|

시장보고서

상품코드

1690063

재활 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Rehabilitation Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

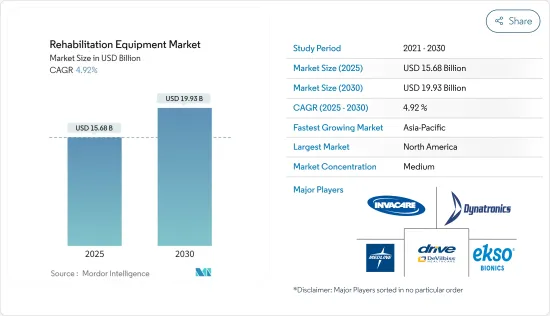

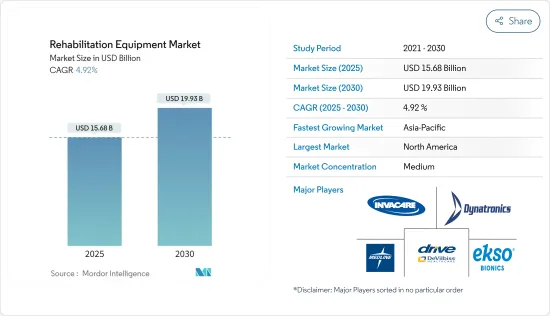

재활 장비 시장 규모는 2025년에 156억 8,000만 달러가 될 것으로 추정되며, 예측 기간(2025-2030년)의 CAGR은 4.92%를 나타내어, 2030년에는 199억 3,000만 달러에 달할 것으로 예측됩니다.

COVID-19는 시장 성장에 큰 영향을 미쳤습니다. COVID-19 회복 후 재활 서비스의 필요성이 증가함에 따라 시장 성장 수요가 이어졌습니다. 예를 들어, 2020년 7월에 발표된 NCBI 논문에 따르면 COVID-19의 중증화 후 많은 환자들은 정상적인 기능에 다양한 문제를 경험하고 이러한 문제를 극복하기 위해 재활 서비스가 필요합니다. 그러나 COVID-19의 봉쇄 규제가 완화되면서 재활센터가 재개되어 환자 유입이 증가하여 재활 시장 수요를 견인하고 있습니다. 이것은 유행 후 시장 성장에 기여할 것으로 예상됩니다.

시장 성장을 가속하는 요인으로는 만성 질환의 이환율 증가, 비전염성 질환의 유병률 증가로 인한 재활 요법에 대한 수요 증가, 유리한 상환 이니셔티브 등이 있습니다. 고령화 사회에서의 관절염과 파킨슨병의 이환율 증가, 외상 환자 증가가 시장 성장의 연료가 되고 있습니다.

세계보건기구(WHO)의 2021년 보고서에 따르면 매년 비전염성 질환은 세계 사망자의 71%를 차지하는 약 4,100만 명에 영향을 미칩니다. 이는 비전염성 질환을 가진 나머지 인구가 진단을 받기 위해 재활센터를 선택하는 수요를 만들어 시장 전체의 성장을 더욱 촉진합니다. 또한 신체장애인의 보조 기구 수요가 높아지고 새로 출시되는 제품에 대한 인지도가 높아지면 재활 장비 시장에 박차를 가하고 있습니다. 예를 들어, 2021년 11월에는 Philips 재단이 싱가포르 심장재단과 제휴하여 재활 프로그램에 환자를 참가하거나 복용 어드히어런스가 부족하게 되었습니다. 2021년 2월에는 Rehabs Near Me가 미국에서 재활센터를 찾는 사람들을 지원하는 24시간 365일 서비스를 시작했습니다. 이와 같이 기업이 재활 장비와 관련된 제품을 지속적으로 출시하고 인지도를 높이는 것이 시장 전체의 성장을 더욱 뒷받침하고 있는 것을 알 수 있습니다.

이와 같이 만성질환의 이환율 증가, 재활치료에 대한 수요 증가, 재활 장비 출시 증가는 예측기간 동안 시장 성장에 기여할 것으로 예상됩니다.

재활 장비 시장 동향

보행 보조 장비 분야는 예측 기간 동안 건전한 성장이 예상됩니다.

보행 보조 장비 분야는 예측 기간 동안 큰 시장 점유율을 차지할 것으로 예측됩니다. 보행 보조 기구에는 일반적으로 지팡이, 목발, 보행기 등의기구가 포함되어 특정 장애를 가진 환자와 노인의 이동을 용이하게합니다. 이러한 기구는 동시에 환자의 지지 기반을 늘리고, 균형을 개선하고 유지하며, 활동성을 높이고, 환자의 타인에 대한 의존을 완화합니다.

유엔 보고서 2022에 따르면 세계 인구 중 65세 이상을 차지하는 비율은 2022년의 10%에서 2050년에는 16%로 상승할 것으로 예측됩니다. 이 인구층은 개인적인 이동 보조를 필요로 하는 몇몇 질병을 앓고 있는 경향이 강해 보행 보조 기기의 채용이 더욱 진행될 것으로 보입니다.

현재 스마트 보행 보조 기기가 인기를 끌고 있으며,이 부문 수요를 견인하고 있습니다. 마찬가지로 제품 출시 증가도 이 부문의 성장에 기여할 것으로 예상됩니다. 예를 들어, 2022년 5월, Samsung Electronics는 보행과 근육의 움직임을 개선하는 액티브 어시스트 알고리즘을 사용하여 운동 능력에 문제가 있는 사용자의 외골격 역할을 하는 웨어러블 디바이스인 지원 로봇 'GEMS Hip'의 승인을 FDA에 요구했습니다.

또한 파나소닉은 2021년 4월 신체적 제약과 넘어짐 경험으로 보행에 불안한 고령자를 대상으로 안전하고 효율적인 보행 훈련을 제공하는 것을 목적으로 한 보행 훈련 로봇의 양산 모델을 출시했습니다.

따라서 노인 인구와 혁신적인 제품 출시 증가가 예측 기간 동안 같은 분야의 성장에 기여할 것으로 예상됩니다.

북미가 시장에서 큰 점유율을 차지할 것으로 예상되며 예측기간 동안도 마찬가지일 것으로 예상됩니다.

예측 기간 동안 북미가 시장을 독점하는 것으로 보입니다. 파킨슨병, 알츠하이머병, 관절염 등 만성 질환의 유병률 상승, 재활 치료에 대한 수요 증가, 다수의 대기업의 존재가 북미에서 재활 장비의 성장을 가속하고 있습니다.

미국에서는 노년 인구가 증가함에 따라 만성 질환을 앓고있는 위험이 크게 증가하고 있습니다. 이것은 대부분의 미국인들이 앞으로 수십년 동안 만성 질환의 영향을 받을 가능성이 높다는 것을 보여줍니다. 이러한 상황은 재활 장비에 대한 심각한 요구를 초래하고 시장 전체의 성장을 가속합니다.

또한 2022년 1월 BTS 데이터에 따르면 2,520만 명의 미국인이 집 밖으로 이동하기 어려운 장애물이 있었습니다. 또한 2021년 ACL 보고서에 따르면 65세 인구는 2040년까지 21.6% 증가하며, 85세 이상은 2040년 1,440만 명에 이를 것으로 예상됩니다. 이동 문제가 발생하기 쉬운 노인 인구가 증가함에 따라 이러한 리프트 장비 수요는 예측 기간 동안 증가할 것으로 예상됩니다.

선진 제품 개발에 있어서의 연구 활동의 활성화도 시장 개척을 뒷받침하고 있습니다. 예를 들어, 2022년 11월, Penumbra Inc.는 REAL 시스템 플랫폼을 확장하고 재활을 위한 핸즈프리, 전신 가상현실 기반을 제공하기 시작했습니다. REAL y-시리즈는 전신 아바타에서 상지와 다리를 모두 수행하는 핸즈프리와 테더가 없는 가상현실 재활 플랫폼 중 하나입니다.

환자를 안전하게 취급하기 위한 정부의 이니셔티브와 메디케어 등의 상환 프로그램 증가도 이 지역의 재활 장비 시장에 박차를 가할 것으로 예상됩니다.

재활 장비 산업 개요

재활 장비 시장의 경쟁은 중간 정도입니다. 현재 시장을 독점하고 있는 기업으로는 Medline Industries Inc., Drive DeVilbiss Healthcare, Invacare Corporation, Ekso Bionics, Dynatronics Corporation, GF HEALTH PRODUCTS, Caremax Rehabilitation Equipment, Hill-Rom Services Inc., Hospital Equipment Mfg.Co. 등입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 만성 질환의 부담 증가

- 재활 치료 수요 증가

- 재활 치료에 대한 의식 고조

- 시장 성장 억제요인

- 불리한 상환과 인식 부족

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 제품 유형별

- 일상생활 보조 기구

- 의료용 침대

- 욕실 및 화장실 보조 기구

- 읽기 쓰기 및 컴퓨터 보조 기구

- 기타 일상 생활 보조 기구

- 운동 장비

- 상체 운동 장비

- 하체 운동 장비

- 신체 지지 장치

- 이용자 리프트

- 의료용 리프트 슬링

- 이동성 장비

- 보행 보조 장치

- 휠체어 및 스쿠터

- 일상생활 보조 기구

- 용도별

- 물리 치료

- 작업 치료

- 기타 용도

- 최종 사용자별

- 병원

- 재활 센터

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Medline Industries Inc.

- Drive DeVilbiss Healthcare

- Invacare Corporation

- Ekso Bionics

- Dynatronics Corporation

- GF HEALTH PRODUCTS INC.

- Caremax Rehabilitation Equipment Co. Ltd

- Hill-Rom Services INC.

- Hospital Equipment Mfg. Co.

- Roma Medical Aids Ltd

- Marsi Bionics SL

- ReWalk Robotics

- ULS Robotics Co. Ltd

제7장 시장 기회와 앞으로의 동향

KTH 25.04.09The Rehabilitation Equipment Market size is estimated at USD 15.68 billion in 2025, and is expected to reach USD 19.93 billion by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

COVID-19 had a significant impact on the growth of the market. The increased need for rehabilitation services after the COVID-19 recovery drove the demand for the market's growth. For instance, as per the NCBI article published in July 2020, after severe COVID-19 disease, many patients will experience various problems with normal functioning and require rehabilitation services to overcome these problems. However, the relaxation of the COVID-19 lockdown restrictions resulted in the reopening of rehabilitation centers and a rise in patient inflow, thereby driving the demand for the rehabilitation market. This is expected to contribute to the market's growth in the post-pandemic period.

Some of the factors driving the market growth include the increasing incidence of chronic diseases, rising demand for rehabilitation therapies due to the growing prevalence of non-communicable diseases, and favorable reimbursement initiatives. Increasing incidences of arthritis and Parkinson's in the aging population and the growing number of trauma patients fuel the market's growth.

As per World Health Organization 2021, each year, non-communicable diseases affect around 41 million people representing 71% of deaths globally. This will create the demand for the rest of the population with non-communicable conditions to opt for rehabilitation centers to get them diagnosed and further promote the overall market's growth. Moreover, the high demand for assisted devices in the handicapped population and growing awareness about newly available products also fuel the rehabilitation equipment market. For instance, in November 2021, Philips Foundation partnered with Singapore Heart Foundation to address the lack of patient participation in rehabilitation programs and medication adherence. In February 2021, Rehabs Near Me launched a 24*7 service to assist people in the United States looking for rehab centers. Thus, it is evident that the companies are continuously launching products associated with rehabilitation equipment and creating awareness further drives the overall market growth.

Thus, the increasing incidence of chronic diseases, rising demand for rehabilitation therapies, and increasing launches of rehabilitation equipment are expected to contribute to the market's growth over the forecast period.

Rehabilitation Equipment Market Trends

Walking Assist Devices Segment Estimated to Witness a Healthy Growth Over the Forecast Period

The walking assist devices segment is expected to hold a major market share over the forecast period. Walking assistive devices generally involve devices, such as canes, crutches, and walkers, that allow easy mobility in patients with specific physical disabilities and the elderly population. These devices increase the patient's base of support at the same time, improve and maintain balance, increase activity, and reduce the patient's dependency on others.

According to the UN report 2022, the share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. This population is highly prone to have several diseases requiring personal mobility aid, which will further result in the adoption of walking assist devices.

Currently, smart walking assistive devices are gaining popularity, driving this segment's demand and thereby fuelling the segment studied. Likewise, increasing product launches are also expected to contribute to the growth of the segment studied. For instance, in May 2022, Samsung Electronics sought approval from FDA for its assistive robot "GEMS Hip," a wearable device that acts as an exoskeleton for users with mobility issues, using an active assist algorithm to improve gait and muscle movement.

Also, in April 2021, Panasonic launched a mass production model of its walk training robot designed to provide safe and efficient walk training for elderly citizens, who have apprehensions about walking because of physical restrictions and the experience of falling.

Thus, the high geriatric population and rising innovative product launches are expected to contribute to the growth of the studied segment over the forecast period.

North America Expected to Hold a Significant Share in the Market and Expected to do the Same in the Forecast Period

North America is expected to dominate the market over the forecast period. The rising prevalence of chronic diseases, such as Parkinson's, Alzheimer's, and arthritis, the increasing demand for rehabilitation therapies, and the presence of several major players are driving the growth of rehabilitation equipment in North America.

The risk of being affected by a chronic disease is increasing dramatically in the United States due to the rising geriatric population. This indicates that most Americans are likely to be affected by chronic diseases in the coming decades. This situation gives rise to a critical need for rehabilitation equipment and thus drives the overall market growth.

Moreover, as per the BTS data in January 2022, 25.2 million Americans had disabilities that made traveling outside the home difficult. In addition, according to the ACL report on 2021, people aged 65 years were expected to grow by 21.6% of the population by 2040, and people aged 85 and older were expected to reach 14.4 million in 2040. As the geriatric population susceptible to mobility issues increases, the demand for these lifting equipment is expected to increase over the forecast period.

Increasing research activities in developing advanced products are also boosting market growth. For instance, in November 2022, Penumbra Inc. launched the hands-free, full-body virtual reality-based offering for rehabilitation, expanding the REAL system platform. REAL y - series is one of the hands-free, non-tethered virtual reality rehabilitation platforms to perform both upper and lower extremities with a full body avatar.

Increasing government initiatives for safe patient handling and reimbursement programs such as Medicare are also expected to fuel the rehabilitation equipment market in this region.

Rehabilitation Equipment Industry Overview

The Rehabilitation Equipment Market is moderately competitive. Some of the companies currently dominating the market are Medline Industries Inc., Drive DeVilbiss Healthcare, Invacare Corporation, Ekso Bionics, Dynatronics Corporation, GF HEALTH PRODUCTS, Caremax Rehabilitation Equipment Co. Ltd, Hill-Rom Services Inc., and Hospital Equipment Mfg. Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Chronic Diseases

- 4.2.2 Rising Demand for Rehabilitation Therapies

- 4.2.3 Rising Awareness Initiatives Regarding Rehabilitation Therapies

- 4.3 Market Restraints

- 4.3.1 Unfavorable Reimbursements and Lack of Awareness

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market SIze by Value in USD Million)

- 5.1 By Product Type

- 5.1.1 Daily Living Aids

- 5.1.1.1 Medical Beds

- 5.1.1.2 Bathroom and Toilet Assist Devices

- 5.1.1.3 Reading Writing and Computer Aids

- 5.1.1.4 Other Daily Living Aids

- 5.1.2 Exercise Equipment

- 5.1.2.1 Upper Body Exercise Equipment

- 5.1.2.2 Lower Body Exercise Equipment

- 5.1.3 Body Support Devices

- 5.1.3.1 Patient Lifts

- 5.1.3.2 Medical Lifting Slings

- 5.1.4 Mobility Equipment

- 5.1.4.1 Walking Assist Devices

- 5.1.4.2 Wheelchairs and Scooters

- 5.1.1 Daily Living Aids

- 5.2 By Application

- 5.2.1 Physiotherapy

- 5.2.2 Occupational Therapy

- 5.2.3 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Rehab Centers

- 5.3.3 Others End-Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medline Industries Inc.

- 6.1.2 Drive DeVilbiss Healthcare

- 6.1.3 Invacare Corporation

- 6.1.4 Ekso Bionics

- 6.1.5 Dynatronics Corporation

- 6.1.6 GF HEALTH PRODUCTS INC.

- 6.1.7 Caremax Rehabilitation Equipment Co. Ltd

- 6.1.8 Hill-Rom Services INC.

- 6.1.9 Hospital Equipment Mfg. Co.

- 6.1.10 Roma Medical Aids Ltd

- 6.1.11 Marsi Bionics SL

- 6.1.12 ReWalk Robotics

- 6.1.13 ULS Robotics Co. Ltd