|

시장보고서

상품코드

1911700

접착제 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

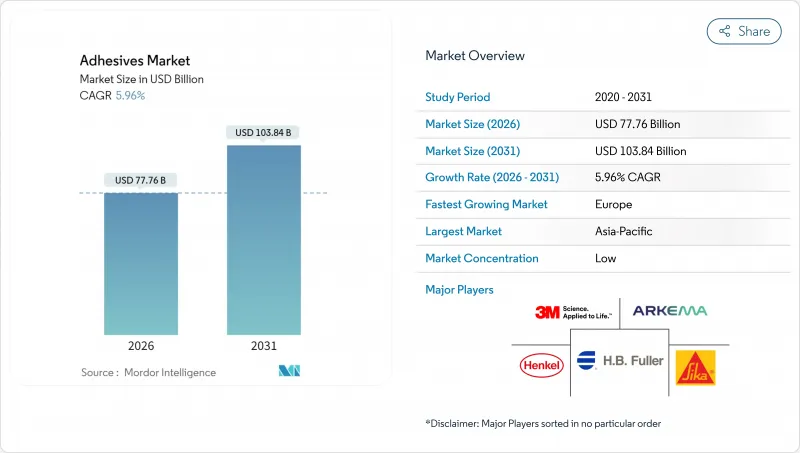

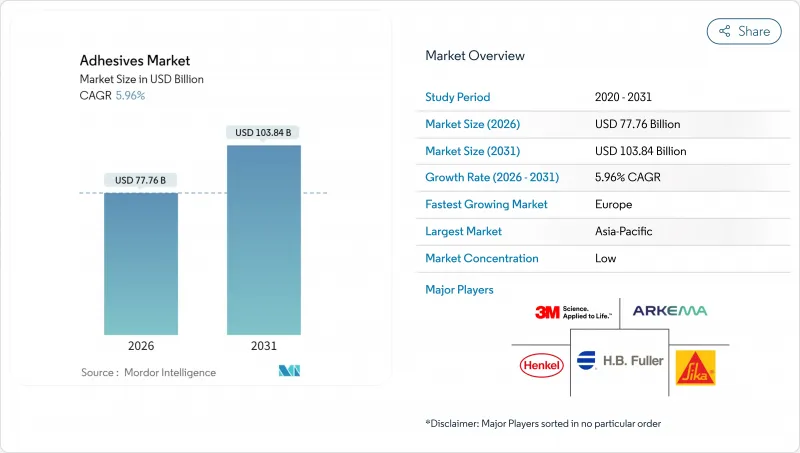

접착제 시장은 2025년의 733억 9,000만 달러에서 2026년에는 777억 6,000만 달러로 성장하고 2026년부터 2031년에 걸쳐 CAGR 5.96%로 성장을 지속하여, 2031년까지 1,038억 4,000만 달러에 달할 전망입니다.

전자상거래에 따른 포장 자동화 확대, 인프라 사업에서의 구조 접착의 우선순위 증가, 자동차 제조업체에 의한 경량 복합재 설계를 지원하는 접착제 사용량 증가에 의해 수요는 급증하고 있습니다. 브랜드가 VOC 규제치를 충족시키는 필요성으로 인해 수성 화학제품이 주류를 차지하는 한편, 용제가 불필요한 가공성과 고속 라인 대응에 의해 핫멜트 플랫폼의 점유율이 확대되고 있습니다. 수지 분야에서는 아크릴계가 고성능 용도로 계속 주도적 지위를 유지하는 한편, VAE/EVA계는 유연성과 비용 효율의 크기로 인해 건설 분야에서의 수요를 획득하고 있습니다. 지역별 동향은 분리되어 있으며 아시아태평양이 수량 성장을 견인하는 한편, 유럽에서는 규제에 대응하는 고부가가치 등급이 확대되고 있습니다.

세계의 접착제 시장의 동향 및 인사이트

전자상거래의 급성장으로 안전하고 빠른 포장용 접착제에 대한 수요 증가

온라인 소매 창고에서는 밀리초 단위로 경화하면서도 컨베이어 충격이나 복합 수송에 견디고, 소포의 무결성을 유지하는 핫멜트 및 감압 접착제 등급이 채용되고 있습니다. 풀필먼트 센터에서는 두 자릿수의 주문 증가를 보고했으며, 주요 EC 회랑에서 포장용 접착제 수요량은 15-20% 증가하고 있습니다. 인도는 온라인 소매 부문에서만 2024년 포장용 접착제 수요가 18% 증가했습니다. 이는 브랜드 소유자가 열대 기후에 적합한 변조 방지 씰을 의무화했기 때문입니다. 지속가능성 목표는 종이 재활용 공정과 호환되는 수성 및 바이오 유래 옵션에 추가적인 기세를 더합니다. 포장업자는 현재 기재를 깨끗한 상태로 유지하고 2차 섬유 회수를 용이하게 하는 박리 등급을 지정하고 있습니다.

세계의 건설 부문 업 사이클이 구조용 및 마루용 접착제의 소비를 높임

아시아태평양의 메가 프로젝트 계획이 가속화되고 기계적 체결이 비효율적이거나 고장 위험이 높은 콘크리트, 강재 및 복합재 접합용으로 고강도 속경화형 배합 수요가 높아지고 있습니다. 대형 타일과 조립식 패널에는 시공 사이클 단축과 구조적 무결성을 높이는 전단 저항성 접착제가 요구되고 있습니다. 바커 케미칼사는 2024년 타일 및 단열 시스템용 건설용 접착제 수요 증가에 대응하기 위해 난징과 캘버트 시티에서 VAE 생산 능력을 확대하였습니다. 유럽 및 북미의 에너지 보수 인센티브는 기류 차단 실란트 및 단열 접착제에 대한 수요를 지속하고 있습니다. 한편, 개정된 건축 기준법은 내진성과 열교량 저감을 위한 접착 접합을 권장하고 있습니다.

석유 원료 가격 변동이 제조업체의 이익률을 압박

에틸렌 및 프로필렌과 같은 원유 연동형 단량체는 접착제 원료 비용의 최대 60%를 차지합니다. 2024년에는 아크릴산 가격이 25-30% 변동하여 특히 헤지 능력이 없는 중소 컨버터 기업에서 분기별 추가 요금이 이익률을 압박했습니다. 환율변동은 세계 시장에 조달하고 현지에서 청구하는 기업의 부담을 증대시킵니다. 변동 위험을 완화하기 위해 제조업체는 이중 조달 및 재고 위험 전략을 채택하고 있지만, 이들은 물류의 복잡화와 운전 자금 수요 증가를 초래합니다.

부문 분석

아크릴 시스템은 건축 외관, 자동차 인테리어 및 점착 라벨의 내후성 성능으로 인해 2025년 세계의 접착제 시장에서 22.60%의 점유율을 차지했습니다. VAE/EVA 제품 라인은 유연한 바닥재, 타일 고정, 포장 필름 라미네이션에 대한 수요 증가로 2031년까지 연평균 복합 성장률(CAGR) 6.28%로 성장할 전망입니다. 폴리우레탄계 등급은 높은 접착 강도, 내약품성, 탄성이 중요한 수송기기 및 항공우주 분야에서 확고한 지위를 유지하고 있습니다. 에폭시계는 극단적인 열이나 피로에 직면하는 전자기기나 풍력 블레이드 접합부에 사용되지만, 경화 사이클이 길기 때문에 성장은 늦어지고 있습니다. 하이브리드 화학 기술은 현재 아크릴의 자외선 내성과 폴리우레탄의 강인성, 또는 VAE의 유연성과 에폭시의 강성을 조합하여 배합 설계자의 설계를 확대하고 있습니다.

수지의 지속적인 혁신으로 컨버터가 특정 기재 및 사용 환경에 맞게 성능을 미세조정하는 가운데, 세계의 접착제 시장은 계속 확대되고 있습니다. 아크릴계 제조업체는 내수백화성을 높이는 자기가교성 에멀젼에 투자하고, VAE 공급업체는 저표면 에너지 필름에 대한 접착성을 향상시키기 위해 극성 단량체 함량을 늘리고 있습니다. 바이오 원료 수요가 증가하고 있지만, 비용과 공급량의 확대 가능성이 급속한 보급을 제한하고 있습니다. 전략적 수지 선정에서는 규제 적합성, 사용 온도, 총 적용 비용 간의 균형이 점점 중시되고 있으며, 제조업체는 상품화된 최종 용도에서 차별화를 도모할 수 있게 되었습니다.

본 접착제 시장의 보고서는 수지별(폴리우레탄, 에폭시, 아크릴, 시아노아크릴레이트, VAE/EVA 등), 기술별(수성, 용제계, 반응성 등), 최종 사용자 산업별(건축 및 건설, 포장, 자동차, 항공우주, 목공 및 건설공구 등), 지역별(아시아태평양, 북미, 유럽 등)로 구성되어 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

아시아태평양은 중국, 인도, 동남아시아의 집중적인 제조 클러스터와 공공 인프라 투자로 세계의 접착제 시장의 36.30%를 차지하고 있습니다. 중국의 도시 철도 및 주택 프로젝트는 구조용 아크릴 수지에 대한 수요를 촉진하고 인도의 타일 접착제 부문은 급속한 도시 주택 건설로 연간 15% 이상의 성장을 보이고 있습니다. 헨켈 및 테사와 같은 신규 공장을 포함한 지역 공급업체는 현지 공급 시스템을 강화하고 리드 타임을 단축하고 있습니다. 특히 EVA와 아크릴 에멀젼에서는 예정된 증산이 다운스트림 수요의 둔화에 의해 과잉 재고 위험을 수반하기 때문에 생산 능력 과잉에 대한 우려가 계속되고 있습니다.

유럽은 2031년까지 연평균 CAGR 6.25%로 가장 높은 성장이 전망되고 있습니다. 이는 규제 강화로 가공업자가 재생 가능한 저배출 시스템으로 이행하고 있기 때문입니다. 2026년 시행 예정인 EU 포장 및 포장폐기물 규제에서는 기계적 재활용 공정에서 완전히 분리 가능하고 PFAS를 포함하지 않는 접착제가 요구됩니다. 독일의 EV 이행은 열전도성 및 난연성 접착제 수요를 견인하고, 프랑스의 건축 개보수 보조금 제도는 단열재용 접착제 수요를 자극하고 있습니다.

북미에서는 관세로 인한 단량체에 대한 투자가 공급 안정성을 강화하고 꾸준한 성장을 유지하고 있습니다. 2025년 이후 가동 예정인 아크릴산 생산 능력(미국 멕시코 걸프 지역)은 수입 의존도를 낮추고, 수송 시간을 단축하여 지역의 배합 제조업체를 뒷받침할 전망입니다. 멕시코는 자동차 수출 거점으로서의 역할로 인해 구조용 및 헴 플랜지용 접착 시스템 수요가 증가하는 한편 캐나다에서는 한랭지 건축 기준에 의해 패널 주택용 동결 내성 접착제가 선호되고 있습니다. 이 동향은 인프라 법안의 진척과 자동차 생산 사이클에 좌우되지만, 생산 회귀와 지속가능성 이니셔티브를 배경으로 계속 호조를 유지할 전망입니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 전자상거래의 급성장에 의해 안전하고 빠르게 경화하는 포장용 접착제에 대한 수요 확대

- 세계의 건설 경기 호황에 의해 구조용 및 바닥용 접착제의 소비량 증가

- 경량화와 EV 플랫폼이 자동차용 접착제의 보급을 가속화

- AI를 활용한 배합 최적화에 의해 연구 개발 기간 및 커스텀 접착 비용 대폭 절감

- 2025년 미국 관세 이후 아크릴 단량체 공급의 니어쇼어링이 지역 생산 능력을 재구축

- 억제요인

- 석유 원료 가격의 변동이 접착제 제조업체의 이익률을 압박

- 휘발성 유기 화합물(VOC) 및 화학물질 규제의 강화가 용제계 접착제의 판매를 억제

- 고급 접착제 조합 기술자의 세계적인 부족에 의해 상품화 사이클 지연

- 밸류체인 분석

- Porter's Five Forces

- 공급자의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 수지별

- 폴리우레탄

- 에폭시 수지

- 아크릴

- 시아노아크릴레이트

- VAE/EVA

- 실리콘

- 기타 수지

- 기술별

- 수성

- 용제계

- 반응성

- 핫멜트

- UV 경화형 접착제

- 최종 사용자 업계별

- 건축 및 건설

- 포장

- 자동차

- 항공우주산업

- 목공 및 건설공구

- 신발 및 가죽 제품

- 의료

- 기타 최종 사용자 산업

- 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 인도네시아

- 말레이시아

- 싱가포르

- 태국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%) 및 순위 분석

- 기업 프로파일

- 3M

- Aica Kogyo Co..Ltd.

- Arkema

- AVERY DENNISON CORPORATION

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

제7장 시장 기회 및 미래 전망

CSM 26.01.28The Adhesives market is expected to grow from USD 73.39 billion in 2025 to USD 77.76 billion in 2026 and is forecast to reach USD 103.84 billion by 2031 at 5.96% CAGR over 2026-2031.

Demand accelerates as packaging automation scales with e-commerce, infrastructure programs prioritize structural bonding, and automakers increase adhesive volumes to support lightweight multi-material designs. Water-borne chemistries dominate because brands must meet VOC limits, yet hot-melt platforms gain share through solvent-free processing and rapid line speeds. Within resins, acrylics continue to rule high-performance applications, while VAE/EVA lines capture construction volumes thanks to flexibility and cost efficiency. Regional dynamics diverge, with Asia-Pacific supplying volume growth and Europe advancing premium, regulation-ready grades.

Global Adhesives Market Trends and Insights

E-commerce Boom Enlarging Demand for Secure, High-Speed Packaging Adhesives

Online retail warehouses rely on hot-melt and pressure-sensitive grades that cure in milliseconds yet sustain box integrity through conveyor impacts and multi-modal shipping. Fulfilment centers report double-digit order growth, driving 15-20% volume increases for packaging adhesives in key e-commerce corridors. India's online retail sector alone lifted packaging-adhesive offtake by 18% in 2024 as brand owners mandated tamper-evident bonds suitable for tropical climates. Sustainability goals add momentum for water-borne and bio-sourced options compatible with paper recycling streams. Packagers now specify easily removable grades that leave substrates clean, easing secondary fiber recovery.

Global Construction Upcycle Raising Consumption of Structural and Flooring Adhesives

Megaproject pipelines in Asia-Pacific accelerate uptake of high-strength, fast-set formulations for concrete, steel, and composite bonding where mechanical fasteners are slow or prone to failure. Large-format tiles and pre-fabricated panels need shear-resistant adhesives that shorten installation cycles and enhance structural integrity. Wacker Chemie expanded VAE capacity in Nanjing and Calvert City during 2024 to serve rising construction-adhesive demand in tile and insulation systems. Energy-retrofit incentives in Europe and North America sustain airflow-sealant and insulation-adhesive volumes, while updated building codes champion bonded joints for seismic resilience and thermal-bridge reduction.

Petro-Feedstock Price Volatility Squeezing Manufacturer Margins

Crude-linked monomers such as ethylene and propylene account for up to 60% of adhesive raw-material cost. Acrylic-acid prices swung 25-30% during 2024, forcing quarterly surcharges that erode margins, especially for smaller converters without hedging power. Currency shakiness multiplies the burden for firms that source globally but invoice locally. To blunt volatility, producers adopt dual-sourcing and inventory-risk strategies, yet these raise logistics complexity and working-capital needs.

Other drivers and restraints analyzed in the detailed report include:

- Lightweighting and EV Platforms Accelerating Automotive Adhesive Penetration

- Near-Shoring of Acrylic Monomer Supply in the United States

- Escalating VOC and Chemicals Regulation Curbing Solvent-Borne Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems held a 22.60% share of the global adhesives market in 2025, supported by weather-resistant performance across construction facades, automotive trim, and pressure-sensitive labels. VAE/EVA lines are growing at a 6.28% CAGR through 2031, propelled by flexible flooring, tile-setting, and packaging-film lamination. Polyurethane grades stay entrenched in transportation and aerospace where high bond strength, chemical resistance, and elasticity are critical. Epoxies serve electronics and wind-blade joints that face extreme heat and fatigue, though their growth lags due to longer cure cycles. Hybrid chemistries now combine acrylic UV resistance with polyurethane toughness or VAE flexibility with epoxy rigidity, widening formulator toolkits.

Continuous resin innovation keeps the global adhesives market expanding as converters fine-tune performance for specific substrates and service environments. Acrylic players invest in self-crosslinking emulsions that boost water whitening resistance, while VAE suppliers ramp polar-monomer content to enhance adhesion to low-surface-energy films. Demand for bio-based feedstocks rises, yet cost and supply scalability limit rapid penetration. Strategic resin selection increasingly balances regulatory compliance, service temperature, and total applied cost, enabling manufacturers to differentiate within commoditized end uses.

The Adhesives Report is Segmented by Resin (Polyurethane, Epoxy, Acrylic, Cyanoacrylate, VAE/EVA, and More), Technology (Water-Borne, Solvent-Borne, Reactive, and More), End-User Industry (Building and Construction, Packaging, Automotive, Aerospace, Woodworking and Joinery, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia-Pacific holds 36.30% of the global adhesives market thanks to concentrated manufacturing clusters and public infrastructure spending across China, India, and Southeast Asia. China's urban rail and residential projects spur demand for structural acrylics, while India's tile-adhesive segment grows more than 15% annually on rapid urban housing. Regional suppliers, including new Henkel and tesa plants, enhance local availability and cut lead times. Overcapacity concerns persist, particularly in EVA and acrylic emulsions, where planned expansions risk surplus inventory if downstream uptake slows.

Europe is forecast to post the fastest 6.25% CAGR through 2031 as regulations push converters toward recyclable, low-emission systems. The EU Packaging and Packaging Waste Regulation, effective in 2026, will require adhesives that separate cleanly in mechanical recycling streams and eliminate PFAS content. Germany's EV transition drives demand for thermally conductive and flame-retardant adhesives, while France's building-retrofit subsidies stimulate insulation-bond volumes.

North America records steady momentum as tariff-induced monomer investments bolster supply security. Gulf Coast acrylic-acid capacity coming online from 2025 lessens reliance on imports and supports regional formulators with shorter transit times. Mexico's role as an automotive export hub lifts demand for structural and hem-flange bonding systems, whereas Canada's cold-weather construction codes favor freeze-resistant adhesives for panelized housing. The trajectory hinges on infrastructure-bill progress and automotive production cycles but remains positive amid reshoring and sustainability commitments.

- 3M

- Aica Kogyo Co..Ltd.

- Arkema

- AVERY DENNISON CORPORATION

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- MAPEI S.p.A.

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding N.V.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom enlarging demand for secure, high-speed packaging adhesives

- 4.2.2 Global construction upcycle raising consumption of structural and flooring adhesives

- 4.2.3 Lightweighting and EV platforms accelerating automotive adhesive penetration

- 4.2.4 AI-driven formulation optimisation slashing research and development timelines and custom-bonding costs

- 4.2.5 Near-shoring of acrylic monomer supply in US post-2025 tariffs reshapes regional capacity

- 4.3 Market Restraints

- 4.3.1 Petro-feedstock price volatility squeezing adhesive manufacturer margins

- 4.3.2 Escalating VOC and chemicals regulation curbing solvent-borne adhesive sales

- 4.3.3 Global shortage of senior adhesive formulators slowing commercialisation cycles

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Cyanoacrylate

- 5.1.5 VAE/EVA

- 5.1.6 Silicone

- 5.1.7 Other Resins

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Reactive

- 5.2.4 Hot Melt

- 5.2.5 UV Cured Adhesives

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Packaging

- 5.3.3 Automotive

- 5.3.4 Aerospace

- 5.3.5 Woodworking and Joinery

- 5.3.6 Footwear and Leather

- 5.3.7 Healthcare

- 5.3.8 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Australia

- 5.4.1.6 Indonesia

- 5.4.1.7 Malaysia

- 5.4.1.8 Singapore

- 5.4.1.9 Thailand

- 5.4.1.10 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema

- 6.4.4 AVERY DENNISON CORPORATION

- 6.4.5 Dow

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 Illinois Tool Works Inc.

- 6.4.10 Jowat SE

- 6.4.11 MAPEI S.p.A.

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd.

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding N.V.

- 6.4.16 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment