|

시장보고서

상품코드

1690735

독일의 항공우주 및 방위 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Germany Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

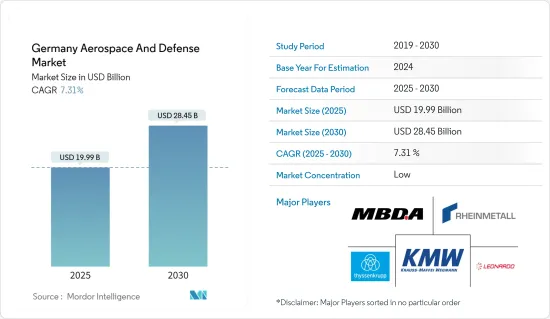

독일의 항공우주 및 방위 시장 규모는 2025년 199억 9,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 7.31%로 확대되어, 2030년에는 284억 5,000만 달러에 이를 것으로 예측됩니다.

독일의 방위산업은 향후 수년간 강력한 성장을 이루는 태세를 갖추고 있습니다. 국방 지출의 급증과 군비 취득의 활성화에 힘입어 독일 정부는 방위력을 적극 강화하고 시장 확대의 무대를 갖추고 있습니다.

러시아에 의한 우크라이나 침공 후 독일은 군사 개발에 중점을 두게 되었습니다. 국내 방위기업은 투자를 대폭 확대하고 국가의 방위력을 강화하기 위해 최첨단 군비에 자원을 투입하고 있습니다.

그러나 장기적인 시장 성장이 우려되기 때문에 독일군은 제약 강화에 직면하고 있습니다. 방어부문은 무기 주문이 쇄도하고 첨단 장비를 관리 및 유지하기 위한 훈련된 인재의 고용이 병행하여 급증함에 따라 큰 기회를 맞이하는 태세를 갖추고 있습니다.

독일 항공우주 및 방위 시장 동향

Maintenance Repair Overhole 부서는 예측 기간 동안 현저한 성장을 보여줄 전망

독일의 방위 산업은 특히 유지 보수 수리 오버홀(MRO) 분야에서 현저한 성장을 이루려고합니다. 이 성장의 주요 요인은 독일 정부가 공군의 능력을 강화하고 세계 표준에 맞추는 데 중점을 두고 있다는 것입니다. 이 중점은 전투기 획득의 현저한 증가로 강조됩니다.

2023년 12월 독일은 621대의 항공기와 헬리콥터를 보유했습니다. 그 내역은 전투기 209기, 수송기 46기, 전투 헬리콥터 287기, 훈련기 및 헬리콥터 39기, 특수 임무기 37기, 유조선 3기입니다. 이 다양한 함대를 유지하는 것은 작전 즉각성에 매우 중요하며 대규모 MRO 서비스가 필요합니다. 또한 독일의 군용 항공 MRO 시장 성장의 주요 촉진요인은 국가의 군사비가 증가된다는 것입니다. 2023년 독일 국방 지출은 554억 달러에 이르렀으며 2022년부터 0.6% 증가했습니다.

최근 국경 분쟁이 증가함에 따라 독일은 전투기의 능력을 강화할 필요성이 더욱 커지고 있습니다. 이것은 항공기 구매 증가로 이어져 정기적인 유지 보수 서비스에 대한 수요를 밀어 올리고 있습니다. 예를 들어, Airbus Helicopters는 2023년 12월 독일에서 H145M 쌍발 헬리콥터 82대의 납품과 함께 23억 달러의 계약을 획득했습니다. 이 계약에는 62개의 확정 주문과 20개의 옵션이 있으며, 7년간의 지원 서비스 계약도 포함되어 있으며, 납품은 2024년에 시작될 예정입니다.

2022년 12월, 독일 국방부는 Lockheed Martin과 독일 공군의 노후화된 토네이도 전투 폭격기를 대체하는 35대의 F-35 Lightning II에 대해 88억 달러의 계약을 체결했습니다. 이러한 전략적 조달은 첨단 군용기 개발에 있어서 독일과 타국과의 협력관계의 심화와 함께 국가의 방위 항공기 MRO 능력의 기회를 급증시켜 향후 수년간 시장 성장을 가속할 것입니다.

예측기간 중 육군 부문이 시장을 독점할 전망

육군 부문은 이 나라의 군사비 급증에 힘입어 예측 기간 동안에도 시장 우위를 유지했습니다. 독일 정부는 군사력 강화를 위해 국방군비 조달에 힘을 쏟고 있으며 시장 성장을 뒷받침할 것으로 보입니다.

러시아와 우크라이나의 분쟁에 대응하여 독일은 군사비에 1,070억 달러의 특별 기금을 계상하고, 국방 지출을 GDP의 2% 이상으로 밀어 올렸습니다. 이 국방 지출의 급증은 구체적인 조달 행동에 연결되어 있습니다. 예를 들어, Rheinmetall AG는 2023년 7월 독일군에게 367대의 군용 트럭과 차량 커스터마이즈를 위한 1,830대의 교환 가능한 스왑 바디 플랫폼을 공급하는 3억 900만 달러의 계약을 획득했습니다. 납품은 2023년 3분기에 예정되어 있었습니다.

마찬가지로 2023년 3월 독일은 호주와 30밀리포를 탑재한 복서 패밀리를 기반으로 하는 신형 전투 정찰차에 관한 계약을 체결했습니다. 납품 개시는 2025년 예정입니다. 독일 정부는 기존의 장갑차의 근대화에도 힘을 쏟고 있습니다. 2023년 4월, Rheinmetall AG와 Krauss-Maffei Wegmann(KMW)는 2029년까지 화력과 지휘통제 능력을 강화할 것을 약속하고, Puma 보병 전투차 143대를 업그레이드하는 임무를 맡았습니다

2024년까지 650억 달러의 군사비 달성을 목표로 국방부는 다양한 조달 활동에 적극적으로 참여하고 있습니다. 2022년 6월, Teledyne Technologies의 부문인 Teledyne FLIR Defense는 독일 육군에게 127대의 UGV PackBot 525의 납품 완료를 발표했습니다. 이 UGV는 아프가니스탄 동굴에서 이라크 도로에 이르는 높은 전투 능력이 알려져 있으며 독일군의 무기고에 크게 참가하게 됩니다.

2022년 12월 독일 국방부는 Milrem Robotics 및 Krauss-Maffei Wegmann(KMW)과 공동으로 14대의 THEMIS UGV를 우크라이나에 공급하는 계약을 체결했습니다. 독일 육군의 선진적인 UGV 조달과 방어 강화 이니셔티브의 중시 증가는 앞으로 수년간 시장 성장을 가속하는 태세를 정돈하고 있습니다.

독일 항공우주 및 방위 산업 개요

독일의 방위 산업은 단편화되어 있으며 다양한 기업이 시장을 독점하고 있습니다. 주요 기업은 Rheinmetall AG, Lockheed Martin Corporation, Airbus SE, Leonardo SpA, RTX Corporation 등이 있습니다.

다양한 시장 기업들이 독일 정부와 합작 투자를 설립하고 국가의 장기 방어 능력을 높이기 위해 고급 방어 무기를 개발하고 있습니다. 이러한 벤처는 지역 기업이 시장에서의 존재감을 높이는 데 도움이 됩니다. 게다가, 일부 국제 방위 기업들이 독일 시장에 대한 투자 증가는 업계 내 기회의 수를 증가시킬 것으로 예상됩니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 산업별

- 제조, 설계, 엔지니어링

- 유지보수, 수리, 오버홀

- 유형별

- 육군

- 해군

- 공군

- 우주

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Rheinmetall AG

- Diehl Stiftung & Co. KG

- Lockheed Martin Corporation

- Airbus SE

- Krauss-Maffei Wegmann GmbH & Co. KG

- MBDA

- Leonardo SpA

- Liebherr Group

- RTX Corporation

- BAE Systems PLC

- thyssenkrupp AG

제7장 시장 기회와 앞으로의 동향

JHS 25.04.09The Germany Aerospace And Defense Market size is estimated at USD 19.99 billion in 2025, and is expected to reach USD 28.45 billion by 2030, at a CAGR of 7.31% during the forecast period (2025-2030).

The German defense industry is poised for robust growth in the coming years. Bolstered by a surge in defense spending and heightened acquisitions of armaments, the German government is actively fortifying its defense capabilities, setting the stage for market expansion.

After the Russian invasion of Ukraine, Germany intensified its focus on military development. Domestic defense firms have significantly ramped up investments, channeling resources into cutting-edge armaments to bolster the nation's defense, which is expected to fuel the market's growth.

However, the German military faces mounting restrictions, as there are concerns about long-term market growth. The defense sector is poised for a significant opportunity with an influx of weapon orders and a parallel surge in hiring trained personnel to manage and maintain sophisticated equipment.

Germany Aerospace and Defense Market Trends

The Maintenance, Repair, and Overhaul Segment is Expected to Showcase Remarkable Growth During the Forecast Period

The German defense industry is poised for significant growth, particularly in its maintenance, repair, and overhaul (MRO) segment. This growth is primarily attributed to the German government's heightened focus on bolstering its air force capabilities, aligning them with global standards. This emphasis is underscored by a notable uptick in fighter aircraft acquisitions.

In December 2023, Germany had an active fleet of 621 aircraft and helicopters. This fleet included 209 combat aircraft, 46 transport aircraft, 287 combat helicopters, 39 training aircraft and helicopters, 37 special mission aircraft, and three tanker aircraft. Maintaining this diverse fleet is crucial for operational readiness and necessitates substantial MRO services. Furthermore, a key driver for the military aviation MRO market's growth in Germany is the nation's escalating military expenditure. In 2023, German defense spending reached USD 55.4 billion and marked a 0.6% increase from 2022, showcasing a consistent trend of budgetary increments.

Increasing border disputes in recent years have further underscored the need for Germany to fortify its fighter aircraft capabilities. This has translated into increased aircraft acquisitions, subsequently driving the demand for periodic maintenance services. For instance, in December 2023, Airbus Helicopters secured a USD 2.3 billion contract from Germany, entailing the delivery of 82 H145M twin-engine helicopters. This deal, with 62 firm orders and 20 options, also includes a seven-year support service commitment, with deliveries slated to commence in 2024.

In December 2022, the German Ministry of Defense signed a USD 8.8 billion agreement with Lockheed Martin for 35 F-35 Lightning II aircraft to replace the aging Tornado fighter-bomber aircraft in the German Air Force's fleet, with deliveries scheduled to start in 2026. These strategic procurements, alongside Germany's deepening collaborations with other nations in developing advanced military aircraft, are set to create a surge in opportunities for the nation's defense aircraft MRO capabilities, fueling the market's growth in the coming years.

The Army Segment is Expected to Dominate the Market During the Forecast Period

The army segment maintained its market dominance during the forecast period, buoyed by a surge in the country's military expenditure. The German government's heightened focus on defense armament procurement to bolster military capabilities is set to fuel the market's growth.

In response to the Russia-Ukraine conflict, Germany earmarked a special fund of USD 107 billion for its military, pushing defense spending beyond 2% of GDP. This surge in defense spending has translated into tangible procurement actions. For instance, in July 2023, Rheinmetall AG secured a USD 309 million contract to supply 367 military trucks to the German armed forces alongside 1,830 interchangeable swap-body platforms for vehicle customization. Deliveries were slated for the third quarter of 2023.

Similarly, in March 2023, Germany signed a deal with Australia for new combat reconnaissance vehicles based on the Boxer family, featuring a 30-millimeter gun. Deliveries are scheduled to commence in 2025. The German government is also intensifying its focus on modernizing existing armored vehicles. In April 2023, Rheinmetall AG and Krauss-Maffei Wegmann (KMW) were tasked with upgrading 143 Puma infantry fighting vehicles, with a commitment to enhance firepower and command and control capabilities by 2029.

With a target to reach USD 65 billion in military expenditure by 2024, the defense ministry has been actively engaging in various procurement activities. In June 2022, Teledyne FLIR Defense, a division of Teledyne Technologies, announced the completion of deliveries for 127 PackBot 525 UGVs to the German Army. These UGVs, known for their combat prowess from the caves of Afghanistan to the roads of Iraq, are a significant addition to the German Armed Forces' arsenal.

In December 2022, the German Ministry of Defense, in collaboration with Milrem Robotics and Krauss-Maffei Wegmann (KMW), signed a deal to supply 14 THeMIS UGVs to Ukraine. The growing emphasis on advanced UGV procurement and defense enhancement initiatives by the German Army is poised to propel the market's growth in the coming years.

Germany Aerospace and Defense Industry Overview

The German defense industry is fragmented, with various players dominating the market. Some of the major players are Rheinmetall AG, Lockheed Martin Corporation, Airbus SE, Leonardo SpA, and RTX Corporation.

Various market players are establishing joint ventures with the German government to develop advanced defense armaments to increase the country's long-term defense capability. Such ventures are helping regional players to increase their presence in the market. Moreover, increasing investments by several international defense companies in the German market are expected to increase the number of opportunities within the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Industry

- 5.1.1 Manufacturing, Design, and Engineering

- 5.1.2 Maintenance, Repair, and Overhaul

- 5.2 By Type

- 5.2.1 Army

- 5.2.2 Navy

- 5.2.3 Airforce

- 5.2.4 Space

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rheinmetall AG

- 6.2.2 Diehl Stiftung & Co. KG

- 6.2.3 Lockheed Martin Corporation

- 6.2.4 Airbus SE

- 6.2.5 Krauss-Maffei Wegmann GmbH & Co. KG

- 6.2.6 MBDA

- 6.2.7 Leonardo SpA

- 6.2.8 Liebherr Group

- 6.2.9 RTX Corporation

- 6.2.10 BAE Systems PLC

- 6.2.11 thyssenkrupp AG