|

시장보고서

상품코드

1911406

의지 및 보조기 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Prosthetics And Orthotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

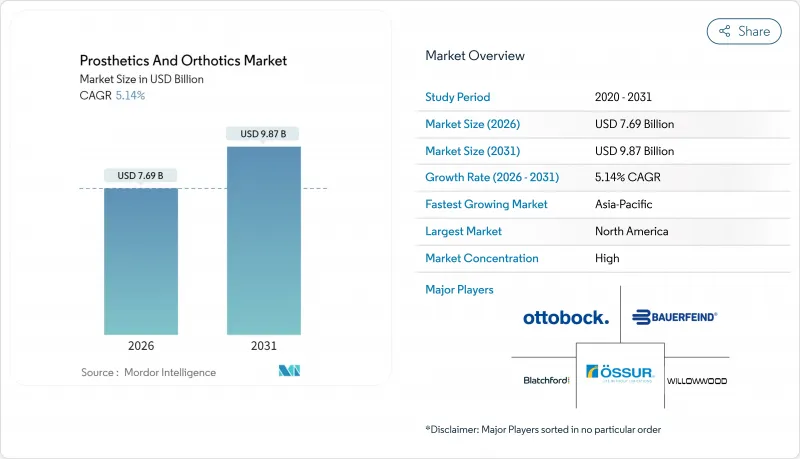

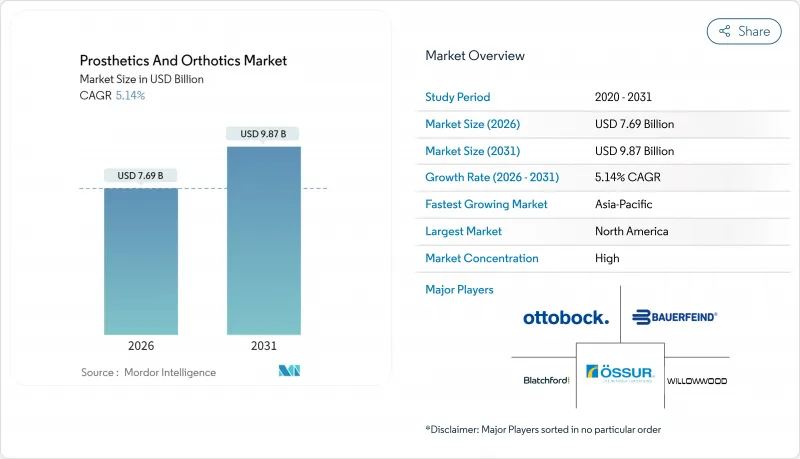

의지 및 보조기 시장은 2025년에 73억 1,000만 달러로 평가되었고, 2026년 76억 9,000만 달러에서 2031년까지 98억 7,000만 달러에 이를 것으로 보입니다. 예측기간(2026-2031년)의 CAGR은 5.14%를 나타낼 전망입니다.

당뇨병 관련 사지 절단 증가, 급속한 인구 고령화, 꾸준한 보험급여 개선이 지속적인 수요 증가 요인으로 작용하고 있습니다. 마이크로프로세서 제어 무릎 관절 및 센서 기반 보조기 등 기술 발전은 임상 적용 범위를 확대하는 동시에 프리미엄 가격 책정을 뒷받침하고 있습니다. 제조업체들이 반복적 수익 확보를 위해 서비스 네트워크를 통합하면서 업계 통합이 가속화되고 있습니다. 한편, 공급망 차질과 의료진 부족은 여전히 주요 장애물로 남아 기업들이 소재 다각화와 인력 교육 투자를 촉진하고 있습니다.

세계의 의지 및 보조기 시장 동향 및 인사이트

당뇨병 관련 절단의 급증

현재 당뇨병 합병증은 하지 절단 수술의 약 3분의 2를 차지하며, 당뇨병 환자의 절단률은 21.7%, 말초신경병증 유병률은 44.4%에 달합니다. 캐나다에서만 2024년 당뇨병 관련 절단으로 7,720건의 입원이 발생했으며, 이로 인해 의료 시스템에 7억 5,000만 달러의 비용이 발생했습니다. 신흥 아시아 지역에서 발생률이 가장 빠르게 증가함에 따라, 2030년까지 하지 보조 장치에 대한 수요는 견조하게 유지될 전망입니다.

고령화와 골관절염 부담

아시아태평양 지역의 노인 인구는 2050년까지 9억 2,300만 명에 달할 것으로 예상되며, 이는 해당 지역 인구의 18%에 해당합니다. 골관절염 유병률도 함께 증가하면서 보조기 사용이 급성 손상 치료에서 장기적인 이동성 보존으로 전환되고 있습니다. 일본과 싱가포르 사례는 민간 부문 참여가 고사양 보조기 솔루션 접근성을 확대하는 방식을 보여줍니다. 관절 수술을 예방하기 위해 지불 주체가 첨단 보조기 지원을 확대함에 따라 보조기 사용량은 지속적인 성장세를 보일 전망입니다.

높은 기기 비용 및 불균등한 보험 적용

사지 결손을 가진 230만 미국인 중 절단 보철물을 받은 사람은 절반 미만이며, 이는 주로 보험 적용 한도와 사전 승인 절차의 장벽 때문입니다. 제니엄 X4 마이크로프로세서 무릎과 같은 첨단 의지 기술은 상당한 투자를 필요로 하며, 가격은 정교한 기술과 장기적 비용을 상쇄할 수 있는 향상된 기능적 결과를 반영합니다. 변동적인 보험 적용 법규는 입증된 기능적 장점에도 불구하고 지역적 불평등을 강화하고 첨단 기기 도입을 저해합니다.

부문 분석

2025년 매출의 57.65%를 차지한 보조기 시장은 만성 관절 및 척추 질환에 대한 다용도성을 입증했습니다. 당뇨병 관련 발 합병증에는 하지 보조기가, 척추 보조기는 손상 회복과 퇴행성 질환 모두에 대응합니다. 보조기를 통한 조기 개입이 수술을 대체하는 사례가 증가하며 지불자 전략을 형성하고 있습니다. 의지 시장은 규모는 작지만 지능형 무릎 관절과 맞춤형 소켓이 보행 효율성을 개선함에 따라 6.53%의 더 빠른 연평균 성장률(CAGR)을 기록 중입니다. 당뇨병으로 인한 절단 수술 증가로 하체 솔루션이 주류를 이루는 반면, 상지 수요는 근전도 기술 발전과 3D 프린팅 맞춤형 부품의 혜택을 받고 있습니다. 라이너 및 모듈식 관절과 같은 부품 카테고리는 반복적인 교체 수요를 주도하며 성장을 강화하고 있습니다.

마이크로프로세서 채택 확대와 외상 생존율 증가는 예측 기간 내 의지 부문 시장 규모가 전체 산업 평균을 상회할 것으로 전망됩니다. 맞춤형 적층제조 소켓은 조정 방문 횟수를 줄이고, 클라우드 기반 결과 추적은 가치 기반 구매 계약을 지원하여 의지 채택을 더욱 촉진합니다.

지역별 분석

북미는 2025년 수익의 41.90%를 차지하고, 기능 저하의 절단자용 마이크로프로세서 무릎 관절의 상환을 인정하는 메디케어 규칙 개정과 밀접한 임상의 네트워크에 지지되고 있습니다. 미국은 혁신을 주도하고 DARPA 자금을 통한 신경 인터페이스 시험을 실시하여 상업 스핀아웃을 가속화하고 있습니다. 캐나다에서는 국민 모두 보험제도가 기본적인 지체장치를 보증하고, 멕시코는 중산계급의 지출 증가와 마키라도라(수출가공구) 기반의 부품 생산의 혜택을 받고 있습니다.

유럽의 성장은 독일, 영국, 프랑스가 주도하며, 이들 국가의 포괄적 보험 제도는 첨단 보조기 및 사지 보철 장치를 보장합니다. 의료기기 규정(MDR)에 따른 규제 조정은 국경을 넘는 제품 출시를 간소화하지만, 보상 상한선은 국가별로 다릅니다. 이탈리아와 스페인은 고령화 인구와 증가하는 공공 의료 예산을 통해 성장 잠재력을 보입니다.

아시아태평양은 8.12%의 연평균 복합 성장률(CAGR)로 가장 빠르게 성장하고 있습니다. 중국은 공공-민간 협력 클리닉을 통해 장애 서비스를 확대하고 있으며, 현지 제조사들은 대중 수요를 충족시키기 위해 중급 기기 생산을 확대 중입니다. 인도의 정부 보조금과 저비용 3D 프린팅은 농촌 지역 절단 환자들 사이에서 보급을 촉진합니다. 일본과 한국은 로봇 보조기 및 센서 통합 부문에서 선도적 위치를 유지하며, 광범위한 지역적 보급 전 시험장으로 기능합니다. 호주의 잘 구축된 보험급여 제도와 의료진 교육 체계는 인공지능 기반 보행 분석 기술의 조기 도입을 뒷받침합니다.

이러한 지역적 동향이 함께 의지 및 보조기 시장은 꾸준한 확대를 계속하고 있으며, 지역별 성장률의 차이가 제조업체에 제품 포트폴리오나 현지화 전략의 최적화 기회를 제공합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트의 3개월간 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 당뇨병 관련 절단 수술의 급증

- 고령화 사회와 변형성 관절증의 부담

- 마이크로프로세서 및 근전 기술 발전

- 선진국 시장에서의 상환 범위 확대

- AI 기반 예측 보행 분석 기술 도입

- 군사 R&D의 민간 기기로 확산

- 시장 성장 억제요인

- 높은 장치 비용 및 불균등한 보험 적용

- 공인 의지 및 보조기 임상전문가(O&P)의 부족

- 탄소섬유 공급망의 변동성

- 성과 기반 보상(Pay-for-outcome) 보험 적용 위험

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 상환환경

제5장 시장 규모와 성장 예측

- 유형별

- 보조기

- 하지 의지

- 상지 의지

- 척추 의지

- 의지

- 다리 의지

- 상지 의지

- 라이너, 소켓 및 모듈러 부품

- 보조기

- 기술별

- 기존/신체 동력식

- 전동식/근전식

- 마이크로프로세서 제어 방식

- 하이브리드

- 3D 프린팅/적층 조형

- 최종 사용자별

- 병원

- 의지 및 보조기 클리닉

- 재활센터

- 재택치료 환경

- 군사 및 퇴역 군인 관련 시설

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Ossur

- Ottobock

- Hanger Inc.

- Zimmer Biomet

- Blatchford Group

- Fillauer LLC

- Steeper Group

- WillowWood Global

- College Park Industries

- Proteor

- Bauerfeind AG

- DJO Global(Enovis)

- Trulife

- Ortho Europe

- Spinal Technology Inc.

- Thuasne

- 3M Health Care

- Stryker Corporation

- Johnson & Johnson(DePuy Synthes)

- Smith & Nephew

제7장 시장 기회와 장래의 전망

HBR 26.01.29The prosthetics and orthotics market was valued at USD 7.31 billion in 2025 and estimated to grow from USD 7.69 billion in 2026 to reach USD 9.87 billion by 2031, at a CAGR of 5.14% during the forecast period (2026-2031).

Rising diabetes-related limb loss, rapid population aging, and steady reimbursement improvements are creating durable demand tailwinds. Technology upgrades-including microprocessor-controlled knees and sensor-guided bracing-are expanding clinical indications while supporting premium pricing. Consolidation is accelerating as manufacturers integrate service networks to secure recurring revenue. Meanwhile, supply-chain disruptions and clinician shortages remain key headwinds, encouraging firms to diversify materials and invest in workforce training.

Global Prosthetics And Orthotics Market Trends and Insights

Rapid Rise in Diabetes-Related Amputations

Diabetes complications now account for roughly two-thirds of lower-limb amputations, with diabetic patients experiencing a 21.7% amputation rate and peripheral neuropathy prevalence of 44.4%. In Canada alone, diabetes-related amputations triggered 7,720 hospitalizations in 2024, costing healthcare systems USD 750 million. With incidence climbing fastest in emerging Asia, demand for lower-extremity devices is set to remain robust through 2030.

Aging Population & Osteoarthritis Burden

Asia-Pacific's elderly cohort is projected to reach 923 million by 2050, equal to 18% of the region's population. Osteoarthritis prevalence is rising in tandem, shifting orthotic use from acute injury care to long-term mobility preservation. Japan and Singapore illustrate how private sector involvement broadens access to high-spec bracing solutions. As payers increasingly fund advanced supports to forestall joint surgery, orthotics volumes are poised for sustained growth.

High Device Cost & Uneven Reimbursement

Fewer than half of the 2.3 million Americans living with limb loss have received a prosthesis, largely due to coverage caps and prior-authorization hurdles. Advanced prosthetic technologies like the Genium X4 microprocessor knee represent significant investments, with pricing reflecting the sophisticated technology and improved functional outcomes that could offset long-term . Variable parity laws reinforce geographic inequities and temper advanced-device uptake despite documented functional advantages.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Microprocessor & Myoelectric Technology

- Expanding Reimbursement in Developed Markets

- Shortage of Certified O&P Clinicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Orthotics captured 57.65% of 2025 revenue, underscoring their versatility for chronic joint and spinal conditions. Lower-limb braces meet diabetes-linked foot complications, while spinal orthoses address both injury recovery and degenerative disease. Early intervention with bracing increasingly substitutes for surgery, shaping payer strategies. Prosthetics, though smaller, are on a faster 6.53% CAGR track as intelligent knees and customizable sockets improve gait efficiency. Lower-extremity solutions dominate, powered by diabetes-driven amputations, whereas upper-limb demand benefits from myoelectric advances and 3D-printed personalized parts. Component categories such as liners and modular joints anchor recurring replacement sales, reinforcing growth.

Continued microprocessor adoption and rising trauma survivorship position the prosthetics and orthotics market size for the prosthetics segment to outpace the broader industry average by the forecast horizon. Customized additive-manufactured sockets are lowering adjustment visits, while cloud-based outcome tracking supports value-based purchase contracts, further stimulating prosthetic adoption.

The Prosthetics and Orthotics Market Report is Segmented by Type (Orthotics, Prosthetics), Technology (Conventional, Electric-Powered, Microprocessor-Controlled, Hybrid, 3D-Printed), End User (Hospitals, P&O Clinics, Rehabilitation Centers, Home-Care, Military Facilities), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.90% of 2025 revenue, buoyed by Medicare rule changes that reimburse microprocessor knees for lower-functioning amputees and by a dense clinician network. The United States leads innovation, hosting DARPA-funded neural-interface trials that accelerate commercial spin-outs. Canada's universal coverage underwrites basic limb devices, while Mexico benefits from rising middle-class spending and maquiladora-based component production.

Europe's growth is anchored by Germany, the United Kingdom, and France, where comprehensive insurance schemes cover advanced braces and limbs. Regulatory coordination under the Medical Device Regulation streamlines cross-border product launches, though reimbursement ceilings vary. Italy and Spain present upside via aging demographics and rising public healthcare budgets.

Asia-Pacific is the fastest-growing territory at 8.12% CAGR. China is expanding disability services through public-private clinics, while local producers scale mid-range devices to meet mass demand. India's government subsidies and low-cost 3D printing spur uptake among rural amputees. Japan and South Korea remain leaders in robotic bracing and sensor integration, acting as proving grounds before broader regional deployment. Australia's well-developed reimbursement schemes and clinician training pipelines support early adoption of AI-enabled gait analytics.

Together, these regional dynamics ensure steady expansion of the prosthetics and orthotics market, with differential growth offering manufacturers opportunities to tailor portfolios and localization strategies.

- Ossur

- Ottobock

- Hanger Inc.

- Zimmer Biomet

- Blatchford Group

- Fillauer

- Steeper Group

- WillowWood Global

- College Park Industries

- Proteor

- Bauerfeind

- DJO Global

- Trulife

- Ortho Europe

- Spinal Technology Inc.

- Thuasne

- 3M Health Care

- Stryker

- Johnson & Johnson

- Smiths Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid rise in diabetes-related amputations

- 4.2.2 Ageing population & osteoarthritis burden

- 4.2.3 Advances in microprocessor & myoelectric tech

- 4.2.4 Expanding reimbursement in developed markets

- 4.2.5 AI-driven predictive gait analytics adoption

- 4.2.6 Military R&D spill-over into civilian devices

- 4.3 Market Restraints

- 4.3.1 High device cost & uneven reimbursement

- 4.3.2 Shortage of certified O&P clinicians

- 4.3.3 Carbon-fiber supply-chain volatility

- 4.3.4 Pay-for-outcome reimbursement risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Reimbursement Landscape

5 Market Size & Growth Forecasts

- 5.1 By Type (Value)

- 5.1.1 Orthotics

- 5.1.1.1 Lower-Limb Orthotics

- 5.1.1.2 Upper-Limb Orthotics

- 5.1.1.3 Spinal Orthotics

- 5.1.2 Prosthetics

- 5.1.2.1 Lower-Extremity Prosthetics

- 5.1.2.2 Upper-Extremity Prosthetics

- 5.1.2.3 Liners, Sockets & Modular Components

- 5.1.1 Orthotics

- 5.2 By Technology (Value)

- 5.2.1 Conventional / Body-Powered

- 5.2.2 Electric-Powered / Myoelectric

- 5.2.3 Microprocessor-Controlled

- 5.2.4 Hybrid

- 5.2.5 3D-Printed / Additive Manufactured

- 5.3 By End User (Value)

- 5.3.1 Hospitals

- 5.3.2 Prosthetics & Orthotics Clinics

- 5.3.3 Rehabilitation Centers

- 5.3.4 Home-Care Settings

- 5.3.5 Military & Veterans Affairs Facilities

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Ossur

- 6.3.2 Ottobock

- 6.3.3 Hanger Inc.

- 6.3.4 Zimmer Biomet

- 6.3.5 Blatchford Group

- 6.3.6 Fillauer LLC

- 6.3.7 Steeper Group

- 6.3.8 WillowWood Global

- 6.3.9 College Park Industries

- 6.3.10 Proteor

- 6.3.11 Bauerfeind AG

- 6.3.12 DJO Global (Enovis)

- 6.3.13 Trulife

- 6.3.14 Ortho Europe

- 6.3.15 Spinal Technology Inc.

- 6.3.16 Thuasne

- 6.3.17 3M Health Care

- 6.3.18 Stryker Corporation

- 6.3.19 Johnson & Johnson (DePuy Synthes)

- 6.3.20 Smith & Nephew

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment