|

시장보고서

상품코드

1690195

폴리머 가공 조제 - 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Polymer Processing Aid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

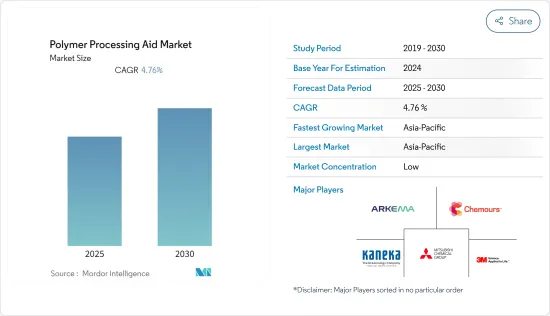

폴리머 가공 조제 시장은 예측 기간 중에 CAGR 4.76%로 성장할 것으로 예상됩니다.

COVID-19 팬데믹은 폴리머 가공 조제 시장에 타격을 주었습니다.세계의 봉쇄와 정부에 의한 엄격한 규칙에 의해 대부분의 생산 거점이 폐쇄되어 치명적인 타격을 받았습니다.

주요 하이라이트

- 중기적으로는 블로우 필름이나 캐스트 필름에 있어서의 폴리머 가공 조제 수요 증가, 와이어 및 케이블 분야에서의 수요 증가가 시장을 견인하는 주된 요인이 되고 있습니다.

- 그러나, 압출 공정에서 사용되는 폴리머에 따라서는 폴리머 가공 조제에 의한 품질상의 문제나 제품 비용의 높이가 시장 확대를 막는 중요한 장벽이 될 것으로 예측됩니다.

- 하지만 섬유 및 라피아 기업에서 폴리머 가공 조제에 대한 요구가 높아지고 향후 통신 프로젝트, 전기자동차의 보급 확대 등은 시장 성장에 다양한 유리한 기회를 제공할 것으로 예상됩니다.

- 아시아태평양은 중국, 인도, 일본 등의 국가에서 소비가 가장 많아 폴리머 가공 조제 시장을 세계적으로 지배하고 있습니다.

폴리머 가공 조제 시장 동향

블로우 필름과 캐스트 필름 부문에서의 수요 증가

- 폴리머 가공 조제는 용융 폴리머를 파이프, 필름, 튜브, 기타 제품으로 성형하기 위한 압출 공정에서 사용됩니다.

- 폴리머 가공 조제는 필름의 투명성을 높이고, 매끄러움을 향상시키고, 제품의 외관을 개선하고, 기계적 특성을 향상시키는데 도움이 됩니다.

- Packaging Association과 Plastics Industry Association에 따르면, 세계의 플라스틱 캐스트 필름 기술 시장은 2023년에 144억 8,660만 달러에 달할 것으로 추정되고 있습니다. 캐스트 필름 기술은 주로 식품 포장이나 공업 포장에 이용되고 있습니다.

- 게다가 포장용 필름, 농업용 필름, 테이프 수요 증가에 의해 고밀도 폴리에틸렌(HDPE), 직쇄상 저밀도 폴리에틸렌(LLDPE), 저밀도 폴리에틸렌(LDPE) 등, 높은 기계적 강도나 내구성 등의 특성이 개선된 폴리머 수요가 증가하고 있습니다.

- 국제광업자원회의(IMARC)에 따르면 식품포장 세계 시장가치는 2022년에 3,630억 달러로, 2028년에는 5,120억 달러에 달할 것으로 예상되고 있습니다.

- 또한, 플라스틱 공업 협회에 의하면, 세계의 플라스틱 필름 시장의 포장 분야는 2023년까지 30,280.8킬로톤에 이를 것으로 예측되고 있습니다.

- 폴리머 가공 조제 시장은 상기의 모든 요인에 의해 예측 기간 중에 급속하게 성장할 것으로 예상됩니다.

시장을 독점하는 아시아태평양

- 예측기간 중 아시아태평양이 폴리머 가공 조제 시장을 독점할 것으로 예상됩니다.

- Packaging Association과 Plastics Industry Association에 따르면 아시아태평양의 플라스틱 캐스트 필름 기술 시장은 2023년에 62억 6,360만 달러의 가치로 추정됩니다.

- 중국은 건설 붐에 휩싸여 있습니다. 이 나라는이 지역에서 가장 큰 건축 시장을 가지고 있으며 전 세계 건설 투자의 20%를 차지합니다. 중국 정부는 2022년에 신규 인프라 채권의 연간 한도를 3조 8,500억 위안(약 5,724억 9천만 달러)으로 책정할 것으로 추정되며, 이는 2021년의 3조 6,500억 위안(약 5,427억 5천만 달러)보다 증가한 수치입니다.

- 폴리머 가공은 제품의 표면 품질을 향상시켜 용융 파괴를 없애고 금형 퇴적물을 줄이는데 도움이 됩니다.

- 게다가 중국, 인도, 일본, 한국 등의 국가에서는 식품 포장이나 농업 분야에 있어서의 클린 필름 수요를 충족시키기 위해서, 폴리머 가공 조제 수요가 증가할 것으로 예상됩니다.

- 또한, 폴리머 가공 조제를 최적으로 이용하는 것으로, 제조시의 폴리에틸렌에의 데미지를 경감할 수 있습니다.

- 이와 같이 항공, 방위, 자동차, 통신, 과학연구소, 상업시설 등 다양한 용도에 있어서 폴리머 제품에 대한 수요가 높아지면서 폴리머 가공 조제에 대한 수요에 박차를 가하고 있어 그 결과 폴리머 가공 조제 시장을 촉진하고 있습니다.

- Organisation Internationale des Constructeurs d'Automobiles(OCIA)에 따르면 최대 자동차 생산 지역인 아시아태평양도 2022년에는 7%의 성장률을 기록했습니다.

- 또한 중국에서는 2021년에 2,612만대의 자동차가 생산된 반면, 2022년에는 약 2,702만대의 자동차가 생산되어 약 3%의 성장률을 기록했습니다.

- 민간 항공국(DGCA)에 따르면 인도의 항공 부문은 급속히 확대되었습니다. 2034년까지 세계의 주요 항공시장 중 하나가 될 것으로 예측됐습니다.

- 상기의 요인과 정부의 지원에 의해 예측 기간 중에 폴리머 가공 조제 수요가 증가할 것으로 예상됩니다.

폴리머 가공 조제 산업 개요

폴리머 가공 조제 시장은 세분화되어 있으며 주요 기업의 시장 점유율은 미미합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 포장 업계에서의 폴리프로필렌 수요 증가

- 건축 및 인프라 산업에 있어서의 PVC와 HDPE의 사용

- 기타 촉진요인

- 억제요인

- 폴리머 가공 조제에 의한 품질상의 난점과 제품 비용의 상승

- 기타 억제요인

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 폴리머 유형

- 폴리에틸렌

- LLDPE

- LDPE

- 고밀도 폴리에틸렌

- 폴리프로필렌

- PVC, ABS, 폴리카보네이트

- 기타 폴리머

- 폴리에틸렌

- 용도

- 블로우 필름 및 캐스트 필름

- 와이어 및 케이블

- 압출 블로우 성형

- 섬유 및 라피아

- 파이프 및 튜브

- 기타 용도

- 최종 사용자 산업

- 포장

- 건축 및 건설

- 수송

- 섬유

- IT 및 통신

- 기타 최종 사용자 산업

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율 분석(%)**, 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- 3M

- Ampacet Corporation

- Arkema

- Avient Corporation

- BASF SE

- Clariant

- DAIKIN INDUSTRIES, Ltd.

- Dow

- Evonik Industries AG

- Fine Organic Industries Limited

- Guangzhou Shine Polymer Technology Co. Ltd

- Gujarat Fluorochemicals Limited(GFL)

- HANNANOTECH CO., LTD.

- Kaneka Corporation

- LG Chem

- MicroMB(INDEVCO Group)

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Nouryon

- Plastiblends

- PMC Group, Inc.

- Shanghai Lanpoly Polymer Technology Co. Ltd

- Solvay

- The Chemours Company

- Tosaf Compounds Ltd

- WSD CHEMICAL COMPANY

제7장 시장 기회와 앞으로의 동향

- 전기자동차의 보급 확대

- 통신 분야의 향후 프로젝트

The Polymer Processing Aid Market is expected to register a CAGR of 4.76% during the forecast period.

The COVID-19 pandemic harmed the polymer processing aid market. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering from 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the medium term, major factors driving the studied market include increasing demand for polymer processing aids in blown film and cast film and rising demand from the wire and cable segment.

- However, quality difficulties and high product costs due to polymer processing aid depending on the polymer utilized during the extrusion process are important barriers projected to stymie market expansion.

- Nevertheless, the increasing need for polymer processing aid in the fiber and raffia company, forthcoming telecommunications projects, and increasing electric vehicle penetration are expected to offer various lucrative opportunities for the market's growth.

- The Asia-Pacific region dominated the polymer processing aid market globally, with the highest consumption from countries such as China, India, and Japan.

Polymer Processing Aid Market Trends

Increasing Demand from Blown Film and Cast Film Segment

- A polymer processing aid is used during polymer formulation when molten polymers are subjected to extrusion processes to be formulated into pipes, film, tubes, and other products. Polymer processing aid improves the quality of finished products.

- Polymer processing aids help in increasing film transparency, improving smoothness, improving product appearance, and improving mechanical properties. Owing to these factors, the demand for polymer processing aid is increasing in the blown film and cast film segment.

- According to the Packaging Association and Plastics Industry Association, the global plastic cast film technology market is estimated to be worth USD 14,486.6 million in 2023. The cast film technique is mostly utilized in food and industrial packaging.

- Additionally, the rise in demand for packaging films, agriculture films, and tapes is increasing the demand for polymers such as high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), and low-density polyethylene (LDPE) with improved properties such as high mechanical strength and durability.

- According to the International Mining and Resources Conference (IMARC), the global market value of food packaging was USD 363 billion in 2022 and is expected to reach USD 512 billion in 2028.

- Moreover, according to the Plastics Industry Association, the packaging segment of the global plastic film market is predicted to reach 30,280.8 kilotons by 2023. Plastic film packaging is utilized in industries such as food packaging, pharmaceutical packaging, and medical packaging.

- The polymer processing aid market is expected to grow rapidly over the forecast period due to all the abovementioned factors.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for polymer processing aid during the forecast period. Due to the increasing demand for plastics from various end-user industries like packaging, automotive, and building and construction, the demand for polymer processing aid is increasing in countries like China, India, Japan, and South Korea.

- According to the Packaging Association and Plastics Industry Association, the Asia-Pacific plastic cast film technology market is estimated to be worth USD 6,263.6 million in 2023. The cast film technique is mostly utilized in food and industrial packaging.

- China is amid a construction mega-boom. The country includes the largest building market in the region, making up 20% of all construction investments globally. The Chinese government is estimated to include an annual limit for new infrastructure bonds worth CNY 3.85 (~USD 572.49) trillion in 2022, up from CNY 3.65 trillion (~USD 542.75 million) in 2021.

- Polymer processing helps improve product surface quality, eliminate melt fractures, and reduce die deposits. These factors are expected to positively impact the polymer processing aid market.

- Additionally, the demand for polymer processing aid is expected to increase to meet the demand for clean films in food packaging and agriculture sectors in countries like China, India, Japan, and South Korea. It will stimulate the polymer processing aid market in the region.

- Furthermore, the optimum utilization of polymer processing aids can reduce the damage to polyethylene during manufacturing.

- Thus, the rise in demand for polymer products from various applications such as aviation, defense, automobile, telecommunication, scientific research labs, commercial facilities, and others is fueling the demand for polymer processing aid and, thus, propelling its market.

- According to Organisation Internationale des Constructeurs d'Automobiles (OCIA), Asia-Pacific, the largest automotive production region, also witnessed a growth rate of 7% in 2022. The production of motor vehicles increased from 46.76 million in 2021 to 50.02 million in 2022, respectively.

- Moreover, around 27.02 million motor vehicles were produced in China in 2022, compared to 26.12 million motor vehicles produced in 2021, witnessing a growth rate of about 3%.

- According to the Directorate General of Civil Aviation (DGCA), India's aviation sector rapidly expanded. The industry had established itself as a cost-effective and trustworthy alternative to time-consuming and lengthy excursions by road or rail. With a discernible development pattern, India was predicted to become one of the world's major aviation markets by 2034. As of fiscal year 2022, IndiGo was the market leader in the sector, accounting for around 55% of the market.

- The above factors and government support are expected to increase the demand for polymer processing aid during the forecast period.

Polymer Processing Aid Industry Overview

The polymer processing aid market is fragmented, with the top players accounting for a marginal market share. Some of the key companies in the market include 3M, Arkema, The Chemours Company, Mitsubishi Chemical Corporation, and Kaneka Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Polypropylene from the Packaging Industry

- 4.1.2 Usage of PVC and HDPE in the Building and Infrastructure Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Quality Difficulties and High Product Costs due to Polymer Processing Aid

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value

- 5.1 Polymer Type

- 5.1.1 Polyethylene

- 5.1.1.1 LLDPE

- 5.1.1.2 LDPE

- 5.1.1.3 HDPE

- 5.1.2 Polypropylene

- 5.1.3 PVC, ABS, and Polycarbonate

- 5.1.4 Other Polymer Types

- 5.1.1 Polyethylene

- 5.2 Application

- 5.2.1 Blown Film and Cast Film

- 5.2.2 Wire and Cable

- 5.2.3 Extrusion Blow Molding

- 5.2.4 Fibers and Raffia

- 5.2.5 Pipe and Tube

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Transportation

- 5.3.4 Textiles

- 5.3.5 IT and Telecommunication

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 UK

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Abalysis (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ampacet Corporation

- 6.4.3 Arkema

- 6.4.4 Avient Corporation

- 6.4.5 BASF SE

- 6.4.6 Clariant

- 6.4.7 DAIKIN INDUSTRIES, Ltd.

- 6.4.8 Dow

- 6.4.9 Evonik Industries AG

- 6.4.10 Fine Organic Industries Limited

- 6.4.11 Guangzhou Shine Polymer Technology Co. Ltd

- 6.4.12 Gujarat Fluorochemicals Limited (GFL)

- 6.4.13 HANNANOTECH CO., LTD.

- 6.4.14 Kaneka Corporation

- 6.4.15 LG Chem

- 6.4.16 MicroMB (INDEVCO Group)

- 6.4.17 Mitsubishi Chemical Corporation

- 6.4.18 Mitsui Chemicals Inc.

- 6.4.19 Nouryon

- 6.4.20 Plastiblends

- 6.4.21 PMC Group, Inc.

- 6.4.22 Shanghai Lanpoly Polymer Technology Co. Ltd

- 6.4.23 Solvay

- 6.4.24 The Chemours Company

- 6.4.25 Tosaf Compounds Ltd

- 6.4.26 WSD CHEMICAL COMPANY

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Electric Vehicles Penetration

- 7.2 Upcoming Projects in the Telecommunication Sector