|

시장보고서

상품코드

1692481

병원 자산 추적 및 재고 관리 시스템 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Hospital Asset Tracking And Inventory Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

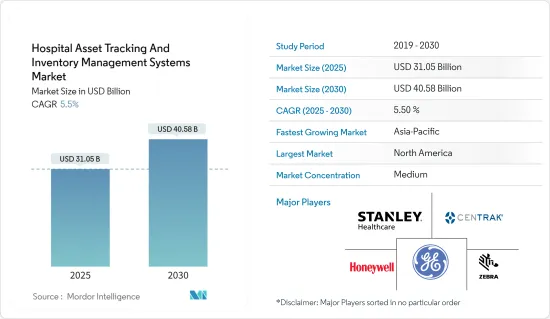

세계의 병원 자산 추적 및 재고 관리 시스템 시장 규모는 2025년 310억 5,000만 달러로 추정되며 예측 기간 중(2025-2030년) CAGR 5.5%로 확대되어, 2030년에는 405억 8,000만 달러에 이를 것으로 예측됩니다.

전 세계적으로 볼 때, 병원 부문은 추적 시스템의 정비, 의료기기의 부적절한 관리, 직원 관리 부족으로 인해 COVID-19 발생 초기에 큰 영향을 받았습니다. 따라서 병원에서 자산 추적 및 재고 관리를 개선하기 위한 기술 솔루션의 필요성이 부각되었습니다. 예를 들어, 미국 보건복지부가 2020년에 실시한 전국 조사의 결과에 따르면 COVID-19 팬데믹 기간 동안 병원은 적절한 인원 배치를 유지할 수 없거나 직원에게 충분한 지원을 제공하지 못했다고 보고되었습니다.

일부 국가에서는 COVID-19가 유행하는 동안 병원에서 중요한 의료기기가 부족했다고 보고했습니다. 미국 FDA는 미국인, 특히 의료기기를 사용하거나 구매하는 사람들에게 투명성을 제공하기 위해 2020년에 장비 부족 목록을 발표했습니다. 이러한 사례는 병원 자산 추적 및 재고 관리 업계의 주요 기업에 유리한 기회를 제공하여 유행기간에 시장 성장을 가속했습니다. 그러나 시스템 수요 측면에서 시장은 유행 전의 상태에 도달해 향후 몇 년 동안 안정적인 성장이 예상됩니다.

또한 건강 관리 환경에서 RTLS와 RFID 사용 급증, 자산 관리 수요 증가, 병원 지출 증가, 시장 내 제품 출시 및 승인 등의 전략적 개발 등이 분석 기간 동안 시장 성장을 가속할 것으로 예측됩니다. 자산 추적, 실내 네비게이션 개선, 서브미터 정밀도로 보다 정확하게 태그를 찾을 수 있는 소프트웨어를 제공해 왔습니다.

또한 보다 우수한 자산 추적 솔루션에 대한 인식과 요구 증가, 기술 혁신, 제품 출시, 제휴, 인수 등이 시장 성장을 뒷받침하고 있습니다. 2021년 11월, Philips N.V.는 실시간 업무 의사결정 지원을 제공하는 Performance Flow 제품을 설계했습니다. Performance Flow는 직원, 기계 및 시설 간의 생산성을 극대화하고, 하드웨어, 소프트웨어, 데이터 분석, 워크플로우 분석, 재고 관리로 구성된 완벽하게 통합된 솔루션을 제공하고, 병원이 최적의 기술을 선택하고 규제 부담 위험을 줄이기 위한 독립적인 컨설팅을 실시했습니다.

따라서 위의 요인으로 인해 조사 대상 시장은 분석 기간 동안 성장할 것으로 예상됩니다.

병원 자산 추적 및 재고 관리 시스템 시장 동향

무선 자동 식별(RFID) 부문은 예측 기간 동안 강력한 성장이 예상됩니다.

RFID(Radio-frequency Identification) 부문은 예측 기간 중에 대폭적인 성장이 예상됩니다.

최근에는 건강 관리에서 수동 초고주파 무선 식별(UHF RFID) 무선 기술의 사용이 증가하고 있습니다. UHF 대역에서 RFID 시스템은 860 - 930MHz 범위에서 작동합니다. 또한, RFID 태그에서의 다양한 기업에 의한 기술 혁신이, RFID 태그를 비용 대비 효과가 뛰어나게 하고, 병원 자산 추적이나 재고 관리의 필요성을 높이고 있는 것이, 이 부문의 성장을 가속하고 있습니다.

예를 들어 2022년 4월 TrackCore Inc.는 Terso Solutions와 제휴하여 수동 트래킹 과정에서 병원이 경험하는 페인포인트를 만났습니다.

게다가 병원 수 증가는 병원이 자원을 추적하는데 도움이 되기 때문에 RFID 수요를 증대시키고 있습니다.

이와 같이 앞서 언급한 요인들로부터 RFID 부문은 분석 기간을 통해 시장에서 큰 점유율을 얻는 것으로 보입니다.

북미가 병원 자산 추적 및 재고 관리 시스템 시장을 독점할 전망

북미는 병원 수 증가, 더 나은 건강 관리 인프라, 이용 가능한 기술에 관한 사람들과 건강 산업 이해 관계자의 인식, 미국에 시장 기업이 집중하고 있는 등의 요인에 의해 시장을 독점할 것으로 예상됩니다. 국가 병원 협회의 데이터에 따르면, 2021년 미국의 병원 수는 6,093곳이었습니다.

또한, 특히 미국에서는 제품 출시, 제휴 및 인수가 증가하고 있으며, 시장 성장을 뒷받침하고 있습니다. 2022년 6월, Fresenius Kabi는 AmerisourceBergen와 제휴해 RFID 포트폴리오를 확대해 병원의 재고관리를 개선했습니다. Fresenius Kabi+RFID의 무선 주파수 태그가 달린 약제 포트폴리오는 AmerisourceBergen의 약제 트레이 솔루션과 호환성을 가지게 됩니다. Fresenius Kabi+RFID 의약품 라벨에 포함된 고성능 RAIN RFID 태그에는 병원이 즉시 재고를 식별, 식별 및 관리하는 데 필요한 중요한 정보가 포함되어 있습니다.

따라서 위의 요인으로부터 조사한 시장의 성장은 북미에서 예측됩니다.

병원 자산 추적 및 재고 관리 시스템 산업 개요

병원 자산 추적 및 재고 관리 시스템 시장은 세계 및 지역적으로 사업을 전개하는 기업이 다수 존재하기 때문에 그 성격상 적당히 통합되어 있습니다. 시장 내 주요 기업에는 GE Healthcare, Cybra Corporation, Stanley Healthcare, CenTrak Inc, Qorvo Inc, Airista Flow Inc, Honeywell International Inc, Sonitor Technologies, Jadak-A Novanta Company, Midmark Corporation, Elpas Solutions 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 병원에서 RFID와 RTLS 기술 수요 증가

- 병원에서의 보다 나은 자산 관리에 대한 수요 증가

- 의료시설 개선을 위한 병원 지출의 급증

- 시장 성장 억제요인

- 설치 및 유지 보수의 높은 비용

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 기술별

- 무선 자동 인식(RFID)

- 실시간 로케이팅 시스템(RTLS)

- 바코드 스캐너

- 소프트웨어 분석

- 기타

- 제품 유형별

- 모바일 기기

- 고정기기

- 기타 재고자산

- 용도별

- 기기 및 기구 추적

- 직원 및 소모품 추적

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- GE Healthcare

- Honeywell International Inc.

- Stanley Healthcare

- Zebra Technologies Corp.

- CenTrak Inc.

- Qorvo Inc.

- AiRISTA Flow Inc.

- Cybra Corporation

- Sonitor Technologies

- Jadak-A Novanta Company(Thinkmagic)

- Midmark Corporation

- Elpas Solutions

제7장 시장 기회와 앞으로의 동향

JHS 25.05.07The Hospital Asset Tracking And Inventory Management Systems Market size is estimated at USD 31.05 billion in 2025, and is expected to reach USD 40.58 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Globally, the hospital sector witnessed a significant impact of the COVID-19 outbreak in its initial stage due to a lack of better tracking systems, improper management of medical devices, and poor staff management. Therefore, this highlighted the need for technological solutions for better asset tracking and inventory management in hospitals. For instance, the United States Department of Health and Human Services results of a national survey in 2020 stated that hospitals reported that they were not able to maintain adequate staffing levels or offer staff adequate support during the COVID-19 pandemic.

Several countries reported that there was a shortage of crucial medical devices in hospitals during the COVID-19 outbreak. The US FDA published a device shortage list in 2020 to provide transparency to Americans, particularly those who use or purchase medical devices. Thus, such instances provided lucrative opportunities for key players within the hospital asset tracking and inventory management industry, thereby driving the market's growth during the pandemic phase. However, the market has reached its pre-pandemic nature in terms of demand for the systems and is expected to witness steady growth in the coming years.

Moreover, the upsurge in the use of RTLS and RFID in healthcare settings, growth in the demand for asset management, and increase in hospital spending, along with strategic developments such as product launches and approvals within the market are anticipated to drive the market's growth over the analysis period. In June 2022, Silicon Labs introduced its new Bluetooth location services solution using precise, low-power Bluetooth devices, which offers software that can track assets, improve indoor navigation, and more accurately find tags with sub-meter accuracy. In the same year, the platform was adopted by Borda Technology, which offers IoT for Healthcare for asset management and asset utilization. With such new product launches, the market studied is expected to grow significantly in the coming years.

In addition, the increasing awareness and need for better asset tracking solutions, innovation, product launches, partnerships, and acquisitions are boosting the market growth. For instance, in November 2021, Philips N.V. designed the Performance Flow product, which offers real-time operational decision support. Performance Flow maximizes productivity between employees, machinery, and facilities and offers a fully integrated solution made up of hardware, software, data analytics, workflow analysis, and inventory management, as well as independent consultancy to help hospitals choose the best technology and lower the risk of regulatory burden.

Therefore, owing to the aforementioned factors, the studied market is anticipated to witness growth over the analysis period. However, the high cost of installation and maintenance is likely to impede the market's growth.

Hospital Asset Tracking And Inventory Management Systems Market Trends

Radio-frequency identification (RFID) Segment is Expected to Witness Strong Growth Over the Forecast Period

The radio-frequency identification (RFID) segment is expected to witness substantial growth over the forecast period. Like barcode technology, RFID reads data from tags using radio waves rather than optically scanning the barcodes on labels. RFID's ability to read stored data without having to see the tag or label is one of its primary advantages, which is anticipated to drive the segment's growth.

In recent times, the use of passive ultra-high frequency radio frequency identification (UHF RFID) wireless technology in healthcare is on the rise. In the UHF band, RFID systems operate in the 860-930 MHz range. Owing to this, RFID is the leading wireless technology providing input data to the Internet of Things used across hospitals. Moreover, the innovations by different companies in RFID tags, making them a cost-effective and growing necessity for hospital asset tracking and inventory management, are driving the segment's growth.

For instance, in April 2022, TrackCore Inc. partnered with Terso Solutions to encounter pain points experienced by hospitals with manual tracking processes. These facilities may maintain a completely compliant workflow through automation by utilizing Terso's RFID in conjunction with TrackCore's electronic health record (EHR) and enterprise resource planning (ERP) connections. Over 900 hospitals in the United States are currently served by TrackCore, Inc.

Additionally, the increasing number of hospitals is augmenting the demand for RFIDs as it helps hospitals to track their resources. For instance, as per the data from the Ministry of Health and Family Welfare (India) published in April 2022, Uttar Pradesh state had the largest number of hospitals in India and the number of multispecialty hospitals is on the rise all over the country.

Thus, due to the aforementioned factors, the RFID segment is expected to garner a significant share of the market throughout the analysis period.

North America is Expected to Dominate the Hospital Asset Tracking and Inventory Management Systems Market

North America is expected to dominate the market owing to factors such as the growing number of hospitals, better healthcare infrastructure, awareness among people and healthcare industry stakeholders about available technologies, and the high concentration of market players in the United States. According to the American Hospital Association data for 2022, there were a total of 6,093 hospitals in the United States during the year 2021. Thus, the presence of these hospitals necessitates the adoption of asset tracking and inventory management solutions across the region, in turn, driving market growth.

Moreover, the increasing number of product launches, partnerships, and acquisitions, particularly in the United States, is bolstering the market's growth. For instance, in June 2022, Fresenius Kabi partnered with AmerisourceBergen to expand its RFID portfolio to improve hospital inventory management. Fresenius Kabi +RFID's portfolio of radio frequency-tagged medications will now be compatible with AmerisourceBergen's medication tray solution. AmerisourceBergen, one of the pharmaceutical distributors in the United States, offers a medication tray solution that uses cutting-edge Radio Frequency Identification (RFID) technology to assist hospitals in better managing their medication inventory visibility and tracking. A high-performance RAIN RFID tag implanted on the label of Fresenius Kabi +RFID pharmaceuticals contains the vital information hospitals need to instantly identify, locate, and manage their inventory.

Therefore, owing to the above-mentioned factors, the growth of the studied market is anticipated in the North American region.

Hospital Asset Tracking And Inventory Management Systems Industry Overview

The hospital asset tracking and inventory management systems market is moderately consolidated in nature due to the presence of the number of companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold significant market share and are well known. Some of the key players within the market include GE Healthcare, Cybra Corporation, Stanley Healthcare, CenTrak Inc, Qorvo Inc, AiRISTA Flow Inc, Honeywell International Inc, Sonitor Technologies, Jadak- A Novanta Company, Midmark Corporation, Elpas Solutions among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand of RFID and RTLS Technology Across Hospital Settings

- 4.2.2 Growing Demand for Better Asset Management in Hospitals

- 4.2.3 Surge in Hospital Spending for Improved Healthcare Facilities

- 4.3 Market Restraints

- 4.3.1 High Cost of Installation and Maintenance

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Technology

- 5.1.1 Radio-frequency identification (RFID)

- 5.1.2 Real-time locating systems (RTLS)

- 5.1.3 Barcode Scanners

- 5.1.4 Software Analytics

- 5.1.5 Others

- 5.2 By Product Type

- 5.2.1 Mobile Equipment

- 5.2.2 Fixed Equipment

- 5.2.3 Other Inventories

- 5.3 By Application

- 5.3.1 Device & Instruments Tracking

- 5.3.2 Staff & Supplies Tracking

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 GE Healthcare

- 6.1.2 Honeywell International Inc.

- 6.1.3 Stanley Healthcare

- 6.1.4 Zebra Technologies Corp.

- 6.1.5 CenTrak Inc.

- 6.1.6 Qorvo Inc.

- 6.1.7 AiRISTA Flow Inc.

- 6.1.8 Cybra Corporation

- 6.1.9 Sonitor Technologies

- 6.1.10 Jadak- A Novanta Company (Thinkmagic)

- 6.1.11 Midmark Corporation

- 6.1.12 Elpas Solutions