|

시장보고서

상품코드

1692534

북미의 도시 보안 스크리닝 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)North America Urban Security Screening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

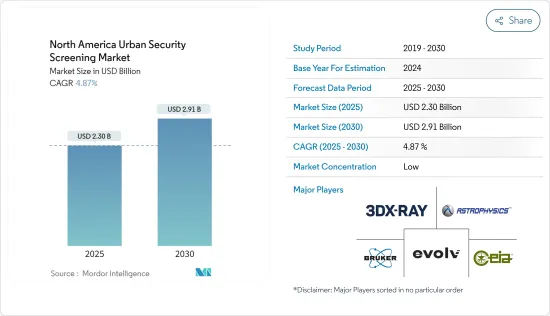

북미의 도시 보안 스크리닝 시장 규모는 2025년에 23억 달러로 추정되고, 2030년에는 29억 1,000만 달러에 달할 것으로 예측되고, 예측 기간 중(2025-2030년)의 CAGR은 4.87%를 나타낼 전망입니다.

다양한 공공 및 중요 기반 시설에 대한 테러 공격 위협이 증가함에 따라 특히 국경 검문소, 정부 기관, 스포츠 단지, 행사장 등의 장소에서 관련 위험 요소를 완화하기 위해 보안 스크리닝이 필수적입니다.

X-선 수하물 스캔 장치는 관공서, 기업 시설, 대중교통 시스템(MRTS) 등 보안이 엄격한 장소에서 사용됩니다.

각국 정부는 경제 성장을 위해 스마트 시티를 개발하는 데 중요한 역할을 하고 있습니다. 그들은 혁신 도시 보안 스크리닝 시장 발전을 위해 인프라를 확보하고 규제를 통과시키고 있습니다.

많은 기업이 자동화된 보안 심사 프로세스를 개발하여 시장의 성장을 더욱 촉진하고 있습니다.

비용 문제는 종종 가장 먼저 제기되는 문제 중 하나입니다. 금속 탐지기에 대한 초기 투자는 금속 탐지기를 운영하는 데 필요한 전체 자원의 극히 일부에 불과합니다. 워크스루 금속 탐지기는 값비싼 초기 구매 비용 외에도 지속적인 유지보수가 필요합니다. 고정형 금속 탐지기의 가격은 1,000달러에서 30,000달러까지 다양합니다.

COVID-19의 대유행에도 불구하고, 시장의 공급업체들은 다양한 최종 사용자 산업의 강력한 수요를 충족하기 위해 데이터 센터 건설을 진행하고 있으며, 이는 시장의 성장을 더욱 촉진하고 있습니다. 북미 지역의 데이터센터에 대한 수요는 여전히 높습니다. 2021년 3월, 아마존은 팬데믹으로 인한 대역폭 수요 증가에 대응하기 위해 버지니아주 루던 카운티에 3개의 데이터 센터를 빠르게 건설할 계획이라고 발표했습니다.

북미의 도시 보안 스크리닝 시장 동향

관공청이 최종 사용자로 급성장

- 정부는 정부청사의 X-선 검사장치에 크게 공헌하고 있습니다.

- 보안 문제는 중요한 문제입니다. 정부와 민간 기업은 이 지역에서 테러 활동이 증가함에 따라 상당한 금액을 투자하고 있습니다. 보안 점검 및 감시는 법원, 대사관, 국회의사당, 정부 은행, 도서관 등과 같은 정부 건물과 테러 공격의 잠재적 위험이 있는 기타 보안이 중요한 장소에서 우려되는 분야입니다.

- 캐나다 정부는 공공 부문의 건설 수요를 해결하는 데 초점을 맞춘 많은 새로운 연방 서비스 부서를 출범시켜 시장의 성장을 주도하고 있습니다. 예를 들어, 2022년 2월 캐나다의 40대 건설업체 중 하나인 Govan Brown은 공공 부문의 건설 수요를 해결하고 정부 재산을 포함한 캐나다 국가 자산의 가치를 높이기 위한 새로운 부서를 신설한다고 발표했습니다.

- 미국 인구조사국에 따르면 미국의 연방공공건설액은 2021년 40억 달러 이상 감소했습니다.

- 시장에 진출한 기업들은 다양한 고객에게 서비스를 제공하고 이들로부터 수익을 창출하기 위해 제품에 고급 기능을 통합하고 있습니다. 예를 들어, 2021년 10월 3D 투시 기술을 기반으로 첨단 엑스레이 보안 시스템을 개발하는 캐나다 기술 회사인 VOTI Detection Inc.는 글로벌 어페어 캐나다로부터 전 세계 캐나다 대사관에 엑스레이 스캐닝 시스템을 공급하는 3년 계약을 체결했습니다.

- 이 3년 계약에는 2022년 1월까지 납품되는 20대의 스캐닝 시스템의 초기 주문이 포함됩니다. 세계의 Affers Canada는 캐나다 국내 세계의 Affers Building과 세계의 캐나다 대사관에서 위협 검진을 위한 엑스레이 장비를 제공할 의무가 있었습니다.

미국이 큰 시장 점유율을 차지할 것으로 예상

- 총기 소유, 대량 총격 사건, 팬데믹 인식에 대한 현재의 거시적 추세는 이 지역의 도시 보안 검사 장비에 대한 수요를 주도하고 있습니다.

- 보안은 미국의 의료 리더들에게 우선 순위입니다. 총기 폭력 기록 보관소에 따르면 2021년에 미국에서 693건의 대량 총격 사건이 발생했는데, 이는 대부분의 사람들이 자유롭게 모일 수 없었던 한 해 동안의 기록입니다.

- 이러한 사건을 줄이기 위해 노스웰 헬스는 2022년 8월 뉴하이드 파크의 롱 아일랜드 유대인 의료 센터, 베이 쇼어의 사우스 쇼어 대학 병원, 맨해튼의 레녹스 헬스 그리니치 빌리지 입구에 무기 및 밀수품을 검사하는 첨단 종합 탐지 시스템을 도입하여 의료 시스템 내 모든 병원에 이 기술을 도입하기 위한 노력을 기울이고 있습니다.

- 미국의 교정 시설은 교도소와 감옥으로 유입되는 마약, 특히 마약 및 기타 유해 물질이 묻은 종이의 유입을 막기 위해 고군분투하고 있습니다. 마약이 묻은 종이는 건조되면 사람의 눈에 띄지 않기 때문에 밀수에 이상적인 소재가 될 수 있습니다.

- 우편물은 불법 약물과 밀수품을 교정 시설로 밀반입하는 가장 대표적인 수단입니다. 우편물 유입으로 인해 우편물 검사관과 교도관이 유해 물질에 노출될 위험이 커지고 재소자의 약물 과다 복용과 사망이 증가했습니다. 이 문제를 해결하기 위해 2022년 8월, 데스크톱 T-레이 보안 이미징 스캐너의 저명한 공급업체인 RaySecur는 불법 약물이 묻은 서류를 감지하는 T-Suite 이미지 처리 플랫폼의 확장을 발표했습니다. 미국 세관국경보호국(CBP)에 따르면 2022년 10월까지 미국에서 총 655,780파운드의 마약이 압수되어 시장에서 엑스레이 검색 제품의 사용이 더욱 증가하고 있습니다.

북미의 도시 보안 스크리닝 산업 개요

북미의 도시 보안 스크리닝 시장은 3D X-Ray Ltd., Astrophysics Inc., Bruker Corporation, Evolv Technologies 등의 주요 기업에 의해 세분화되어 있습니다.

2022년 9월, 미국 운수 보안국(TSA)은 스미스 디텍션의 HI-SCAN 6040 CTiX X-선 스캐너를 체크포인트 특성 스크리닝 시스템(CPSS)의 중간 규모 인증 제품 목록(QPL)에 추가했습니다.

2022년 2월, Evolv Technology는 Evolv Express의 개선 사항을 발표했습니다. 이 시스템은 행사장 입구에서 수집한 무기 검사 및 탐지 데이터를 마일스톤 비디오 관리 시스템(VMS) 및 타이탄 HST 대량 알림 시스템과 통합한 최초의 시스템으로, Evolv Express의 검사 인텔리전스를 보완 보안 기술로 확장하고 행사장 보안 전문가들의 관리를 간소화 및 개선합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- COVID-19의 산업에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 보안 검사 산업, 특히 지능형 위협 탐지 등의 자동화 증가

- 지역 전역의 테러 활동 급증

- 학교 및 대학의 보안 검사에 대한 정부 대처 증가

- 스마트시티에 대한 정부의 대처 증가

- 시장 성장 억제요인

- 지정 학적 시나리오 및 COVID-19 대유행 등으로 인한 공급망 문제

- 높은 설치 비용 및 유지 보수 비용

제6장 시장 세분화

- 제품 유형별

- X-선

- 밀리미터파

- 금속 감지기

- 방사선 검출

- 화학 물질 및 미량 검출

- 최종 사용자 산업별

- 기업 빌딩

- 우편실 스크리닝

- 창고 및 물류

- 관공청 빌딩

- 수송

- 데이터센터

- 법 집행 기관

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 프로파일

- 3DX-Ray Ltd(Image Scan Holdings PLC)

- Astrophysics Inc.

- Bruker Corporation

- CEIA SpA

- Evolv Technologies

- Leidos

- Liberty Defense

- Linev Systems US Inc.

- Nuctech Company Ltd

- Rapiscan Systems Limited

- Rohde & Schwarz

- Smiths Detection Group Ltd

- Tek84 Inc.

- Teledyne Flir LLC

- Thermo Fisher Scientific Inc.

- Vehant Technologies

- VOTI Detection Inc.

The North America Urban Security Screening Market size is estimated at USD 2.30 billion in 2025, and is expected to reach USD 2.91 billion by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

With the increasing terror attack threats at various public and critical infrastructures, security screening is vital, especially for places like border checkpoints, government organizations, sports complexes, event stages, etc., to help mitigate the associated risk factor.

X-ray baggage scanning devices are used in high-security places like government offices, corporate establishments, and the Mass Rapid Transit System (MRTS). Optional features such as network supervisory workstation (NSW), video management, and threat image projection (TIP) are employed along with these scanners to make them more effective and efficient.

The national governments play a crucial role in developing smart cities to enhance their economic growth. They are acquiring infrastructure and passing regulations favoring the development of the security screening market across the innovative city sector. For instance, the United States House and Senate unanimously passed bipartisan legislation to maintain and improve career and technical education through creative learning to help Americans obtain skills needed for jobs.

Many companies are developing the automated security screening process, further driving the market's growth. For instance, Genetec launched a mission control solution to automate the screening process and establish effective and standardized procedures for staff and visitors to maintain proper health safety measures and minimize the risk of outbreaks.

Cost is frequently one of the first issues brought up. The initial investment in the metal detector is only a tiny portion of the overall resources required to run it. Walk-through metal detectors require ongoing maintenance in addition to an expensive initial purchase. The price of a fixed metal detector can range from USD 1,000 to USD 30,000. According to a National Institute of Justice assessment, models in the USD 4,000 to USD 5,000 price range often offer characteristics best suited for various environments.

Despite the COVID-19 pandemic, vendors in the market are progressing toward constructing data centers to cater to the strong demand from various end-user industries, further driving the market's growth. Demand for data centers in North America remains high. In March 2021, Amazon announced plans to fast-track the construction of three data centers in Loudoun County, Virginia, likely in response to the increasing demand for bandwidth due to the pandemic.

North America Urban Security Screening Market Trends

Government Buildings to be the Fastest Growing End-user

- The government significantly contributes to x-ray machines in government buildings. Government agencies are increasingly adopting digital imaging to enhance productivity and provide greater access to certain information types. The increasing spending on adopting X-ray machines is expected to boost the market's growth.

- Security concerns are a significant issue. Governments and private enterprises invest considerable amounts of money owing to growing terrorist activity in the region. Security checks and surveillance are an area of concern in government buildings like courthouses, embassy houses, parliament houses, government banks, libraries, etc., and other security-critical places with a potential risk of terrorist attacks.

- The Canadian government launched many New Federal Services Divisions focused on addressing the construction needs of the public sector, which drives the market's growth. For instance, in February 2022, Govan Brown, one of Canada's top 40 contractors, announced a new division for addressing the construction needs of the public sector and enhancing the value of Canada's national assets, including government property.

- According to the US Census Bureau, the value of federal public construction in the United States declined by over USD 4 billion in 2021.

- The companies in the market are incorporating advanced features in their products to serve a wide range of customers and generate revenue from them. For instance, in October 2021, VOTI Detection Inc., a Canadian technology company that develops advanced X-ray security systems based on 3D perspective technology, was awarded a three-year contract from Global Affairs Canada to supply x-ray scanning systems to Canadian embassy locations worldwide.

- The three-year contract included an initial order for 20 scanning systems to be delivered by January 2022. Global Affairs Canada was mandated to provide x-ray machines for threat screening at Global Affairs buildings in Canada and Canadian embassies worldwide.

United States is Expected to Hold a Major Market Share

- The current macro trends in firearms ownership, mass shootings, and pandemic awareness drive the region's demand for urban security screening equipment.

- Security is a priority for healthcare leaders in the United States. However, in the wake of mass shootings, several hospitals realized gaps in their safety strategies that must be addressed. According to EvolvTechnologies, 444 million privately-owned guns are in circulation in the United States. According to the Gun Violence Archive, in 2021, there were 693 mass shootings in the United States, a record in a year when most people were not free to gather. In June 2022, a mass shooting at a Tulsa, Oklahoma, hospital left four people dead, and a second hospital shooting occurred on the same day in Dayton, Ohio, causing prominent damage.

- To mitigate such events, in August 2022, Northwell Health implemented advanced comprehensive detection systems to screen for weapons and contraband at the entrances of Long Island Jewish Medical Center in New Hyde Park, South Shore University Hospital in Bay Shore, and Lenox Health Greenwich Village in Manhattan as an effort to bring the technology to all hospitals in the health system.

- Correctional facilities in the United States are struggling to stem the flow of drugs into prisons and jails, particularly papers soaked with drugs and other harmful substances. When dried, drug-laced papers can be undetectable to humans, making the papers an ideal substrate for smuggling.

- Postal mail is a top way of smuggling illicit drugs and contraband into correctional facilities. The influx augmented the exposure risk for mail screeners and correctional officers to harmful substances and resulted in increased inmate overdoses and deaths. To combat this issue, in August 2022, RaySecur, a prominent provider of desktop T-ray security imaging scanners, announced an expansion of its T-Suite Image Processing Platform for detecting papers laced with illicit drugs. According to CBP, in 2022, till October, a total of 655,780 lbs of the drug got seized in the United States, further boosting the usage of x-ray screening products in the market.

North America Urban Security Screening Industry Overview

The North American urban security screening market is fragmented with major players like 9.1 3DX-Ray Ltd, Astrophysics Inc., Bruker Corporation, and Evolv Technologies. These companies are adopting various strategies to expand their market share, including product development, mergers, and geographic expansions.

In September 2022, the US transportation security administration (TSA) added Smiths Detection's HI-SCAN 6040 CTiX X-ray scanner to its Checkpoint Property Screening System (CPSS) Mid-Size Qualified Products List (QPL). This scanning system was designed to produce high-quality 3D images to facilitate faster baggage assessment using visual operator inspection and automated object recognition.

In February 2022, Evolv Technology announced enhancements to Evolv Express. It is the first system to integrate weapons screening and detection data collected at venue entrances with Milestone Video Management System (VMS) and Titan HST mass notification system, further expanding Evolv Express' screening intelligence to complementary security technologies and simplifying and improving management for venue's security professionals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation in the Security Screening Industry, Especially to Detect Advanced Threats, etc.

- 5.1.2 Upsurge in Terror Activities Across the Region

- 5.1.3 Increasing Government Initiatives on Security Inspection in Schools and Colleges

- 5.1.4 Increasing Government Initiatives for Smart Cities

- 5.2 Market Restraints

- 5.2.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic, etc.

- 5.2.2 High Installation and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 X-ray Products

- 6.1.2 Millimeter Wave Products

- 6.1.3 Metal Detectors

- 6.1.4 Radiation Detection Products

- 6.1.5 Chemicals and Trace Detection Products

- 6.2 By End-user Industry

- 6.2.1 Corporate Buildings

- 6.2.2 Mailroom Screening

- 6.2.3 Warehouse and Logistics

- 6.2.4 Government Buildings

- 6.2.5 Transportation

- 6.2.6 Data Centers

- 6.2.7 Law Enforcement

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3DX-Ray Ltd (Image Scan Holdings PLC)

- 7.1.2 Astrophysics Inc.

- 7.1.3 Bruker Corporation

- 7.1.4 CEIA SpA

- 7.1.5 Evolv Technologies

- 7.1.6 Leidos

- 7.1.7 Liberty Defense

- 7.1.8 Linev Systems US Inc.

- 7.1.9 Nuctech Company Ltd

- 7.1.10 Rapiscan Systems Limited

- 7.1.11 Rohde & Schwarz

- 7.1.12 Smiths Detection Group Ltd

- 7.1.13 Tek84 Inc.

- 7.1.14 Teledyne Flir LLC

- 7.1.15 Thermo Fisher Scientific Inc.

- 7.1.16 Vehant Technologies

- 7.1.17 VOTI Detection Inc.