|

시장보고서

상품코드

1690139

인도의 옥상 태양광 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India Rooftop Solar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

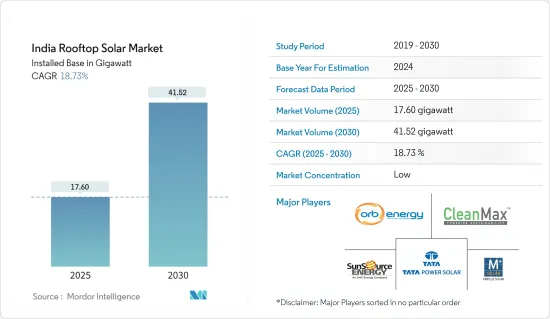

인도의 옥상 태양광 시장 규모는 설치 기준으로 2025년 17.60기가와트에서 2030년에는 41.52기가와트로 성장할 것으로 추정됩니다. 예측 기간 중(2025-2030년) CAGR은 18.73%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 장기적으로는 상업 및 산업 분야에서 수요 증가나 재생 가능 에너지 통합에 대한 정부의 중시라고 하는 요인이 시장 성장의 큰 촉진요인이 될 것으로 예상됩니다.

- 반면에 옥상 프로젝트의 설치 속도가 느려지면 향후 몇 년 동안 인도의 옥상 태양광 시장의 성장을 억제할 수 있습니다.

- 그럼에도 불구하고 미개척 태양광 잠재력과 분산화의 진전으로 주택 및 산업 고객은 중앙 송전망에 대한 의존도를 낮출 수 있으며 예측 기간 동안 성장 기회가 될 것으로 기대됩니다.

인도의 옥상 태양광 시장 동향

온그리드 부문이 시장을 독점할 전망

- 온그리드 지붕 시스템에서는 태양광 발전 패널과 어레이가 파워 인버터 유닛을 통해 전력 회사의 송전망에 연결되어 전력 회사의 송전망과 병행하여 작동합니다. 소비자가 발전한 전력은 넷 미터링 방식에 의해 중앙 송전망에 공급됩니다. 이러한 연결은 전기 요금을 줄이기 위해 상업용, 산업용 및 주택용 소비자가 일반적으로 사용합니다.

- 인도에서는 정부의 다양한 정책과 이니셔티브에 의해 계통 연계형 태양광 발전 시스템이 최근 크게 성장하고 있습니다. 이는 2030년 신재생에너지 국가 목표 달성을 뒷받침할 것으로 보입니다.

- 인도에서는 주정부 및 중앙정부의 태양광 발전 옥상 설치를 촉진하기 위해 Grid Connected Solar Rooftop Scheme이 도입되었습니다. 인도에서는 2026년 3월 말까지 계통 연계 옥상 태양광 프로젝트의 누적 설비 용량 약 4만 메가와트의 달성을 목표로 하고 있습니다.

- 예를 들어, 신재생에너지부는 설정된 목표를 달성하기 위해 2019년 3월에 옥상 태양광 프로그램 단계 II 계획을 시작했습니다. 이 계획 하에, 동성은 소비자에게 개인 가구 또는 주민 복지 협회/그룹 주택 협회에 옥상 태양광(RTS)을 설치하기 위한 중앙 자금 지원(CFA)을 제공할 예정입니다.

- 2023년 9월, 소비자가 RTS를 설치하기 위한 온라인 절차를 용이하게 하기 위해 전국 포털이 개설되었습니다. 전국 어느 지역의 주택 소비자도 옥상 태양광 패널의 설치를 신청해, 보조금을 직접 은행 계좌에 받을 수 있습니다.

- 신재생에너지부(MNRE)에 따르면 2023년부터 2024년 사이에 계통에 연결된 옥상 태양광의 누적 설비 용량은 11.8GW에 달하고, 2022년부터 2023년 8.9GW에서 33.86% 증가했습니다. 2023년에 여러 대규모 태양광 발전 프로젝트가 가동되어 송전망에 접속된 것이 설치 용량 급증의 주요 요인이 되었습니다.

- 구자라트, 마하라슈트라, 카르나타카는 송전망의 옥상 태양광 장비 용량이 가장 많은 주입니다. 2024년 3월까지의 발전량은 구자라트주가 345만kW, 카르나타카주가 790만kW, 라자스탄주가 115만kW였습니다.

- 전체적으로 발전을 위한 옥상 태양광의 채용이 증가하고 있는 것, 지원 정책, 체계, 야심적인 재생 가능 에너지 목표라는 형태로 정부의 지원이 있다는 등의 요인으로부터 예측 기간 중 인도의 옥상 태양광 시장에서는 온그리드 부문이 크게 성장할 것으로 예상됩니다.

신재생에너지 통합을 중시하는 정부가 시장을 견인할 전망

- 신·재생가능에너지부(MNRE)에 따르면 인도는 태양광발전 도입에 있어서 세계 제5위의 지위를 확보하고 있습니다. 2023년 6월 30일 기준 인도에서는 총 7,010만kW의 태양광 발전 프로젝트가 가동되었습니다. 이 용량은 지상 설치형 태양광 프로젝트가 5,722만 kW, 옥상 설치형 태양광 프로젝트가 1,037만 kW, 오프그리드 태양광 프로젝트가 251만 kW입니다.

- 2023년 3월 기준 옥상 태양광 용량은 8,877MW로 증가했습니다(2022년 9월 30일 기준 7,520MW). 이 성장의 주요 요인은 주택 소비자의 의식이 증가하고 주택 분야를 대상으로 한 정부 보조금입니다.

- 정부는 옥상 태양광 도입을 지원하기 위한 종합적인 정책과 정책을 수립했습니다. 정부는 여러 넷미터링 이니셔티브를 실시하여 옥상 태양광 이용자가 발전한 잉여 전력을 송전망에 매전할 수 있게 하고, 경제적인 이점을 제공함과 동시에 송전망의 안정을 촉진했습니다.

- 예를 들어, 2024년 3월, 라자스탄 전력 규제 위원회(RERC)는 옥상 태양광 장비의 넷미터링 상한을 500kW에서 1MW로 끌어올렸습니다. 이 위원회의 결정은 인터넷 미터링 용량을 확대하여 옥상 태양열 설비의 도입을 촉진하는 것을 목적으로 하고, 특별 명령에 의해 내려졌습니다.

- 게다가 2023년 11월, 타밀 나두 전력 규제위원회(TNERC)는 MSME 부문의 옥상 태양열 소비자들에게 네트워크 요금의 50%를 면제하겠다는 주정부의 지시를 지지하는 새로운 명령을 내렸습니다.

- 2023년 3월 기준 MNRE는 2023년 1월까지 목표 357.9MW에 대해 약 40.4MW의 옥상 태양광 용량이 설치되었다고 발표했습니다.

- 2023년 8월 마하라슈트라 전력 규제위원회는 태양광 지붕상 프로젝트의 넷미터링 상한을 1MW로 끌어올리는 규제 개정을 제안했습니다. 인도의 대부분의 주에서는 MNRE가 의무화하고 있는 옥상 태양광소의 넷미터링 적용량은 500kW 정도였습니다. 이번 개정안이 승인되면 대구 소비자에 의한 옥상 태양광 프로젝트의 도입이 늘어날지도 모릅니다. 이것은 인도의 옥상 태양광 시장의 개척에 긍정적일지도 모릅니다.

- 이러한 정부 인센티브는 보통 보조금, 세액 공제, 보조금, 대출 제도, 녹색 크레딧 추가 등이 있습니다. 인도 정부는 주택용, 상업용, 산업용(C&I) 태양광 발전 시스템에 대해 재정적으로 매력적인 새로운 우대 제도를 전개하고 있습니다. 이것이 예측 기간 동안 시장을 견인하게 될 것입니다.

인도의 옥상 태양광 산업 개요

인도의 옥상 태양광 시장은 세분화되어 있습니다. 이 시장의 주요 기업으로는 Clean Max Enviro Energy Solutions Pvt. Ltd, Tata Power Solar Systems Limited, Orb Energy Pvt. Ltd, Amplus Solar Power Private Limited, Sunsource Energy Pvt. Ltd 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 시장 규모와 수요 예측(-2029년)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 신재생에너지 통합을 위한 정부의 강조점

- 상업 및 산업 부문 수요 증가

- 성장 억제요인

- 느린 속도의 옥상 프로젝트 설치

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 최종 사용자

- 산업

- 상업(공공 부문 포함)

- 주택

- 그리드 유형(정성적 분석 전용)

- 온그리드

- 오프그리드

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Cleantech Energy Corporation Pte Ltd

- Fourth Partner Energy Pvt. Ltd

- Amplus Solar Power Pvt. Ltd

- Clean Max Enviro Energy Solutions Pvt. Ltd

- Sunsource Energy Pvt. Ltd

- Orb Energy Pvt. Ltd.

- Tata Power Solar Systems Limited

- Mahindra Susten Pvt. Ltd

- Growatt New Energy Technology Co. Ltd

- Roofsol Energy Pvt. Ltd

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 미개발된 태양광 잠재력과 탈중앙화 증진을 위한 집중

The India Rooftop Solar Market size in terms of installed base is expected to grow from 17.60 gigawatt in 2025 to 41.52 gigawatt by 2030, at a CAGR of 18.73% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increasing demand in the commercial and industrial sectors and government emphasis on renewable energy integration are expected to be significant drivers for the market's growth.

- On the other hand, slow-paced installation of rooftop projects may likely restrain the growth of the Indian rooftop solar market over the coming years.

- Nevertheless, the untapped solar potential and focus on increasing decentralization would enable residential and industrial customers to rely less on central grids, which is expected to be a growth opportunity during the forecast period.

India Rooftop Solar Market Trends

The On-grid Segment is Expected to Dominate the Market

- In the on-grid rooftop system, photovoltaic panels or arrays are connected to the utility grid through a power inverter unit, allowing them to operate in parallel with the electric utility grid. The electricity generated by consumers is fed into the central power grid through a net-metering scheme. Such kind of connection is commonly used by commercial, industrial, and residential consumers to reduce electricity bills.

- In India, on-grid or grid-connected solar PV systems have witnessed significant growth in recent years owing to the various government policies and initiatives. This is likely to support the country in achieving its 2030 national renewable energy target.

- The country introduced the Grid Connected Solar Rooftop Scheme to promote solar rooftop installation by the state and central government. India aims to achieve a cumulative installed capacity of about 40,000 MW from Grid Connected Rooftop solar projects by the end of March 2026.

- For instance, the Ministry of New and Renewable Energy launched the Rooftop Solar Programme Phase-II scheme in March 2019 to reach the set targets. Under the scheme, the ministry is expected to provide consumers with Central Financial Assistance (CFA) for installing Rooftop Solar (RTS) in individual households or Resident Welfare Associations/Group Housing Societies.

- In September 2023, the National Portal was launched to ease the online process for consumers to install RTS. Residential consumers from any part of the country are eligible to apply for the installation of rooftop solar panels and receive a subsidy directly in their bank accounts.

- According to the Ministry of New and Renewable Energy (MNRE), during the 2023-2024 period, the cumulative solar rooftop installed capacity connected to the grid reached 11.8 GW, representing an increase of 33.86% from 8.9 GW in the 2022-2023 period. Several large-scale solar energy projects were operational and connected to the grid during 2023, which was majorly responsible for the sharp increase in the installed capacity.

- Gujarat, Maharashtra, and Karnataka are the states with the highest on-grid rooftop solar PV installed capacity. Until March 2024, Gujarat generated 3.45 GW, while Karnataka and Rajasthan generated around 7.9 GW and 1.15 GW, respectively.

- Overall, factors including the increasing adoption of rooftop solar energy for power generation, government support in the form of supportive policies, schemes, and ambitious renewable targets are expected to witness significant growth of the on-grid segment in the Indian solar rooftop market during the forecast period.

Government Emphasis on Renewable Energy Integration is Expected to Drive the Market

- According to the Ministry of New and Renewable Energy (MNRE), India secured the fifth position globally in the deployment of solar power. As of June 30, 2023, the country commissioned solar projects with a total capacity of 70.10 GW. This capacity comprised 57.22 GW from ground-mounted solar projects, 10.37 GW from rooftop solar projects, and 2.51 GW from off-grid solar projects.

- As of March 2023, the rooftop solar capacity increased to 8,877 MW, compared to 7,520 MW as of September 30, 2022. The primary factors attributed to this growth included heightened awareness among residential consumers and government subsidies targeted toward the residential segment.

- The government has formulated comprehensive policies and regulations to support rooftop solar deployment. The government took several net metering initiatives, which allow rooftop solar users to sell excess electricity generated back to the grid, providing financial benefits and promoting grid stability.

- For instance, in March 2024, the Rajasthan Electricity Regulatory Commission (RERC) raised the limit for net metering from 500 kW to 1 MW for rooftop solar installations. The Commission's decision, made through a suo motu order, aims to promote the adoption of rooftop solar installations by expanding the net metering capacity.

- Further, in November 2023, the Tamil Nadu Electricity Regulatory Commission (TNERC) issued a new order endorsing the state government's directive to exempt 50% of network charges for rooftop solar consumers in the MSME sector.

- As of March 2023, the MNRE quoted that about 404 MW of rooftop solar capacity was installed against the target of 357.9 MW up to January 2023, a decline from 678 MW since the previous financial year.

- In August 2023, the Maharashtra Electricity Regulatory Commission proposed amendments in regulations to increase the capping of net metering to 1 MW for solar rooftop projects. The net-metering applicability stood around 500 kW for rooftop solar plants in most Indian states as mandated by MNRE. The approval of proposed amendments might lead to an increase in the adoption of rooftop solar projects by large consumers. This might benefit the development of the solar rooftop market in India.

- These government incentives usually include subsidies, tax credits, grants and loan programs, and additional green credits. The Indian government is rolling out new fiscally attractive incentive schemes for residential, commercial, and industrial (C&I) solar PV systems. This will likely drive the market during the forecast period.

India Rooftop Solar Industry Overview

The Indian rooftop solar market is fragmented. Some key players in this market include Clean Max Enviro Energy Solutions Pvt. Ltd, Tata Power Solar Systems Limited, Orb Energy Pvt. Ltd, Amplus Solar Power Private Limited, and Sunsource Energy Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Emphasis Towards Renewable Energy Integration

- 4.5.1.2 Increasing Demand in the Commercial and Industrial Sector

- 4.5.2 Restraints

- 4.5.2.1 Slow-Paced Installation of Rooftop Projects

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 End-user

- 5.1.1 Industrial

- 5.1.2 Commercial (Including Public Sector)

- 5.1.3 Residential

- 5.2 Grid Type (Qualitative Analysis Only)

- 5.2.1 On-grid

- 5.2.2 Off-grid

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cleantech Energy Corporation Pte Ltd

- 6.3.2 Fourth Partner Energy Pvt. Ltd

- 6.3.3 Amplus Solar Power Pvt. Ltd

- 6.3.4 Clean Max Enviro Energy Solutions Pvt. Ltd

- 6.3.5 Sunsource Energy Pvt. Ltd

- 6.3.6 Orb Energy Pvt. Ltd.

- 6.3.7 Tata Power Solar Systems Limited

- 6.3.8 Mahindra Susten Pvt. Ltd

- 6.3.9 Growatt New Energy Technology Co. Ltd

- 6.3.10 Roofsol Energy Pvt. Ltd

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Solar Potential and Focus to Increase Decentralization