|

시장보고서

상품코드

1910806

파이로필라이트 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Pyrophyllite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

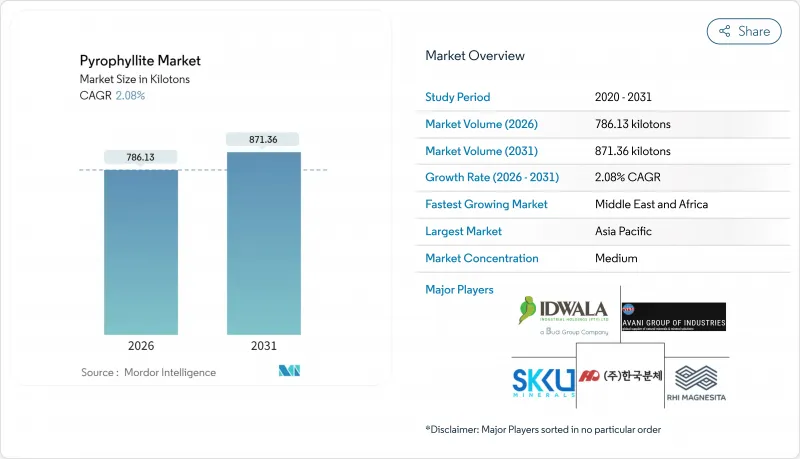

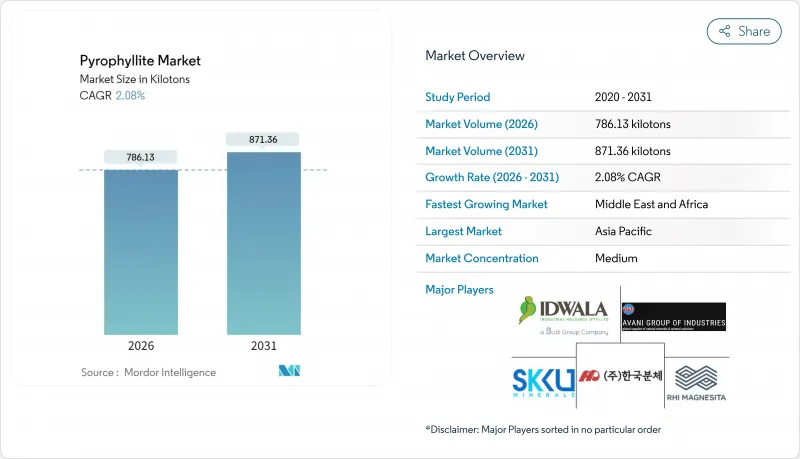

파이로필라이트 시장은 2025년 770.11킬로톤으로 평가되었으며, 2026년 786.13킬로톤에서 2031년까지 871.36킬로톤에 이를 것으로 예상됩니다. 예측 기간(2026-2031년)의 CAGR은 2.08%를 나타낼 것으로 전망됩니다.

이 꾸준한 확장은 열 안정성, 화학적 불활성 및 저수축성과 같은 광물의 신뢰할 수 있는 물리적 특성으로 인해 산업 사용자가 재현 가능한 제품 품질을 유지하는 데 기여하고 있습니다. 수요의 성장은 아시아태평양에 의해 지원되고 있으며, 이 지역에서는 세라믹 생산 능력의 확대와 전기 아크 제강이 결합되어 처리량의 높은 수준을 유지하고 있습니다. 고체 전지용 세라믹이나 고후막 보호 코팅이 새로운 수요 창출 포인트가 되어, 기존 충전제 용도의 신장 둔화를 상쇄하고 있습니다. 호흡성 결정성 실리카에 대한 규제 감시의 강화는 채굴 비용을 끌어올리는 한편, 분진 억제 기술이 뛰어난 자본력이 있는 공급자에게 유리한 품질 관리 기준의 향상을 가져옵니다. RHI 마그네시타에 의한 2024년 레스코 제품 인수로 대표되는 경쟁 환경의 통합은 대규모 내화물 구매자에게 공급 안정성을 강화하고 파이로필라이트 시장이 전략적 재료 플랫폼 역할을 한다는 것을 보여주었습니다.

세계의 파이로필라이트 시장 동향과 인사이트

아시아태평양에서 세라믹 생산 능력 확대

중국과 인도 전역의 타일 및 위생 도자기 라인의 견조한 확장은 삼축 도자기 혼합물에 대한 대량 흡수를 통해 파이로필라이트 시장을 지원합니다. 생산자는 카올린 기반의 배합비에 비해 최대 24%의 강도 향상을 지적하여 물류 비용 절감으로 이어지는 경량 제품의 실현을 가능하게 하고 있습니다. 소성 사이클의 단축은 지역의 탈탄소화 정책에 따라 에너지 소비를 더욱 줄이고 탄소 발자국을 축소합니다. 정부의 경기자극책에 의한 저가 주택 수요의 확대에 따라 타일 제조업체는 예측 가능한 조건으로 파이로필라이트를 조달하는 선도계약을 확보하고 카올린 가격의 변동 위험을 회피하고 있습니다. 또한 이 광물이 멀라이트로 확실히 열 변환되는 특성은 유약 결함을 최소화하고 높은 이익률을 실현하는 고급 타일 SKU의 생산을 지원하고 있습니다. 이러한 구조적 이점으로 인해 파이로필라이트 시장은 아시아태평양의 세라믹 산업 경쟁력에 필수적인 존재가 되고 있습니다.

전기 아크 강철의 내화물 수요 증가

전기로에 의한 조강 생산의 비율이 증가하고 있어, 각 설비에는 급격한 열 사이클을 견디는 냄비·탄디쉬용 내화물이 불가결합니다. 일본의 제철소는 수십년에 걸쳐 파이로필라이트(국내에서는 「규조토」라고 불립니다)를 채용해, 1,600℃의 가동 조건하에서의 멀라이트 형성 특성을 실증해 왔습니다. 인도와 동남아시아의 신규 전기로 도입도 같은 재료 사양을 채용하고 있어 지역 조달 계약을 촉진하고 있습니다. 다국적 내화물 제조업체는 RHI 마그네시아의 2024년 미국 자산 인수에서 볼 수 있듯이 수직 통합을 통해 공급 위험을 헤지하고 있습니다. 제철소가 스코프 1 배출량 감축을 위해 스크랩 용해를 강화하는 가운데, 파이로필라이트 시장은 돌풍을 받아 내화물 분야에서의 우위성을 더욱 견고하게 하고 있습니다.

직업성 분진 위험 규제

미국 광산안전위생국(MSHA)은 2024년 허용 흡입성 결정성 실리카 농도를 50㎍/㎥로 낮추어 25㎍/㎥에서의 대책 실시를 의무화했습니다. 이에 따라 새로운 기술적 대책과 건강 감시 의무가 발생하고 있습니다. 유럽 지령도 이에 준거하고 있어 컴플라이언스는 세계의 과제가 되고 있습니다. 환기설비 업그레이드, 버그하우스 필터 설치, ISO 준거 모니터링을 실시하기 위해서는 자본 지출이 필요하며, 특히 중견 광산 기업에 있어서 이익률에 부담이 됩니다. 그러나 대기업은 이러한 규제를 활용하여 제3자 인증을 받은 「저분진」공급 프로그램에 의한 차별화를 도모하고, 파이로필라이트 시장에서 점유율 확대의 가능성을 지니고 있습니다.

부문 분석

2025년 시점의 파이로필라이트 시장에서 천연 등급은 86.64%를 차지했습니다. 이것은 심플한 파쇄·선별 플로우 시트에 의해 납품 비용의 경제성이 유지되고 있기 때문입니다. 라자스탄과 노스캐롤라이나의 광산은 세계 무역의 기반이 되어 내화물·세라믹 공장에 최소한의 선별 공정으로 직접 공급하고 있습니다. 이러한 공급량은 거시 산업 생산량에 따른 기준선 성장을 지원합니다.

가공된 「기타」그레이드는 기초 규모야말로 작은 것, 2031년까지 연평균 복합 성장률(CAGR) 2.68%로 천연 그레이드를 웃도는 성장이 전망됩니다. 생산자는 자기 분리, 부선, 탈이온수 세정을 구사해, 철 함유량을 0.4 중량% 미만으로 삭감합니다. 이를 통해 반투명 스파크 플러그 절연체 및 고체 전해질 프레임워크와 같은 고도의 용도를 개발할 수 있습니다. 마이크로파 구이와 습식 고강도 자기 분리를 조합하여 철분 96% 제거를 실현하여 전자기기 제조업체에서의 채용이 확대되고 있습니다. 광산 회사는 두 가지 제품 전략을 통해 파이로필라이트 시장의 상품층을 수익화하는 동시에 특수품 마진을 획득하여 결국 수익 구성을 강화하고 있습니다.

파이로필라이트 시장 보고서는 유형별(천연 파이로필라이트, 기타 유형), 용도별(세라믹, 내화물, 충전재, 유리 섬유, 고무·지붕재, 비료, 장식석, 기타 용도), 지역별(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)으로 분류되어 있습니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

지역별 분석

아시아태평양은 2025년 소비량의 75.50%를 차지하며 중국, 인도, 일본의 광산에서 가마까지의 통합 공급망이 이를 지원했습니다. 인도 단독으로 약 15만 톤을 생산하며, 이는 세계 생산량의 24-25%에 해당하며, 지역 세라믹 산업 클러스터에 원재료의 안정적인 공급을 가져오고 있습니다. 세계 세라믹 타일 출하량의 절반을 차지하는 중국 타일 제조업체는 운임 우위를 확보하기 위해 연간 구매 계약을 앞당겨 체결했습니다. 동시에 일본은 연속 주조 공정에서 틈새 내화물에 고순도 로제키를 활용하고 있으며,이 지역의 세련된 용도 범위를 강조하고 있습니다.

중동 및 아프리카는 2031년까지 2.74%의 연평균 복합 성장률(CAGR)로 가장 빠르게 성장하는 지역입니다. 걸프 협력 회의의 인프라 개념은 타일 수요를 밀어 올리는 반면, 북아프리카의 미니 밀은 수입 의존도를 줄이기 위해 지역 내화물 공급을 지정합니다. 남아프리카와 모로코의 광물 개발업체는 파이로필라이트 시장으로의 무역 흐름을 재조정할 수 있는 자국의 원료 공급원의 개척을 목표로 새로운 광상을 찾아 알루미나 편암대를 조사했습니다.

북미에서는 연방 정부의 엄격한 실리카 규제로 인해 컴플라이언스 비용이 상승하고 있으며 사용 가능한 최상의 제어 기술을 채택하는 것이 장려되고 완만한 성장을 유지하고 있습니다. 애팔래치아 지방 사업자는 중서부 철강 고객과의 근접성을 강조하고 있으며, 서해안 항만은 아시아를 위한 고품질 분말의 수출을 촉진하고 있습니다. 유럽에서는 고부가가치 공업용 세라믹과 특수 코팅에 주력하고 현지 광상 순도가 부족한 경우 인도에서 고부가가치 등급을 수입하고 있습니다. 남미의 잠재적 가능성은 브라질이 보유한 4,515만 3,000톤의 탈크 파이로필라이트 매장량 기반에 의해 지원되고 있으며, 하류 수요가 확대되는 대로 미래의 국내 선광 거점의 기반이 될 것입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 아시아의 세라믹 생산 능력 확대

- 전기 아크제강에 있어서 내화물 수요 증가

- 고막 두께 공업용 도료용 경량 광물 필러

- 석면 소송 후 화장품 분야에서 활석에서 파이로필라이트로의 전환

- 고순도 알루미늄·실리콘 원료를 필요로 하는 고체 전지용 세라믹

- 시장 성장 억제요인

- 직업성 분진 위험 규제

- 풍부한 대체 광물(탈크, 카올린, 장석)

- 저철분·고알루미나 광체의 부족

- 밸류체인 분석

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 유형별

- 천연 파이로필라이트

- 기타 유형

- 용도별

- 세라믹

- 내화물

- 충전재(종이, 도료, 살충제)

- 유리 섬유

- 고무 및 지붕재

- 비료(토양 개량제)

- 장식용 석재

- 기타 용도

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 튀르키예

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 이집트

- 나이지리아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/순위 분석

- 기업 프로파일

- Anand Talc

- Avani Group

- Hankook Mineral Powder Co. Ltd.

- Hebei Yayang Spodumene Co., Ltd.

- Idwala Industrial Holdings

- Jinhae Pyrophyllite

- Liaoyuan Pharmaceutical Co., Ltd.

- NINGBO INNO PHARMCHEM CO., LTD.

- PT Gunung Bale

- RT Vanderbilt Holding Company, Inc.

- RHI Magnesita

- SAMIROCK Company

- SEPRA

- SKKU Minerals

- Wonderstone

제7장 시장 기회와 향후 전망

KTH 26.01.26The Pyrophyllite Market was valued at 770.11 kilotons in 2025 and estimated to grow from 786.13 kilotons in 2026 to reach 871.36 kilotons by 2031, at a CAGR of 2.08% during the forecast period (2026-2031).

This steady expansion reflects the mineral's dependable physical attributes-thermal stability, chemical inertness, and low-shrinkage behavior-that help industrial users maintain reproducible product quality. Demand growth is anchored in Asia-Pacific, where ceramics capacity build-outs and electric-arc steelmaking together keep throughput volumes high. Solid-state battery ceramics and high-build protective coatings create incremental demand points that offset slower growth in legacy filler uses. Intensifying regulatory oversight of respirable crystalline silica raises mining costs, yet also elevates quality-control standards that favor well-capitalized suppliers with robust dust-mitigation technology. Competitive consolidation-illustrated by RHI Magnesita's 2024 purchase of Resco Products-reinforces supply security for large refractory buyers, underlining the pyrophyllite market's role as a strategic materials platform.

Global Pyrophyllite Market Trends and Insights

Ceramics Capacity Build-out in Asia-Pacific

Robust expansions in tile and sanitary-ware lines throughout China and India underpin the pyrophyllite market by absorbing large volumes into triaxial porcelain mixes. Producers cite up to 24% strength gains over kaolin-based recipes, enabling lighter-weight products that cut logistics costs. Shorter firing cycles further lower energy consumption and trim carbon footprints in line with regional decarbonization policies. As government stimulus pushes affordable housing, tile makers secure forward contracts that lock in pyrophyllite at predictable terms, shielding them from kaolin price swings. The mineral's predictable thermal conversion to mullite also minimizes glaze defects, supporting premium tile SKUs that command higher margins. These structural gains make the pyrophyllite market integral to Asia-Pacific's ceramic competitiveness.

Rising Refractory Demand in Electric-Arc Steelmaking

Electric-arc furnaces now account for a growing share of crude steel output, and each unit requires ladle and tundish refractories that resist rapid thermal cycling. Japanese steelmakers have relied on pyrophyllite (locally called roseki) for decades, validating its mullite-forming behavior under 1,600 °C service loads. New EAF rollouts across India and Southeast Asia replicate those material specifications, driving regional procurement contracts. Multinational refractory houses hedge supply risk through vertical integration, as seen in RHI Magnesita's 2024 U.S. asset acquisition. As steel mills intensify scrap melting to curtail Scope 1 emissions, the pyrophyllite market enjoys tailwinds that reinforce its refractory franchise.

Occupational Dust-Hazard Regulations

The U.S. Mine Safety and Health Administration in 2024 cut allowable respirable crystalline silica levels to 50 μg/m3 and mandated action at 25 μg/m3, triggering new engineering controls and medical surveillance obligations. European directives align closely, making compliance a global imperative. Upgrading ventilation, installing baghouse filters, and conducting ISO-compliant monitoring impose capital outlays that weigh on margins, especially for mid-tier miners. However, larger operators leverage these mandates to differentiate via third-party certified "low-dust" supply programs, potentially consolidating share within the pyrophyllite market.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Mineral Fillers for High-Build Industrial Coatings

- Shift from Talc to Pyrophyllite in Cosmetics After Asbestos Litigation

- Abundant Substitute Minerals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural grades constituted 86.64% of the pyrophyllite market in 2025 on the strength of straightforward crushing-and-screening flowsheets that keep delivered-cost economics favorable. Rajasthan and North Carolina mines anchor global trade, supplying refractory and ceramic plants directly with minimal upgrading. These volumes underpin baseline growth that aligns with macro industrial output.

Processed "other" grades occupy a smaller base yet outpace natural grades at a 2.68% CAGR to 2031. Producers deploy magnetic separation, flotation, and de-ionized water washing to slash iron to below 0.4 wt%, unlocking advanced uses such as translucent spark-plug insulators and solid-state electrolyte frameworks. Microwave roasting coupled with wet-high-intensity magnetic separation achieves 96% iron removal, widening acceptance among electronics manufacturers. Dual-product strategies let miners monetize the pyrophyllite market's commodity tier while capturing specialty margins, ultimately strengthening their revenue mix.

The Pyrophyllite Market Report is Segmented by Type (Natural Pyrophyllite, Other Types), Application (Ceramics, Refractory, Filler Materials, Fiberglass, Rubber and Roofing, Fertilizers, Ornamental Stones, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 75.50% of 2025 consumption, underpinned by integrated mine-to-kiln supply chains in China, India, and Japan. India alone produced roughly 150,000 tons, equal to 24-25% of global output, conferring raw-material security to regional ceramics clusters. Chinese tile producers, accounting for half of world ceramic-tile shipments, front-load annual purchase contracts to lock in freight advantage. Concurrently, Japan leverages high-purity roseki for niche refractories in continuous-casting operations, underscoring the region's sophisticated application spectrum.

The Middle East and Africa is the fastest-growing geography at 2.74% CAGR through 2031. Gulf Cooperation Council infrastructure visions push tile demand, while North African steel mini-mills specify local refractory supply to cut import reliance. Mineral developers in South Africa and Morocco survey aluminous schist belts for new deposits, aiming to foster indigenous feedstock streams that could recalibrate trade flows into the pyrophyllite market.

North America sustains modest growth amid stringent federal silica rules that lift compliance costs but incentivize best-available-control-technology adoption. Appalachian operators bank on proximity to midwestern steel customers, whereas West-Coast ports facilitate Asian exports of upgraded powders. Europe focuses on high-margin technical ceramics and specialty coatings, importing value-added grades from India when local deposits lack required purity. South America's latent potential rests on Brazil's 45.153 million-ton talc-and-pyrophyllite reserve base, which underpins future domestic beneficiation hubs once downstream demand scales.

- Anand Talc

- Avani Group

- Hankook Mineral Powder Co. Ltd.

- Hebei Yayang Spodumene Co., Ltd.

- Idwala Industrial Holdings

- Jinhae Pyrophyllite

- Liaoyuan Pharmaceutical Co., Ltd.

- NINGBO INNO PHARMCHEM CO., LTD.

- PT Gunung Bale

- R.T. Vanderbilt Holding Company, Inc.

- RHI Magnesita

- SAMIROCK Company

- SEPRA

- SKKU Minerals

- Wonderstone

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ceramics capacity build-out in Asia

- 4.2.2 Rising refractory demand in electric-arc steelmaking

- 4.2.3 Lightweight mineral fillers for high-build industrial coatings

- 4.2.4 Shift from talc to pyrophyllite in cosmetics after asbestos litigation

- 4.2.5 Solid-state battery ceramics requiring high-purity Al-Si feedstocks

- 4.3 Market Restraints

- 4.3.1 Occupational dust-hazard regulations

- 4.3.2 Abundant substitute minerals (talc, kaolin, feldspar)

- 4.3.3 Scarcity of low-iron, high-Al2O3 ore bodies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Natural Pyrophyllite

- 5.1.2 Other Types

- 5.2 By Application

- 5.2.1 Ceramics

- 5.2.2 Refractory

- 5.2.3 Filler Materials (Paper, Paints, Insecticides)

- 5.2.4 Fiberglass

- 5.2.5 Rubber and Roofing

- 5.2.6 Fertilizers (Soil Conditioners)

- 5.2.7 Ornamental Stones

- 5.2.8 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anand Talc

- 6.4.2 Avani Group

- 6.4.3 Hankook Mineral Powder Co. Ltd.

- 6.4.4 Hebei Yayang Spodumene Co., Ltd.

- 6.4.5 Idwala Industrial Holdings

- 6.4.6 Jinhae Pyrophyllite

- 6.4.7 Liaoyuan Pharmaceutical Co., Ltd.

- 6.4.8 NINGBO INNO PHARMCHEM CO., LTD.

- 6.4.9 PT Gunung Bale

- 6.4.10 R.T. Vanderbilt Holding Company, Inc.

- 6.4.11 RHI Magnesita

- 6.4.12 SAMIROCK Company

- 6.4.13 SEPRA

- 6.4.14 SKKU Minerals

- 6.4.15 Wonderstone

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment