|

시장보고서

상품코드

1690950

저궤도(LEO) 위성 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)LEO Satellite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

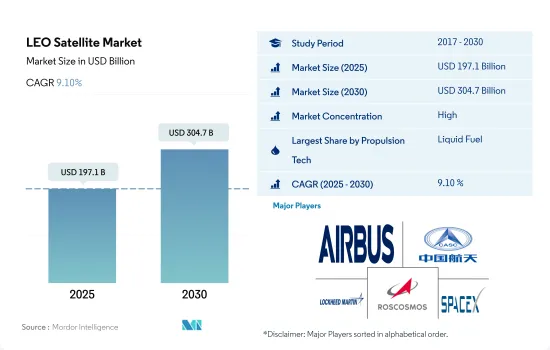

저궤도(LEO) 위성 시장 규모는 2025년에 1,971억 달러로 추정되고, 2030년에는 3,047억 달러에 이를 것으로 예측되며, 예측 기간 2025년부터 2030년까지 CAGR 9.10%로 성장할 전망입니다.

시장 점유율의 대부분을 차지하는 액체 연료 추진 시스템

- 저궤도(LEO) 위성은 통신, 지구관측, 네비게이션, 원격 감지 등 다양한 산업에 필수적입니다. 추진 시스템은 이러한 위성의 성능, 효율성 및 운영 능력을 결정하는 중요한 역할을 수행합니다.

- 액체 추진 시스템은 LEO 위성 시장에서 널리 사용되며 높은 추력과 비추력 능력을 제공합니다. 이러한 시스템은 일반적으로 히드라진과 같은 액체 연료와 사산화질소와 같은 산화제를 조합하여 사용합니다. 액체 추진은 정확한 궤도 조작, 정지 전이 궤도(GTO) 투입, 미션의 유연성을 가능하게 합니다. 복잡한 궤도 조정, 특정 궤도로의 페이로드 수송, 위성 퇴역이 필요한 LEO 위성 임무는 액체 추진 시스템에 의존합니다.

- 전기 추진은 연료 효율과 임무 수명 연장으로 LEO 위성 시장에서 큰 지지를 얻고 있습니다. 이온 및 홀 효과 스러스터를 포함하는 전기 추진 시스템은 전계를 이용하여 이온을 가속하고 추력을 발생시킵니다. 전기 추진은 SpaceX의 Starlink 및 OneWeb과 같은 기업이 입증한 것처럼 대규모 LEO 위성 별자리 배포를 가능하게 합니다. 이러한 시스템은 정확한 스테이션 유지보수 장치와 오랜 기간 궤도 조정이 필요한 용도에 특히 적합합니다.

- 콜드 가스 스러스터 및 웜 가스 스러스터를 포함한 가스 기반 추진 시스템은 LEO 위성 시장에서 널리 사용됩니다. 이들 시스템은 질소, 크세논 등의 압축 가스를 이용하여 추력을 발생시킵니다. 급속한 궤도 변경과 빈번한 재위치를 필요로 하는 LEO 위성 미션에서는 높은 추력 능력으로 인해 가스 기반 추진 시스템에 의존하는 경우가 많습니다.

북미가 2029년 시장 점유율 85.4%로 시장 수요 견인

- 세계의 LEO 위성 시장은 고속 인터넷, 통신 서비스, 다양한 산업에 걸친 데이터 전송 수요 증가에 견인되어 향후 수년간 크게 성장할 것으로 예상됩니다. 이 시장은 북미, 유럽, 아시아태평양 시장 점유율과 수익 창출에 대해 분석할 수 있습니다. 2017-2022년까지 4100개 이상의 위성이 제조되었으며 이 부문의 다양한 운영자에 의해 LEO로 발사되었습니다.

- 북미는 The Boeing Company, Lockheed Martin, Northrop Grumman 등 여러 주요 시장 기업의 존재로 인해 세계 LEO 위성 시장을 독점할 것으로 예상됩니다. 또한 미국 정부는 첨단 위성 기술 개발에 많은 투자를 하고 있으며, 이는 북미 시장의 성장을 가속할 것으로 기대됩니다. 2017-2022년까지 이 지역은 LEO에 제조 및 발사된 전체 위성의 72%를 차지했습니다.

- LEO 위성 시장은 유럽의 고속 인터넷 및 통신 서비스 수요 증가로 인해 크게 성장할 것으로 예상됩니다. 유럽 우주 기관(ESA)은 첨단 위성 기술 개발에 많은 투자를 하고 있으며, 이는 시장 성장을 가속할 것으로 기대됩니다. 2017-2022년까지 이 지역은 제조되고 LEO로 발사된 전체 위성의 12%를 차지했습니다.

- 아시아태평양은 중국, 인도, 일본 등 국가에서 위성 기반 통신 서비스에 대한 수요가 증가하고 있기 때문에 LEO 위성 시장에서 큰 성장이 예상됩니다. 2017-2022년까지 아시아태평양은 LEO에 제조 및 발사된 위성 전체의 9%를 차지했습니다.

세계의 LEO 위성 시장 동향

연료 및 운영 효율성 향상이 시장에 긍정적 영향을 미칠 전망입니다.

- 위성 임무의 성공은 비행 전의 질량 특성의 측정 정확도와 질량 특성을 엄격한 한계 내에서 수용하기 위해 위성의 적절한 밸러스트에 크게 의존합니다. 질량 특성을 적절히 제어할 수 없는 경우, 발사 후 위성이 넘어지거나 올바른 방향으로 가려고 하여 스러스터의 능력을 곧바로 소진해 버릴 가능성이 있습니다. 태양전지판은 위성이 지구를 돌아 다니는 동안 태양의 방향을 계속 향해야 합니다.

- 저궤도 위성은 지구 상공 160km에서 2000km의 궤도를 돌고, 1바퀴 도는 데 약 1시간 반이 걸리며, 지구 표면의 일부만 커버합니다. 위성의 질량은 발사에 큰 영향을 미칩니다. 위성이 무거울수록 무거울수록 우주로 발사하는데 필요한 연료와 에너지가 늘어나기 때문입니다. 위성을 발사하려면 시속 약 2만 8,000km라는 초고속까지 가속하여 지구의 주회 궤도에 올려야 합니다. 이 속도를 달성하는 데 필요한 에너지의 양은 위성의 질량에 비례합니다.

- 결과적으로 위성이 무거울수록 우주로 발사하려면 더 큰 로켓과 더 많은 연료가 필요합니다. 그 결과 발사 비용이 상승하고 사용 가능한 로켓 유형도 제한됩니다. 질량에 따라 크게 분류되는 것은 1,000kg을 넘는 대형 위성입니다. 2017년부터 2022년까지 65개 이상의 대형 위성이 LEO 궤도에서 발사되었습니다. 중형 위성은 질량이 500kg과 1000kg의 위성으로 250기 이상의 중형 위성이 발사되었습니다. 발사 질량이 500kg 미만인 위성은 소형 위성입니다. LEO 궤도에는 4000대 이상의 소형 위성이 있습니다.

지구관측, 영상 처리 및 연결 서비스에 대한 수요 증가는 LEO 위성 카테고리의 연구 개발 지출이 급증할 것으로 예상됩니다.

- 저궤도(LEO)는 상대적으로 지표에 가까운 궤도입니다. LEO는 보통 고도 1000km 이하이지만, 지구 상공 160km까지 상승하는 경우도 있습니다. LEO 위성은 통신, 군사 정찰 및 기타 이미지 용도에 널리 사용됩니다. 통신 위성은 LEO까지의 신호 런타임이 짧다는 장점이 있습니다. 이 전파 지연이 감소하면 대기 시간이 단축됩니다. 우주로 보내지는 위성의 대부분은 LEO 별자리에 속합니다. 주요 LEO 위성 별자리 중 하나는 위성 통신 공급자 이리듐이 소유하고 있습니다. 아마존이 소유한 카이퍼 시스템즈와 같은 기업은 우주에서 광대역 연결을 제공하기 위해 원웹 스타링크와 같은 기업과 경쟁하고 싶기 때문에 세계적으로 LEO 궤도에서 경쟁업체 간의 적대 관계가 높습니다. 연방통신위원회 승인 후, 회사는 2023년 첫 위성을 발사할 예정입니다.

- 아시아태평양에서 우주 관련 활동 증가를 고려하여 위성 제조업체는 위성 제조 능력을 강화하고 있습니다. 강력한 우주 인프라를 갖춘 유명한 아시아태평양 국가는 중국, 인도, 일본, 한국입니다. 중국 국가 우주국은 국가 민간 우주 인프라 시설 강화를 포함하여 2021-2025년 우주 탐사 우선 사항을 발표했습니다. 이 계획의 일환으로 중국 정부는 위성 인터넷을 위한 13,000 위성 별자리를 개발하기 위해 중국 위성 네트워크 그룹을 설립했습니다. 전반적으로 LEO 위성에 대한 연구개발 비용의 동향은 기술 혁신의 필요성과 정부 자금에 힘입어 증가하는 경향이 있습니다. 이 투자는 LEO 위성의 성능과 능력을 향상시키는 신기술 개발로 이어질 것으로 기대됩니다.

LEO 위성 산업 개요

LEO 위성 시장은 상당히 통합되어 있으며 상위 5개사에서 95.84%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Airbus SE, China Aerospace Science and Technology Corporation(CASC), Lockheed Martin Corporation, ROSCOSMOS and Space Exploration Technologies Corp.(알파벳 순으로 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 위성의 질량

- 우주 개발에 대한 지출

- 규제 프레임워크

- 세계

- 호주

- 브라질

- 캐나다

- 중국

- 프랑스

- 독일

- 인도

- 이란

- 일본

- 뉴질랜드

- 러시아

- 싱가포르

- 한국

- 아랍에미리트(UAE)

- 영국

- 미국

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 용도별

- 통신

- 지구관측

- 네비게이션

- 우주 관측

- 기타

- 위성 질량별

- 10-100kg

- 100-500kg

- 500-1000kg

- 10kg 미만

- 1000kg 이상

- 최종 사용자별

- 상업

- 군사 및 정부

- 기타

- 추진 기술별

- 전기식

- 가스

- 액체 연료

- 지역별

- 아시아태평양

- 유럽

- 북미

- 세계 기타 지역

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Airbus SE

- Astrocast

- China Aerospace Science and Technology Corporation(CASC)

- German Orbital Systems

- GomSpaceApS

- Lockheed Martin Corporation

- Nano Avionics

- Planet Labs Inc.

- ROSCOSMOS

- Space Exploration Technologies Corp.

- SpaceQuest Ltd

- Surrey Satellite Technology Ltd.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The LEO Satellite Market size is estimated at 197.1 billion USD in 2025, and is expected to reach 304.7 billion USD by 2030, growing at a CAGR of 9.10% during the forecast period (2025-2030).

Liquid fuel propulsion system occupies majority of the market share

- Low Earth orbit (LEO) satellites have become integral to various industries, including telecommunications, Earth observation, navigation, and remote sensing. The propulsion system plays a crucial role in determining the performance, efficiency, and operational capabilities of these satellites.

- Liquid propulsion systems have been widely used in the LEO satellite market, offering high thrust and specific impulse capabilities. These systems typically use liquid fuels, such as hydrazine, combined with oxidizers like nitrogen tetroxide. Liquid propulsion enables precise orbital maneuvers, geostationary transfer orbit (GTO) insertion, and mission flexibility. LEO satellite missions requiring complex orbital adjustments, payload delivery to specific orbits, and satellite decommissioning rely on liquid propulsion systems.

- Electric propulsion has gained significant traction in the LEO satellite market due to its fuel efficiency and extended mission lifetimes. Electric propulsion systems, including ions and Hall-effect thrusters, utilize electric fields to accelerate ions and generate thrust. Electric propulsion enables the deployment of large-scale LEO satellite constellations, as demonstrated by companies like SpaceX's Starlink and OneWeb. These systems are particularly suitable for applications that require precise station-keeping maneuvers and orbital adjustments over extended periods.

- Gas-based propulsion systems, including cold gas and warm gas thrusters, are extensively used in the LEO satellite market. These systems utilize compressed gases, such as nitrogen or xenon, to generate thrust. LEO satellite missions that require rapid orbital changes or frequent repositioning often rely on gas-based propulsion systems due to their higher thrust capabilities.

North America is driving the market demand with a market share of 85.4% in 2029

- The global LEO satellite market is expected to grow significantly in the coming years, driven by increasing demand for high-speed internet, communication services, and data transfer across different industries. The market can be analyzed with respect to North America, Europe, and Asia-Pacific as to market share and revenue generation. During 2017-2022, more than 4100 satellites were manufactured and launched by various operators in this segment into LEO.

- North America is expected to dominate the global LEO satellite market due to the presence of several leading market players, such as The Boeing Company, Lockheed Martin, and Northrop Grumman. The US government has also been investing heavily in the development of advanced satellite technology, which is expected to drive the growth of the market in North America. During 2017-2022, the region accounted for 72% of the total satellites manufactured and launched into LEO.

- The LEO satellite market is expected to grow significantly due to the increasing demand for high-speed internet and communication services in Europe. The European Space Agency (ESA) has been investing heavily in the development of advanced satellite technology, which is expected to drive the growth of the market. During 2017-2022, the region accounted for 12% of the total satellites manufactured and launched into LEO.

- Asia-Pacific is expected to witness significant growth in the LEO satellite market due to the increasing demand for satellite-based communication services in countries such as China, India, and Japan. During 2017-2022, Asia-Pacific accounted for 9% of the total satellites manufactured and launched into LEO.

Global LEO Satellite Market Trends

The trend for better fuel and operational efficiency is expected to positively impact the market

- The success of a satellite mission is highly dependent on the accuracy of measuring its mass properties before the flight and the proper ballasting of the satellite to bring the mass properties within tight limits. Failure to properly control mass properties can result in the satellite tumbling end over end after launch or quickly using up its thruster capacity in an attempt to point in the correct direction. Solar panels must continue to point toward the sun as the satellite orbits the Earth.

- Low earth orbit satellites orbit from 160 to 2000 km above the Earth, take approximately 1.5 hours for a full orbit, and only cover a portion of the Earth's surface. The mass of a satellite has a significant impact on the launch of the satellite. This is because the heavier the satellite, the more fuel and energy are required to launch it into space. Launching a satellite involves accelerating it to a very high speed, typically around 28,000 km per hour, to place it in orbit around the Earth. The amount of energy required to achieve this speed is proportional to the mass of the satellite.

- As a result, a heavier satellite requires a larger rocket and more fuel to launch it into space. This, in turn, increases the cost of the launch and can also limit the types of launch vehicles that can be used. The major classification types according to mass are large satellites that are more than 1,000 kg. During 2017-2022, 65+ large satellites were launched in the LEO orbit. A medium-sized satellite has a mass of 500 and 1000 kg, and 250+ medium-sized satellites were launched. Satellites with a launch mass of less than 500 kg are small satellites. There are 4000+ small satellites in the LEO orbit.

Growing demand for earth observation, imaging, and connectivity services is expected to surge the research and development expenditure in LEO satellites category

- Low Earth orbit (LEO) is an orbit relatively closer to the surface of the Earth. LEO is usually below 1000 km altitude but can be as high as 160 km above Earth. LEO satellites are widely used for communications, military reconnaissance, and other imaging applications. Communications satellites have the advantage of short signal runtimes to LEO. This reduction in propagation delay results in lower latency. Most satellites sent into space are in the LEO constellation. One of the major LEO satellite constellations is owned by satellite communications provider Iridium. The competitive rivalry in the LEO orbit globally is high as companies such as Amazon-owned Kuiper Systems want to compete with companies like OneWeb's Starlink to provide broadband connectivity from space. After Federal Communications Commission approval, the company plans to launch its first satellite to be launched in 2023.

- Considering the increase in space-related activities in the Asia-Pacific region, satellite manufacturers are enhancing their satellite production capabilities. The prominent Asia-Pacific countries with robust space infrastructure are China, India, Japan, and South Korea. China National Space Administration announced space exploration priorities for 2021-2025, including enhancing national civil space infrastructure facilities. As a part of this plan, the Chinese government established China Satellite Network Group Co. Ltd to develop a 13,000-satellite constellation for satellite internet. Overall, the trend in R&D expenditure on LEO satellites is an increase, driven by the need for innovation and government funding. This investment is expected to lead to the development of new technologies that will improve the performance and capabilities of LEO satellites.

LEO Satellite Industry Overview

The LEO Satellite Market is fairly consolidated, with the top five companies occupying 95.84%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), Lockheed Martin Corporation, ROSCOSMOS and Space Exploration Technologies Corp. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Spending On Space Programs

- 4.3 Regulatory Framework

- 4.3.1 Global

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 France

- 4.3.7 Germany

- 4.3.8 India

- 4.3.9 Iran

- 4.3.10 Japan

- 4.3.11 New Zealand

- 4.3.12 Russia

- 4.3.13 Singapore

- 4.3.14 South Korea

- 4.3.15 United Arab Emirates

- 4.3.16 United Kingdom

- 4.3.17 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Satellite Mass

- 5.2.1 10-100kg

- 5.2.2 100-500kg

- 5.2.3 500-1000kg

- 5.2.4 Below 10 Kg

- 5.2.5 above 1000kg

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Military & Government

- 5.3.3 Other

- 5.4 Propulsion Tech

- 5.4.1 Electric

- 5.4.2 Gas based

- 5.4.3 Liquid Fuel

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Astrocast

- 6.4.3 China Aerospace Science and Technology Corporation (CASC)

- 6.4.4 German Orbital Systems

- 6.4.5 GomSpaceApS

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 Nano Avionics

- 6.4.8 Planet Labs Inc.

- 6.4.9 ROSCOSMOS

- 6.4.10 Space Exploration Technologies Corp.

- 6.4.11 SpaceQuest Ltd

- 6.4.12 Surrey Satellite Technology Ltd.

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms