automotive, and power generation industries have been driving the demand for conductive silicone in Asia-Pacific.

- Countries in the region, such as China, India, Japan, Indonesia, and Vietnam, are witnessing increasing investments in power generation projects, boosting the growth of the conductive silicone market.

- The heightened significance of anti-static packaging for dust control during electric charge and sustaining functionality and longevity of electrical and electronic devices is anticipated to increase the utilization of conductive silicone in electronics. Asia is the largest producer of electrical and electronic devices, with countries like China, Japan, India, and ASEAN countries leading production.

- China is the most extensive base for electronics production in the world. Electronic products such as smartphones, TVs, and other personal devices recorded the highest growth.

- According to official data, in 2023, Huahong Group's Wuxi planned to build a 12-inch specialty process production line with a process grade covering 65/55-40 nm and a monthly production capacity of 83,000 pieces.

- Furthermore, Nexchip Semiconductor Corporation invested around USD 2.9 billion in 2023 in the 12-inch wafer manufacturing project.

- Recently, China has been investing in various renewable energy projects due to the growing demand for energy in the country. In November 2023, the Government of China planned to install 230 GW of wind and solar capacity. The country invested a total of USD 140 billion in 2023 in various wind and solar projects with the aim of achieving its 2060 carbon-neutral target.

- The country has budgeted USD 455 billion in grid investments from 2021-2025, an increase of 60% from the previous decade. It also doubled its grid-connected energy storage capacity from 2020 to reach 67 GW in 2023.

- Hence, the factors mentioned above are expected to drive the demand for conductive silicone in the region during the forecast period.

Conductive Silicone Industry Overview

The conductive silicone market is consolidated in nature. The major players operating in the market (not in any particular order) include Wacker Chemie AG, DOW, Shin-Etsu Chemical Co. Ltd, Momentive, and Avantor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 SCOPE OF THE REPORT

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Electronics Industry

- 4.1.2 Increasing Usage in the Solar Industry

- 4.2 Restraints

- 4.2.1 Alternative to Conductive Silicone in EMI Shielding

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 By Product Type

- 5.1.1 Elastomers

- 5.1.2 Resins

- 5.1.3 Gels

- 5.1.4 Other Product Types (Pastes, Gap Fillers, Adhesives, and Greases)

- 5.2 By Application

- 5.2.1 Adhesives and Sealants

- 5.2.2 Thermal Interface Materials

- 5.2.3 Encapsulant and Potting Compounds

- 5.2.4 Conformal Coatings

- 5.2.5 Other Applications (Biomedical and Photocatalysis)

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Power Generation

- 5.3.4 Electrical and Electronics

- 5.3.5 Other End-user Industries (Industrial Machinery, Consumer Goods, and Aerospace)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Avantor Inc.

- 6.4.3 CHT Germany GmbH

- 6.4.4 Dongguan City Betterly New Materials Co. Ltd

- 6.4.5 Dow

- 6.4.6 Elkem ASA

- 6.4.7 Euro Technologies

- 6.4.8 Henkel AG & Co. Kgaa

- 6.4.9 Momentive

- 6.4.10 Parker Hannifin Corporation

- 6.4.11 Polymax Ltd

- 6.4.12 Shin-Etsu Chemical Co. Ltd

- 6.4.13 Silicone Solutions

- 6.4.14 Soliani Emc Srl

- 6.4.15 Specialty Silicone Products Inc.

- 6.4.16 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Technological Developments in Medical Devices