|

시장보고서

상품코드

1910938

유럽의 수축 및 스트레치 슬리브 라벨 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Europe Shrink And Stretch Sleeve Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

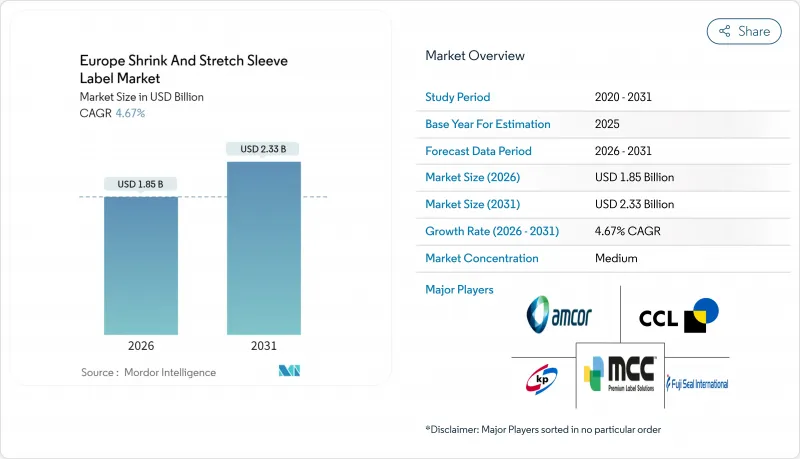

유럽의 수축 및 스트레치 슬리브 라벨 시장은 2025년 17억 7,000만 달러로 평가되었으며, 2026년 18억 5,000만 달러에서 2031년까지 23억 3,000만 달러에 이를 것으로 예측됩니다.

예측기간(2026-2031년)의 CAGR은 4.67%로 전망되고 있습니다.

고급 소비재의 지속적인 수요, 재활용 규제 강화, 폴리올레핀 가공 라인에 대한 급속한 투자는 이러한 안정적인 성장 궤도를 뒷받침합니다. 음료 브랜드는 시각적 효과를 손상시키지 않고 보증금 반환 제도에 대응하기 위해 슬리브 재설계를 진행하고 있으며, 퍼스널케어 기업은 프리미엄 가격 설정을 정당화하기 위해 360도 그래픽을 확대하고 있습니다. EU의 분별검사를 통과하는 소재를 요구하는 가공업자의 움직임에 의해 폴리에틸렌 소재의 대체가 가속화되고 있습니다. 석유화학산업의 통합이 진행되어 수지 비용이 상승하는 가운데 경쟁 격화에 의해 중견 컨버터는 생산 능력의 증강 또는 철수 사이에서 선택을 요구받고 있습니다. 인라인 디지털 인쇄 기술의 도입으로 비용 효율적인 소형 로트 생산이 가능해 브랜드 오너는 캠페인의 지역화 및 재고 리스크의 감소를 도모하고 있습니다.

유럽의 수축 및 스트레치 슬리브 라벨 시장의 동향 및 인사이트

매장에서의 호소력 향상에 대한 수요 증가

소매 진열 공간의 합리화가 진행되어 시각적 경쟁이 격화하고 있습니다. 브랜드 오너는 풀 바디 슬리브를 도입해 일반 용기를 360도 광고 수단으로 변모시키고 있습니다. 크래프트 음료 라인은 한정판 그래픽을 활용하여 단위 이익률을 향상시키는 반면 대중 소다 브랜드는 충전 라인의 속도를 방해하지 않고 계절별 디자인을 회전시키고 있습니다. 서유럽 소비자는 프리미엄 미관에 대해 반복 구매로 대응하는 경향이 계속되어 슬리브가 점착 라벨과의 가격 경쟁에서 우위성을 유지하는 데 도움이 되고 있습니다. 소매업체가 프라이빗 브랜드 품목을 확대하는 가운데 전국적인 브랜드는 상품화를 피하기 위해 차별화된 장식에 주력하고 있습니다. 유럽의 포장 산업 전체 시장 규모가 2024년 1,530억 유로에서 2029년에는 1,860억 유로로 확대될 것으로 예상되면서 고급 형태에 성장의 여지가 있음이 나타나고 있습니다.

변조 방지 보호의 필요성

EU의 의약품 안전 모니터링 제도로 인해 가시적인 안전 기능을 채택해야 하며, 수축 슬리브는 박리 시 눈에 보이는 손상을 남기기 때문에 매력적입니다. 건강기능식품 제조업체는 판매 시점에서 포장 인증을 위해 마이크로 텍스트와 색상 변경 잉크를 통합합니다. 2024년 이후 위조품에 대한 우려가 급격히 높아지면서 슈퍼마켓에서는 고급 주스에 대해 변조 방지 사양을 우선시하는 경향이 강해지고 있습니다. 정부 검사관은 또한 콜드체인 감사 시 부정 개봉을 즉시 확인할 수 있는 슬리브를 선호합니다. 전자상거래의 확대는 포장이 개선될 수 있는 새로운 접점을 낳으면서 수요를 더욱 높이고 있습니다.

EU 포장 및 포장폐기물 규정의 엄격화

PPWR(포장 및 포장폐기물 규정)은 재활용 설계 체크리스트를 도입하여 기존 슬리브 구조의 대부분을 1일간 무효화했습니다. 컨버터 기업은 2027년까지 라인 검사, 연구실 검사, 타사 인증 비용을 부담함과 동시에 해마다 증가하는 EPR(생산자 책임 재활용) 비용을 흡수해야 합니다. 브랜드 소유자는 본 규제를 가격 재협상의 기회로 이용하고 투자 피크 시에 공급업체를 압박하고 있습니다. 서유럽의 집행기관은 2024년에 이미 700만 유로의 포장 관련 벌금을 부과했으며 이는 단기적인 컴플라이언스 위험을 부각하고 있습니다. 자금 조달에 시달리는 중소기업은 업그레이드를 앞두고 시장에서 철수할 위험이 있습니다.

부문 분석

열수축 슬리브는 복잡한 병 모양과의 적합성과 음료 라인에서의 변조 방지 기능의 통합성이 실증되면서 2025년 유럽의 수축 및 스트레치 슬리브 라벨 시장에서 68.02%의 점유율을 차지했습니다. 이는 시간당 5만개의 병을 증기 터널로 처리하는 고생산량 탄산음료 및 물 브랜드에 있어서는 여전히 주요 선택사항입니다. 그러나, 규제 강화와 비용 상승이라는 억제요인에 의해 특히 용기 설계상 가열이 불필요한 마찰 부착이 가능한 경우, 브랜드 오너는 스트레치 슬리브의 시험적 도입을 촉진하고 있습니다. 유럽의 수축 및 스트레치 슬리브 라벨 시장에서는 박리용이성이 컴플라이언스상의 차별화 요인이 되기 때문에 스트레치 형태가 2031년까지 연평균 복합 성장률(CAGR) 5.61%로 확대할 것으로 예측되고 있습니다.

위험 회피를 위해 컨버터는 현재 수지 수축률과 스트레치 롤스톡을 전환할 수 있는 듀얼 어플라이어를 운영하여 고객 사양에 대응하고 있습니다. 이 새로운 균형은 약간의 오븐 조정으로 두 기술을 모두 수용할 수 있는 LDPE 기판에도 혜택을 제공합니다. 퍼스널케어 부문에서 조기에 스트레치를 도입한 기업은 수축식 대체품에 비해 4%의 재료 절약을 실현해 수지 가격 상승의 상쇄에 기여하고 있습니다. 천공 기술에 대한 투자는 소비 후 박리를 단순화하여 열수축 라인의 전망을 더욱 강화합니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 매장에서의 호소력 향상에 대한 수요 증가

- 변조 방지 대책의 필요성

- 360° 브랜딩 표면으로의 전환

- 재생 가능한 폴리올레핀 수축 필름의 도입

- 인라인 디지털 인쇄 통합

- 초박형 슬리브를 가능하게 하는 리튬 금속 첨가 잉크

- 억제요인

- EU 포장 및 포장폐기물 규정의 엄격화

- 버진 PET-G와 PVC 수지의 가격 상승

- 다층 필름의 재활용 제한

- EU 보증금 반환 시스템에서 슬리브 제거의 병목

- 산업 밸류체인 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 공급자의 협상력

- 구매자 및 소비자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 주요 기계 제조업체

제5장 시장 규모 및 성장 예측

- 유형별

- 수축 슬리브

- 스트레치 슬리브

- 기타 유형

- 재료별

- 폴리염화비닐(PVC)

- 글리콜 변성 폴리에틸렌테레프탈레이트(PET-G)

- 폴리에틸렌(PE)

- 폴리프로필렌(PP)

- 기타

- 용도별

- 음료

- 식품

- 퍼스널케어

- 기타

- 국가별

- 독일

- 프랑스

- 영국

- 이탈리아

- 러시아

- 폴란드

- 네덜란드

- 스페인

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Amcor PLC

- CCL Industries Inc.

- Klockner Pentaplast GmbH and Co. KG

- Fuji Seal International Inc.

- Huhtamaki Oyj

- Smurfit WestRock PLC

- Mondi PLC

- Multi-Color Corporation

- Sleevezone Ltd.

- Folienprint Risse Etiketten GmbH

- Oerlemans Plastics BV

- Decomatic SA

- Polifilm Extrusion GmbH

- Maca Srl

- Sleever International Company

- Derprosa Films SLU

- DOW Chemical Company

- UPM Raflatac Oy

- Constantia Flexibles Group GmbH

- Avery Dennison Corporation

- Label-Aire Inc.

제7장 시장 기회 및 미래 전망

CSM 26.02.04The Europe shrink and stretch sleeve label market was valued at USD 1.77 billion in 2025 and estimated to grow from USD 1.85 billion in 2026 to reach USD 2.33 billion by 2031, at a CAGR of 4.67% during the forecast period (2026-2031).

Sustained demand from premium consumer goods, tightening recyclability rules, and rapid investments in polyolefin converting lines underpin this steady trajectory. Beverage brands are re-engineering sleeves to survive deposit-return schemes without sacrificing visual impact, while personal care players scale 360-degree graphics to justify premium shelf pricing. Material substitution toward polyethylene accelerates as converters seek substrates that pass EU sorting trials. Competitive intensity rises as petrochemical consolidation inflates resin costs, forcing mid-tier converters to choose between capacity upgrades and exit. Inline digital printing unlocks cost-effective short runs that help brand owners localize campaigns and reduce inventory risk.

Europe Shrink And Stretch Sleeve Label Market Trends and Insights

Demand to Increase On-Shelf Appeal

Retail shelf space rationalization intensifies visual competition, prompting brand owners to adopt full-body sleeves that convert an ordinary container into a 360-degree billboard. Craft beverage lines exploit limited-edition graphics to boost unit margins, while mass-market soda brands rotate seasonal artwork without disrupting fill-line speeds. Western European consumers continue to reward premium aesthetics with repeat purchases, helping sleeves defend pricing versus pressure-sensitive labels. As retailers expand private-label ranges, national brands double down on differentiated decoration to avoid commoditization. The broader European packaging sector's value climb from EUR 153 billion in 2024 to EUR 186 billion by 2029 signals headroom for upscale formats.

Need for Tamper-Evident Protection

EU pharmacovigilance rules mandate overt security features, making shrink sleeves attractive because removal leaves visible damage. Nutraceutical producers embed micro-text and color-shift inks to authenticate packages at point of sale. Counterfeit concern has risen sharply since 2024, pushing supermarkets to favor tamper-proof formats even for premium juices. Government inspectors also prefer sleeves that signal breach instantly during cold-chain audits. Growing e-commerce adds another touch-point where packages can be compromised, further raising demand.

Stricter EU Plastics-Packaging Waste Directives

PPWR introduces design-for-recycling checklists that invalidate many legacy sleeve constructions overnight. Converters must finance line trials, laboratory tests, and third-party certifications before 2027 while absorbing EPR fees that escalate annually. Brand owners use the legislation to renegotiate pricing, squeezing suppliers during investment peaks. Western European enforcement agencies already issued EUR 7 million in packaging fines during 2024, underscoring near-term compliance risk.Cash-strapped SMEs defer upgrades, risking market exit.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward 360° Branding Surfaces

- Adoption of Recyclable Polyolefin Shrink Films

- Limited Recycling Streams for Multilayer Films

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heat shrink sleeves represented 68.02% of the Europe shrink and stretch sleeve label market size in 2025 thanks to proven conformity around intricate bottle contours and integrated tamper-evidence on beverage lines. They remain the go-to choice for high-volume soda and water brands that run containers through steam tunnels at 50,000 bottles per hour. Yet regulatory and cost headwinds encourage brand owners to trial stretch sleeves, especially where container designs allow friction application without heat. The Europe shrink and stretch sleeve label market expects stretch formats to post a 5.61% CAGR through 2031 as removal ease becomes a compliance differentiator.

Converters hedging risk now operate dual-capability applicators, shifting between resin shrink ratios and stretch roll stocks to match customer specifications. The new equilibrium also benefits low-density polyethylene substrates that accommodate both technologies with minor oven adjustments. Early stretch adopters in personal care report 4% material savings versus shrink alternatives, helping offset resin inflation. Investment in perforation technology further future-proofs heat shrink lines by simplifying post-consumer detachment.

The Europe Shrink and Stretch Sleeve Label Market Report is Segmented by Type (Heat Shrink Sleeve, Stretch Sleeve, and More), Material (PVC, PET-G, PE, PP, and More), Application (Beverage, Food, Personal Care, and More), and Geography (Germany, France, United Kingdom, Italy, Russia, Poland, Netherlands, Spain, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor PLC

- CCL Industries Inc.

- Klockner Pentaplast GmbH and Co. KG

- Fuji Seal International Inc.

- Huhtamaki Oyj

- Smurfit WestRock PLC

- Mondi PLC

- Multi-Color Corporation

- Sleevezone Ltd.

- Folienprint Risse Etiketten GmbH

- Oerlemans Plastics B.V.

- Decomatic S.A.

- Polifilm Extrusion GmbH

- Maca S.r.l.

- Sleever International Company

- Derprosa Films S.L.U.

- DOW Chemical Company

- UPM Raflatac Oy

- Constantia Flexibles Group GmbH

- Avery Dennison Corporation

- Label-Aire Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand to increase on-shelf appeal

- 4.2.2 Need for tamper-evident protection

- 4.2.3 Shift toward 360° branding surfaces

- 4.2.4 Adoption of recyclable polyolefin shrink films

- 4.2.5 Inline digital printing integration

- 4.2.6 Lithium-metal additive inks enabling ultra-thin sleeves

- 4.3 Market Restraints

- 4.3.1 Stricter EU plastics-packaging waste directives

- 4.3.2 Rising prices of virgin PET-G and PVC resins

- 4.3.3 Limited recycling streams for multi-layer films

- 4.3.4 Sleeve removal bottlenecks in EU deposit-return schemes

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers/Consumers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Major Machine Suppliers

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Heat Shrink Sleeve

- 5.1.2 Stretch Sleeve

- 5.1.3 Other Types

- 5.2 By Material

- 5.2.1 Polyvinyl Chloride (PVC)

- 5.2.2 Polyethylene Terephthalate Glycol-modified (PET-G)

- 5.2.3 Polyethylene (PE)

- 5.2.4 Polypropylene (PP)

- 5.2.5 Other Materials

- 5.3 By Application

- 5.3.1 Beverage

- 5.3.2 Food

- 5.3.3 Personal Care

- 5.3.4 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Russia

- 5.4.6 Poland

- 5.4.7 Netherlands

- 5.4.8 Spain

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 CCL Industries Inc.

- 6.4.3 Klockner Pentaplast GmbH and Co. KG

- 6.4.4 Fuji Seal International Inc.

- 6.4.5 Huhtamaki Oyj

- 6.4.6 Smurfit WestRock PLC

- 6.4.7 Mondi PLC

- 6.4.8 Multi-Color Corporation

- 6.4.9 Sleevezone Ltd.

- 6.4.10 Folienprint Risse Etiketten GmbH

- 6.4.11 Oerlemans Plastics B.V.

- 6.4.12 Decomatic S.A.

- 6.4.13 Polifilm Extrusion GmbH

- 6.4.14 Maca S.r.l.

- 6.4.15 Sleever International Company

- 6.4.16 Derprosa Films S.L.U.

- 6.4.17 DOW Chemical Company

- 6.4.18 UPM Raflatac Oy

- 6.4.19 Constantia Flexibles Group GmbH

- 6.4.20 Avery Dennison Corporation

- 6.4.21 Label-Aire Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment