|

시장보고서

상품코드

1690064

압력 주입 백 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Pressure Infusion Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

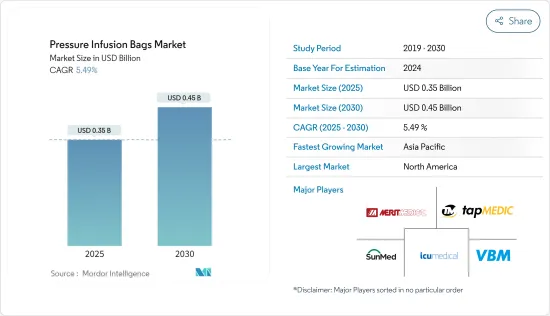

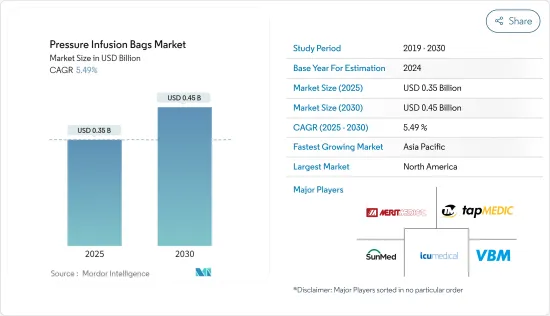

압력 주입 백 시장 규모는 2025년에 3억 5,000만 달러에 이를 것으로 추정되며, 예측 기간(2025-2030년)의 CAGR은 5.49%를 나타내고, 2030년에는 4억 5,000만 달러에 도달할 것으로 예측됩니다.

COVID-19의 유행은 시장에 큰 영향을 미쳤습니다. COVID-19의 봉쇄 기간 동안 병원의 응급 부문 입원이 증가하고 COVID-19의 사례 수가 빠른 속도로 증가했기 때문에 압력 주입 백 수요가 크게 증가했기 때문입니다. 예를 들어 2021년 9월 PubMed가 발표한 논문에 따르면 미국에서 COVID-19와 관련된 응급진료가 0-4세, 5-11세, 12-17세로 증가하고 COVID-19가 확인된 환자 입원이 2021년 중 0-17세로 증가했다는 연구가 진행되었습니다.

위의 논문에서는 2021년 7월과 8월에 ICU에 입원한 0-17세의 COVID-19 환자의 비율은 20%와 18%였다고 합니다. 따라서 압력 주입 시장은 COVID-19의 큰 유행에 의해 큰 영향을 받았습니다. 그러나 팬데믹은 현재 침전되고 있기 때문에 조사 예측 기간 동안 안정적인 추이가 예상됩니다.

시장 성장을 가속하는 특정 요인으로는 만성 질환의 유병률 증가, 긴급 수혈 사례 급증, 기술 진보, R&D 이니셔티브 증가 등이 있습니다. 2022년 7월 호주 보건복지연구소가 발표한 데이터에 따르면 2021년에는 호주인의 거의 절반(47%, 1,160만명)이 하나 이상의 일반적인 만성질환(당뇨병, 암, 정신·행동질환, 만성신장병 등)을 앓고 있다고 추정되었습니다. 따라서 만성 질환 환자가 증가함에 따라 주입 백 수요는 예측 기간 동안 증가합니다.

게다가 JAMA Network가 2022년 6월에 스웨덴에서 연구해 발표한 논문에 따르면 일반 인구에서의 아테롬성 동맥경화증의 유병률과 부담이 매우 높아지고 있으며, 다혈관 아테롬성 동맥경화증의 추정 유병률은 3%에서 42%였습니다. 죽상 동맥 경화증과 같은 질병의 치료에는 수술 절차가 포함되어 가압 주입 백의 사용량이 증가합니다.

압력 주입기는 또한 혈액, 혈액 제제, 혈액 확장제, 정맥주사 용액, 침습적 혈압 모니터링 절차의 급속 주입 등 다양한 의료 절차에 필요한 구성 요소가 되었습니다. 예를 들어, 2022년 8월에 NCBI에 의해 갱신된 논문에 따르면, 임상 상황이 결정질 주입의 급속 주입을 지시할 수 있는 급성 환경에서 압력 주입 백은 더 높은 주입 속도를 달성하기 위해 사용됩니다.

따라서, 만성 질환 증가 및 압력 주입 백의 기술적 진보와 같은 앞서 언급한 모든 요인들이 예측 기간 동안 시장을 밀어올릴 것으로 예상됩니다. 그러나 숙련된 전문가 부족은 시장 성장을 방해할 것으로 예상됩니다.

압력 주입 백 시장 동향

혈액 및 약물 주입은 예측 기간 동안 압력 주입 백 시장에서 수익성있는 성장을 보일 것으로 예상됩니다.

혈액 및 약물 주입은 예측 기간 동안 압력 주입 백 시장에서 수익성있는 성장을 보일 것으로 예상됩니다. 만성질환의 유병률이 세계적으로 상승하고 있기 때문에 저·중소득국에서도 다양한 만성질환의 치료가 세계 보건 커뮤니티와 정부에 의해 점점 우선적으로 되고 있습니다. 그 결과 세계 질병 부담에 대처하기 위해 신속한 주입 수요가 현저하게 높아지고 압력 주입 백의 사용과 채용이 증가하고 있습니다.

수액 과다는 울혈성 심부전이나 신부전 등 다양한 장기의 기능부전에 의해 일반적으로 일어나는 상태입니다. 저삼투압이 중증이거나 장기간 지속되면 심장 기능의 보상 변화가 진행성 심부전으로 악화될 수 있습니다. 그러므로 심부전 환자의 저액량 상태를 피하기 위해 압력 주입 백이 사용되어 조사된 시장 수요를 증가시킬 것으로 예상됩니다.

Heart and Circulatory Disease Statistics 2023에 따르면 2021년부터 2022년까지 영국의 NHS 병원에 심장·순환기 질환으로 입원한 환자는 936,556명이었습니다. 이는 2020-2021년 807,074명에서 증가했습니다. 따라서 병원에서 심혈관 질환 입원 환자 증가는 혈액 및 약물 주입 수요를 증가시키고 예측 기간 동안 동일한 부문의 성장에 기여할 것으로 예상됩니다.

또한 다양한 지역에서 압력 주입 백의 가용성을 높이기 위한 혈액·약제 주입 IV 백의 출시, 제휴, 파트너십 등 주요 기업에 의한 전략적 활동 증가는 예측 기간에 걸쳐 시장 성장을 강화할 것으로 예상됩니다. 예를 들어 2022년 6월 Gufic Biosciences는 인도에서 약물전달용 듀얼 챔버 IV 백을 출시했습니다. Gufic Biosciences는 인도에서 IV 백을 생산하기 위해 프랑스 파트너와 협력했습니다.

따라서 심혈관 질환과 암 등 만성 질환의 유병률 증가와 주요 기업의 전략적 활동으로 조사 대상 부문은 예측 기간 동안 성장을 나타낼 것으로 기대됩니다.

예측기간 중 북미가 압력 주입 백 시장에서 큰 점유율을 차지할 전망

북미는 주로 만성질환의 높은 유병률, 높은 헬스케어 지출, 만성질환의 수술적 치료가 증가함에 따라 압력 주입 백 시장에서 큰 점유율을 차지할 것으로 예상됩니다. 또한 압력 주입 시스템의 급속한 진보는 북미 시장 성장을 가속할 것으로 예상됩니다.

미국 암 협회가 발표한 2023년 통계에 따르면 2023년 미국에서 약 195만 건의 새로운 암이 진단되었으며, 이는 2022년의 191만 건과 비교했을 때 약 2배가량 증가한 수치입니다. 암 치료는 인체에서 영양을 빼앗아 궤양, 위장 기능 장애, 물리적 폐색을 일으켜 신체에 영향을 주기 때문에 환자에게 비경구 영양을 공급하는 수요가 높아집니다. 이 때문에 환자에게 무균 비경구 주입을 가압 주입하는 데 사용되는 가압 주입 백 수요가 증가하고 시장 확대를 뒷받침할 것으로 예상됩니다.

게다가, 국내에서 수행되는 정형외과의 대체술과 흉부 수술과 같은 복잡한 수술은 대부분의 정맥 주사제가 압력 주입 백을 통해 투여되기 때문에 압력 주입 백 수요를 증가시킬 것으로 예상됩니다. 예를 들어, 캐나다 건강정보연구소가 2022년 12월에 발표한 데이터에 따르면, 캐나다에서는 2021년부터 2022년에 걸쳐 약 700건의 외래환자에 의한 고관절 치환술과 무릎 관절 치환술이 이루어졌습니다. 이와 같이 치환술의 건수가 많기 때문에 예측기간 중 시장 성장이 기대됩니다.

게다가 2021년 전미 안전위원회의 데이터에 따르면 미국에서는 2021년에 320만명이 스포츠나 레크리에이션 도구에 의한 부상으로 구급부에서 치료를 받았습니다. 부상과 가장 자주 관련된 활동은 운동, 사이클링, 농구입니다. 따라서 이러한 유형의 활동과 관련된 부상 수 증가는 압력 주입 백의 채용을 증가시킬 것으로 예상됩니다.

또한 인수, 제휴, 기타 이니셔티브 등 다양한 주요 전략적 이니셔티브의 채택에 기업이 주력하게 되면서 시장에서의 수액백의 수가 증가하여 시장의 성장이 촉진될 것으로 예상됩니다. 예를 들어 2022년 1월 ICU Medical Inc.는 Smiths Group PLC에서 Smiths Medical 인수를 완료했습니다. Smiths Medical의 사업에는 주사기 및 외래용 주입 장치(압력 주입 백 포함), 버스큘러 접근, 생체 케어 제품 등이 포함됩니다.

따라서 만성질환 증가와 수술의 필요성 등 앞서 언급한 모든 요인들이 주요 기업의 전략적 인수와 함께 북미 시장 성장을 뒷받침할 것으로 예상됩니다.

압력 주입 백 산업 개요

압력 주입 백 시장은 적당하게 단편화되고, 소수의 선도 기업으로 구성됩니다. Eakin Healthcare Group(Armstrong Medical Inc.), Merit Medical System, ICU Medical Inc., Tapmedic LLC, SunMed 등의 기업이 시장에서 큰 점유율을 차지하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 만성 질환 증가와 긴급 수혈 사례의 급증

- 기술의 진보와 연구개발 이니셔티브 증가

- 시장 성장 억제요인

- 숙련된 전문가의 부족

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 제품 유형별

- 재사용 가능

- 일회용

- 재료별

- 나일론

- 폴리우레탄

- 기타 재료

- 용도별

- 혈액 및 약물 주입

- 침습적 혈압 모니터링 절차

- 최종 사용자별

- 병원 및 진료소

- 외래환자시설

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Eakin Healthcare Group(Armstrong Medical Inc.)

- Ecomed

- Merit Medical Systems

- Sarstedt AG & Co. KG

- ICU Medical Inc.

- SunMed

- Tapmedic LLC

- VBM Medizintechnik GmbH

- Spengler SAS

- Fairmont Medical

- Biegler GmbH

제7장 시장 기회와 앞으로의 동향

KTH 25.04.09The Pressure Infusion Bags Market size is estimated at USD 0.35 billion in 2025, and is expected to reach USD 0.45 billion by 2030, at a CAGR of 5.49% during the forecast period (2025-2030).

The COVID-19 pandemic had a significant impact on the market since the demand for pressure infusion bags increased considerably during the COVID-19 lockdown with the number of COVID-19 cases increasing at a faster rate with increased hospital emergency department admissions. For instance, according to an article published by PubMed in September 2021, a study was conducted in the United States which showed that COVID-19-related emergency visits increased for persons aged 0-4, 5-11, and 12-17 years, and hospital admissions of patients with confirmed COVID-19 increased for persons aged 0-17 years during 2021.

The abovementioned article also stated that the proportion of COVID-19 patients aged 0-17 years who were admitted to an ICU ranged from 20% and 18% during July and August 2021. Thus, the pressure infusion market was significantly impacted by the COVID-19 pandemic. However, as the pandemic has subsided currently, the studied market is expected to have stable during the forecast period of the study.

Certain factors that are driving the market growth include the rising prevalence of chronic diseases and surge in emergency transfusion cases and technological advancements, and increasing R&D initiatives. According to the data published by the Australian Institute of Health and Welfare in July 2022, it is estimated that almost half (47%, or 11.6 million) of Australians have one or more common chronic health conditions (including diabetes, cancer, mental and behavioral conditions, and chronic kidney disease) in 2021. Therefore, as the number of chronic disease patients increases, the demand for infusion bags will increase over the projected period.

Moreover, according to an article published by JAMA Network in June 2022, a study was conducted in Sweden which showed that the prevalence and burden of atherosclerosis in the general population have been very high, and the estimated prevalence of poly-vascular atherosclerosis ranged from 3% to 42%. The treatment of diseases like atherosclerosis includes surgical procedures, which will lead to more usage of pressure infusion bags.

The pressure infuser has also become a necessary component of various medical procedures such as rapid infusion of blood, blood products, blood expanders, IV solutions, and invasive pressure monitoring procedures. For instance, according to an article updated by NCBI in August 2022, in an acute setting, where the clinical situation might indicate a rapid infusion of crystalloid fluids, pressure infusion bags are used to achieve a higher infusion rate.

Thus, all aforementioned factors, such as the increasing number of chronic diseases and the technological advancement in pressure infusion bags, are expected to boost the market over the forecast period. However, the lack of skilled professionals is expected to impede the growth of the market.

Pressure Infusion Bags Market Trends

Blood and Drug Infusion is Expected to Show Lucrative Growth in the Pressure Infusion Bags Market Over the Forecast Period

Blood and drug infusions are carried out whenever any surgical procedure takes place that involves the loss of blood or the need for drug injection through infusion bags. As the prevalence of chronic diseases is rising worldwide, the treatment of various chronic diseases has been increasingly prioritized by the global health community or governments, even in low- and middle-income countries. As a result, the demand for rapid fluid transfusion has risen significantly in order to address the global disease burden, thus leading to a rise in the utilization and adoption of pressure infusion bags.

Hypovolemia is a condition that is commonly caused by dysfunction of various organs, such as congestive heart failure or kidney failure. If the hypovolemia is severe or persists over a long period of time, the compensatory changes in cardiac function may deteriorate into progressive cardiac failure. Hence, to avoid hypovolemia conditions in heart failure patients, pressure infusion bags are used, which is expected to increase the demand for the market studied.

According to the Heart and Circulatory Disease Statistics 2023, 936,556 patients were admitted to NHS hospitals in England for heart and circulatory diseases during 2021-2022. This was an increase from 807,074 patients in 2020-2021. Hence, the increase in cardiovascular disease admissions in hospitals is expected to increase the demand for blood and drug infusions, thereby contributing to the segment's growth over the forecast period.

Additionally, the increase in strategic activities by key players like blood and drug infusion IV bag launches, collaboration, and partnerships to increase the availability of pressure infusion bags across various regions are expected to bolster market growth over the forecast period. For instance, in June 2022, Gufic Biosciences launched dual-chamber IV bags for drug delivery in India. Gufic Biosciences collaborated with its French counterpart to manufacture the IV bag in India.

Hence, with the growing prevalence of chronic diseases such as cardiovascular diseases and cancer and strategic activities by the key players, the studied segment is expected to witness growth over the forecast period.

North America is Expected to Hold a Significant Share in the Pressure Infusion Bags Market Over the Forecast Period

North America is expected to hold a significant share of the pressure infusion bags market, primarily due to the high prevalence of chronic diseases, high healthcare expenditures, and the increase in surgical treatments for chronic diseases. In addition, the rapid advancements in pressure infusion systems are also expected to fuel market growth in the North American region.

According to the 2023 statistics published by the American Cancer Society, about 1.95 million new cancer cases are expected to be diagnosed in the United States in 2023, as compared to 1.91 million cases in 2022. Cancer treatment deprives the human body of nutrition and affects the body by causing ulcers, gastrointestinal dysfunction, and physical blockages, which increases the demand for delivering parenteral nutrition to patients. This is expected to fuel demand for pressure infusion bags, which are used to pressurize sterile parenteral fluids to patients, boosting market expansion.

Additionally, complex procedures, such as orthopedic replacements or thoracic surgery, performed in the country are expected to increase the demand for pressure infusion bags since intravenous medications are mostly given through pressure infusion bags. For instance, according to the data published by the Canadian Institute for Health Information in December 2022, about 700 outpatient hip and knee replacements were performed in Canada during 2021-2022. Thus, a high number of replacement procedures is expected to fuel market growth over the forecast period.

Furthermore, according to the data from the National Safety Council in 2021, an estimated 3.2 million people were treated in emergency departments for injuries involving sports and recreational equipment in the United States in 2021. The activities most frequently associated with injuries are exercise, cycling, and basketball. Therefore, the rise in the number of injuries associated with these types of activities is also expected to increase the adoption of pressure infusion bags.

Additionally, the increasing focus of the companies on adopting various key strategic initiatives such as acquisitions, partnerships, and other initiatives is expected to increase the number of infusion bags in the market, thereby propelling market growth. For instance, in January 2022, ICU Medical Inc. completed its acquisition of Smiths Medical from Smiths Group PLC. The Smiths Medical business includes syringes and ambulatory infusion devices (including pressure infusion bags), vascular access, and vital care products.

Hence, all the aforementioned factors, such as the increasing number of chronic diseases and their requirement for surgeries, coupled with strategic acquisitions by the key players, are expected to boost the growth of the market in the North America Region.

Pressure Infusion Bags Industry Overview

The pressure infusion bags market is moderately fragmented and consists of a few major players. Companies like Eakin Healthcare Group (Armstrong Medical Inc.), Merit Medical System, ICU Medical Inc., Tapmedic LLC, and SunMed hold a substantial market share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic Diseases and Surge in Emergency Transfusion Cases

- 4.2.2 Technological Advancements and Increasing R&D Initiatives

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product Type

- 5.1.1 Reusable

- 5.1.2 Disposable

- 5.2 By Material

- 5.2.1 Nylon

- 5.2.2 Polyurethane

- 5.2.3 Other Materials

- 5.3 By Application

- 5.3.1 Blood and Drug Infusion

- 5.3.2 Invasive Pressure Monitoring Procedures

- 5.4 By End Users

- 5.4.1 Hospitals and Clinics

- 5.4.2 Outpatient Facilities

- 5.4.3 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Eakin Healthcare Group (Armstrong Medical Inc.)

- 6.1.2 Ecomed

- 6.1.3 Merit Medical Systems

- 6.1.4 Sarstedt AG & Co. KG

- 6.1.5 ICU Medical Inc.

- 6.1.6 SunMed

- 6.1.7 Tapmedic LLC

- 6.1.8 VBM Medizintechnik GmbH

- 6.1.9 Spengler SAS

- 6.1.10 Fairmont Medical

- 6.1.11 Biegler GmbH