|

시장보고서

상품코드

1690156

특수 차량 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Specialty Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

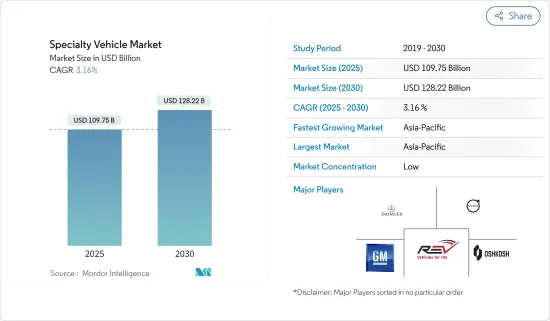

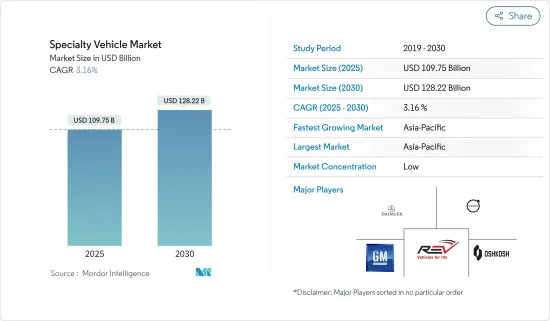

특수 차량 시장 규모는 2025년에 1,097억 5,000만 달러에 이를 것으로 추정됩니다. 예측기간 중(2025-2030년) CAGR은 3.16%를 나타내고, 2030년에는 1,282억 2,000만 달러에 달할 것으로 전망됩니다.

특수 차량 시장은 주로 운송활동 정지를 일으켜 공급망을 혼란시킨 COVID-19 팬데믹으로 인해 2020년에 감소를 경험했습니다. 그러나 봉쇄조치가 해제된 뒤 세계 행정기관이 의료시설, 응급 서비스, 관련 기기에 많은 투자를 시작했기 때문에 시장은 큰 성장을 보이기 시작했습니다.

장기적으로 민간 부문의 적극적인 참여로 중국과 인도 등 건설 산업의 확대가 특수 차량 시장을 견인할 것으로 예상됩니다. 물류 부문의 확대는 공기압을 동력원으로 하는 특수 벌크 캐리어나 탱크로리 트레일러에 대한 수요가 높아져 벌크 캐리어 시장의 견인역이 될 것으로 예상됩니다. 따라서 기업은 혁신적인 제품 개발에도 힘을 쏟고 있습니다.

주요 하이라이트

- 2022년 10월, GAZ는 체체나부트의 AvtoVAZ Argun 공장에서 상용차 GAZelle Next를 생산하기 시작했습니다. 이 모델은 학교 버스, 구급차, 주택 및 커뮤니티 서비스에도 사용할 수 있습니다.

또한 제조업체는 비용 절감, 새로운 서비스 모델 요구 사항, 플랫폼 전환으로 매력적인 서비스 제공, 재료 및 생산 가격 상승에 주력하고 있습니다. 특수 차량 산업에서 고객의 구매 습관은 특히 제품 사용자 정의와 관련하여 극적으로 변화하고 있습니다. 맞춤형 수요가 증가함에 따라 OEM은 더 많은 선택과 복잡성에 직면해 있습니다.

예측 기간 동안 CAGR은 아시아태평양이 가장 높고 유럽과 북미가 계속될 것으로 예상됩니다. 미국에서는 푸드트랙 사업, 이동쇼룸, 광고·프로모션 등의 목적으로 소규모 사업자가 이러한 차량을 사용하고 있으며, 여행, 의료, 헬스케어 대응 차량 수요도 예측 기간 중에 증가할 것으로 전망됩니다.

특수 차량 시장 동향

법 집행 기관 및 의료 시설에 대한 지출 증가

전염병, 유행병, 교통사고, 가정 및 산업 부상, 정부가 주최하는 의료 프로그램 증가가 의료·건강용 특수 차량 수요를 촉진하고 있습니다. 미국에서는 3분에 1명이 이환하는 혈액암 등의 질병이 혈액 수요를 증대시켜, 혈액 운반차 시장 성장을 뒷받침하고 있습니다.

에볼라 출혈열과 COVID-19와 같은 최근 전염병과 유행병은 구급차, 이동 약국, 이동 집중 치료실 수요를 증가시키고 있습니다. 많은 국가에서는 구급차 수요 증가가 인구 증가를 초과합니다. 일부 국가에서는 건강상의 응급 상황에 대응하기 위해 고급 건강 관리 차량을 사용하고 있습니다. 예를 들어 COVID-19의 봉쇄 제한이 해제된 후 뉴질랜드에서는 이동 수술실 서비스가 재개되었습니다. 자율주행차기술의 대두와 개발에 따라 가까운 미래 구급의료차량에 반자율주행지원기술이 탑재될 것으로 예상됩니다. 법 집행 기관과 건강 관리 시설에 대한 세계 정부 지출 증가는 특수 차량 수요를 견인하고 있습니다.

또한 일본에서 사용되는 특수 차량의 수는 2012년 약 164만대에서 지난해 177만대에 이르렀습니다. 그 결과 SPV의 수는 지난 10년간 꾸준히 증가했습니다.

예측기간 동안 아시아태평양이 가장 높은 성장률을 보임

아시아태평양은 특수 차량 시장을 선도할 것으로 예상됩니다. 기술 개발의 진전이 이 지역의 특수 차량 시장의 성장을 뒷받침하고 있습니다. COVID-19 팬데믹시에는 다양한 기업이 지방자치단체 등에 구급차를 납입했습니다. 그러나 팬데믹 후에는 각사가 전략적 제휴를 맺고 선진적인 구급차를 발매하는 등 구급차의 새로운 개발도 진행되고 있습니다.

예를 들어 2022년 10월 응급의료 대응 서비스를 제공하는 메달란스 헬스케어는 국내 최대의 통신사업자인 릴리언스 지오와 공동으로 5G-Smart 연결 구급차를 출시했습니다.

2022년 5월 : EV Expo 2022에서 인도 최초의 EV 응급 응답기가 발표됩니다. AmbulanceMe 앱은 Made in India의 전기 구급차를 지원합니다.

의료 및 헬스케어 대응 차량의 분야도 큰 점유율을 차지하는 분야입니다. 전기 추진, 독립적인 환자 구획, 음압 창조 기술, 자외선 소독 등의 설계 및 기타 혁신적인 변화가 가까운 미래에 의료용 특수 차량 시장을 추진할 것으로 예상됩니다.

특수 차량 산업 개요

특수 차량 시장은 상당히 단편화되어 있으며, 다임러, GM 그룹, 볼보 AB 등 다국적 기업이 진입하고 있습니다. 시장에서는 많은 인수, 합작 투자, 전기자동차 및 자율 주행 기술에 대한 투자가 이루어지고 있습니다.

예를 들어, 2022년 2월, 라이트닝 e 모터스는 제너럴 모터스와의 새로운 제휴를 발표하고, 100% 전기자동차의 클래스 3에서 클래스 6의 중형 상용차를 개발하는 최초의 GM 특수 차량 제조업체(SVM)가 되었습니다. 셔틀, 배송 트럭, 구급차, 학교 버스는 모두 GM 섀시에서 지원됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자·소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 구급차

- 소화 트럭

- 이동식 연료 운반 유조선

- 기타 유형

- 용도 유형별

- 법 집행 및 공공 안전

- 의료 및 헬스케어

- 레크리에이션 차량

- 기타 서비스

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- LDV Inc.

- Force Motors Limited

- Matthews Specialty Vehicles Inc.

- Specialty Vehicles Inc.

- Farber Specialty Vehicles

- REV Group

- Daimler AG

- Volvo Group

- General Motors Company

- Spartan Motors Inc.(Shyft Group)

- Emergency One Group

- Oshkosh Corporation

제7장 시장 기회와 앞으로의 동향

KTH 25.04.09The Specialty Vehicle Market size is estimated at USD 109.75 billion in 2025, and is expected to reach USD 128.22 billion by 2030, at a CAGR of 3.16% during the forecast period (2025-2030).

The market for specialty vehicle market experienced a decline in 2020, primarily owing to the COVID-19 pandemic, which caused a halt in transportation activities, disrupting the supply chain. However, after the lockdown measures were revoked, the market started witnessing significant growth as governing bodies across the world started investing heavily in healthcare facilities and emergency services, and associated equipment.

Over the long term, the expansion of the construction industry in countries such as China and India, with active participation from the private sector, is expected to drive the specialized vehicle market. The expansion of the logistics sector is expected to drive the demand for special pneumatically powered bulk carriers and tank truck trailers, which will drive the bulk carrier market. Therefore, players are also focusing on developing innovative products. For instance,

Key Highlights

- In October 2022, GAZ began manufacturing commercial vehicles GAZelle Next at the AvtoVAZ Argun plant in Chechenavto. The model can also be used for school buses, ambulances, housing, and community services.

Moreover, manufacturers are also focusing on lowering costs, new service model requirements, providing appealing services due to shifting platforms, and rising material and production prices. Customers' purchasing habits in the specialty vehicle industry are changing dramatically, particularly when it comes to product customization. As the demand for customization grows, OEMs face more options and complexity.

Asia-Pacific is anticipated to witness the highest CAGR over the forecast period, followed by Europe and North America. The usage of these vehicles by small businesses in the United States for purposes such as food truck businesses, mobile showrooms, and advertising and promotions, along with the demand for travel, medical, and healthcare response vehicles, is expected to rise during the forecast period.

Specialty Vehicles Market Trends

Increase in Spending on Law Enforcement and Healthcare Facilities

The rise in epidemics and pandemics, traffic accidents, household and industrial injuries, and government-sponsored healthcare programs is driving demand for medical and healthcare specialty vehicles. Diseases such as blood cancer, which affect one person every three minutes in the United States, have increased the demand for blood, propelling the market growth for bloodmobiles.

Recent epidemics and pandemics, such as the Ebola and COVID-19 outbreaks, have increased demand for ambulances, mobile pharmacies, and mobile intensive care units. In many countries, the increase in demand for ambulances has outpaced population growth. Several countries are using advanced healthcare vehicles to cater to health emergencies. For instance, after the COVID-19 lockdown restrictions were lifted, the mobile operation theatre service resumed in New Zealand. With the rise and development of autonomous vehicle technology, emergency medical vehicles are expected to be outfitted with semi-autonomous driving assistance technology in the near future. The increase in global government spending on law enforcement and healthcare facilities is driving the demand for specialty vehicles.

Moreover, the number of specialty vehicles in use in Japan reached 1.77 million last year, up from around 1.64 million in 2012. As a result, the number of SPVs increased steadily over the previous decade.

Asia-Pacific to Exhibit the Highest Growth Rate Over the Forecast Period

Asia-Pacific is anticipated to lead the specialty vehicle market. The advancements in technology developments are propelling the growth of the specialty vehicles market in the region. Various companies have delivered ambulances to local authorities and other countries during the COVID-19 pandemic. However, post-pandemic, there have also been new developments in ambulances as companies are getting into a strategic collaboration and launching advanced ambulances.

For instance, in October 2022, Medulance Healthcare, an emergency medical response service provider, launched a 5G-Smart connected ambulance in collaboration with Reliance Jio, the country's largest telecom operator.

In May 2022: At the EV Expo 2022, India's first EV emergency responder will be unveiled. The AmbulanceMe app is compatible with the Made in India Electric first responder vehicle.

The medical and healthcare response vehicles sector is another sector that holds a major share of the market. Design and other innovative changes such as electric propulsion, separate patient compartment, negative pressure creation technology, and UV disinfection are expected to propel the medical specialty vehicle market in the near future.

Specialty Vehicles Industry Overview

The specialty vehicle market is fairly fragmented, with multinational players including Daimler, GM Group, and Volvo AB. Many acquisitions, joint ventures, and investments in electric and autonomous driving technology are taking place in the market.

For instance, in February 2022, Lightning eMotors announced a new partnership with General Motors, making it the first GM Specialty Vehicle Manufacturer (SVM) to develop 100% electric Class 3 through 6 medium-duty commercial vehicles. Shuttles, delivery trucks, ambulances, and school buses are all supported by GM chassis.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ambulances

- 5.1.2 Fire Extinguishing Trucks

- 5.1.3 Mobile Fuel Carrying Tankers

- 5.1.4 Other Types

- 5.2 By Application Type

- 5.2.1 Law Enforcement And Public Safety

- 5.2.2 Medical And Healthcare

- 5.2.3 Recreational Vehicles

- 5.2.4 Other Services

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 LDV Inc.

- 6.2.2 Force Motors Limited

- 6.2.3 Matthews Specialty Vehicles Inc.

- 6.2.4 Specialty Vehicles Inc.

- 6.2.5 Farber Specialty Vehicles

- 6.2.6 REV Group

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 General Motors Company

- 6.2.10 Spartan Motors Inc. (Shyft Group)

- 6.2.11 Emergency One Group

- 6.2.12 Oshkosh Corporation