|

시장보고서

상품코드

1690717

중국의 택배, 특송, 소포(CEP) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)China Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

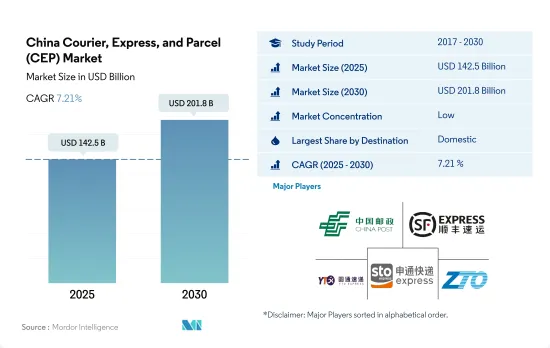

중국의 택배, 특송, 소포(CEP) 시장 규모는 2025년에 1,425억 달러, 2030년에는 2,018억 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR은 7.21%를 나타낼 전망입니다.

국경 간 전자상거래에 의한 국제택배 서비스 증가

- 2023년에는 국내에서 약 29,522의 택배 사업자가 영업하고 있었습니다. 중국의 익스프레스 딜리버리 업계는 온라인 소매의 급성장에 크게 힘쓰고 지난 10년간 비약적인 성장을 이루었습니다. CEP의 취급량을 늘리기 위해 많은 기업들이 다양한 전략을 채택하고 있습니다. 예를 들어, 2023년 9월부터 Shein은 중국에서 미국 창고로 저렴한 가격의 의류와 가정용품을 더 많이 보내고 구매자의 배송 시간을 앞당기고 있습니다.

- 국내 및 국제 택배, 익스프레스, 소포 배송 부문의 금액과 수량은 전자상거래로 인한 것이 크고, 2023년에는 소매 매출의 27.6%가 온라인으로 이루어졌습니다. 전자상거래 이용자는 2027년까지 13억 3,000만 명에 달할 것으로 예상되므로 전자상거래 시장의 가치는 더욱 상승할 것으로 전망됩니다.

중국의 택배, 특송, 소포(CEP)시장 동향

14차 5개년 계획에서 청정에너지 인프라 개발 및 운송부문 투자에 대한 주목이 높아짐에 따라 성장을 견인

- 2023년 중국의 청정 에너지 부문은 이 나라의 경제 확대에 크게 기여했습니다. 에너지 및 클린 에어(CREA)에 따르면 중국의 재생 가능 에너지 인프라에 대한 투자 금액은 8,900억 달러에 이르렀으며, 같은 해 화석 연료 공급에 대한 세계 투자 금액과 거의 비슷했습니다. 신재생에너지원, 원자력, 전력망, 에너지저장, 전기자동차(EV), 철도를 포함한 청정에너지는 2023년 중국 GDP의 9.0%를 차지하며 전년대비 7.2%에서 증가합니다. EV의 생산 대수는 2023년에 전년 대비 36% 증가했습니다.

- 제14차 5개년 계획(2021-2025년)에서 중국은 교통망 확대의 목표를 밝혔습니다. 2025년까지 고속철도는 2020년 38,000km에서 50,000km로 확대되어 인구 50만명 이상의 도시의 95%를 250km의 노선으로 커버합니다. 2025년까지 철도를 165,000km, 민간공항을 270km이상, 도시지하철을 10,000km, 고속도로를 190,000km, 고수준 내륙수로를 18,500km로 늘리는 것을 목표로 하고 있습니다. 2025년까지 종합적인 개발을 달성하는 것이 첫 번째 목표이며 교통 시스템의 변화와 GDP에 대한 기여의 진전을 중시하고 있습니다.

러시아 우크라이나 전쟁 중 중국 디젤 가솔린 소매 가격은 역사적인 고수준으로 치솟았습니다.

- 2023년 중국의 원유 수입량은 2022년 대비 11% 증가한 5억 6,399만 톤, 하루 1,128만 배럴에 달했습니다. 이 급증은 러시아 우크라이나 전쟁에서 세계 원유 가격이 상승하고 중국 연료 가격이 역사적인 고가에 도달했기 때문입니다. 2024년 1-2월기 원유 수입량은 전년 동기 대비 5.1% 증가한 8,831만 톤에 달했습니다. 이 증가는 먼저 싼 가격으로 원유를 구입했기 때문입니다. 브렌트 선물은 2023년 9월에 97.69달러로 피크를 올렸고, 12월에는 72.29달러까지 하락했고, 2024년 3월에는 84.05달러까지 상승했습니다. 2024년 3월에 OPEC 그룹이 6월 말까지 감산을 연장하기로 결정하여 원유 가격이 더욱 상승했습니다. 이 그룹은 세계 수요의 6% 가까이를 감산하기 때문에 이 움직임은 세계의 석유 수요에 대한 우려를 높이고 있습니다. 또한 최근 원유가격 상승은 2024년 하반기 이후 중국 수입을 감퇴시킬 수 있습니다.

- 중국은 최근 세계 원유가격의 변동에 따라 가솔린과 경유의 소매가격을 조정할 예정입니다. 이번 가격 인상은 세계 공급 박박과 수요 전망의 호전을 반영한 것입니다. NDRC에 따르면 중국 가솔린과 디젤 가격은 2024년 톤당 28달러 상승합니다. 연료 수요의 감소가 예상되는 것, 2035년까지 석유 기반 연료가 주요 선택사항인 것으로 보입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 및 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구동태

- 경제 활동별 GDP 분포

- 경제활동별 GDP 성장률

- 인플레이션율

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수 및 창고업의 GDP

- 수출 동향

- 수입 동향

- 연료 가격

- 물류 실적

- 인프라

- 규제 프레임워크

- 중국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 마무리

- 국내

- 국제

- 배달 속도

- 익스프레스

- 비익스프레스

- 모델

- 기업간(B2B)

- 기업 대 소비자(B2C)

- 소비자간(C2C)

- 출하 중량

- 중량화물

- 경량화물

- 중량화물

- 수송 형태

- 항공편

- 도로

- 기타

- 최종 사용자

- 전자상거래

- 금융 서비스(BFSI)

- 헬스케어

- 제조업

- 제1차 산업

- 도매 및 소매업(오프라인)

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- China Post

- DHL Group

- FedEx

- Hongkong Post

- La Poste Group

- SF Express(KEX-SF)

- Shanghai YTO Express(Logistics) Co., Ltd.

- STO Express Co., Ltd.(Shentong Express)

- United Parcel Service of America, Inc.(UPS)

- Yunda Holding Co. Ltd.

- ZTO Express

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 기술의 진보

- 정보원과 참고문헌

- 도표 목록

- 주요 인사이트

- 데이터 팩

- 용어집

The China Courier, Express, and Parcel (CEP) Market size is estimated at 142.5 billion USD in 2025, and is expected to reach 201.8 billion USD by 2030, growing at a CAGR of 7.21% during the forecast period (2025-2030).

Increase in international parcel delivery services owing to cross-border e-commerce

- There were around 29,522 courier businesses operating in the country in 2023. China's express delivery industry has grown exponentially over the past decade, largely driven by the rapid growth of online retail. Many companies are adopting different strategies to increase CEP volumes. For instance, since September 2023, Shein has been sending more low-priced apparel and home goods to U.S. warehouses from China to speed up shipping times for shoppers.

- The value and volume of the domestic and international courier, express, and parcel delivery segments are largely driven by e-commerce, wherein 27.6% of retail sales were made online in 2023. The value of the CEP market is further expected to rise as e-commerce users are expected to reach 1.33 billion by 2027.

China Courier, Express, and Parcel (CEP) Market Trends

Rising focus on developing clean energy infrastructure and transport sector investment under 14th Five-Year Plan driving growth

- In 2023, China's clean energy sector significantly contributed to the country's economic expansion. According to Energy and Clean Air (CREA), China's investment in renewable energy infrastructure amounted to USD 890 billion, almost matching global investments in fossil fuel supply for the same year. Clean energy, including renewable energy sources, nuclear power, electricity grids, energy storage, electric vehicles (EVs), and railways, constituted 9.0% of China's GDP in 2023, up from 7.2% YoY. EV production grew by 36% YoY in 2023.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

China's retail diesel and gasoline prices were soared to historically high levels amid the Russia-Ukraine War

- In 2023, China imported 11% more crude oil than in 2022, totaling 563.99 mn metric tons (MMT), or 11.28 mn barrels per day. This surge was due to increased global crude oil prices amid the Russia-Ukraine War, causing fuel prices in China to reach historic highs. In Jan-Feb 2024, crude oil imports rose by 5.1% YoY, reaching 88.31 MMT. This increase was driven by purchasing crude oil at lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, fell to USD 72.29 in December, and rose to USD 84.05 by March 2024. The decision made by the OPEC+ group in March 2024 to extend output cuts until the end of June has further boosted crude prices. This move has raised concerns about global oil demand, as the group is reducing production by nearly 6% of world demand. The recent increase in crude prices may also dampen China's imports starting from H2 2024.

- China plans to adjust retail prices for gasoline and diesel to align with recent shifts in global crude oil prices. The price hike reflects a tightening of global supply and a positive forecast for demand. According to NDRC, gasoline and diesel prices in China will increase by USD 28 per ton in 2024. Although there's expectation of declining demand for fuels, oil-based fuels will remain the primary choice until 2035.

China Courier, Express, and Parcel (CEP) Industry Overview

The China Courier, Express, and Parcel (CEP) Market is fragmented, with the major five players in this market being China Post, SF Express (KEX-SF), Shanghai YTO Express (Logistics) Co., Ltd., STO Express Co., Ltd. (Shentong Express) and ZTO Express (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 China

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 China Post

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 Hongkong Post

- 6.4.5 La Poste Group

- 6.4.6 SF Express (KEX-SF)

- 6.4.7 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.8 STO Express Co., Ltd. (Shentong Express)

- 6.4.9 United Parcel Service of America, Inc. (UPS)

- 6.4.10 Yunda Holding Co. Ltd.

- 6.4.11 ZTO Express

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록