|

시장보고서

상품코드

1690926

동남아시아, 중동 및 아프리카의 소형 무기 및 탄약 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Southeast Asia, Middle-East And Africa Small Arms And Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

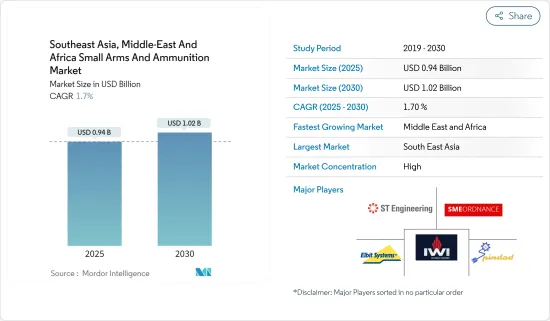

동남아시아, 중동 및 아프리카의 소형 무기 및 탄약 시장 규모는 2025년에 9억 4,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 1.7%로 성장할 전망이며, 2030년에는 10억 2,000만 달러에 달할 것으로 예측됩니다.

이웃 국가들과의 긴장이 커지면서 동남아시아와 중동의 여러 나라에서는 소형 무기 및 탄약 조달을 강화하고 있습니다. 군사 및 법 집행 요원의 훈련이 일관되게 수요의 원동력임에 변함이 없지만, 국경 분쟁, 과격파의 위협, 내란 등의 요인이 이러한 무기의 필요성을 증폭시키고 있습니다.

최근 정부의 뒷받침을 받아 UAE, 사우디아라비아, 동남아시아 일부 국가들의 무기 및 탄약 제조업체가 시장에서의 존재감을 꾸준히 높이고 있습니다. 터키, UAE, 사우디아라비아에서 급성장하는 국방 부문은 기존 및 신규 시장 참가자 쌍방에 새로운 과제를 제기하는 태세입니다.

탄약의 국내 생산을 강화하는 움직임이 선명해지고 있으며, 비용 효율적인 노동력을 요구하는 외국 기업에 있어서, 이들 국가들은 매력적인 진출처가 되고 있습니다. 그러나 이 동향은 현지 방위 기업에 과제를 제기할 가능성이 있는 한편, 선진무기를 도입하는 신규 참가 기업에 문을 열기도 합니다. 그러나 기술적 제약이 향후 수년간 수요 전망을 약화시킬 수 있음은 주목할 만합니다.

동남아시아, 중동 및 아프리카의 소형 무기 및 탄약 시장 동향

예측 기간 동안 군사 부문이 시장을 독점할 전망

군사 부문은 현재 시장에서 압도적인 지위를 차지하고 있으며 예측 기간 동안에도 이 리드를 유지할 전망입니다. 세계의 군사 행동이 증가함에 따라, 군는 전투 수요를 충족시키기 위해 더 강력한 소형 무기에 점점 더 눈길을 돌리고 있습니다. 군용 장갑의 진보에 따라 주기적인 충격을 주고 적에게 더 큰 데미지를 주는 총기가 중시되도록 되었습니다. 많은 나라가 최신 소화기를 적극적으로 조달하고 무기고를 정비하고 있습니다. 예를 들어 2022년 4월 인도 방위 엑스포에서 인도네시아 경찰은 Kale Kalip(터키)에서 터키 제반자동 권총 KMR762를 확보했습니다. 동시에 인도네시아 육군은 KNG-C5 소총을 주문했습니다. 또한 2022년 3월 인도네시아는 반자동 저격총 KMR 762 소총을 무기고에 추가했습니다. 2023년 9월 방글라데시 경찰은 산탄 총탄 35,000발, 공포탄 6,000발, 최루 가스탄 3.22,000발, 저격 소총 30정, 기타 폭동 진압에 필수적인 물품을 포함한 대폭적인 조달을 실시해 재고를 증강했습니다.

중동 및 동남아시아의 무기 및 탄약 제조 부문에서는 현지화 노력이 급증하고 있습니다. 이 지역 정부는 군사 조달 전략에서 현지 생산과 재투자 오프셋을 의무화하는 경향이 커지고 있습니다. 2022년 11월 말레이시아의 Maruss Sdn Bhd와 인도네시아의 PT Pindad는 무기 제조에 관한 매우 중요한 각서에 서명했습니다. 이 제휴는 다양한 구경의 탄약 공급과 함께 소형 무기 및 그 부품의 수탁 제조에 착수하는 것을 목적으로 합니다. 이러한 노력으로 군사 분야의 성장이 촉진됩니다.

사우디아라비아는 예측 기간 동안 현저한 성장을 이룰 전망

예측 기간 동안 사우디아라비아는 방위 능력을 강화하고 차세대 무기로 전진하기 위한 정부의 많은 투자를 통해 상당한 시장 성장이 예상됩니다. 2023년 사우디아라비아는 세계 5위의 국방 지출국이 되어 755억 달러의 예산이 할당되어 현저한 성장을 보였습니다.

현재의 지정학적 상황을 감안할 때, 사우디아라비아의 이웃 국가들(북쪽은 이라크, 페르시아 만을 사이에 두고 이란, 남쪽은 예멘 등)은 큰 위협이 되고 있으며, 탄약 구입을 우선해야 합니다. 준군사부대를 포함한 50만 명을 넘는 군사력을 가진 사우디 요원은 주로 FN F2000(5.56x45밀리), 부시마스터 M4유형(5.56x45밀리), FN파이브 세븐(5.7x28밀리), ORSIS T-5000(7.62x51mm NATO) 등의 총기에 의존하고 있습니다.

사우디아라비아는 많은 군사비를 지출하고 있음에도 불구하고 현재 현지 방위기업을 지원하고 있는 것은 불과 2%에 불과하며 세계 유수의 무기 및 탄약 수입국이 되고 있습니다. 이 의존도를 낮추기 위해 정부는 비전 2030의 일환으로 2030년까지 국산 군비비를 50%로 끌어올리는 것을 목표로 하고 있습니다. 비전 2030의 중요한 이니셔티브는 사우디아라비아 군뿐만 아니라 중동 및 북아프리카의 기타 국가들을 위해 다양한 탄약을 생산하는 국영 기업인 사우디아라비아 군 산업(SAMI)의 설립입니다.

동남아시아, 중동 및 아프리카의 소형 무기 및 탄약 산업 개요

동남아시아, 중동 및 아프리카의 소형 무기 및 탄약 시장을 독점하고 있는 것은 주요 기업입니다. Southeast Asia and the Middle East and Africa. These include Israel Weapon Industries (IWI) Ltd, Elbit Systems Ltd, PT Pindad, SME Ordnance Sdn Bhd Company (SMEO), Singapore Technologies Engineering Ltd. 등입니다.

최근 정부의 뒷받침을 받아 UAE, 사우디아라비아, 동남아시아 및 아프리카 일부 국가의 국내 무기 및 탄약 제조업체가 시장에서의 존재감을 꾸준히 높이고 있습니다. 터키, UAE, 사우디아라비아의 방위 부문 상승은 기존 및 신흥 시장 진출 기업에 대한 과제입니다. 주목해야할 것은 이 지역의 기업들이 최첨단 기술을 제공할 뿐만 아니라 NATO군이 사용하는 장비의 수준에 필적하는 것입니다. 국제 OEM과 경쟁하면서 이러한 기업들은 선진적인 제품으로 인기를 끌고 투자자와 주문의 수를 늘리고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 무기

- 권총

- 라이플

- 머신건

- 샷건

- 탄약

- 치사성

- 비치사성

- 무기

- 최종 사용자별

- 민간

- 법 집행 기관

- 군사

- 지역별

- 동남아시아

- 싱가포르

- 말레이시아

- 인도네시아

- 기타 동남아시아

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 터키

- 이스라엘

- 바레인

- 쿠웨이트

- 카타르

- 오만

- 기타 중동 및 아프리카

- 동남아시아

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Singapore Technologies Engineering Ltd

- PT Pindad

- ME Ordnance Sdn Bhd Company(smeo)

- Elbit Systems Ltd

- Saudi Arabian Military Industries(SAMI)

- Oman Munition Production Company(OMPC)

- Jorammo

- Kenya Ordnance Factories Corporation

- Defence Industries Corporation of Nigeria

- Israel Weapon Industries(IWI) Ltd

제7장 시장 기회 및 향후 동향

AJY 25.04.09The Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market size is estimated at USD 0.94 billion in 2025, and is expected to reach USD 1.02 billion by 2030, at a CAGR of 1.7% during the forecast period (2025-2030).

Amid escalating tensions with neighboring nations, several countries in Southeast Asia and the Middle East are ramping up their acquisitions of small arms and ammunition. While military and law enforcement personnel training remains a consistent driver of demand, factors like border disputes, militant threats, and civil unrest amplify the need for these armaments.

Over recent years, bolstered by government backing, local arms and ammunition manufacturers in the UAE, Saudi Arabia, and select Southeast Asian nations have steadily expanded their market presence. The burgeoning defense sectors in Turkey, the UAE, and Saudi Arabia are poised to pose fresh challenges for both incumbent and new market entrants.

With a clear push toward bolstering domestic ammunition production, these nations are becoming attractive destinations for foreign companies eyeing cost-effective labor. However, while this trend may pose challenges for local defense firms, it also opens the door for new players to introduce advanced weaponry. Yet, it's worth noting that technological constraints could temper the demand outlook in the coming years.

Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market Trends

The Military Segment is Expected to Dominate the Market During the Forecast Period

The military segment currently holds a dominant position in the market and is poised to maintain this lead through the forecast period. As global military engagements rise, armed forces are increasingly turning to more potent small arms to meet combat demands. With advancements in military armor, there is a heightened emphasis on firearms that deliver cyclical impacts, inflicting greater damage on adversaries. Many nations are actively procuring and advancing their arsenals with the latest small arms. For example, at the April 2022 Indian Defense Expo, the Indonesian Police secured Turkish Semi-automatic KMR762 pistols from Kale Kalip (Turkey). Concurrently, the Indonesian Army placed orders for KNG-C5 rifles. Additionally, in March 2022, Indonesia added a semi-automatic sniper KMR 762 rifle to its arsenal. In September 2023, the Bangladeshi Police bolstered its inventory with a significant procurement, including 35 lakh shotgun bullets, 6 lakh blank cartridges, 3.22 lakh tear gas shells, 30 sniper rifles, and other essential riot control items.

The arms and ammunition manufacturing sector in the Middle East and Southeast Asia witnessed a surge in localization efforts. Governments in these regions are increasingly mandating local production and re-investment offsets in their military procurement strategies. In November 2022, Malaysia's Maruss Sdn Bhd and Indonesia's PT Pindad inked a pivotal memorandum of understanding (MoU) for arms manufacturing. This collaboration aims to delve into contract manufacturing for small arms and their components alongside ammunition supplies of varying calibers. Such initiatives are set to propel the growth of the military segment.

Saudi Arabia is Anticipated to Witness Significant Growth During the Forecast Period

During the forecast period, Saudi Arabia is poised for significant market growth, driven by the government's substantial investments in bolstering its defense capabilities and advancing to the next generation of weaponry. In 2023, the nation ranked as the world's fifth-largest defense spender, allocating a budget of USD 75.5 billion, marking a notable increase.

Given the current geopolitical landscape, Saudi Arabia's neighboring nations-such as Iraq to the north, Iran across the Persian Gulf, and Yemen to the south-present considerable threats, underscoring the nation's need to prioritize ammunition purchases. With a military force exceeding half a million, including paramilitary units, Saudi personnel predominantly rely on firearms like the FN F2000 (5.56x45 mm), Bushmaster M4-Type (5.56x45 mm), FN Five-seven (5.7x28 mm), and ORSIS T-5000 (7.62x51 mm NATO).

Despite its significant military spending, only 2% currently supports local defense firms, making Saudi Arabia the world's leading arms and ammunition importer. To reduce this reliance, as part of Vision 2030, the government aims to elevate local military equipment spending to 50% by 2030. A key initiative under Vision 2030 is the establishment of Saudi Arabian Military Industries (SAMI), a state-owned entity producing a range of ammunition not just for Saudi forces but also for other nations in the Middle East and North Africa.

Southeast Asia, Middle-East And Africa Small Arms And Ammunition Industry Overview

Key players dominate the small arms and ammunition market in Southeast Asia and the Middle East and Africa. These include Israel Weapon Industries (IWI) Ltd, Elbit Systems Ltd, PT Pindad, SME Ordnance Sdn Bhd Company (SMEO), and Singapore Technologies Engineering Ltd.

In recent years, bolstered by government backing, domestic arms and ammunition manufacturers in the UAE, Saudi Arabia, and select nations in Southeast Asia and Africa have steadily expanded their market presence. The rising defense sectors in Turkey, the UAE, and Saudi Arabia are set to challenge both established and emerging market entrants. Notably, these regional players not only offer cutting-edge technology but also match the caliber of equipment used by NATO forces. As they vie with international OEMs, these firms are gaining traction for their advanced offerings and attracting a growing number of investors and orders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness-Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Arms

- 5.1.1.1 Handguns

- 5.1.1.2 Rifles

- 5.1.1.3 Machine Guns

- 5.1.1.4 Shotguns

- 5.1.2 Ammunition

- 5.1.2.1 Lethal

- 5.1.2.2 Non-lethal

- 5.1.1 Arms

- 5.2 End User

- 5.2.1 Civil

- 5.2.2 Law Enforcement

- 5.2.3 Military

- 5.3 Geography

- 5.3.1 Southeast Asia

- 5.3.1.1 Singapore

- 5.3.1.2 Malaysia

- 5.3.1.3 Indonesia

- 5.3.1.4 Rest of Southeast Asia

- 5.3.2 Middle East and Africa

- 5.3.2.1 Saudi Arabia

- 5.3.2.2 United Arab Emirates

- 5.3.2.3 Turkey

- 5.3.2.4 Israel

- 5.3.2.5 Bahrain

- 5.3.2.6 Kuwait

- 5.3.2.7 Qatar

- 5.3.2.8 Oman

- 5.3.2.9 Rest of Middle East and Africa

- 5.3.1 Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Singapore Technologies Engineering Ltd

- 6.2.2 PT Pindad

- 6.2.3 ME Ordnance Sdn Bhd Company (smeo)

- 6.2.4 Elbit Systems Ltd

- 6.2.5 Saudi Arabian Military Industries (SAMI)

- 6.2.6 Oman Munition Production Company (OMPC)

- 6.2.7 Jorammo

- 6.2.8 Kenya Ordnance Factories Corporation

- 6.2.9 Defence Industries Corporation of Nigeria

- 6.2.10 Israel Weapon Industries (IWI) Ltd