|

시장보고서

상품코드

1690800

자동차용 스마트 글래스 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Automotive Smart Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

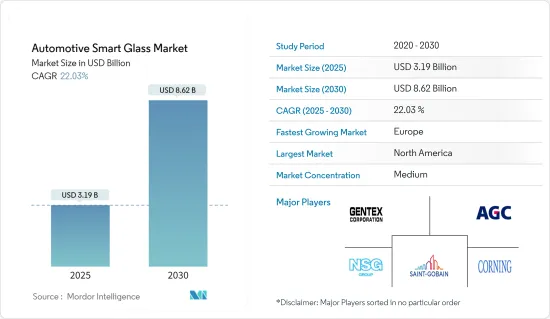

세계의 자동차용 스마트 글래스 시장 규모는 2025년 31억 9,000만 달러로 예상되며, 예측기간 중(2025-2030년) CAGR 22.03%로 확대되어, 2030년에는 86억 2,000만 달러에 달할 것으로 예측됩니다.

자동차용 스마트 글래스 시장은 기술의 진보와 첨단 차량 기능에 대한 소비자 수요가 증가함에 따라 현저한 성장을 이루고 있습니다. 전환 가능한 유리로도 알려진 스마트 글래스는 색조 조정, 투명도 조정, 열 감소 등의 기능을 제공하여 자동차의 편안함과 에너지 효율을 모두 향상시킵니다.

개발 업체는 스마트 글래스 솔루션의 성능과 신뢰성을 향상시키기 위해 신소재와 신기술을 지속적으로 개발하고 있습니다. 예를 들어, 일렉트로크로믹 기술과 SPD(Suspended Particle Device) 기술의 발전으로 스마트 글래스 제품의 응답 시간 단축, 에너지 효율 향상, 내구성 강화가 가능해졌습니다.

자동차 제조업체, 유리 제조업체, 기술 제공업체간의 제휴도 시장 확대의 원동력이 되고 있습니다. 유리 제조업체와 자동차 제조업체 양쪽의 전문 지식을 활용해, 고도의 기능성과 쾌적성을 요구하는 소비자의 요구에 응하는 것으로, 스마트 글래스 솔루션의 신형 차에 통합을 가능하게 하고 있습니다.

게다가 자동차 제조업체가 사용자 경험, 에너지 효율, 환경 지속가능성을 향상시키는 혁신적인 기능으로 자사 제품의 차별화를 도모하는 가운데 자동차용 스마트 글래스 시장은 지속적인 성장이 예상되고 있습니다. 이 진화는 자동차의 디자인과 기능의 미래를 형성하는 데 스마트 글래스 기술의 중요성이 증가하고 있음을 뒷받침합니다.

자동차용 스마트 글래스 시장 동향

자동차에서 부유입자장치(SPD)의 보급률 상승

승용차가 자동차용 스마트 글래스 시장의 우위를 견인하고 있다는 것은 업계의 여러 요인과 동향에서도 분명합니다. 2023년 세계 자동차 판매량은 약 6,520만 대로 급증했으며, 2022년 약 5,860만 대에서 크게 증가했습니다. 이러한 자동차 판매량 증가 추세는 스마트 글래스 솔루션을 포함한 첨단 자동차 기술에 대한 수요 증가를 반영합니다.

서스펜션 입자 장치(SPD)는 자동차 분야에서 중요한 혁신으로 부상하고 있습니다. 이 장치는 자동차의 유리와 플라스틱을 동적으로 조정 가능한 광 관리 시스템으로 바꾸어 운전 경험을 향상시킵니다. 이 기술은 특히 선루프, 창문, 바이저에 유익하며 사용자의 편안함과 자동차의 미관을 크게 향상시킵니다.

SPD 스마트 글라스는 효율성이 뛰어나며 PDLC 스마트 글라스는 평방미터당 3와트를 필요로 하지만 SPD 스마트 글라스는 평방미터당 1.5와트만 소비합니다. 이 낮은 에너지 소비는 연비의 향상과 환경 부하의 감소로 이어집니다. 예를 들어 Continental에 따르면 SPD 스마트 글래스는 이산화탄소 배출량을 킬로미터당 4그램 줄이고 항속 거리를 5.5% 늘릴 수 있다고 합니다.

게다가 SPD 스마트 글래스는 차량 내부의 열을 크게 줄여 더욱 편안하고 고급스러운 운전 경험에 기여합니다. Mercedes-Benz는 S클래스 세단이나 SL 로드스터 등의 하이엔드 모델에 SPD 유리를 채용해 차내 온도를 최대 10℃(화씨 18도) 저하시켰습니다. 이 감소는 탑승자의 쾌적성을 높일 뿐만 아니라 적외선이나 자외선에 의한 조기 노화로부터 내장재를 보호하는 효과도 있습니다.

스마트 글래스 기술의 진전과 대기업 자동차 제조업체에 의한 채용에 의해 승용차는 자동차용 스마트 글래스 시장에서 우위성을 유지할 것으로 예상됩니다. Continental과 같은 기업에 의한 R&D에 대한 지속적인 투자와 Mercedes-Benz와 같은 고급 브랜드의 실용적인 이점을 입증함으로써 스마트 글래스는 앞으로도 자동차 산업의 경쟁 환경에서 중요한 기능이 될 것입니다.

이러한 통합은 쾌적성과 효율성을 요구하는 소비자 수요에 응할 뿐만 아니라, 보다 광범위한 환경 및 지속가능성 목표에도 맞추어 시장을 견인하는 승용차의 역할을 더욱 견고하게 하고 있습니다.

유럽이 시장에서 가장 빠른 성장률이 예상

럭셔리 자동차에 대한 수요는 특히 유행에 따라 최근 몇 년동안이 지역 전체에서 급증하고 있습니다. 이 성장의 원동력이 되고 있는 것은 기존 기능으로부터, 선루프나 자동 착색 유리 등 고도의 편리성 기능으로 크게 전환되고 있는 것입니다. 이러한 추세는 자동차의 편안함과 고급감 향상에 대한 소비자의 선호도 증가와 일치합니다.

유럽의 주요 시장에서 승용차 판매량 증가, 고급차 판매량 증가, 자동차 선루프에 대한 선호도 증가 등 몇 가지 중요한 요인들이 시장 성장을 가속하고 있습니다. 독일의 자동차 부문은 수십년동안 유럽 산업의 근간을 지원하여 하이테크 자동차 생산과 혁신의 리더로 발전해 왔습니다. 특히 독일에서는 자동차의 연구개발비가 60% 이상 순증하고 있어 자동차용 스마트 글래스 수요를 견인하는 중요한 혁신 거점으로서의 역할을 강조하고 있습니다. 예를 들면

- 한국의 주요 화학기업인 LG Chem Ltd.은 독일 자동차 부품 공급업체인 Webasto SE에 전환 가능한 글레이징 필름을 공급하는 계약을 획득하여 자동차용 스마트 글래스 필름 시장에 진출했습니다.

- 2024년 4월에 발표된 계약에 따라 LG Chem은 자동차용 선루프 시스템 제조에 사용되는 고급 전환 가능한 유리 필름을 베바스트에 제공합니다. LG Chem 기술이 탑재된 이 시스템은 유럽 전역의 자동차 제조업체에 공급될 예정입니다.

Microsoft와 Volkswagen은 2022년 5월에 증강현실 안경을 자동차에 통합하기 위해 협력했습니다. 이 제휴는 미래의 모빌리티 컨셉의 중요한 요소인 증강현실을 보다 현실에 가깝게 하는 것을 목적으로 하고 있습니다. Volkswagen은 Microsoft와 협력하여 복합현실 안경 'HoloLens 2'를 이동차량에서 이용할 수 있게 하고 미래의 모빌리티를 소개합니다.

스마트 글라스를 탑재한 신차의 발매가 잇따르고, 제조업체 각사는 이 분야에서의 사업 확대를 도모하고 있습니다. Audi, BMW, Nissan, Range Rover 등의 유명한 자동차 제조업체는 각각 Q 시리즈, X 시리즈, Qashqai, Evoque 등 인기 모델에 선루프 옵션을 제공합니다. 이러한 추세는 자동차 산업, 특히 고급 차량 부문에서 첨단 편의성 기능의 중요성이 증가하고 있음을 뒷받침합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 스마트 글래스 기술을 탑재한 고급차·프리미엄차의 보급 확대

- 시장 성장 억제요인

- 높은 초기 비용이 시장 성장을 억제할 것으로 예측

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 기술 유형별

- 일렉트로크로믹

- 폴리머 분산액 디바이스(PDLC)

- 부유 입자 디바이스(SPD)

- 용도 유형별

- 후방 및 사이드 창문

- 선루프 유리

- 전방 및 후방 윈드실드

- 차량 유형별

- 승용차

- 상용차

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 브라질

- 남아프리카

- 기타 국가

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Corning Inc.

- Guardian Industries

- Saint-Gobain SA

- AGP Glass

- Hitachi Chemical Co. Ltd

- Research Frontiers Inc.

- Nippon Sheet Glass Co. Ltd

- AGC Inc.

- Gentex Corporation

- Gauzy Ltd.

제7장 시장 기회와 앞으로의 동향

- 차량 커넥티비티나 일렉트로닉스와의 통합

The Automotive Smart Glass Market size is estimated at USD 3.19 billion in 2025, and is expected to reach USD 8.62 billion by 2030, at a CAGR of 22.03% during the forecast period (2025-2030).

The Automotive Smart Glass Market is witnessing significant growth, driven by technological advancements and increasing consumer demand for advanced vehicle features. Smart glass, also known as switchable glass, offers functionalities such as tinting, transparency control, and heat reduction, enhancing both comfort and energy efficiency in automobiles.

Manufacturers are continually developing new materials and technologies to improve the performance and reliability of smart glass solutions. For instance, advancements in electrochromic and SPD (Suspended Particle Device) technologies have enabled faster response times, better energy efficiency, and enhanced durability of smart glass products.

Collaborations between automotive manufacturers, glass suppliers, and technology providers are also driving market expansion. Partnerships enable the integration of smart glass solutions into new vehicle models, leveraging the expertise of both glass manufacturers and automotive OEMs to meet consumer demands for advanced functionality and comfort.

Furthremore, the Automotive Smart Glass Market is poised for continued growth as automakers seek to differentiate their products with innovative features that enhance user experience, energy efficiency, and environmental sustainability. This evolution underscores the increasing importance of smart glass technologies in shaping the future of automotive design and functionality.

Automotive Smart Glass Market Trends

Rise in penetration of suspended particle devices (SPD) in vehicles

Passenger cars are driving the dominance of the Automotive Smart Glass Market, as evidenced by multiple factors and trends in the industry. In 2023, global car sales surged to approximately 65.2 million units, a significant increase from around 58.6 million in 2022. This upward trend in car sales reflects the growing demand for advanced automotive technologies, including smart glass solutions.

Suspended particle devices (SPD) are emerging as a critical innovation within the automotive sector. These devices enhance the driving experience by transforming car glass or plastic into a dynamically adjustable light-management system. This technology is particularly beneficial for sunroofs, windows, and visors, significantly improving user comfort and vehicle aesthetics.

SPD smart glasses stand out for their efficiency, consuming only 1.5 watts per square meter, compared to the 3 watts per square meter required by PDLC smart glass. This lower energy consumption translates into better fuel efficiency and reduced environmental impact. For example, Continental reports that SPD smart glass can reduce carbon dioxide emissions by 4 grams per kilometer and extend the driving range by 5.5%.

Moreover, SPD smart glass contributes to a more comfortable and luxurious driving experience by significantly reducing heat inside the vehicle. Mercedes-Benz has implemented SPD glass in high-end models like the S-class sedan and SL roadster, which has shown a reduction in interior temperature by up to 10 degrees Celsius (18 degrees Fahrenheit). This reduction not only enhances passenger comfort but also protects interior materials from premature aging caused by infrared and ultraviolet radiation.

Given the advancements in smart glass technology and its adoption by leading automotive manufacturers, passenger cars are positioned to continue their dominance in the Automotive Smart Glass Market. The ongoing investment in research and development by companies like Continental and the practical benefits demonstrated by luxury brands such as Mercedes-Benz ensure that smart glass will remain a key feature in the competitive landscape of the automotive industry.

This integration not only caters to consumer demand for comfort and efficiency but also aligns with broader environmental and sustainability goals, further solidifying the role of passenger cars in driving the market forward.

Europe is Expected to Grow at the Fastest Rate in the Market

The demand for luxury cars has surged across the region in recent years, particularly post-pandemic. This growth is driven by a significant shift from traditional features towards advanced convenience features, such as sunroofs and automatic tinted glass. This trend aligns with the increasing consumer preference for enhanced comfort and luxury in vehicles.

Several key factors are propelling the market's growth, including a rise in passenger car sales in major European markets, increasing sales of luxury cars, and a growing preference for vehicle sunroofs. The German automotive sector has been the backbone of the European industry for decades, evolving into a leader in high-tech automotive production and innovation. Notably, Germany has seen a net growth of over 60% in automotive R&D, highlighting its role as a critical innovation hub driving the demand for automotive smart glass. For instance,

- LG Chem Ltd., a leading South Korean chemical company, has entered the automotive smart glass film market by securing a contract to supply switchable glazing films to German auto parts supplier Webasto SE.

- Under the agreement announced in April 2024, LG Chem will provide its advanced switchable glass films to Webasto for use in manufacturing automotive sunroof systems. These systems, equipped with LG Chem's technology, will be supplied to car manufacturers across Europe.

Microsoft and Volkswagen collaborated to integrate augmented reality glasses into vehicles in May 2022. This partnership aims to bring augmented reality, a key element of future mobility concepts, closer to reality. Volkswagen has worked with Microsoft to make the HoloLens 2 mixed-reality glasses available in mobile vehicles, showcasing the future of mobility.

The market is further encouraged by several new car launches featuring smart glass, prompting manufacturers to expand their operations in this segment. Prominent car manufacturers like Audi, BMW, Nissan, and Range Rover are offering sunroof options in popular models such as the Q-series, X-series, Qashqai, and Evoque, respectively. This trend underscores the growing importance of advanced convenience features in the automotive industry, particularly within the luxury car segment.

Automotive Smart Glass Industry Overview

The automotive smart glass market is moderately consolidated, with a few major players such as Saint Gobin, AGC Inc., Nippon Sheet Glass Co. Ltd., Gentex Corporation, and Cornering Inc. having significant shares in the market due to their well-established and developed products among various automakers. The companies are focusing on innovative technologies and following strategies, like acquisition, licensing the technology, and partnership, to expand, sustain, and capture the potential demand for rapid adoption of technological trends in the automotive industry. For instance,

- In January 2023, Asahi India Glass partnered with Enormous Brands to create impactful brand films for AIS Windows, its doors and windows solutions brand. This move comes as the Indian system windows and doors market evolves, driven by changing lifestyles, urbanization, and smart city construction. AIS Windows caters to customer preferences with a range of aluminum and uPVC framing materials and diverse glass solutions, positioning itself to significantly impact the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption Of Luxury And Premium Vehicles Equipped With Smart Glass Technologies

- 4.2 Market Restraints

- 4.2.1 High Initial Cost Is Anticipated To Restrain The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Technology Type

- 5.1.1 Electrochromic

- 5.1.2 Polymer Dispersed Liquid Device (PDLC)

- 5.1.3 Suspended Particle Device (SPD)

- 5.2 By Application Type

- 5.2.1 Rear and Side Windows

- 5.2.2 Sunroof Glass

- 5.2.3 Front and Rear Windshield

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Corning Inc.

- 6.2.2 Guardian Industries

- 6.2.3 Saint-Gobain SA

- 6.2.4 AGP Glass

- 6.2.5 Hitachi Chemical Co. Ltd

- 6.2.6 Research Frontiers Inc.

- 6.2.7 Nippon Sheet Glass Co. Ltd

- 6.2.8 AGC Inc.

- 6.2.9 Gentex Corporation

- 6.2.10 Gauzy Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration with Vehicle Connectivity and Electronics