|

시장보고서

상품코드

1690938

인도네시아의 방위 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Indonesia Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

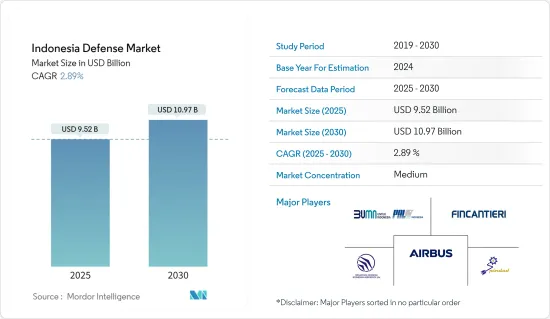

인도네시아의 방위 시장 규모는 2025년에 95억 2,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 2.89%로 성장할 전망이며, 2030년에는 109억 7,000만 달러에 달할 것으로 예측됩니다.

인도네시아에서는 첨단 군사 장비에 대한 수요가 증가함에 따라 방위 산업의 강화에 주력하고 있습니다. 정부 전략은 장기적인 자급 자족에 대한 길을 열기 위해 선도적인 OEM 기술 이전을 중시하면서 무기 및 방위 시스템을 조달하고 있습니다. 인도네시아 국내에서는 육상 차량, 무기, 미사일, UAV의 전문 기술을 연마하고 있습니다. 향후 몇 년간은 비행 제어 장치, 탄두, 제트 엔진 등 보다 복잡한 시스템에 진출할 계획입니다.

MEF 개념 하에서 인도네시아는 능력 기반 방위 접근법을 채택하고 군비를 강화하고 있습니다. 이 전략은 위협의 평가 및 재정 능력에 맞는 방위 자산의 획득을 수반합니다. 주목할 점은 인도네시아와 다른 ASEAN 국가들이 남중국해에서 중국과의 영토 분쟁에 휘말려 있기 때문에 인도네시아 정부가 군사 투자를 활발하게 하고 있다는 것입니다.

게다가 인도네시아는 진화하는 전략 상황을 잘 극복하기 위해 노후화된 방위 시스템의 대폭적인 검토를 생각하고 있습니다. 이러한 현대화의 추진이 시장의 성장을 뒷받침하고 있으며 예측 기간 동안 플러스 궤도를 그릴 것으로 보입니다.

인도네시아의 방위 시장 동향

가장 높은 성장이 예상되는 탄약 부문

인도네시아의 지정학적 긴장 증가와 방위 예산 증가가 시장 수요를 촉진하고 있습니다. 2023년 인도네시아의 방위비는 94억 8,000만 달러에 달했습니다. 현 정부는 최소 요구 전력(MEF) 목표 달성의 과제에 직면하고 있습니다. 이 지연은 주로 예산의 제약과 정치적 불확실성에 기인합니다. 2022년 6월 인도네시아는 2019년부터 2024년까지 MEF 목표를 70%로 수정했습니다. 군사적 야망과 지역 안보 우려에 힘입어 인도네시아는 방위 지출을 강화했습니다. 이 나라의 군는 육해 공군 합쳐 약 40만 4,500명으로 다양한 총기를 장비하고 있습니다. 이러한 수요 증가는 최근 조달 활동에도 나타납니다. 예를 들어, 2023년 7월 인도네시아 경찰은 330만 달러에 해당하는 1,857정의 폭동용 총을 확보했습니다.

인도네시아는 근대화의 요구에 현지 기업을 우선시하는 자세로 외국 공급업체에 대한 의존도를 낮추는 것을 목표로 하고 있습니다. 또한 국내 방위 산업을 강화하기 위해 기술 이전과 오프셋을 중시할 계획입니다. 2023년 8월에 인도네시아가 방위 부문 강화를 위해 사우디아라비아에 지원을 요청했을 때 이 방향에서의 현저한 움직임이 관찰되었습니다. 이 협의에서 핀바드와 같은 국영 무기 제조업체는 그 능력을 선보이며 방위 생산에서 자급 자족에 대한 추진을 시사했습니다. 이와 같이 방위력 강화를 위한 투자 확대 및 선진탄약의 조달 증가가 이 부문의 성장을 견인하고 있습니다.

예측기간 동안 항공기가 시장을 독점

인도네시아 청와대는 2040년대 중반까지 1,250억 달러를 투자할 야심찬 군사 현대화 계획을 발표했습니다. 이 계획은 인도네시아가 외국의 대출에 계속 의존하고 있음을 강조합니다. 구체적으로는 방위 장비에 790억 달러, 25년간의 유지비에 325억 달러, 나머지 134억 달러를 대외 대출의 이자 지급에 충당한다고 합니다.

재무부의 문서에 따르면 2022년에는 방위 예산의 약 32%가 현대화 프로젝트에 충당되어 조달과 유지가 대상이 됩니다. 특필해야할 것은 고정익 항공기의 증강입니다. 2024년 1월 인도네시아에서는 라팔 18기의 최종 납품이 시작되었습니다. 이는 2022년 9월과 2023년 8월에 각각 6대와 18대의 라팔이 납품된 이후로 인도네시아가 2022년 2월에 주문한 42대의 항공기 주문을 충족하게 됩니다. 2024년 2월 인도네시아는 국영 항공우주 회사 PT Dirgantara Indonesia(PTDI)에 3,500만 달러의 CN235-220 수송기를 주문했습니다. 널리 평가되는 C-130 허큘리스보다 가볍고 컴팩트하게 설계된 CN-235는 특히 C-130과 같은 대형 운송 플랫폼을 사용하는 것이 비효율적일 때 보완적인 자산이 됩니다. 이러한 조달 노력은 방위 예산의 더 큰 비율을 필요로 하는 태세를 갖추고 있으며, 현 정부에 과제를 야기할 수 있습니다.

인도네시아의 방위 시장 산업 개요

인도네시아의 방위 시장은 반 고정적입니다. 과거 인도네시아는 주요 군사 장비 조달을 외국 방위 계약자에 의존했습니다. 그러나 최근의 동향에서 인도네시아는 국영기업 개발에 주력하고 있습니다. PT PAL Indonesia, PT Pindad, PT Dirgantara Indonesia, Airbus SE, FINCANTIERI SpA 등이 시장의 주요 기업입니다.

정부의 최근 방위 계약은 현지 기업의 번영을 도왔습니다. 그러나 예산 제약이 이러한 기업의 성장 기회를 즉시 방해할 수 있습니다. 일본과 인도 등 다른 아시아 국가와의 긴밀한 관계는 일본의 방위 산업의 성장을 돕고 수출을 통해 경제에 기여하고 있습니다. 공동 방위 생산 계획은 현지 방위 산업의 미래 공급망을 더욱 강화할 수 있습니다. 이와 같이 인도네시아가 대규모 군비근대화를 계획하고 있는 가운데, 방위 기업은 인도네시아의 방위 시장에서 존재감을 높이는 큰 성장 기회를 갖고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 인원 훈련 및 보호

- 통신 시스템

- 무기 및 탄약

- 포병 및 박격포 시스템

- 보병무기

- 미사일 및 미사일 방위 시스템

- 탄약

- 차량별

- 육상기

- 해양기

- 항공기

제6장 경쟁 구도

- 기업 프로파일

- PT PAL Indonesia

- PT Pindad

- PT. Dirgantara Indonesia

- PT Len Industri

- PT. Dahana

- SCYTALYS

- Leonardo SpA

- Airbus SE

- BAE Systems PLC

- FINCANTIERI SpA

- Kongsberg Gruppen ASA

- Daewoo Shipbuilding & Marine Engineering Co. Ltd

제7장 시장 기회 및 향후 동향

AJY 25.04.09The Indonesia Defense Market size is estimated at USD 9.52 billion in 2025, and is expected to reach USD 10.97 billion by 2030, at a CAGR of 2.89% during the forecast period (2025-2030).

Indonesia is intensifying its focus on bolstering the local defense industry in response to rising demand for advanced military equipment. The government's strategy involves procuring weapons and defense systems, emphasizing technology transfers from leading OEMs to pave the way for long-term self-sufficiency. Domestically, Indonesian entities are honing their expertise in land vehicles, arms, missiles, and UAVs. In the coming years, they plan to venture into more intricate systems like flight controls, warheads, and jet engines.

Under the MEF initiative, Indonesia is adopting a capability-based defense approach to fortify its armed forces. This strategy entails acquiring defense assets aligned with threat assessments and financial capabilities. Notably, Indonesia and other ASEAN nations are embroiled in territorial conflicts with China in the South China Sea, prompting heightened military investments from the Indonesian government.

Furthermore, Indonesia is contemplating a significant overhaul of its aging defense systems to better navigate the evolving strategic landscape. This modernization thrust is propelling the market's growth, with projections indicating a positive trajectory during the forecast period.

Indonesia Defense Market Trends

Ammunition Segment Expected to Show Highest Growth

Indonesia's rising geopolitical tensions and increased defense budgets have fueled market demand. In 2023, Indonesia's defense spending reached USD 9.48 billion. The current administration faces challenges in meeting its minimum essential force (MEF) target. This delay primarily stems from budget constraints and political uncertainties. In June 2022, Indonesia revised its MEF target to 70% for the 2019-2024 phase. Driven by its military ambitions and regional security concerns, Indonesia bolstered its defense spending. The nation's military comprises approximately 404,500 personnel across its Army, Navy, and Air Force, all equipped with various firearms. This heightened demand is evident in recent procurement activities. For instance, in July 2023, the Indonesian police secured 1,857 riot guns worth USD 3.3 million.

Indonesia is poised to prioritize local firms for its modernization needs, aiming to lessen its reliance on foreign suppliers. The nation also plans to emphasize technology transfers and offsets to bolster its domestic defense industry. A notable move in this direction was seen in August 2023 when Indonesia sought assistance from Saudi Arabia to enhance its defense sector. During the discussions, state-owned arms manufacturers like Pinbad showcased their capabilities, signaling a push toward self-sufficiency in defense production. Thus, growing investment in enhancing defense capabilities and rising procurement of advanced ammunition are driving the growth of the segment.

Air-based Vehicles to Dominate the Market During the Forecast Period

Indonesia's presidential office has outlined an ambitious military modernization plan, earmarking a substantial USD 125 billion investment through the mid-2040s. This plan underscores Indonesia's ongoing reliance on foreign loans. Specifically, the proposal allocates USD 79 billion for defense equipment, another USD 32.5 billion for sustainment over 25 years, and the remaining USD 13.4 billion to service interest on foreign loans.

Documents from the Ministry of Finance indicate that in 2022, approximately 32% of the defense budget was earmarked for modernization projects, covering procurement and sustainment. Notably, the country is bolstering its fixed-wing aircraft fleet. In January 2024, Indonesia saw the final installment of 18 Rafale aircraft come into effect. This followed the earlier deliveries of 6 and 18 Rafale aircraft in September 2022 and August 2023, respectively, culminating in fulfilling the 42-aircraft order placed by Indonesia in February 2022. In February 2024, Indonesia ordered three more CN235-220 transport aircraft from the state-owned aerospace company PT Dirgantara Indonesia (PTDI) for USD 85 million. The CN-235, designed to be lighter and more compact than the widely acclaimed C-130 Hercules, is a complementary asset, especially when using a larger transport platform like the C-130 would be inefficient. These procurement endeavors are poised to necessitate a larger share of the defense budget, potentially posing a challenge for the incumbent government.

Indonesia Defense Market Industry Overview

Indonesia's defense market is semi-consolidated. In the past, Indonesia depended on foreign defense contractors to procure major military equipment. However, in recent years, Indonesia has focused more on developing its state-owned companies. PT PAL Indonesia, PT Pindad, PT Dirgantara Indonesia, Airbus SE, and FINCANTIERI SpA are some of the major players in the market.

Recent defense contracts from the government helped the local companies to prosper. However, budget constraints can hamper the growth opportunities of these companies soon. Close relationships with other Asian countries like Japan and India helped the country's defense industry grow and contribute to the economy through exports. Joint defense production plans can further enhance the future supply chain of the local defense industry. Thus, as Indonesia plans for a major military equipment modernization, defense companies have a significant growth opportunity to increase their presence in the Indonesian defense market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Personnel Training and Protection

- 5.1.2 Communication Systems

- 5.1.3 Weapons and Ammunitions

- 5.1.3.1 Artillery and Mortar Systems

- 5.1.3.2 Infantry Weapons

- 5.1.3.3 Missile and Missile Defense Systems

- 5.1.3.4 Ammunition

- 5.1.4 By Vehicles

- 5.1.4.1 Land-based Vehicles

- 5.1.4.2 Sea-based Vehicles

- 5.1.4.3 Air-based Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PT PAL Indonesia

- 6.1.2 PT Pindad

- 6.1.3 PT. Dirgantara Indonesia

- 6.1.4 PT Len Industri

- 6.1.5 PT. Dahana

- 6.1.6 SCYTALYS

- 6.1.7 Leonardo SpA

- 6.1.8 Airbus SE

- 6.1.9 BAE Systems PLC

- 6.1.10 FINCANTIERI SpA

- 6.1.11 Kongsberg Gruppen ASA

- 6.1.12 Daewoo Shipbuilding & Marine Engineering Co. Ltd