|

시장보고서

상품코드

1690753

미국의 MEP 서비스 : 시장 점유율 분석, 산업 동향, 성장 예측(2025년-2030년)United States (US) MEP Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

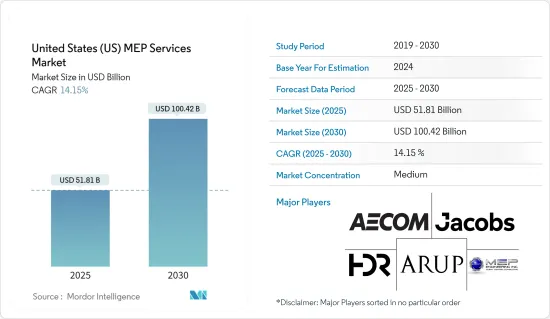

미국의 MEP(기계, 전기, 배관) 서비스 시장 규모는 2025년에 518억 1,000만 달러로 추정되고, 2030년에는 1,004억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 14.15%를 나타낼 전망입니다.

주요 하이라이트

- 기계, 전기, 배관(MEP)은 건물의 다양한 MEP 시스템을 계획, 설계 및 관리하는 업무를 포함하며, 건물 건설, 계획 및 관리에 BIM이 점점 더 많이 통합됨에 따라 MEP 서비스가 더욱 주목받고 있습니다.

- MEP는 프로젝트 건설 비용의 상당 부분을 차지합니다. 덴버 국제공항 리노베이션, 뉴욕시 대중교통 업그레이드 등 이 지역에서 건설 프로젝트가 증가함에 따라 시장 성장을 견인할 것으로 예상됩니다.

- 코로나19 팬데믹은 공급망의 중단과 관련하여 MEP 서비스 시장에 영향을 미쳤습니다.

- 모든 서비스 제공업체의 수익 중 상당 부분이 MEP 설계에서 발생하기 때문에 설계는 MEP 서비스에서 중요한 역할을 합니다. 컨설팅-특정 엔지니어의 연구에 따르면, 2019년 한 해 동안 모든 MEP 대기업의 매출 중 절반 이상(58%)이 MEP 설계에서 발생했으며, 기업당 평균 MEP 설계 매출은 8,390만 달러로 전년도에 비해 크게 증가한 것으로 나타났습니다.

- 미국의 MEP 서비스 수요는 신축과 개보수 및 리노베이션 수요에 의해 주도되고 있으며, 두 부문 모두 시장에서 두드러진 점유율을 차지하고 있습니다.

- 친환경 시스템을 설치하는 것이 결국 환경과 예산에 도움이 될 것이라는 업계의 공감대가 형성되면서 건설 설계 업계에서 지속 가능성 개념이 탄력을 받고 있습니다. EPA에 따르면 미국의 전력 생산은 전체 에너지 소비의 40%를 차지합니다.

- 미국 에너지 정보국(EIA)에 따르면 상업용 건물에서 에너지를 많이 소비하는 부분은 전체 건물 에너지의 35%인 HVAC 시스템, 11%인 조명, 18%인 냉장고, 온수기, 냉동고와 같은 가전제품이며 나머지는 다양한 전자제품이 나눠서 소비합니다.

- 하지만 현재 시장 상황에서는 코로나19의 영향으로 건설 프로젝트 중 일부가 지연되고, 일부는 발주처인 기업 및 정부 기관의 영향으로 취소되었습니다. 예를 들어, 공급망 제약으로 인해 최종 사용자 기업이 중국에서 수입한 건설 자재의 약 30%가 제조 생산량이 감소했습니다.

미국의 MEP 서비스 시장 동향

신규 건설이 시장 성장을 견인

- 미국 건설업협회(AGC)에 따르면 건설 산업은 미국 경제에 크게 기여하는 산업입니다. 건설은 제조, 광업 및 다양한 MEP 서비스의 주요 고객 중 하나입니다.

- 주택 건설 부문은 코로나19 위기 이후 미국 경제 회복의 주역으로 2020년 3분기부터 두 자릿수 성장률을 기록하며 경제 회복과 전체 건설 산업 성장에 크게 기여하고 있습니다.많은 건설 프로젝트가 봉쇄의 기회를 활용하기 위해 빠르게 진행되어 코로나19 기간 동안 수익이 증가했습니다.

- 또한, 기업 매출은 꾸준히 증가하고 있으며 수익은 여전히 상당한 압박을 받고 있습니다. 업계가 직면한 과제 중에는 지속적인 비용 압박, 생산성에 영향을 미치는 지속적인 인력 부족, 기존 시스템으로는 달성하기 어려운 수준의 가격 책정 및 운영 정밀도를 요구하는 고정 입찰 프로젝트에 대한 추세 등이 있습니다.

- 또한 성공적인 구현과 기술을 흡수하기 위한 인력의 숙련도 향상이라는 측면에서 추가적인 장애물이 될 수도 있습니다. 이러한 어려움에도 불구하고 MEP 기업은 미국의 교통 및 인프라 업그레이드 노력과 스마트 시티 메가 프로젝트의 성장 등 다양한 산업 기회로부터 잠재적으로 혜택을 받을 수 있습니다.

시장 성장을 견인하는 의료 기관 수요

- 이 지역의 의료 부문은 경제의 최적 기능을 위한 중요한 부문 중 하나로 간주됩니다. 그러나 의료 기관의 비효율적인 계획과 부족한 자원이라는 큰 문제에 직면해 있습니다. 예를 들어, 휴매나와 피츠버그 대학교 연구진은 2012년 1월부터 2019년 5월까지의 데이터를 바탕으로 의료비 지출의 약 25%가 비효율적인 것으로 파악할 수 있다고 보고했습니다.

- 이에 따라 의료 부문의 최종 사용자들은 시설의 비효율성을 활용할 수 있는 MEP 서비스의 잠재력을 깨닫기 시작했습니다. 또한 의료 시설에서는 수술실, 산부인과, 소아과 등 각 부서마다 고유한 요구 사항이 있습니다. 또한 부적절한 설계는 환자 치료에 치명적인 영향을 미칠 수 있습니다. 예를 들어, 낮은 내부 공기질은 환자의 건강에 악영향을 미칠 수 있습니다. 따라서 MEP 서비스는 의료 운영의 근간이 되는 시스템을 지원할 수 있는 잠재력을 가지고 있습니다.

- 또한, 현재 진행 중인 코로나19 팬데믹은 이 지역의 팬데믹 대응 준비가 부족하다는 것을 보여주었고, 보건 시스템의 비효율성과 불평등을 드러냈습니다. 예를 들어, 의료 인프라는 코로나19 환자를 수용할 수 없으며 다른 선진국에 비해 1인당 병상 수가 적습니다.

- 이에 따라 이 지역의 정부 기관들이 효율적인 의료 시설 건설에 많은 자원을 할당하기 시작하면서 MEP 서비스에 대한 수요가 급증할 것으로 예상됩니다.

미국의 MEP 서비스 산업 개요

미국 MEP 서비스 시장은 적당히 세분화되어 있습니다. 주요 기업으로는 Jacobs Engineering Group Inc, HDR Inc, AECOM, and Arup Group. 등입니다.

- 2020년 6월, AECOM은 글로벌 대체 자산 관리 회사인 Canyon Partners, LLC와 파트너십을 맺고 The Martin Group과 합작 투자하여 중층 학생 주택 프로젝트인 Wexler의 대중교통 중심 개발을 시작한다고 발표했습니다. 이 회사는 퍼시픽 웨스턴 은행으로부터 7,330만 달러의 선순위 건설 대출을 받았다고 발표했습니다. 이 프로젝트는 2020년 가을까지 완공될 예정입니다.

- 2020년 10월, 샌프란시스코 캘리포니아 대학교(UCSF)는 파르나서스 하이츠(파르나서스 하이츠)에 위치한 새 병원인 UCSF 헬렌 딜러 메디컬 센터의 MEP 수석 엔지니어로 아럽과 샌프란시스코 소재 의료 전문업체 마제티를 선정했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- COVID-19의 설계 및 엔지니어링 서비스 산업에 대한 영향 평가

- 미국에서 MEP 엔지니어의 현재 고용 지수

- 기술의 발전이 MEP 서비스 산업에 미치는 영향(CAD, BIM, MEP 소프트웨어 등)

제5장 시장 역학

- 시장 성장 촉진요인

- 핵심 오퍼링에 집중하기 위해 MEP 서비스 아웃소싱에 대한 강조 증가

- 상업 및 의료 기관의 꾸준한 수요

- 진화하는 비즈니스 모델과 기업과 서비스 공급 업체 간의 협업의 본질

- 시장 성장 억제요인

- 높은 시장 집중도와 통합 솔루션에 대한 수요 증가로 인한 운영상의 어려움은 소규모 기업에 영향

제6장 시장 세분화

- 유형별

- 신축

- 개보수 및 리노베이션

- 커미셔닝 활동

- 기타

- 산업별

- 의료

- 상업용 사무실

- 교육기관

- 공공장소 및 시설

- 산업 시설 및 창고

- 기타 상업시설(데이터센터, 조사 등)

제7장 경쟁 구도

- 기업 프로파일

- Jacobs Engineering Group Inc.

- HDR Inc

- Arup Group

- AECOM

- MEP Engineering

- Stantec Inc.

- Affiliated Engineers Inc.

- Macro Services

- WSP Group

- AHA Consulting

- Burns Engineering

- Wiley Wilson

제8장 투자 분석

제9장 시장의 미래

HBR 25.05.09The United States MEP Services Market size is estimated at USD 51.81 billion in 2025, and is expected to reach USD 100.42 billion by 2030, at a CAGR of 14.15% during the forecast period (2025-2030).

Key Highlights

- Mechanical electrical and plumbing (MEP) involves planning, designing, and managing various MEP systems of a building, and with the increasing incorporation of BIM in building construction, planning, and management, MEP services are further gaining traction.

- The MEP contribute to the significant portion of projects' construction cost. With the growing number of construction projects in the region, such as Denver International Airport renovation and New York City transit upgrades, it is expected to drive the growth of the market.

- The COVID-19 pandemic has impacted the MEP services market with respect to disruptions in the supply chain. Lead times for some products were increased due to factory shutdowns. However, now with factories functioning at full capacities, production levels are beginning to see significant improvements.

- Design plays a vital role in MEP services as a significant share of the revenue for any service provider is generated from MEP design. According to a study by Consulting-Specifying Engineer, over half (58%) of the revenue from all of MEP giants combined during 2019 was generated from MEP design, with an average MEP design revenue of USD 83.9 million per firm and observed a significant increase compared to the previous year.

- The US demand for MEP services is driven by new construction and retrofit and renovation demand with both segments, driving a prominent share of the market. However, the new construction segment commands a slight upper hand when it comes to the MEP services market share in the country.

- The concept of sustainability is gaining momentum in the construction design industry; the industry consensus is that installing eco-friendly systems would eventually benefit the environment and the budget. According to the EPA, electricity generation in the US accounts for 40% of the total energy consumption. Thereby vendors in the regions are leveraging the MEP technologies such as solar collectors and ventilation with heat recovery accompanied by their services to counter the demand.

- According to the US Energy Information Administration (EIA), in a commercial building, major energy-consuming sections are HVAC systems at 35% of the total building energy, lighting at 11%, appliances, such as refrigerators, water heaters, and freezers at 18%, and the remaining is shared among various other electronics. This is where MEP service providers become vital in developing robust designs that enable consumers to reduce costs.

- However, in the current market scenario, some of the construction projects have been delayed, and some resulted in cancellation as the result of the impact of COVID-19 on the companies and government bodies that commissioned them. For instance, nearly 30% of imported construction material deployed by the end-user firms from China due to supply chain constraints manufacturing output has declined. These instances showcase some of the negative outlooks of the MEP services market that holds the potential to hinder market growth.

US MEP Services Market Trends

New Construction to Drive the Market Growth

- As per the Associated General Contractors (AGC) of America, the construction industry is a major contributor to the US economy. The industry has more than 733,000 employers with over 7 million employees and creates nearly USD 1.4 trillion worth of structures each year. Construction is one of the major customers for manufacturing, mining, and a variety of MEP services. It is also seen as a significant economic reviver during the recession period.

- The residential construction sector has been the star performer of the United States' economic recovery from the COVID-19 crisis, posting double-digit growth rates since the third quarter of 2020 and making significant contributions to the rebound of the economy and the overall construction industry growth. Many construction projects were fast-tracked to utilize the opportunity of the lockdown and resulted in an increased revenue during the COVID-19 phase. Over the forecast period, the market is expected to correct the sudden increase in projects undertaken.

- Moreover, firm revenues are steadily rising, and the bottom lines are still under considerable pressure. Among the challenges that the industry face is sustained cost pressures, ongoing labor shortages that affect productivity, and trends toward fixed-bid projects that often demand a level of pricing and operations precision that is difficult to obtain with traditional systems. While the industry still trails broader digital acceptance maturity, the continued adoption of digital technologies could alleviate some of these issues.

- It can also present additional hurdles in terms of successful implementations and upskilling the workforce to absorb the technologies. Despite these challenges, MEP firms are poised to potentially benefit from various significant industry opportunities, including the US transportation and infrastructure upgrade initiative and the growth of smart city mega-projects.

Demand from Healthcare Institutions to Drive Market Growth

- The healthcare sector in the region is considered one of the crucial sectors for the optimal functioning of the economy. However, it faces the huge problem of inefficient planning and insufficient resources at the healthcare facilities. For instance, Humana and the University of Pittsburgh researchers reported that based on the data from January 2012 to May 2019, approximately 25% of healthcare spending could be characterized as inefficient.

- Thereby, end-user from the healthcare sector are starting to realize the potential offered by MEP services to leverage inefficiencies in the facilities. Moreover, In a healthcare facility, each department has its specific requirements: operation theatre, Gynaecological Department, or the Paediatrics Department. Additionally, incompetent designs could lead to a catastrophic effect on patient treatment. For instance, low internal air quality could cause adverse effects on the health of the patients. Thus, MEP services hold the potential to support the systems that are the backbone of healthcare operations.

- Furthermore, the ongoing pandemic COVID-19 has showcased the region's lack of preparation to counter the pandemic and has exposed the health system's inefficiencies and inequities. For instance, the healthcare infrastructure cannot accommodate COVID-19 patients and has fewer hospital beds per capita than other developed countries.

- Thereby these instances are expected to surge the demand for MEP service as the government bodies in the region are starting to allocate many resources into the construction of efficient medical facilities. For instance, In May 2020, AECOM announced it had completed the New York City Department of Design and Construction's (DDC) project to construct two temporary hospitals that are aimed to serve as COVID-19 emergency facilities.

US MEP Services Industry Overview

The United States MEP Services Market is moderately fragmented. The major companies include Jacobs Engineering Group Inc, HDR Inc, AECOM, and Arup Group. Vendors in the market are leveraging partnerships and collaborations to capture the market share. Some of the recent developments in the market are:

- June 2020: AECOM, in partnership with Canyon Partners, LLC, a global alternative asset management firm, announced a joint venture with The Martin Group to begin the transit-oriented development of Wexler, a mid-rise student housing project. The company announced that it had taken a USD 73.3 million senior construction loan from Pacific Western Bank. The project is scheduled to be completed by fall 2020.

- October 2020: The University of California, San Francisco (UCSF) selected Arup and San Francisco-based healthcare specialists Mazzetti as the lead MEP engineers of record for its new hospital, UCSF Helen Diller Medical Center at Parnassus Heights (Parnassus Heights). Arup could also be providing additional services for the project, including civil engineering services and acoustics/vibration and logistics consulting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Design and Engineering Services Industry

- 4.4 Current Employment Index of MEP Engineers in the United States

- 4.5 Impact of Technological Advancements on the MEP Services Industry (CAD, BIM, MEP Software, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Outsourcing of MEP Services to Focus on Core Offering

- 5.1.2 Steady Demand from Commercial and Healthcare Institutions

- 5.1.3 Evolving Business Models and Nature of Collaboration between Firms and Service Vendors

- 5.2 Market Restraints

- 5.2.1 Operational Challenges in High Market Concentration and Growing Demand for End-to-end Offering Affect Smaller Firms

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 New Construction

- 6.1.2 Retrofit & Renovation

- 6.1.3 Commissioning Activity

- 6.1.4 Other Types

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Commercial Offices

- 6.2.3 Educational Institutions

- 6.2.4 Public Spaces and Institutions

- 6.2.5 Industrial establishments & Warehouses

- 6.2.6 Other Commercial entities (Data centers, Research, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jacobs Engineering Group Inc.

- 7.1.2 HDR Inc

- 7.1.3 Arup Group

- 7.1.4 AECOM

- 7.1.5 MEP Engineering

- 7.1.6 Stantec Inc.

- 7.1.7 Affiliated Engineers Inc.

- 7.1.8 Macro Services

- 7.1.9 WSP Group

- 7.1.10 AHA Consulting

- 7.1.11 Burns Engineering

- 7.1.12 Wiley Wilson