|

시장보고서

상품코드

1690698

유럽의 지붕 타일 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Roofing Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

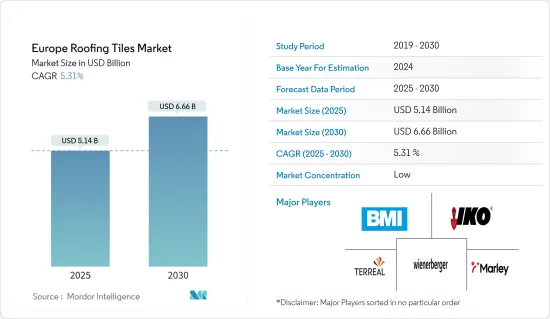

유럽의 지붕 타일 시장 규모는 2025년 51억 4,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 5.31%로 확대되어, 2030년에는 66억 6,000만 달러에 달할 것으로 예측됩니다.

2020년 COVID-19가 발생함에 따라 세계 각지에서 전국적인 록다운, 제조 활동 및 공급망의 혼란, 생산 정지가 발생하여 유럽의 지붕 타일 시장에 부정적인 영향을 미쳤습니다. 그러나 시장은 2021년부터 2022년까지 회복되었으며 예측 기간 동안에도 성장 궤도를 유지할 것으로 예상됩니다.

주요 하이라이트

- 시장을 견인하는 주요 요인으로는 건설 업계 수요 증가와 그린 빌딩에 대한 정부 정책이 있습니다.

- 지붕 타일은 몇 가지 다른 옵션보다 비싼 경향이 있으며, 이는 시장 성장을 방해할 가능성이 높습니다. 또한 건설 업계의 숙련노동자 부족도 시장 확대를 방해할 것으로 예상됩니다.

- 그럼에도 불구하고 태양 지붕 타일의 개발은 시장 성장을위한 다양한 유리한 기회를 제공할 것으로 예상됩니다.

- 유럽 국가 중 독일은 건설 산업의 성장으로 지역 시장을 독점할 것으로 예상됩니다.

유럽 지붕 타일 시장 동향

주거용 부문의 안정적인 성장

- 지붕 타일은 아스팔트 슁글 지붕에 비해 다락방으로의 열 이동을 70% 가까이 삭감할 수 있기 때문에 주택 용도에서이용이 증가하고 있습니다. 지붕 타일은 단독주택, 타운홈, 아파트 등 다양한 주택에 이용할 수 있습니다. 주택용 지붕 타일 시공은 수명이 길어 가장 비용 효율적인 선택의 하나입니다.

- 유럽 각국의 왕성한 수요로 인해 주택 건설은 유럽에서 중요한 시장 중 하나가 되었습니다. 영국 정부에 따르면 주택 공급을 촉진하기 위해 할당된 100억 파운드(127억 달러)의 투자 지원으로 이번 국회 중에 100만 호의 주택을 건설하는 매니페스트 공약을 달성할 전망입니다.

- 2024년 2월에는 더 많은 사람들이 주택을 소유할 수 있도록 영국 전역에서 2만 호의 저렴한 주택을 새로 건설하기 위해 정부가 지원하는 대출 기금에 30억 파운드(38억 달러)가 증가했습니다.

- 유럽위원회의 발표에 따르면 프랑스 정부는 주택 제1계획(Le Logement D'abord)에 따라 세금 면제를 발표했습니다. 이 예산으로 프랑스의 80% 가구에서 주택세가 전액 면제되었습니다. 나머지 20%의 부유층에 대해서는 2021년부터 단계적으로 세율이 인하되고, 2023년까지 주택세가 완전히 폐지됩니다.

- 스페인 국가 통계국(INE)에 따르면 2019년부터 2025년까지 순 세대 건설 호수는 매년 평균 약 13만 5,000호의 속도로 증가할 것으로 예상됩니다. 따라서 주택건설 업계는 예측기간의 후반에 걸쳐 크게 성장할 것으로 예상됩니다.

- 위의 동향과 사실은 예측 기간 동안 주택 부문에서 유럽 지붕 타일의 왕성한 수요를 보여줍니다.

시장을 독점하는 독일

- 독일의 경제 규모는 유럽 최대이며 세계에서도 톱 5에 들어갑니다. 또한 유럽 국가 중에서 가장 큰 주택 스톡을 가지고 있으며, 이는 유럽의 지붕 타일 수요에서 독일이 우위를 차지하고 있음을 보여줍니다.

- 연방통계국(Destatis)의 보고에 따르면 2023년 3월 독일에서는 24,500호의 주택건설이 허용되었으며, 2022년 3월에 비해 건축허가건수는 10,300건(약 29.6%) 감소했습니다.

- 2022년 건축 완성 공사액은 2021년 대비 4.8% 감소했으나 이는 건설가격의 대폭적인 상승 때문입니다.

- Deutsche Welle에 따르면 독일은 2023년부터 2025년까지 신규 주택 건설이 32% 감소할 것으로 예상됩니다. 게다가 2022년에는 29만 5,000호였던 주택이 2025년에는 20만호만 완성될 것으로 추정되고 있어 주택 가격 상승으로 이어질 가능성이 있습니다.

- 독일 주택 건설 업계에서는 신규 주문이 크게 줄어들고 기존 주문의 취소가 자주 발생합니다. 예를 들어, IFO 연구소에 따르면 독일 기업의 약 22%가 2023년 10월에 수주가 취소되었다고 응답하고 있으며, 또한 약 48.7%의 기업이 2023년 10월에 신규 수주의 부족을, 46.6%의 기업이 2023년 9월에 같은 답변을 하고 있습니다.

- 위의 사실 및 수치를 고려하면 독일의 주택 건설 산업은 축소된 것으로 보이지만, 예측 기간 동안 독일의 유럽 지붕 타일 시장의 우위는 유지될 것으로 예상됩니다.

유럽 지붕 타일 산업 개요

유럽의 지붕 타일 시장은 세분화되어 있습니다. 조사 대상 시장의 주요 기업(특별한 순서 없음)에는 Wienerberger AG, BMI Group, TERREAL, IKO Industries Ltd, Marley가 포함됩니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 그린빌딩에 대한 정부의 호의적인 정책 증가

- 건설 업계로부터 수요 증가

- 억제요인

- 다른 지붕재에 비해 높은 가격

- 건설 업계의 숙련노동자 부족

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 유형

- 점토

- 콘크리트

- 기타 유형

- 최종 사용자 산업

- 주택

- 상업

- 인프라

- 산업 및 시설

- 지역

- 독일

- 영국

- 이탈리아

- 프랑스

- 스페인

- 러시아

- NORDIC

- 터키

- 기타 유럽

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%) 분석**/시장 순위 분석

- 주요 기업의 전략

- 기업 프로파일

- BMI Group

- Crown Roof Tiles

- Fornace Laterizi Vardanega Isidoro SRL

- IKO Industries Ltd

- INDUSTRIE COTTO POSSAGNO SpA

- Marley

- TERREAL

- Vortex Hydra SRL Italy

- Wienerberger AG

제7장 시장 기회와 앞으로의 동향

- 태양 지붕 타일 개발

The Europe Roofing Tiles Market size is estimated at USD 5.14 billion in 2025, and is expected to reach USD 6.66 billion by 2030, at a CAGR of 5.31% during the forecast period (2025-2030).

In line with the COVID-19 outbreak in 2020, nationwide lockdowns around the globe, disruptions in manufacturing activities and supply chains, and production halts negatively impacted the European roof tiles market. However, the market recovered from 2021 to 2022 and is expected to continue its growth trajectory during the forecast period.

Key Highlights

- Besides, major factors driving the market studied include increasing demand from the construction industry and favorable government policies for green buildings.

- Roof tiles tend to be more expensive than a few other options, which is likely to hamper the market's growth. The lack of skilled workers in the construction industry is also anticipated to impede market expansion.

- Nevertheless, the development of solar roof tiles is expected to offer various lucrative opportunities for the market's growth.

- Among the European countries, Germany is expected to dominate the regional market due to the growth in its construction industry.

Europe Roofing Tiles Market Trends

Consistent Growth of the Residential Segment

- The usage of roofing tiles for residential applications is increasing because they can reduce the overall heat transfer into the attic by almost 70%, compared to an asphalt shingle roof. Roofing tiles are available for various residences, including single-family homes, townhomes, condominiums, and apartment buildings. The installation of roofing tiles in residential applications is one of the most cost-effective choices due to their long lifespan.

- Strong demand from various European countries makes residential construction one of the significant markets in Europe. According to the UK government, it is on track to meet its manifesto commitment to build 1 million homes in the current parliament with the support of the GBP 10 billion (USD 12.7 billion) investment allocated to boost housing supply.

- In February 2024, an increase of GBP 3 billion (USD 3.8 billion) was made in a government-backed loan fund to build 20,000 new affordable homes across the United Kingdom to help more people own a house.

- As per the European Commission, under its Housing First Plan (Le Logement D'abord), the French government announced tax waivers. Under the budget, the housing tax was entirely removed for 80% of French households. With regard to the remaining 20%, the country's wealthiest households, there was a gradual decrease in this tax rate from 2021, followed by a complete cessation of housing tax by 2023.

- According to Spain's National Statistics Institute (INE), the net household construction is anticipated to increase at an average pace of around 135,000 units every year from 2019 to 2025. Thus, the residential construction industry is expected to grow significantly over the latter period of the forecast period.

- The above-mentioned trends and facts indicate a strong demand for European roof tiles in the residential segment during the forecast period.

Germany to Dominate the Market

- The German economy is the largest in Europe and among the top five largest in the world. It also has the largest housing stock among European countries, which indicates its dominance over the demand for European roof tiles.

- According to the Federal Statistical Office (Destatis) report, in March 2023, the construction of 24,500 dwellings was permitted in Germany, a decrease of 10,300 (approx. 29.6%) in building permits compared with March 2022.

- The turnover in building completion work fell by 4.8% in 2022 compared to 2021 because of the substantial increase in construction prices.

- According to Deutsche Welle, Germany is expected to see a 32% drop in new housing construction between 2023 and 2025. Furthermore, it is estimated that only 200,000 homes will be completed in 2025 compared to 295,000 in 2022, which could lead to an increase in housing prices.

- Germany's residential construction industry has also witnessed new orders being considerably slower and existing orders being canceled much more frequently. For instance, according to the IFO Institute, around 22% of German companies witnessed orders getting canceled in October 2023, about 48.7% of companies also mentioned a lack of new orders in October 2023, and 46.6% mentioned the same in September 2023.

- Considering the above-mentioned facts and figures, even though the German housing construction industry seems to shrink, the country's dominance over the European roof tiles market is expected to be maintained during the forecast period.

Europe Roofing Tiles Industry Overview

The European roof tiles market is fragmented in nature. The major companies in the market studied (in no particular order) include Wienerberger AG, BMI Group, TERREAL, IKO Industries Ltd, and Marley.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Favorable Government Policies for Green Buildings

- 4.1.2 Increasing Demand from Construction Industry

- 4.2 Restraints

- 4.2.1 Higher Price Among Other Roofing Options

- 4.2.2 Lack of Skilled Workers in the Construction Sector

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Clay

- 5.1.2 Concrete

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 NORDIC

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BMI Group

- 6.4.2 Crown Roof Tiles

- 6.4.3 Fornace Laterizi Vardanega Isidoro SRL

- 6.4.4 IKO Industries Ltd

- 6.4.5 INDUSTRIE COTTO POSSAGNO SpA

- 6.4.6 Marley

- 6.4.7 TERREAL

- 6.4.8 Vortex Hydra SRL Italy

- 6.4.9 Wienerberger AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Solar Roof Tiles