|

시장보고서

상품코드

1911285

중동 및 북아프리카의 핀테크 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)MENA Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

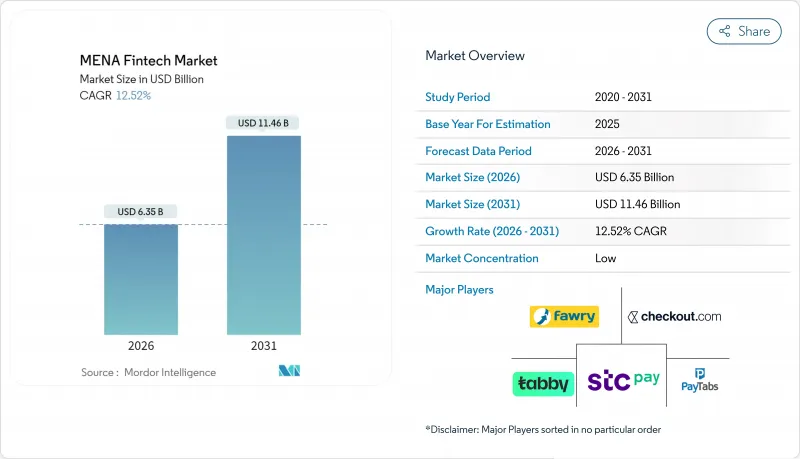

중동 및 북아프리카의 핀테크 시장 규모는 2026년 63억 5,000만 달러에 달할 것으로 예측됩니다.

이는 2025년 56억 5,000만 달러에서 성장한 수치이며, 2031년에는 114억 6,000만 달러에 이를 것으로 전망됩니다. 2026-2031년에 걸친 연평균 복합 성장률(CAGR)은 12.52%로 예측되고 있습니다.

현금 없는 시책의 의무화 확대, 스마트폰의 보급 확대, 벤처 캐피탈의 유입 증가가 디지털 금융 서비스의 대상 고객 기반을 확대하고 있습니다. GCC와 이집트의 중앙 은행 디지털 통화(CBDC)의 시험적 운영은 결제 인프라를 현대화하고 사우디아라비아, 아랍에미리트(UAE) 및 요르단의 규제 샌드 박스는 제품 투입주기를 단축하고 있습니다. 이와 동시에 전자상거래, 임시 계약 경제, 송금 경로가 임베디드 금융의 이용 사례를 촉진하고 있습니다. 산업 관계자는 새로운 수익원을 창출하고 분산된 포지션을 통합하는 플랫폼의 다양화와 크로스보더 파트너십을 통해 대응하고 있습니다.

중동 및 북아프리카의 핀테크 시장의 동향 및 인사이트

정부의 현금 사용 폐지 및 금융포섭 시책이 핀테크 수요를 가속화

사우디아라비아는 2030년까지 거래의 70%를 현금 없는 거래로 하는 목표를 설정했으며 이집트는 2025년까지 성인의 50%가 은행 계좌를 보유하도록 하고, 아랍에미리트는 2024년에 라이선싱 제도를 간소화하는 목표를 제시했습니다. 이러한 목표는 도입의 명확한 지표를 제공하고 민간 사업자의 진입 장벽을 낮춥니다. 요르단의 샌드박스는 규제 위험을 더욱 줄여 스타트업이 법규 대응 비용을 줄이면서 사업 확대를 뒷받침합니다. 정부가 급여 지불과 복지 급여의 디지털화를 추진하는 가운데 소비자의 전자월렛에 대한 친숙함이 높아지고 고객 획득 비용이 저하되고 있습니다. 시책 추진은 소매업체에게 비접촉 결제의 도입을 촉구해 결제 네트워크를 확대하고 있습니다. 이러한 시책이 함께 선순환을 만들어 내고 중동 및 북아프리카의 핀테크 시장을 확대하고 있습니다.

모바일 인터넷 보급률의 급증이 모바일 퍼스트 금융 액세스를 실현

GCC에서는 스마트폰 보급률이 80%를 넘어 모바일이 은행 거래의 기본 채널이 되었습니다. 아랍에미리트(UAE)에서는 이미 디지털 월렛이 POS 지출의 18%를 차지하였고 2027년까지 33%에 이를 전망입니다. 이집트와 모로코는 통신 사업자 기반 대리점 모델을 통해 지점 인프라를 우회하여 사업 비용을 절감하면서 서비스 범위를 확대하고 있습니다. Z세대 사용자는 디지털 월렛을 통한 지역 전자상거래 지출의 23%를 차지하였으며 지속적인 결제 습관을 확립하고 있습니다. 북아프리카에서 4G/5G의 도달범위 확대에 의해 원격으로 신원 확인(KYC) 절차가 가능해져 새로운 고객층의 개발이 진행되고 있습니다. 이처럼 모바일 퍼스트 모델은 모든 소비자층에서 급속한 점유율 확대를 촉진하고 있습니다.

관할 구역별 규제 세분화로 컴플라이언스 부담 증가

19가지의 서로 다른 라이선싱 시스템을 통해 핀테크 기업은 시장별로 별도의 법인을 설립해야 하며, 통일된 프레임워크에 비해 간접비가 15-25% 증가합니다. 자본 규제와 데이터 현지화의 제도 변동은 여권 제도의 적용을 방해하고, 지역 규모에서의 사업 확대를 늦추고 있습니다. 선도적인 기존 기업은 비용을 흡수할 수 있지만 신생 기업은 자원 부족에 직면하고 이는 혁신의 다양성을 제한합니다. 상호 승인의 부족은 크로스보더 오픈 API 연계를 방해하여 통합 데드 존을 생성합니다. 투자자들은 위험을 평가 금액으로 산정하고 여러 국가에 배포하는 해결 방법을 통해 통합을 촉구합니다.

부문 분석

디지털 결제는 2025년 중동 및 북아프리카의 핀테크 시장에서 54.12%의 점유율을 차지하였으며, 거의 보편적인 스마트폰 월렛과 적극적인 가맹점 획득 인센티브가 기반이 되고 있습니다. 이 하위 부문에서는 QR코드 결제나 토큰화 월렛 결제 등의 새로운 결제 채널이 추가되어 고객 정착률이 더욱 강화되었습니다. 디지털 대출은 규모가 작지만 실시간 얼터너티브 데이터 스코어링의 강점을 배경으로 17.74%의 연평균 복합 성장률(CAGR)로 성장하고 있습니다. Fawry사가 2025년에 달성한 10억 EGP의 대출 급증은 결제에서 신용 공여로의 인접 지역 진출을 보여줍니다.

로보 어드바이저와 인슈어테크는 API 퍼스트 유통으로 확대되고, STC Bank와 같은 네오뱅크는 월렛 기반을 풀서비스 계좌로 전환하고 있습니다. 규제 샌드박스는 파라메트릭 보험 및 사용량 기반 보험을 가능하게 하여 실험적인 도입을 촉진합니다. 결제 브랜드는 동일한 앱 내에 크레딧, 투자, 보험 탭을 추가함으로써 크로스셀 시너지 효과가 탄생하여 사용자의 평생 가치가 확대되고 있습니다. 이 다양화의 추진은 중동 및 북아프리카의 핀테크 시장 전체에서 플랫폼 수렴이 가속화되고 있음을 보여줍니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 정부에 의한 현금 결제 폐지와 금융 포섭의 의무화

- 모바일 인터넷의 보급률 급증

- 벤처 캐피탈 자금 조달 및 규제 샌드박스의 진전

- CBDC 파일럿에 의한 크로스보더 결제 기반의 실현

- 전자상거래와 임시 계약 플랫폼으로부터의 임베디드 금융 수요

- 즉각 결제 인프라를 통한 대체 대출 데이터의 활용

- 억제요인

- 관할 구역 간의 규제 분단

- 현금 중심의 습관이 북아프리카에서 고객 획득 비용(CAC)을 높임

- 아랍어 대응 AI/ML 리스크 스코어링 데이터세트의 부족

- 레거시 핵심 은행 IT 시스템의 병목

- 가치 및 공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급자의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 서비스 제안별

- 디지털 결제

- 디지털 대출 및 자금 조달

- 디지털 투자

- 인슈어테크

- 네오뱅킹

- 최종 사용자별

- 소매

- 기업

- 사용자 인터페이스별

- 모바일 애플리케이션

- 웹 및 브라우저

- POS 및 IoT 디바이스

- 지역별

- GCC

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 바레인

- 쿠웨이트

- 오만

- 북아프리카

- 이집트

- 모로코

- 알제리

- 튀니지

- 레반트 지역

- 요르단

- 레바논

- GCC

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

제7장 시장 기회 및 미래 전망

CSM 26.02.04MENA fintech market size in 2026 is estimated at USD 6.35 billion, growing from 2025 value of USD 5.65 billion with 2031 projections showing USD 11.46 billion, growing at 12.52% CAGR over 2026-2031.

A surge in cash-lite policy mandates, broad smartphone availability, and growing venture-capital inflows are expanding the addressable base for digital financial services. Central-bank digital-currency (CBDC) pilots in the GCC and Egypt are modernizing payment rails, while regulatory sandboxes in Saudi Arabia, the UAE, and Jordan shorten product launch cycles. At the same time, e-commerce, gig-economy, and remittance corridors are fuelling embedded-finance use cases. Industry participants respond through platform diversification and cross-border partnerships that create new revenue streams and consolidate fragmented positions.

MENA Fintech Market Trends and Insights

Government Cash-Lite & Financial-Inclusion Mandates Accelerate Fintech Demand

Saudi Arabia targets 70% cashless transactions by 2030, Egypt aims to bank 50% of adults by 2025, and the UAE streamlined licensing in 2024. These targets provide clear metrics for adoption and reduce go-to-market friction for private players. Sandboxes in Jordan further cut regulatory risk, helping startups scale without prohibitive compliance spend. As governments digitize payroll and welfare transfers, consumer familiarity with e-wallets rises, lowering acquisition costs. The policy push also incentivizes retailers to deploy contactless acceptance, enlarging acceptance networks. Collectively, mandates create a virtuous circle that widens the MENA fintech market.

Mobile & Internet Penetration Surge Enables Mobile-First Financial Access

Smartphone penetration tops 80% in GCC states, turning mobiles into the default banking channel. The UAE already sees digital wallets covering 18% of POS spend, on track for 33% by 2027. Egypt and Morocco extend reach through telco-based agent models, bypassing branch infrastructure and shrinking operating costs. Gen Z users account for 23% of regional e-commerce spend via digital wallets, establishing lasting payment habits. Growing 4G/5G coverage in rural North Africa enables remote KYC onboarding, unlocking new customer pools. The mobile-first model thus propels rapid share gains across consumer cohorts.

Regulatory Fragmentation Across Jurisdictions Increases Compliance Burden

Nineteen different licensing regimes require fintechs to form market-specific entities, adding 15-25% to overheads versus unified frameworks. Disparate capital and data-localization rules hinder passporting and delay regional scaling. Larger incumbents absorb the cost but startups face resource strain, limiting innovation diversity. Lack of mutual recognition also hampers cross-border open-API linkage, creating integration dead-zones. Investors price the risk into valuations, nudging consolidation as a workaround for multi-country reach.

Other drivers and restraints analyzed in the detailed report include:

- VC Funding & Sandbox Momentum Fuel Startup Formation

- CBDC Pilots Enabling Cross-Border Rails Create Common API Infrastructure

- Cash-Centric Habits Inflate Customer-Acquisition Costs in North Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments controlled 54.12% of MENA fintech market share in 2025, underpinned by near-ubiquitous smartphone wallets and aggressive merchant-acquiring incentives. The sub-segment added new rails such as QR and tokenized wallet checkout, further cementing stickiness. Digital lending, though smaller, is growing at an 17.74% CAGR on the strength of real-time alternative-data scoring. Fawry's EGP 1 billion disbursement surge in 2025 illustrates payments-to-credit adjacency.

Robo-advisory and insurtech expand via API-first distribution, while neobanks like STC Bank convert wallet bases into full-service accounts. Regulatory sandboxes allow parametric and usage-based policies, fostering experimentation. Cross-sell synergies emerge as payments brands add credit, investment, and insurance tabs within the same app, stretching user lifetime value. The diversification push points to escalating platform convergence across the MENA fintech market.

The MENA Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (GCC, North Africa, Levant). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt cash-lite and financial-inclusion mandates

- 4.2.2 Mobile & internet penetration surge

- 4.2.3 VC funding & sandbox momentum

- 4.2.4 CBDC pilots enabling cross-border rails

- 4.2.5 Embedded-finance demand from e-commerce and gig platforms

- 4.2.6 Instant-payment rails unlocking alternative lending data

- 4.3 Market Restraints

- 4.3.1 Regulatory fragmentation across jurisdictions

- 4.3.2 Cash-centric habits inflating CAC in North Africa

- 4.3.3 Scarcity of Arabic AI/ML risk-scoring datasets

- 4.3.4 Legacy core-bank IT bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 GCC

- 5.4.1.1 Saudi Arabia

- 5.4.1.2 United Arab Emirates

- 5.4.1.3 Qatar

- 5.4.1.4 Bahrain

- 5.4.1.5 Kuwait

- 5.4.1.6 Oman

- 5.4.2 North Africa

- 5.4.2.1 Egypt

- 5.4.2.2 Morocco

- 5.4.2.3 Algeria

- 5.4.2.4 Tunisia

- 5.4.3 Levant

- 5.4.3.1 Jordan

- 5.4.3.2 Lebanon

- 5.4.1 GCC

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Fawry

- 6.4.2 PayTabs

- 6.4.3 Checkout.com

- 6.4.4 Tabby

- 6.4.5 Tamara

- 6.4.6 STC Pay

- 6.4.7 Paymob

- 6.4.8 MNT-Halan

- 6.4.9 Geidea

- 6.4.10 Network International

- 6.4.11 BenefitPay

- 6.4.12 Careem Pay

- 6.4.13 Lean Technologies

- 6.4.14 HyperPay

- 6.4.15 YAP

- 6.4.16 Telda

- 6.4.17 NymCard

- 6.4.18 Sarwa

- 6.4.19 OPay

7 Market Opportunities & Future Outlook

- 7.1 Cross-border GCC-North Africa remittance corridors via tokenized wallets

- 7.2 Green Islamic fintech products aligned with ESG & Sharia mandates