|

시장보고서

상품코드

1911298

경구 경점막 약물 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Oral Transmucosal Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

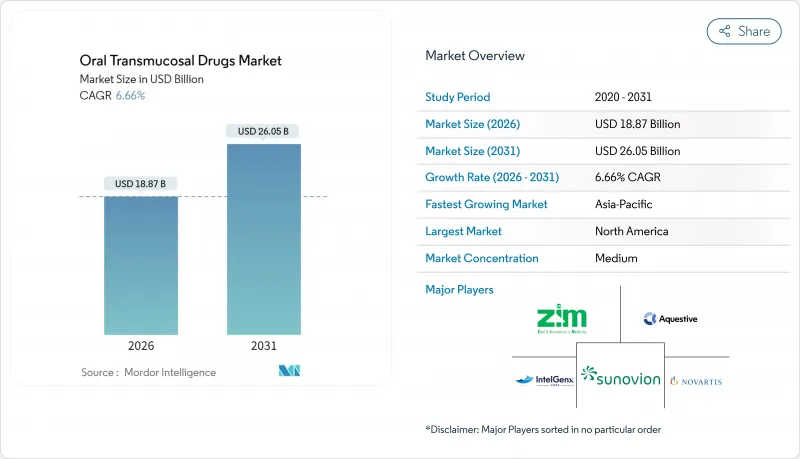

경구 경점막 약물 시장은 2025년에 176억 9,000만 달러로 평가되었으며, 2026년 188억 7,000만 달러에서 2031년까지 260억 5,000만 달러에 이를 것으로 예측됩니다.

예측 기간(2026-2031년)의 CAGR은 6.66%로 예상됩니다.

지속적인 성장은 오피오이드 의존성 치료에 확립된 사용, 발작 시 응급 처치에서의 급속한 보급, 통증 치료 및 환각 요법에서의 응용 확대에 기인합니다. 설하 및 버칼 점막 필름 기술의 지속적인 진보에 의해 작용 발현 시간이 단축되어 생체이용률이 향상되는 한편, 바늘을 사용하지 않고 삼킬 필요가 없는 투여법의 선택성이 높아짐으로써, 소아 및 노인 환자에서의 도입이 촉진되고 있습니다. 미국, 유럽 및 중국의 규제 당국은 혁신적인 제형의 심사를 가속화하고 있으며, 고가치 중추 신경계(CNS) 적응증을 목표로 하는 파이프라인 개발을 촉진하고 있습니다. 제약 대기업이 특수 필름 플랫폼의 라이선싱을 실시해, 제1세대 부프레노르핀 제품의 지적 재산권 절벽(클리프)이 제네릭 의약품이나 차세대 설계로의 길을 열어 갈수록, 경쟁의 격화가 진행되고 있습니다.

세계의 경구 경점막 약물 시장의 동향 및 인사이트

중추 신경계 질환 및 통증 질환에 대한 부담 증가

오피오이드 사용 장애, 간질, 돌발성 암성 통증의 유병률 상승이 속효성 점막 투과 제제에 대한 수요를 뒷받침하고 있습니다. 2025년 FDA가 비오피오이드계 구강내 통증 치료제 수제트리진을 승인한 것은 보다 안전한 통증 치료 옵션에 대한 규제 당국의 지지를 보여줍니다. 소아 경련 발작군에 대한 요구는 리버반트의 소아용 승인에 의해 속효성 벤조디아제핀계 응급 치료제의 적용 연령층이 확대되었습니다. 삼킴장애가 있는 고령화 인구 증가로 물 없이 용해되는 필름 및 스프레이제 대한 처방 경향이 더욱 강해지고 있습니다. 역학적 요인과 편리성이 결합되어 경구 경점막 약물 시장의 장기적인 성장 궤도를 확고하게 하고 있습니다.

2023년 이후 R&D, 파이프라인 및 승인 급증

2023년 이후의 획기적 의약품 및 희소질환용 의약품의 지정 확대에 의해 심사 사이클이 단축되었습니다. 예를 들면 편두통 치료제 RizaFilm과 고농도 제품의 승인을 가능하게 한 부프레노르핀 투여 가이드라인의 재검토를 들 수 있습니다. 아타이 생명과학사의 DMT 구강내 필름 등 환각제 후보가 제2상 시험에 진행되어, 신규 중추 신경계 적응증이 후기 개발 단계로 이행하는 징후를 볼 수 있습니다. 신속한 승인은 투자를 촉진하고 시장의 성장 곡선을 밀어 올립니다.

약물 부하량과 미각 마스킹의 과제

필름 제형은 용해성을 손상시키지 않고 수밀리그램을 초과하는 활성 성분을 배합하는 것은 드물며, 이 형태는 고활성 분자로 제한됩니다. 부프레노르핀과 같은 쓴맛이 있는 원료는 개발 기간을 연장하고 비용을 증가시키는 고급 미각 마스킹 기술을 필요로 합니다. 제형 개발자는 침투 증진제의 평가를 추진하고 있지만, 새로운 첨가제는 모두 독성학적 장벽에 직면하여 승인 지연과 단기적인 시장 성장의 억제요인이 될 수 있습니다.

부문 분석

설하정은 확립된 처방 습관과 광범위한 보험 적용을 배경으로 2025년 경구 경점막 약물 시장 규모의 41.98%를 차지했습니다. 그러나 소아용 제제가 서서히 용해되어 투여 빈도를 줄이는 지속적인 필름 기술 혁신으로 박칼정은 2031년까지 연평균 복합 성장률(CAGR) 7.12%로 성장할 것으로 예상됩니다. 구강 용해 필름은 PharmFilm 기술을 통해 편두통과 정신 질환 치료제 파이프라인에서 난용성 분자의 생체이용률을 향상시킵니다. 액제 및 스프레이제는 아나필락시스나 신생아 경련에 대한 응급 처치 분야를 개척하고 약제용 과자는 만성 질환 치료에서 복약 컴플라이언스를 개선합니다. 40°C 환경에서의 보존을 가능하게 하는 온도 안정성 정제는 열대 지역에서의 접근 확대에 기여합니다.

정제가 주류인 반면, 제조업체는 점막 부착성 폴리머를 통합하여 체류 시간의 연장과 침투성의 향상을 도모하고 있습니다. 필름제는 2분 이내에 효과가 나타나는 신속한 완화를 제공하여 돌발성 통증 발작에 대한 전략적 선택이 되고 있습니다. 신흥 시장에서 수요 증가에 따라 콜드체인 부담을 경감하는 상온 안정성 블리스터 포장에 대한 투자가 촉진되고 있습니다. 이러한 제품 다양성이 함께 경구 경점막 약물 시장 전체의 성장세를 유지하고 있습니다.

설하 경로는 풍부한 혈관 분포에 의한 전신 흡수 속도로 2025년 경구 경점막 약물 시장의 35.22%를 차지했습니다. 버칼 투여는 신경안정제나 진통제 등 장시간 접촉을 필요로 하는 치료에 대응하고, 2031년까지 연률 7.70%로 성장할 전망입니다. 구강 및 잇몸 경로는 국소적인 치주통이나 표적 호르몬 요법 등 특수 용도에 머물러 있습니다.

담즙산염 유도체와 같은 침투 촉진제는 종래에는 주사를 필요로 한 펩티드의 버칼 흡수를 개선합니다. 뺨에 고정된 점막 접착 패치는 8시간 이상 동안 혈장 농도를 유지하여 추가 투여 빈도를 줄입니다. 생체이용률 데이터가 축적됨에 따라 약물 목록의 적용 범위가 확대되고 경구 경점막 약물 시장에서 버칼 투여의 성장 경로가 강화되고 있습니다.

지역별 분석

북미는 2025년 매출액의 42.10%를 차지했으며 획기적인 치료법 경로와 광범위한 보험 적용이 성장에 기여했습니다. FDA가 2024년에 부프레노르핀의 투여 상한을 철폐함으로써 오피오이드 사용 장애 치료 프로그램에서 지속성을 높이는 고농도 필름제의 도입이 촉진되고 있습니다. 미국의 주요 간질센터와 학계 및 산업계의 제휴는 소아 임상시험의 피험자 모집을 가속화하여, 동지역의 주도적 지위를 확고히 하고 있습니다. 아시아태평양은 2031년까지 8.52%라는 가장 높은 CAGR로 추이할 전망입니다. 중국 국가약품감독관리국은 신속심사제도를 실시하여 2024년에는 통증치료 및 종양학 분야의 경점막제제를 포함한 60가지 유형 이상의 혁신 의약품을 승인했습니다. 수탁 제조업체인 WuXi STA에 의한 펩티드 및 고효율 필름 생산에 대한 투자는 이 지역의 규모의 우위성을 뒷받침하고 있습니다. ASEAN의 규제 조화 노력은 국경을 넘은 시장 진입을 촉진하여 대상 환자층을 확대하고 있습니다. 유럽은 소아용 제제를 장려하는 유럽 의약품청의 소아용 판매 승인을 배경으로 꾸준한 성장을 유지하고 있습니다. Buprenorphin Neuraxpharm의 최근 승인은 성숙한 적응증 영역에서 지속적인 혁신을 보여줍니다. 경구 정제보다 우수한 복약 컴플라이언스를 나타내는 필름제에 대해 각국의 의료보험제도에 의한 환급이 확대되고 있습니다. 중동, 아프리카 및 남미에서는 온도 안정성 필름제가 콜드체인 부족을 보완하여 판매량을 높이고 있습니다. 오피오이드 중독 치료용 경구 경점막 날록손 필름을 공급하는 인도적 지원 프로그램은 조기 시장 기반을 구축하고 경제 상황이 개선되면 미래 성장 여지를 제공합니다. 이러한 지역적 다양화가 결합되어 경구 경점막 약물 시장의 지속적인 확대를 뒷받침합니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 중추 신경계 질환 및 통증 질환의 부담 증가

- 2023년 이후 연구개발 파이프라인과 규제 승인의 급증

- 고령자 및 소아 환자의 바늘이 필요 없고 경구 섭취가 불필요한 제형 선호 증가

- 지역 응급 의료 프로토콜에서의 경점막 구급 요법의 급속한 보급

- 마이크로 도즈형 사이키델릭 및 칸나비노이드 제제 필름이 제II상 임상시험 파이프라인에 참가

- 콜드체인 유통망이 부족한 시장을 지원하는 온도 안정성 필름 제제

- 억제요인

- 한정적인 약물 부하량과 미각 마스킹의 과제

- 제1세대 오피오이드 의존증 치료 필름의 특허 절벽

- 비강 분말 자동 주사기와의 경쟁

- 고효율 제형의 소아용 투여량의 균일성에 관한 FDA의 지속적인 우려

- 가치 및 공급망 분석

- 규제 상황

- 기술 전망(필름, 점막 부착성 폴리머, 침투 촉진제)

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측(금액)

- 제품 유형별

- 설하정

- 박칼정

- 구강 용해 필름

- 버칼 필름

- 액제 및 스프레이제

- 약제용 과자류(로젠지, 롤리팝, 껌)

- 기타(패치, 젤)

- 투여 경로별

- 설하 점막

- 버칼 점막

- 구강 점막

- 잇몸 점막

- 적응증별

- 오피오이드 의존증

- 간질 발작 클러스터와 간질

- 통증 및 종양 통증

- 메스꺼움과 구토

- 발기부전

- 기타

- 유통 채널별

- 병원 약국

- 일반 약국

- 온라인 약국 및 전문 약국

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Esteive Therapeutics

- IntelGenx Corp.

- ZIM Laboratories

- CL Pharm Co., Ltd.

- Novartis AG

- Sunovion Pharmaceuticals

- Pfizer Inc.

- GW Pharmaceuticals(Jazz)

- Seoul Pharmaceuticals

- Shilpa Therapeutics

- Indivior PLC

- Cure Pharmaceutical

- Catalent Inc.

- Takeda Pharmaceutical

- Dr. Reddy's Laboratories

- Glenmark Pharmaceuticals

- AdhexPharma

- Astellas Pharma

- BioDelivery Sciences(Collegium)

- Johnson & Johnson(Janssen)

제7장 시장 기회 및 미래 전망

CSM 26.01.23The oral transmucosal drugs market was valued at USD 17.69 billion in 2025 and estimated to grow from USD 18.87 billion in 2026 to reach USD 26.05 billion by 2031, at a CAGR of 6.66% during the forecast period (2026-2031).

Sustained growth comes from established use in opioid dependence treatment, rapid adoption in seizure rescue, and expanding applications in pain and psychedelic therapies. Continuous advances in sublingual and buccal film technologies shorten onset times and improve bioavailability, while the preference for needle-free, swallow-free dosing boosts uptake among pediatric and geriatric patients. Regulatory agencies in the United States, Europe, and China have accelerated reviews for innovative formulations, encouraging pipelines that target high-value CNS indications. Competitive intensity has risen as large pharmaceutical companies license specialty film platforms and as intellectual-property cliffs for first-generation buprenorphine products open the door to generics and next-generation designs.

Global Oral Transmucosal Drugs Market Trends and Insights

Growing burden of CNS and pain disorders

Rising prevalence of opioid use disorder, epilepsy, and breakthrough cancer pain sustains demand for fast-acting transmucosal options. The FDA approval of buccal non-opioid pain drug suzetrigine in 2025 signals regulator support for safer pain alternatives . Pediatric seizure-cluster needs were addressed when Libervant received pediatric approval, broadening age coverage for rapid benzodiazepine rescue. Aging populations with dysphagia further tilt prescribing toward films and sprays that dissolve without water. Together, epidemiology and usability reinforce the long-run trajectory of the oral transmucosal drugs market.

Post-2023 surge in R&D pipelines and approvals

Expanded breakthrough and orphan-drug designations after 2023 shortened review cycles. Examples include RizaFilm for migraine and the re-scoped buprenorphine dosing guidance that cleared higher-strength products. Psychedelic candidates such as atai Life Sciences' DMT buccal film advanced to Phase 2, pointing to novel CNS indications entering late-stage development. Faster approvals encourage investment, lifting the market growth curve.

Limited drug-load and taste-masking challenges

Films rarely exceed a few milligrams of active ingredient without compromising dissolution, restricting the modality to potent molecules. Bitter APIs such as buprenorphine demand sophisticated flavor-blocking that lengthens development and raises cost . Formulators are evaluating permeation enhancers, yet every new excipient faces toxicology hurdles that may delay approvals and weigh on near-term market growth.

Other drivers and restraints analyzed in the detailed report include:

- Patient preference for needle-free, swallow-free dosing

- Rapid adoption of transmucosal rescue in EMS protocols

- Patent cliffs for first-generation opioid-dependence films

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sublingual tablets held 41.98% share of oral transmucosal drugs market size in 2025 on the strength of established prescribing habits and broad reimbursement. Continuous film innovation, however, allows buccal tablets to register a 7.12% CAGR to 2031, propelled by pediatric formulations that dissolve slowly and reduce dosing frequency. Oro-dispersible films benefit from PharmFilm technology, giving poorly soluble molecules higher bioavailability in migraine and psychiatric pipelines. Liquids and sprays carve out rescue niches for anaphylaxis and neonatal seizures, while medicated confectionaries improve compliance in chronic settings. Temperature-stable tablet formats targeting 40°C ambient storage broaden access in tropical regions.

Although tablets dominate, manufacturers integrate mucoadhesive polymers to extend retention time and enhance permeation. Films deliver rapid relief-often within two minutes-making them strategic for breakthrough pain episodes. Elevated demand in emerging markets encourages investment in ambient-stable blister packs that reduce cold-chain burden. Collectively, product diversity maintains growth momentum across the oral transmucosal drugs market.

The sublingual pathway commanded 35.22% oral transmucosal drugs market share in 2025 thanks to rich vascularization that speeds systemic uptake. Buccal delivery grows 7.70% annually through 2031 by catering to therapies that require longer contact time, such as mood stabilizers and analgesics. Lingual and gingival routes remain specialized, addressing localized periodontal pain or targeted hormone therapy.

Permeation enhancers such as bile-salt derivatives improve buccal absorption of peptides that previously required injection. Mucoadhesive patches anchored to the cheek maintain plasma levels over eight hours, reducing rescue-dose frequency. As bioavailability data build, formularies are widening coverage, reinforcing the upward path for buccal applications in the oral transmucosal drugs market.

The Oral Transmucosal Drugs Market Report Segments the Industry Into by Product Type (Sublingual Tablets, Buccal Tablets, and More), by Route of Administration (Sublingual Mucosa, Buccal Mucosa, and More), by Indication (Opioid Dependence, and More), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.10% revenue in 2025, benefiting from breakthrough-therapy pathways and wide insurance coverage. The FDA's 2024 update removing buprenorphine dose ceilings has encouraged higher-strength films that enhance retention in opioid-use-disorder programs. Academic-industry collaborations at leading U.S. epilepsy centers speed recruitment for pediatric trials, consolidating the region's leadership.Asia-Pacific registers the fastest 8.52% CAGR through 2031. China's National Medical Products Administration implemented accelerated reviews that cleared more than 60 innovative drugs in 2024, including transmucosal formulations for pain and oncology. Investment in peptide and high-potency-film production by contract manufacturer WuXi STA underscores the region's scale advantage. Regulatory harmonization initiatives in ASEAN facilitate cross-border market entry, expanding total addressable patients.Europe maintains steady growth on the back of the European Medicines Agency Pediatric-Use Marketing Authorization, which encourages child-friendly formulations. Recent approval of Buprenorphine Neuraxpharm illustrates ongoing innovation within mature indications . National health systems increasingly reimburse films that demonstrate superior adherence over oral tablets.Middle East & Africa and South America deliver incremental volume where temperature-stable films bypass cold-chain gaps. Humanitarian programs that stock oral transmucosal naloxone films for opioid toxicity build early market presence, offering future upside once economic conditions improve. Combined, geographic diversification supports sustained expansion of the oral transmucosal drugs market.

- Aquestive Therapeutics

- Intelgenx

- ZIM Laboratories

- C.L. Pharm Co., Ltd.

- Novartis

- Sunovion Pharmaceuticals

- Pfizer

- GW Pharmaceuticals (Jazz)

- Seoul Pharmaceuticals

- Shilpa Therapeutics

- Indivior

- Cure Pharmaceutical

- Catalent

- Takeda Pharmaceuticals

- Dr. Reddy's Laboratories

- Glenmark Pharmaceuticals

- AdhexPharma

- Astellas Pharma

- BioDelivery Sciences (Collegium)

- Johnson & Johnson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Target CNS And Pain Disorders

- 4.2.2 Surge In R&D Pipelines & Regulatory Approvals Post-2023

- 4.2.3 Preference For Needle-Free, Swallow-Free Dosage Forms Among Geriatrics & Paediatrics

- 4.2.4 Rapid Take-Up Of Transmucosal Rescue Therapies In Community Ems Protocols

- 4.2.5 Micro-Dose Psychedelic & Cannabinoid Films Entering Phase-Ii Pipelines

- 4.2.6 Temperature-Stable Film Formulations Supporting Low-Cold-Chain Markets

- 4.3 Market Restraints

- 4.3.1 Limited Drug-Load & Taste-Masking Challenges

- 4.3.2 Patent Cliffs For First-Generation Opioid Dependence Films

- 4.3.3 Emerging Competition From Intranasal Powder Auto-Injectors

- 4.3.4 Persistent Fda Concerns On Paediatric Dosing Uniformity For High-Potency Apis

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Films, muco-adhesive polymers, permeation enhancers)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD million)

- 5.1 By Product Type

- 5.1.1 Sublingual Tablets

- 5.1.2 Buccal Tablets

- 5.1.3 Oro-dispersible Films

- 5.1.4 Buccal Films

- 5.1.5 Liquids & Sprays

- 5.1.6 Medicated Confectionaries (Lozenges, Lollipops, Gums)

- 5.1.7 Others (Patches, Gels)

- 5.2 By Route of Administration

- 5.2.1 Sublingual Mucosa

- 5.2.2 Buccal Mucosa

- 5.2.3 Lingual

- 5.2.4 Gingival

- 5.3 By Indication

- 5.3.1 Opioid Dependence

- 5.3.2 Seizure Clusters & Epilepsy

- 5.3.3 Pain / Oncology Pain

- 5.3.4 Nausea & Vomiting

- 5.3.5 Erectile Dysfunction

- 5.3.6 Others

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online & Specialty Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Aquestive Therapeutics

- 6.3.2 IntelGenx Corp.

- 6.3.3 ZIM Laboratories

- 6.3.4 C.L. Pharm Co., Ltd.

- 6.3.5 Novartis AG

- 6.3.6 Sunovion Pharmaceuticals

- 6.3.7 Pfizer Inc.

- 6.3.8 GW Pharmaceuticals (Jazz)

- 6.3.9 Seoul Pharmaceuticals

- 6.3.10 Shilpa Therapeutics

- 6.3.11 Indivior PLC

- 6.3.12 Cure Pharmaceutical

- 6.3.13 Catalent Inc.

- 6.3.14 Takeda Pharmaceutical

- 6.3.15 Dr. Reddy's Laboratories

- 6.3.16 Glenmark Pharmaceuticals

- 6.3.17 AdhexPharma

- 6.3.18 Astellas Pharma

- 6.3.19 BioDelivery Sciences (Collegium)

- 6.3.20 Johnson & Johnson (Janssen)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment