|

시장보고서

상품코드

1690755

영국의 택배, 특송 및 소포(CEP) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United Kingdom Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

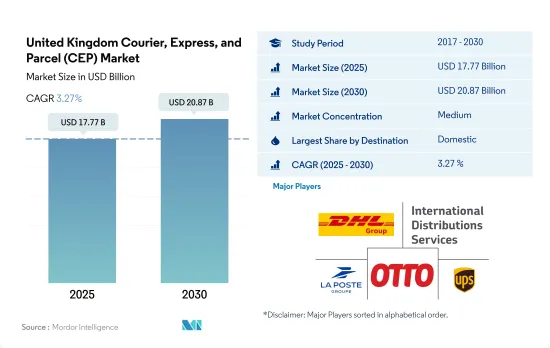

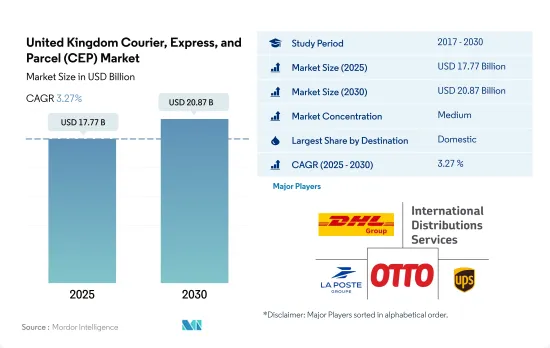

영국의 택배, 특송 및 소포(CEP) 시장 규모는 2025년에 177억 7,000만 달러로 추정되고, 2030년에는 208억 7,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 3.27%를 나타낼 전망입니다.

전자상거래 CEP 주문 증가로 인한 탄소 발자국 감축 이니셔티브의 증가는 CEP 산업에 긍정적인 영향을 미칠 것으로 예상됩니다.

- 전자상거래 산업은 국내외 CEP 부문의 성장을 이끄는 주요 동력입니다. 2022년 영국 소비자들이 온라인에서 가장 많이 구매한 상품은 패션 상품으로 의류가 63%, 신발이 47%의 점유율을 차지했습니다. 그 뒤를 이어 가전제품이 35%, 책, 영화, 게임이 2022년 33%의 점유율로 그 뒤를 이었습니다.

- 시장 점유율이 가장 높은 CEP 기업들은 대량의 소포를 배송하면서 발생하는 탄소 발자국을 줄이기 위해 상당한 조치를 취하고 있습니다. 또한 탄소 배출을 줄이기 위해 2023년까지 5,500대의 전기 밴을 보유하는 것을 목표로 하고 있습니다.

영국의 택배, 특송 및 소포(CEP) 시장 동향

영국의 창고 수는 소비자 주문 처리 센터에 대한 수요 증가로 인해 2027년까지 21만 4,000개에 달할 것으로 예상됩니다.

- 2024년 5월, DP 월드는 고객 경쟁 강화를 위한 5,000만 파운드(6,092만 달러) 투자의 일환으로 코벤트리에 59만 8,000평방피트(약 8,000 평방미터)라는 지금까지 가장 큰 창고를 개설했습니다. 이것은 2023년 9월에 비스터에 개설한 27만 평방피트의 규모의 음악 및 비디오 유통 창고를 오픈한 데 이은 것으로, 영국 실물 음악의 70%와 홈 엔터테인먼트 제품의 35%를 취급합니다. 앞서 DP World는 버튼어폰트렌트에 7만 5,000평방피트의 창고를, 런던 게이트웨이의 물류 허브에 23만평방피트의 규모의 다중 사용자 창고를 오픈했습니다. 사우스햄튼과 런던 게이트웨이의 허브와 함께 78개국에서 운영 중인 DP World는 전 세계 무역의 10%를 관리하고 있습니다.

- 영국 내 대형 창고의 수는 빠르게 증가하고 있습니다. 2027년까지 전체 창고의 약 18%가 소비자 주문 처리용 창고가 될 것입니다.

영국 정부는 연료 가격에 큰 영향을 미치며, 유류세와 부가가치세(표준세율 20%)가 휘발유와 경유 가격의 대부분을 차지합니다.

- 2022년 8월, 유가는 100달러 이하로 하락하여 배럴당 90.63달러로 한 달을 마감했습니다.2023년에는 가격이 더 하락하여 5월에는 배럴당 72.50달러까지 떨어졌습니다. 2024년 3월 영국의 휘발유 가격은 리터당 평균 150.1p로 2023년 11월 이후 가장 높았습니다. 이는 중동 긴장으로 인한 유가 상승과 달러 대비 파운드화 약세 때문입니다.

- 2024년 6월, 영국 정부는 2030년까지 제트 연료에 최소 10%의 지속 가능한 항공 연료(SAF)를 의무화할 계획이라고 밝혔습니다. 현재 SAF는 기존 연료보다 희소성이 낮고 가격이 비싸서 항공 분야에서 사용을 늘리는 데 어려움이 있습니다. SAF는 전 세계적으로 제트 연료의 0.1% 미만을 차지합니다. 입법 승인을 기다리고 있는 정부의 SAF 의무화는 2025년 1월에 시작될 예정입니다.

영국의 택배, 특송 및 소포(CEP) 산업 개요

영국 택배, 특송 및 소포(CEP) 시장은 적당히 통합되어 있으며, 이 시장의 주요 5개 업체는 DHL Group, International Distributions Services (including Royal Mail), La Poste Group, Otto Group (The Hermes Group 포함) and United Parcel Service of America, Inc.(UPS)입니다.(알파벳 순)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구동태

- 경제 활동별 GDP 분포

- 경제활동별 GDP 성장률

- 인플레이션율

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수 및 창고업의 GDP

- 수출 동향

- 수입 동향

- 연료 가격

- 물류 실적

- 인프라

- 규제 프레임워크

- 영국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 판매처

- 국내

- 국제

- 배달 속도

- 특송

- 비특송

- 모델

- 기업 간(B2B)

- 기업 대 소비자(B2C)

- 소비자 간(C2C)

- 출하 중량

- 중량 화물(Heavy Weight Shipments)

- 경량 화물(Light Weight Shipments)

- 중간 중량 화물(Medium Weight Shipments)

- 수송 형태

- 항공

- 도로

- 기타

- 최종 사용자

- 전자상거래

- 금융 서비스(BFSI)

- 의료

- 제조업

- 1차 산업

- 도매 및 소매업(오프라인)

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- APC Overnight

- DHL Group

- FedEx

- GEODIS

- International Distributions Services(Royal Mail 포함)

- La Poste Group

- Otto Group(including The Hermes Group)

- Rapid Parcel

- United Parcel Service of America, Inc.(UPS)

- Yodel

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 기술 발전

- 출처 및 참고문헌

- 도표 목록

- 주요 인사이트

- 데이터 팩

- 용어집

The United Kingdom Courier, Express, and Parcel (CEP) Market size is estimated at 17.77 billion USD in 2025, and is expected to reach 20.87 billion USD by 2030, growing at a CAGR of 3.27% during the forecast period (2025-2030).

Growing carbon footprint reduction initiatives owing to increasing e-commerce CEP orders are expected to positively impact CEP industry

- The e-commerce industry is a leading driver of growth in the domestic and international CEP segments. The most common goods purchased online by UK consumers in 2022 were fashion goods , with clothing accounting for a 63% share and shoes for a 47% share. These were followed by consumer electronics, with a 35% share, and books, movies, and games, with a 33% share in 2022. All these item deliveries collectively drove CEP demand in the United Kingdom.

- CEP companies with some of the biggest market shares are taking significant steps to reduce the carbon footprint generated by delivering huge volumes of parcels. For instance, Royal Mail has allowed 90,000 posties to make on-feet deliveries. Two-thirds of the deliveries are made purely by foot or through a 'park and loop' method, which is mostly on foot. The company is also aiming to have 5,500 electric vans by 2023 in a further effort to reduce carbon emissions. Amazon also started on-foot and electric cargo bike delivery in London in 2022. Initiatives by both companies are a part of their commitment toward all shipments having net-zero carbon emissions by 2040.

United Kingdom Courier, Express, and Parcel (CEP) Market Trends

The UK's warehouse count is expected to reach 214,000 by 2027 due to a rise in demand for consumer fulfillment centers

- In May 2024, DP World opened its largest warehouse yet, a 598,000 sq ft facility in Coventry, as part of a GBP 50 million (USD 60.92 million) investment to boost customer competitiveness. This follows the September 2023 opening of a 270,000 sq ft music and video distribution warehouse in Bicester, handling 70% of the UK's physical music and 35% of home entertainment products. Previously, DP World opened a 75,000 sq ft site in Burton upon Trent and a 230,000 sq ft multi-user warehouse at London Gateway's logistics hub. Alongside its hubs at Southampton and London Gateway, operating in 78 countries, DP World manages 10% of global trade. Such initiaves are expected to boost the GDP contribution from the sector.

- The number of large warehouses in the United Kingdom is rapidly increasing. By 2027, there are expected to be around 214,000 warehouses larger than 50,000 square feet globally. Many of these warehouses are to serve as e-commerce fulfillment centers, and approximately 18% of all warehouses will be for consumer fulfillment by 2027. This increase suggests the global expansion of e-commerce as the proportion of warehouses operating as trade distribution hubs begins to shift in favor of consumer fulfillment centers.

UK government has a major influence on fuel prices, and both fuel duty and VAT (standard 20% rate) make up majority of the petrol and diesel prices

- In August 2022, the oil price dropped under USD 100 and finished the month at USD 90.63 a barrel. Prices dropped further in 2023, and by May, a barrel of oil was down to USD 72.50. In March 2024, petrol prices in the UK averaged 150.1p per litre, the highest since November 2023. This is due to rising oil prices due to Middle East tensions and a weaker pound against the dollar. Although overall inflation has eased, petrol and diesel prices increased in March. Oil prices have since dropped after spiking following Israel's retaliatory attack on Iran in April 2024.

- In June 2024, the UK government confirmed it plans to require at least 10% sustainable aviation fuel (SAF) in jet fuel by 2030. Currently, SAF is scarce and more expensive than traditional fuels, making it challenging to increase its use in aviation. SAF represents less than 0.1% of jet fuel globally. The government's SAF mandate, pending legislative approval, is set to start in January 2025. This follows the 2022 "Jet Zero" strategy aiming for net-zero emissions in aviation by 2050.

United Kingdom Courier, Express, and Parcel (CEP) Industry Overview

The United Kingdom Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being DHL Group, International Distributions Services (including Royal Mail), La Poste Group, Otto Group (including The Hermes Group) and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 United Kingdom

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 APC Overnight

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including Royal Mail)

- 6.4.6 La Poste Group

- 6.4.7 Otto Group (including The Hermes Group)

- 6.4.8 Rapid Parcel

- 6.4.9 United Parcel Service of America, Inc. (UPS)

- 6.4.10 Yodel

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms