|

시장보고서

상품코드

1910897

북미의 배터리 에너지 저장 시스템(BESS) 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)North America Battery Energy Storage System (BESS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

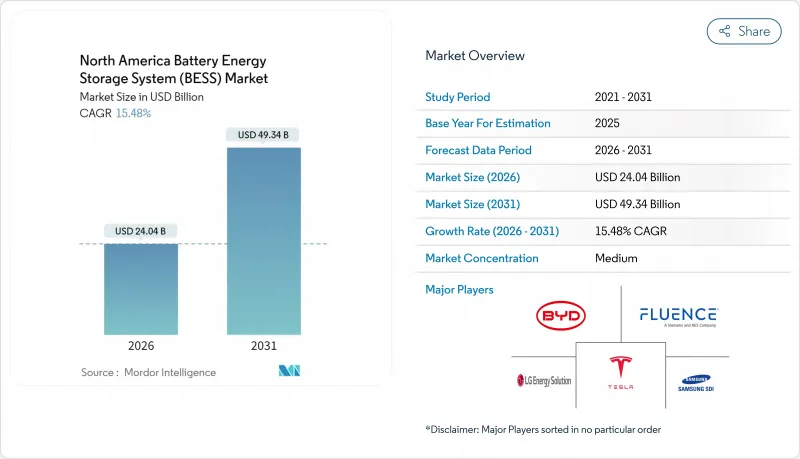

북미의 배터리 에너지 저장 시스템 시장은 2025년 208억 2,000만 달러로 평가되었으며, 2026년 240억 4,000만 달러에서 2031년까지 493억 4,000만 달러에 이를 것으로 예측됩니다. 예측기간(2026-2031년)의 CAGR은 15.48%로 예상됩니다.

연방 세액 공제, 국내 셀 제조, 재생에너지 통합, 데이터센터 확장 및 송전망 혼잡에 의한 급증하는 그리드 규모 수요가 이 성장을 뒷받침하고 있습니다. 인플레이션 억제법에 의해 오프그리드 축전설비에 대한 30%의 투자세액 공제가 확대된 이후 유틸리티 공급자의 조달 활동이 가속화되어 프로젝트 내부 수익률이 향상됨과 동시에 상업 시장의 개발이 촉진되었습니다. 한편 미시간주, 조지아주, 애리조나주의 기가팩토리로 인해 인산철 리튬(LFP) 배터리의 현지 조달 비용이 20-30% 하락하여 가스 화력 피크 대응 설비와의 비용차가 줄어들고 리드 타임도 단축되고 있습니다. 개발 사업자는 현재 도매 전력 가격의 스프레드가 불안정한 상황에서도 주파수 조정, 용량 지불, 에너지 재정 거래에 의한 수익을 쌓을 수 있는 여러 시간 가동이 가능한 자산을 추구하고 있습니다. 테슬라, 플루언스, LG 에너지솔루션 등 수직 통합형 선도기업이 순수한 통합 사업자나 자사 개발 프로젝트를 진행하는 유틸리티 공급자와 경쟁하는 가운데 경쟁 격화가 진행되고 있습니다. 한편, 바나듐 흐름 배터리나 철-공기 배터리 등의 장시간 축전 기술이 8-12시간 및 계절적인 가동 사이클에서 리튬 이온 배터리의 기존 지위에 도전하고 있습니다.

북미의 배터리 에너지 저장 시스템(BESS) 시장의 동향 및 인사이트

주 수준의 신재생에너지 의무화 급증

캘리포니아주의 SB100 법안은 2045년까지 100% 클린 전력화를 목표로 11.5GW의 축전 설비 조달을 규정하고 있습니다. 전력회사는 2024년 중반 이 목표를 뛰어넘어 수년에 걸친 견조한 개발 안건의 파이프라인을 확보했습니다. 뉴욕주는 2030년까지 6GW를 의무화하고 시장 수익의 격차를 메우는 인센티브를 제공합니다. 한편, ERCOT에서는 2024년 연결 신청이 5GW에 달하였고, 전력 부족시 가격 상승과 석탄 화력 폐지가 축전 경제성을 뒷받침했습니다. 분명한 조달 목표는 자본 위험을 줄이고 기관 투자자를 끌어들여 프로젝트 설계를 IEEE 2030.2 상호 운용성 기준에 맞추어 전체 프로젝트의 효율성을 향상시킵니다. 의무화는 장기적인 시장 전망도 제시하며, 제조업체는 공급망의 현지화를, 대출자는 백 레버리지 부채의 구축을 가능하게 합니다. 재생에너지 단독의 목표에서 축전을 명시적으로 포함하는 청정에너지 기준으로 이행하는 주가 늘어나면서 유틸리티 규모 시스템의 기반 수요는 대폭 확대되고 있습니다.

북미의 기가팩토리로 인한 LFP 배터리 비용 감소

CATL, LG 에너지솔루션을 비롯한 공급업체는 셀 1kWh당 35달러, 모듈 1kWh당 10달러의 선진 제조 세액 공제를 적용한 미국 LFP 셀 생산 라인의 가동을 개시했습니다. 국내 생산으로 유틸리티 규모 BESS의 납품 비용은 최대 30% 압축되며 조달 리드 타임은 12-14개월에서 6-8개월로 단축됩니다. 또한 중국 수입품에 대한 섹션 301의 25% 관세의 영향으로부터 개발자를 보호합니다. 전력회사와의 여러 해에 걸친 판매계약에 의해 수량이 확보되고, 관세 리스크의 감소에 의해 프로젝트 파이낸스의 설비투자(CAPEX) 예측이 안정됩니다. 또한 현지 조달 기반은 부품의 표준화와 국내 조달률 보너스 향상을 촉진하여 재정적 회수율을 더욱 개선하고 있습니다.

높은 초기 설비투자액과 원재료 가격 변동

설치된 BESS의 비용은 복합 사이클 가스 터빈(CCGT)의 용량 가격의 2.5-3배에 달하며 탄소 가격 제도가 도입되지 않은 지역에서의 보급을 제한하고 있습니다. 탄산 리튬 가격은 2024년 초 8만 달러/톤에서 연말까지 1만 2,000 달러/톤으로 급락해 고정 가격 EPC 계약을 복잡화하는 조달 변동성을 부각시켰습니다. 코발트와 니켈 공급은 지리적으로 집중되고 NMC 화학 조성은 지정학적 위험에 노출됩니다. 2024년 섹션 232에 따른 중국 관세 회피 조사는 추가 15-25%의 관세로 위협하고 비용 예측을 더욱 불투명하게 하고 있습니다. 장기 판매 계약이 부족한 민간 개발자는 비용 충격의 전가를 고민하고, 특히 수익 스프레드가 변동하는 ERCOT와 CAISO에서는 최종 투자 결정이 늦어지고 있습니다.

부문 분석

리튬 이온 기술은 성숙한 LFP 공급망과 셀 가격 저하를 배경으로 2025년 축전지 시장에서 91.10%의 점유율을 유지했습니다. 흐름 배터리는 5.35%의 점유율을 달성했으며 열폭주의 영향을 받지 않는 8-12시간 방전자산을 요구하는 전력회사의 수요에 의해 연률 30.43%로 성장하고 있습니다. 텍사스주에서 실시된 100MWh 아연 배터리 파일럿 프로젝트에서는 10,000사이클을 달성하여 성능 저하가 최소화되었습니다. 이는 LFP 배터리와의 내구성 차이를 돋보이게 합니다. 흐름 기술을 이용한 축전지 시스템 시장 규모는 계절적인 전력 공급 안정화에 비리튬계 화학물질을 우선시하는 태평양 연안 북서부 전력회사의 RFP(제안 의뢰서)에 의해 확대가 예상됩니다. 주택용 축전 나트륨 이온 배터리의 시험은 한랭지에서의 가능성을 나타내고 있지만, 납축전지는 LFP 비용의 급격한 저하에 의해 전력회사용 용도에서는 계속해서 점유율이 하락하고 있습니다.

흐름 배터리의 도입은 사이클 수명의 경제성과 전력 및 에너지의 독립적인 스케일링에 대한 인식 증가를 보여줍니다. 오레곤 주 21MWh 바나듐 프로젝트는 풍력과 결합하여 수일간의 안정적인 공급 능력을 제공하며 4시간 설계의 리튬 배터리에 필요한 300%의 과잉 용량을 대체하고 있습니다. 나트륨 이온 배터리는 원재료 비용이 낮고, 특히 캘리포니아주의 NEM 3.0 요금 체계 하에서 비용 중시의 주택 시장에서 전개가 기대됩니다. 전력회사의 조달 사양이 장시간 성능으로 이행하면서 4시간 틈새 시장을 넘은 리튬 배터리의 우위성은 점차 저하해 갈 것입니다.

2025년 도입 실적의 88.20%를 온그리드 시스템이 차지하였고, FERC 지침 841 및 도매 시장으로의 적극적인 진입이 이를 뒷받침했습니다. 그러나 광산, 군사기지, 섬 지역의 고비용 디젤 연료에 대한 대체 수요로 인해 오프그리드 및 마이크로그리드 솔루션은 28.10%의 연평균 복합 성장률(CAGR)로 확대되고 있습니다. 캐나다의 광산 마이크로그리드(50MWh)는 디젤 사용량을 70% 절감하여 연간 800만 달러의 절약과 2만 5,000톤의 CO2 배출량 감축을 실현했습니다. 미국 국방부는 2024년 오프그리드 기지용으로 1억 5,000만 달러를 예산화하였습니다. 알래스카의 마을에서는 재생에너지와 축전을 조합하여 디젤 비용을 0.40-0.60 USD/kWh 절감하고 있습니다. 캘리포니아 주와 텍사스 주에서는 온그리드를 유지하면서 산불이나 허리케인 시에 오프그리드로 가동하는 하이브리드형 마이크로그리드가 보급되고 있습니다.

오프그리드의 경제성은 연료비와 송전 비용 절감에 중점을 두고 있으며, kWh당 설비 투자액이 높음에도 불구하고 신속한 투자 회수를 가능하게 하고 있습니다. 카리브해 리조트에서는 10MWh 시스템으로 200만 달러의 디젤 연료비를 절감하고 6년 만에 투자 금액을 회수했습니다. 하이브리드 모델은 수요 반응으로 수익화를 실현하는 동시에 내장해성을 강화하고 있습니다. 업데이트된 IEEE 1547-2018 규격에서는 온그리드에서 오프그리드로의 원활한 이행이 의무화되어 연결 절차가 간소화되고 상업 및 산업(C&I) 사용자의 보급 촉진을 도모하고 있습니다.

북미의 배터리 에너지 저장 시스템(BESS) 시장 보고서는 배터리 유형(리튬 이온 등), 연결 유형(온그리드 및 오프그리드), 구성 부품(배터리 팩 및 랙, 에너지 관리 소프트웨어 등), 에너지 용량 범위(10-100MWh, 500MWh 이상 등), 최종 사용자 용도(전력 회사, 상업 및 산업, 주택), 지역별로 나뉩니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 주 수준의 재생에너지 의무화 급증

- 북미 기가팩토리의 LFP 배터리 비용 저하

- 오프그리드 축전 설비에 대한 세액 공제

- 전력 수요가 높은 데이터센터의 건설 확대

- 자유 시장에서의 수익 구조 혁신

- AI 최적화 BESS 자산 관리

- 억제요인

- 양수 발전 및 LDES와의 경쟁

- 높은 초기 설비투자비용과 원재료 가격의 변동

- 지역의 화재 안전상의 입지에 관한 지불 유예

- 관세 및 무역 안건에 의한 비용 충격

- 공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급자의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 투자분석

제5장 시장 규모 및 성장 예측

- 배터리 유형별

- 리튬 이온(인산철 리튬(LFP), 니켈 망간 코발트(NMC), 리튬 티타네이트(LTO))

- 납축전지

- 흐름 배터리(바나듐 레독스, 아연-브롬)

- 나트륨 이온

- 기타 배터리 기술(니카드 배터리, 하이브리드 및 슈퍼 커패시터)

- 연결 유형별

- 온그리드(전력회사 연결형)

- 오프그리드(마이크로그리드, 하이브리드)

- 컴포넌트별

- 배터리 팩 및 랙

- 전력 변환 시스템(PCS)

- 에너지 관리 소프트웨어(EMS)

- 플랜트 관련 설비 및 서비스

- 에너지 용량 범위별

- 10MWh 미만

- 10-100 MWh

- 100-500 MWh

- 500 MWh 초과

- 최종 사용자 용도별

- 전력회사용

- 상업 및 산업용

- 주택용

- 지역별

- 미국

- 캐나다

- 멕시코

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 제휴, 전력 구입 계약)

- 시장 점유율 분석(주요 기업의 시장 순위 및 점유율)

- 기업 프로파일

- Tesla Inc.

- Fluence Energy Inc.

- LG Energy Solution Ltd.

- Samsung SDI Co. Ltd.

- BYD Company Ltd.

- Panasonic Holdings Corp.

- Saft(TotalEnergies)

- Contemporary Amperex Technology Ltd.

- AES Corporation

- GE Vernova

- ABB Ltd.

- Siemens Energy

- Schneider Electric SE

- Eos Energy Enterprises

- NEC Energy Solutions

- Enel North America

- NextEra Energy Resources

- Sunverge Energy

- Powin LLC

- Wartsila Corporation

제7장 시장 기회 및 미래 전망

CSM 26.02.04The North America Battery Energy Storage System Market was valued at USD 20.82 billion in 2025 and estimated to grow from USD 24.04 billion in 2026 to reach USD 49.34 billion by 2031, at a CAGR of 15.48% during the forecast period (2026-2031).

Federal tax credits, domestic cell manufacturing, and fast-rising grid-scale demand from renewable energy integration, data center build-outs, and transmission congestion underpin this growth. Utility procurement accelerated after the Inflation Reduction Act extended the 30% investment tax credit to stand-alone storage, improving project internal rates of return and unlocking merchant-market development. Meanwhile, Michigan, Georgia, and Arizona gigafactories are reducing the landed costs of lithium-iron-phosphate (LFP) by 20%-30%, thereby narrowing the cost gap with gas peakers and shortening lead times. Developers now pursue multi-hour assets that stack revenues from frequency regulation, capacity payments, and energy arbitrage even as wholesale spreads remain volatile. Competitive intensity is rising as vertically integrated leaders, such as Tesla, Fluence, and LG Energy Solution, vie with pure-play integrators and utilities that self-develop projects. Meanwhile, long-duration alternatives, including vanadium flow and iron-air batteries, challenge lithium-ion incumbency for 8-to-12-hour and seasonal duty cycles.

North America Battery Energy Storage System (BESS) Market Trends and Insights

Surging State-Level Renewable Mandates

California's SB 100 targets 100% clean electricity by 2045 and sets an 11.5 GW storage procurement that utilities exceeded by mid-2024, ensuring a robust multi-year development queue. New York mandates 6 GW by 2030 with incentives that bridge merchant-revenue gaps, while ERCOT registered 5 GW of 2024 interconnection requests as scarcity pricing and coal retirements drove storage economics. Clear procurement targets de-risk capital, attract institutional investors, and align project designs with IEEE 2030.2 interoperability standards, thereby enhancing overall project efficiency. Mandates also signal long-term market visibility, enabling manufacturers to localize supply chains and lenders to structure back-levered debt. As more states shift from renewables-only targets to clean-energy standards that explicitly include storage, the baseline demand for utility-scale systems expands significantly.

Falling LFP Battery Costs from NA Gigafactories

CATL, LG Energy Solution, and other suppliers have commissioned U.S. LFP cell lines subsidized by an advanced-manufacturing credit worth USD 35 per kWh for cells and USD 10 per kWh for modules. Domestic production compresses delivered utility-scale BESS costs by up to 30%, shrinks procurement lead times from 12-14 months to 6-8 months, and shields developers from 25% Section 301 tariffs on Chinese imports. Multi-year offtake deals with utilities lock in volume, while tariff-risk reduction stabilizes CAPEX assumptions for project finance. The localized supply base is also catalyzing component standardization and higher domestic content bonuses, which further improve financial returns.

High Up-Front CAPEX & Raw-Material Swings

Installed BESS costs remain 2.5-3X the capacity price of combined-cycle gas turbines, limiting uptake where carbon pricing is absent. Lithium carbonate prices plummeted from USD 80,000/t in early 2024 to USD 12,000/t by year-end, highlighting procurement volatility that complicates fixed-price EPC contracts. Cobalt and nickel supply is geographically concentrated, exposing NMC chemistries to geopolitical risk. A 2024 Section 232 probe into Chinese tariff circumvention threatens additional 15%-25% duties, further muddying cost forecasts. Merchant developers lacking long-term offtake struggle to pass through cost shocks, slowing final investment decisions, especially in ERCOT and CAISO, where revenue spreads fluctuate.

Other drivers and restraints analyzed in the detailed report include:

- IRA Stand-Alone Storage Tax Credit

- Grid-Hungry Data-Center Build-Out

- Local Fire-Safety Siting Moratoria

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion technologies maintained a 91.10% share of the battery energy storage system market in 2025, driven by mature LFP supply chains and declining cell prices. Flow batteries, although with a 5.35% share, are growing at a 30.43% annual rate as utilities seek 8- to 12-hour discharge assets that are immune to thermal runaway. A 100 MWh zinc-battery pilot in Texas achieved 10,000 cycles with minimal fade, highlighting the longevity gap compared to LFP. The battery energy storage system market size for flow technologies is poised to benefit from Pacific Northwest utility RFPs that favor non-lithium chemistries for seasonal firming. Sodium-ion trials for residential storage show promise in cold climates, while lead-acid continues to lose ground in utility applications due to the rapid decline in LFP costs.

Flow battery adoption indicates a growing recognition of cycle-life economics and the independent scaling of power versus energy. A 21 MWh vanadium project in Oregon, coupled with wind, provides multi-day firm capacity, avoiding the 300% oversizing required by four-hour lithium designs. Sodium-ion's lower raw-material exposure positions it for cost-sensitive residential markets, especially under California's NEM 3.0 tariffs. Shifting utility procurement specs toward long-duration performance will progressively erode lithium's dominance beyond the 4-hour niche.

On-grid systems captured 88.20% of 2025 deployments, supported by FERC Order 841 and robust participation in the wholesale market. However, off-grid and microgrid solutions are expanding at a 28.10% CAGR as mines, military bases, and islands displace expensive diesel. A 50 MWh Canadian mine microgrid reduced diesel use by 70%, saving USD 8 million annually and eliminating 25,000 t CO2. The U.S. Department of Defense earmarked USD 150 million in 2024 for islandable bases, while Alaska villages blend renewables and storage to reduce diesel costs by USD 0.40-0.60 kWh. Hybrid microgrids that retain grid ties but can island during wildfires or hurricanes are proliferating in California and Texas.

Off-grid economics center on avoided fuel and transmission costs, enabling rapid paybacks despite higher per-kWh CAPEX. A Caribbean resort's 10 MWh system eliminated a USD 2 million diesel bill with a six-year payback. Hybrid models also monetize demand-response payments while enhancing resilience. The updated IEEE 1547-2018 standards mandate seamless grid-to-island transitions, simplifying interconnection and fostering broader adoption among commercial and industrial (C&I) users.

The North America Battery Energy Storage System (BESS) Market Report is Segmented by Battery Type (Lithium-Ion, and More), Connection Type (On-Grid and Off-Grid), Component (Battery Pack and Racks, Energy Management Software, and More), Energy Capacity Range (10 To 100 MWh, Above 500 MWh, and More), End-User Application (Utility, Commercial and Industrial, and Residential), and Geography (United States, Canada, and Mexico).

List of Companies Covered in this Report:

- Tesla Inc.

- Fluence Energy Inc.

- LG Energy Solution Ltd.

- Samsung SDI Co. Ltd.

- BYD Company Ltd.

- Panasonic Holdings Corp.

- Saft (TotalEnergies)

- Contemporary Amperex Technology Ltd.

- AES Corporation

- GE Vernova

- ABB Ltd.

- Siemens Energy

- Schneider Electric SE

- Eos Energy Enterprises

- NEC Energy Solutions

- Enel North America

- NextEra Energy Resources

- Sunverge Energy

- Powin LLC

- Wartsila Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging state-level renewable mandates

- 4.2.2 Falling LFP battery costs from NA gigafactories

- 4.2.3 IRA stand-alone storage tax credit

- 4.2.4 Grid-hungry data-centre build-out

- 4.2.5 Merchant-market revenue-stack innovation

- 4.2.6 AI-optimised BESS asset management

- 4.3 Market Restraints

- 4.3.1 Pumped-hydro & LDES competition

- 4.3.2 High up-front CAPEX & raw-material swings

- 4.3.3 Local fire-safety siting moratoria

- 4.3.4 Tariff / trade-case cost shocks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 Market Size & Growth Forecasts

- 5.1 By Battery Type

- 5.1.1 Lithium-ion (Lithium Iron Phosphate (LFP), Nickel-Manganese-Cobalt (NMC), Lithium Titanate (LTO))

- 5.1.2 Lead-acid

- 5.1.3 Flow Battery (Vanadium Redox, Zinc-Bromine)

- 5.1.4 Sodium-ion

- 5.1.5 Other Battery Technologies (NiCd, Hybrid Super-capacitors)

- 5.2 By Connection Type

- 5.2.1 On-Grid (Utility Interconnected)

- 5.2.2 Off-Grid (Micro-Grid, Hybrid)

- 5.3 By Component

- 5.3.1 Battery Pack and Racks

- 5.3.2 Power Conversion System (PCS)

- 5.3.3 Energy Management Software (EMS)

- 5.3.4 Balance-of-Plant and Services

- 5.4 By Energy Capacity Range

- 5.4.1 Below 10 MWh

- 5.4.2 10 to 100 MWh

- 5.4.3 100 to 500 MWh

- 5.4.4 Above 500 MWh

- 5.5 By End-user Application

- 5.5.1 Utility

- 5.5.2 Commercial and Industrial

- 5.5.3 Residential

- 5.6 By Geography

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Tesla Inc.

- 6.4.2 Fluence Energy Inc.

- 6.4.3 LG Energy Solution Ltd.

- 6.4.4 Samsung SDI Co. Ltd.

- 6.4.5 BYD Company Ltd.

- 6.4.6 Panasonic Holdings Corp.

- 6.4.7 Saft (TotalEnergies)

- 6.4.8 Contemporary Amperex Technology Ltd.

- 6.4.9 AES Corporation

- 6.4.10 GE Vernova

- 6.4.11 ABB Ltd.

- 6.4.12 Siemens Energy

- 6.4.13 Schneider Electric SE

- 6.4.14 Eos Energy Enterprises

- 6.4.15 NEC Energy Solutions

- 6.4.16 Enel North America

- 6.4.17 NextEra Energy Resources

- 6.4.18 Sunverge Energy

- 6.4.19 Powin LLC

- 6.4.20 Wartsila Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment