|

시장보고서

상품코드

1910927

인도네시아의 석탄 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Indonesia Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

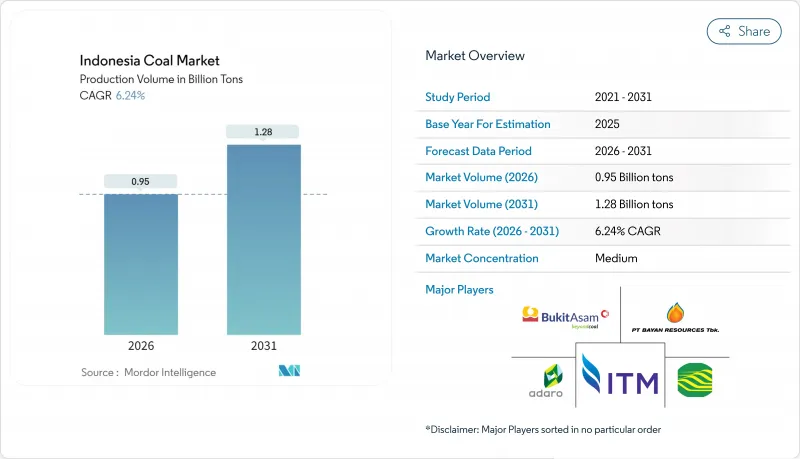

인도네시아의 석탄 시장은 2025년 8억 9,000만 톤에서 2026년에는 9억 5,000만 톤으로 성장하고, 2026년부터 2031년에 걸쳐 CAGR 6.24%로 성장을 지속하여, 2031년까지 12억 8,000만 톤에 달할 것으로 예측되고 있습니다.

시장의 규모는 인도네시아가 세계 최대의 화력발전용 석탄 수출국임을 보여주고 있으며, 이 나라의 전력 구성에서의 확고한 지위를 반영합니다. 탈탄소화 논의가 활발해지는 가운데 PLN(국영전력회사)의 지속적인 베이스로드 수요, 니켈 제련 붐, 확대하는 '차이나 플러스 원' 전략이 함께 수요 성장을 뒷받침하고 있습니다. 통합형 광산업체는 현금 흐름을 안정화하는 장기판매계약을 지속적으로 확보하고 있으며 전략적 비축품의 질은 프리미엄급 생산자에게 추가적인 가격 결정력을 부여하고 있습니다. 동시에 가스화와 디메틸에테르 프로젝트를 촉진하는 규제 개혁이 저품위탄의 새로운 국내 판로를 개척하고 있습니다. 이러한 병행 동향은 세계적으로 석탄 자본 비용이 상승하는 가운데 인도네시아의 석탄 시장이 계속 견조하다는 것을 보여줍니다.

인도네시아의 석탄 시장의 동향 및 전망

저발열량 석탄에 대한 PLN 주도의 베이스로드 수요 지속

PLN(인도네시아 국영전력회사)의 신재생에너지 급속 확장 여지가 제한되면서 석탄은 인도네시아의 전력공급체계의 핵심에 자리잡고 있습니다. 보조금이 적용되는 전력요금 체계에서는 전력회사가 최저 비용의 발전연료를 우선시할 필요가 있으며, 자바 발리 부하센터에 대한 공급에는 아역청탄이 여전히 가장 비용 효율적인 옵션입니다. 송전망의 안정성 확보를 위해서는 석탄화력발전소가 축전지보다 낮은 한계비용으로 주파수 및 전압조정서비스를 제공할 수 있기 때문에 공급 우선도의 추가적인 강화가 요구되고 있습니다. 재무 면에서 PLN의 석탄 조달 예산 배분은 예측 가능하며, 거래 상대방의 신용 리스크를 줄이는 것과 동시에, 광산 회사가 수량이 고정된 다년간의 판매 계약을 구축하는 것을 가능하게 하고 있습니다. 그 결과 인도네시아의 석탄 시장은 신재생에너지의 침투율이 점점 증가하는 가운데에서도 지속되는 구조적 수요의 하한이라는 혜택을 받고 있습니다.

니켈 및 EV전지 제련소용 석탄화력 자가발전의 급증

인도네시아의 2020년 니켈 광석 수출 금지령으로 전기로 가동에 끊김없는 전력 공급을 필요로 하는 니켈 가공 복합 시설에 150억 달러를 넘는 자본이 유입되었습니다. 중국의 거대 자본 제련소는 보통 200-350MW 규모의 자사 전용 석탄 화력 발전소를 설치하고 있으며, PLN의 송전 우선 순위의 영향을 받지 않는 전용 시장을 형성하고 있습니다. 자가소비형 설비에서는 일반적으로 달러 연동 전력구매계약이 연결되어 광산회사는 전력회사로부터 공급보다 높은 수익을 실현하고 있습니다. 이 비즈니스 모델은 프리미엄 마진을 확보하는 동시에 수익원을 다양화합니다. 다운스트림 기업이 전구체, 음극, 배터리 재료 분야에 진출함에 따라 수요는 더욱 확대되고, 석탄 사용이 역설적으로 저탄소 경제와 연결되고 있습니다. 이러한 동향에 의해 2030년까지 산업용 전력 수요의 성장은 국내 평균 소비량을 웃도는 전망이 유지될 것으로 예상됩니다.

국내 판매 의무(DMO)의 가격 상한

인도네시아의 DMO 제도에서 광산 사업자는 연간 생산량의 25%를 정부 설정 기준 가격으로 국내에 판매할 의무가 있습니다. 이 기준 가격은 고가격 사이클 시 수출가격을 최대 30달러/톤 미만으로 낮추기 때문에 강제적인 할인이 마진 확대 기회를 압박하고 기업은 고발열량(고CV) 탄종 생산에 편중하는 인센티브가 발생합니다. 고CV 탄종은 수출 전용으로 할당됩니다. 금융기관은 DMO 상한의 영향을 받는 매장량 평가액을 점차 하향 조정하고 있어 확장을 위한 자금 조달을 어렵게 하고 있습니다. 이 정책은 국영전력회사(PLN)와 산업용 구매자를 가격 급등으로부터 보호하는 한편, 신규 저품위 석탄 프로젝트에 대한 투자 의욕을 저하시키고 인도네시아의 석탄 시장에서 공급 증가를 통한 성장을 억제하는 결과가 되고 있습니다.

부문 분석

아역청탄은 2025년 시점에서 인도네시아 석탄시장의 46.85%를 차지하였으며, 동칼리만탄주 및 남칼리만탄주의 풍부한 탄층을 활용하여 비용 경쟁력 있는 연료를 국내 및 수출 바이어 쌍방에 공급하고 있습니다. 현재의 이점에도 불구하고 2026년부터 2031년에 걸쳐 역청탄 및 코크스탄의 생산량은 CAGR 7.86%로 증가할 것으로 예측되고 인도네시아의 석탄시장 점유율은 2025년 26.40%에서 2031년까지 3분의 1 가량 상승할 전망입니다. 고발열량탄은 톤당 15-20달러의 프리미엄 가격을 실현하여 아시아에서 보급되고 있는 초초임계 화력발전소 사양에 적합합니다. 지역 고로의 야금탄 수요는 적절한 품질의 매장량을 보유하는 생산자의 가격 결정력을 더욱 강화합니다. 갈탄은 국내의 가스화 파일럿 플랜트나 구식 저효율 보일러용이 중심이며, 성장은 평이할 것으로 예측됩니다. 생산지역은 품위분포를 반영하고 있으며, 칼팀 프리마 콜 등 동칼리만탄의 사업자는 프리미엄 품위에 주력하는 반면 수마트라의 광산회사는 주로 PLN(인도네시아 국영전력회사)용으로 아역청탄을 공급하고 있습니다. 이러한 품질 세분화를 통해 기업은 가격 차이와 물류 경제성에 따라 품위 간의 혼합 비율을 조정하여 시장 변동에 대한 위험을 회피하고 포트폴리오의 균형을 유지할 수 있습니다.

인도네시아의 석탄 시장의 보고서는 석탄 등급(갈탄 및 저품위탄, 아역청탄, 역청탄 및 코크스탄) 및 용도(발전, 철강 및 야금, 시멘트 및 기타 용도)별로 분류되어 있습니다. 시장 규모 및 예측은 생산량(톤)으로 제공됩니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 저발열량 석탄에 대한 PLN 주도의 베이스 로드 수요의 장기화

- 니켈 및 EV 배터리용 제련소용 석탄화력 자가발전의 급증

- 차이나+1 전략에 의해 인도네시아로 이동하는 해상 수송 수요

- 정부의 저품위탄용 '가스화 및 DME' 장려책

- 고열량 석탄 수출 프리미엄을 실현하는 CCUS 파일럿 사업

- 억제요인

- 국내 시장 의무(DMO)의 가격 상한

- JETP 자금에 의한 석탄 화력 발전소의 조기 폐업

- 신규 광업허가에 관한 주 수준의 모라토리엄(칼리만탄, 수마트라)

- 인도네시아산 석탄의 ESG 요인에 의한 무역금융비용 상승

- 공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급자의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- PESTEL 분석

제5장 시장 규모 및 성장 예측

- 석탄 등급별

- 갈탄 및 저품위탄

- 아역청탄

- 역청탄 및 코크스탄

- 용도별

- 발전

- 철강 및 야금

- 시멘트 및 기타 용도

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 제휴, 전력 구입 계약)

- 시장 점유율 분석(주요 기업의 시장 순위 및 점유율)

- 기업 프로파일

- PT Bumi Resources Tbk

- PT Adaro Energy Indonesia Tbk

- PT Bayan Resources Tbk

- PT Bukit Asam Tbk

- PT Indo Tambangraya Megah Tbk

- PT Kaltim Prima Coal

- PT Arutmin Indonesia

- PT Kideco Jaya Agung

- PT Berau Coal Energy Tbk

- PT Indika Energy Tbk

- Golden Energy & Resources Ltd

- BlackGold Natural Resources

- PT Bhakti Energi Persada

- PT Bayan International

- PT Multi Harapan Utama

- Adani Indonesia(Adaro JV)

- Glencore(PT Balangan Coal)

- PT Petrosea Tbk

- PT Delta Dunia Makmur Tbk

- PT Resource Alam Indonesia Tbk

제7장 시장 기회 및 미래 전망

CSM 26.01.23The Indonesia Coal market is expected to grow from 0.89 Billion tons in 2025 to 0.95 Billion tons in 2026 and is forecast to reach 1.28 Billion tons by 2031 at 6.24% CAGR over 2026-2031.

The market's scale reflects Indonesia's position as the world's largest thermal-coal exporter and its entrenched role in the country's power mix. Ongoing PLN baseload demand, a nickel smelting boom, and a widening China-plus-One strategy collectively underpin demand growth, despite intensifying decarbonization rhetoric. Integrated miners continue to secure long-term offtake contracts that stabilize cash flows, while strategic reserve quality gives premium-grade producers additional pricing power. At the same time, regulatory reforms encouraging gasification and dimethyl-ether projects are opening new domestic outlets for low-rank coal. These parallel trends signal that the Indonesian coal market will remain resilient even as global capital costs for coal rise.

Indonesia Coal Market Trends and Insights

Prolonged PLN-led Baseload Demand for Low-CV Thermal Coal

PLN's limited headroom for rapid renewable build-out keeps coal in the core of Indonesia's power dispatch stack. Subsidized electricity tariffs require the utility to prioritize the lowest-cost generation fuel, and sub-bituminous coal remains the most cost-effective option delivered to Java-Bali load centers. Grid stability needs further reinforcement of dispatch preference because coal plants provide frequency and voltage services at a lower marginal cost than battery storage. Financially, PLN's budget allocation for coal procurement is predictable, reducing counterparties' credit risk and enabling miners to structure multi-year offtake agreements that lock in volumes. Consequently, the Indonesian coal market benefits from a structural demand floor that persists even as renewable penetration rises incrementally.

Surge in Coal-fired Captive Power for Nickel & EV-battery Smelters

Indonesia's 2020 nickel-ore export ban sparked capital inflows exceeding USD 15 billion into nickel processing complexes that require uninterrupted power for electric-furnace operations. Chinese-backed smelters routinely install on-site coal plants sized at 200-350 MW, providing a dedicated market immune to PLN's dispatch priorities. Captive arrangements typically involve dollar-linked power-purchase agreements, which grant miners higher realizations than utility deliveries. The business model thus secures premium margins while diversifying revenue streams. Demand expands further as downstream players move into precursor-cathode and battery materials, linking coal usage paradoxically to the low-carbon economy. These trends keep industrial offtake growth ahead of national average consumption through 2030.

Mandatory Domestic Market Obligation (DMO) Price Caps

Indonesia's DMO mechanism obliges miners to sell 25% of annual output at a government-set benchmark that trails export parity by up to USD 30 per ton during high-price cycles. This enforced discount compresses margin expansion opportunities and incentivizes firms to skew production toward higher-CV grades, which are earmarked exclusively for export. Financiers increasingly mark down reserve valuations that are exposed to DMO ceilings, complicating debt-raising for expansion. Although the policy shields PLN and industrial buyers from price spikes, it reduces investment appetite in new low-rank coal projects, thereby dampening incremental supply growth in the Indonesian coal market.

Other drivers and restraints analyzed in the detailed report include:

- China-plus-One Strategy Shifting Seaborne Demand to Indonesia

- Government "Gasification & DME" Incentives for Low-rank Coal

- Accelerated Coal-plant Retirement under JETP Funding

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sub-bituminous coal accounted for 46.85% of the Indonesian coal market in 2025, leveraging abundant East and South Kalimantan seams that deliver cost-competitive fuel to both domestic and export buyers. Despite this current dominance, bituminous and coking coal output is forecast to grow at an 7.86% CAGR between 2026 and 2031, lifting its share of the Indonesian coal market from 26.40% in 2025 to nearly one-third by 2031. Higher-CV grades unlock premiums of USD 15-20 per ton and align with emerging ultra-supercritical power-plant specifications in Asia. Metallurgical coal demand from regional blast furnaces further reinforces pricing power for producers with suitable reserve quality. Lignite remains oriented toward domestic gasification pilots and legacy low-efficiency boilers, implying flat growth. Production geography mirrors grade distribution; East Kalimantan operators, such as Kaltim Prima Coal, focus on premium grades, whereas Sumatra miners largely supply sub-bituminous coal to PLN. This quality segmentation enables portfolio balancing, as companies hedge against market swings by adjusting blend ratios between grades according to price differentials and logistics economics.

The Indonesia Coal Market Report is Segmented by Coal Grade (Lignite/Low-Rank, Sub-Bituminous, and Bituminous and Coking) and Application (Power Generation, Iron, Steel, and Metallurgy, and Cement and Other Applications). The Market Size and Forecasts are Provided in Terms of Production Volume (Tons).

List of Companies Covered in this Report:

- PT Bumi Resources Tbk

- PT Adaro Energy Indonesia Tbk

- PT Bayan Resources Tbk

- PT Bukit Asam Tbk

- PT Indo Tambangraya Megah Tbk

- PT Kaltim Prima Coal

- PT Arutmin Indonesia

- PT Kideco Jaya Agung

- PT Berau Coal Energy Tbk

- PT Indika Energy Tbk

- Golden Energy & Resources Ltd

- BlackGold Natural Resources

- PT Bhakti Energi Persada

- PT Bayan International

- PT Multi Harapan Utama

- Adani Indonesia (Adaro JV)

- Glencore (PT Balangan Coal)

- PT Petrosea Tbk

- PT Delta Dunia Makmur Tbk

- PT Resource Alam Indonesia Tbk

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Prolonged PLN-led baseload demand for low-CV thermal coal

- 4.2.2 Surge in coal-fired captive power for nickel & EV-battery smelters

- 4.2.3 China-plus-One strategy shifting seaborne demand to Indonesia

- 4.2.4 Government "Gasification & DME" incentives for low-rank coal

- 4.2.5 CCUS pilots unlocking high-CV export premiums

- 4.3 Market Restraints

- 4.3.1 Mandatory Domestic Market Obligation (DMO) price caps

- 4.3.2 Accelerated coal-plant retirement under JETP funding

- 4.3.3 Provincial moratoria on new mining permits (Kalimantan, Sumatra)

- 4.3.4 Rising ESG-driven trade financing costs for Indonesian coal

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Coal Grade

- 5.1.1 Lignite/Low-Rank

- 5.1.2 Sub-bituminous

- 5.1.3 Bituminous and Coking

- 5.2 By Application

- 5.2.1 Power Generation

- 5.2.2 Iron, Steel, and Metallurgy

- 5.2.3 Cement and Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 PT Bumi Resources Tbk

- 6.4.2 PT Adaro Energy Indonesia Tbk

- 6.4.3 PT Bayan Resources Tbk

- 6.4.4 PT Bukit Asam Tbk

- 6.4.5 PT Indo Tambangraya Megah Tbk

- 6.4.6 PT Kaltim Prima Coal

- 6.4.7 PT Arutmin Indonesia

- 6.4.8 PT Kideco Jaya Agung

- 6.4.9 PT Berau Coal Energy Tbk

- 6.4.10 PT Indika Energy Tbk

- 6.4.11 Golden Energy & Resources Ltd

- 6.4.12 BlackGold Natural Resources

- 6.4.13 PT Bhakti Energi Persada

- 6.4.14 PT Bayan International

- 6.4.15 PT Multi Harapan Utama

- 6.4.16 Adani Indonesia (Adaro JV)

- 6.4.17 Glencore (PT Balangan Coal)

- 6.4.18 PT Petrosea Tbk

- 6.4.19 PT Delta Dunia Makmur Tbk

- 6.4.20 PT Resource Alam Indonesia Tbk

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment