|

시장보고서

상품코드

1693393

이탈리아의 실란트 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Italy Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

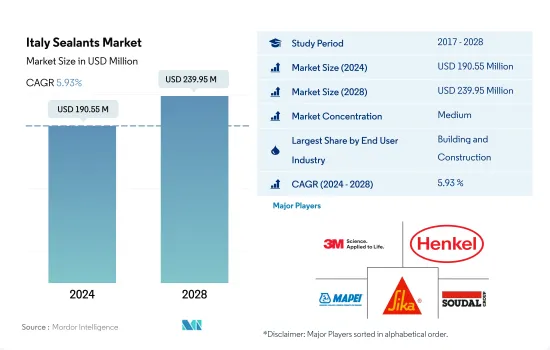

이탈리아의 실란트 시장 규모는 2024년 1억 9,055만 달러, 2028년에는 2억 3,995만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2028년) CAGR 5.93%로 성장할 것으로 예측됩니다.

신축과 노후화된 건물의 개수로 실란트 수요가 높아집니다.

- 이탈리아의 실란트 시장은 방수, 내후성 실링, 균열 실링, 눈지 실링 등, 건축 및 건설 활동에 있어서의 실란트의 용도가 다방면에 이르기 때문에 주로 건설 업계가 견인해, 기타 최종사용자 산업 부문이 이어집니다. 건설 산업은 이 나라의 GDP의 8% 가까이를 차지하고 있습니다. 2018년, 이탈리아는 건설 및 관련 공사에 있어서 49만사 이상의 기업을 등록했습니다.

- 다양한 실란트가 포팅이나 보호용도로 전자기기나 전기기기 제조에 널리 사용되고 있습니다. 이것은 다른 최종 사용자 산업 부문에서 실란트 수요를 촉진할 것으로 예상됩니다.

- 실란트는 헬스케어 산업에 있어서 다양한 용도가 있어, 이탈리아는 수십년에 걸쳐 의료기기의 제조에 있어서 현저한 개발을 달성해 왔습니다. 이탈리아 정부는 또한 2024년 말에 3,133개의 기기를 업그레이드하기 위해 11억 8,000만 유로를 투자하는 계획을 발표했습니다.

이탈리아 실란트 시장 동향

인프라 분야에 대한 정부 정책과 투자 증가로 건설 업계 촉진

- 이탈리아에서는 공공 인프라 부문에 대한 관민 투자를 촉진하기 위해 2017년 예산법이 도입되었습니다. 2019년 피렌체시는 보다 대규모 도시 재개발 계획의 일환으로 새로운 경기장을 개발하기 위한 토지도 승인했습니다.

- 그러나 2020년에는 이탈리아가 COVID-19의 대유행으로 최악의 피해를 입은 국가 중 하나였기 때문에 이탈리아의 건설 시장은 23% 축소되었습니다. 이탈리아의 건설비는 유럽의 다른 많은 지역보다 꽤 싸고, 특히 별장의 건설비는 싸기 때문에 이것이 향후의 주택 건설을 밀어줄 것으로 예상됩니다.

- 이탈리아의 건설시장은 예측기간 중(2022-2028년) CAGR 3.2%를 나타낼 것으로 예상됩니다.

전기차 수요 증가가 자동차 생산을 뒷받침할 가능성이 높

- 이탈리아는 유럽의 주요 자동차 업체 중 하나입니다.

- 2020년 자동차 생산 대수는 2019년 동시기에 비해 20% 축소되었습니다.

- 2020년에는 전기자동차의 성장이 더욱 가속화됐습니다. 모든 플러그인 차량의 총 판매 대수는 5만 500대로 증가했습니다.

- 마찬가지로 2021년에도 이탈리아의 EV 시장은 성장을 계속했습니다.

이탈리아 실란트 산업 개요

이탈리아 실란트 시장은 적당히 통합되어 있으며 상위 5개사에서 63.07%를 차지하고 있습니다. 시장 주요 기업에는 3M, Henkel AG & Co. KGaA, MAPEI SpA, Sika AG and Soudal Holding NV(알파벳순)가 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 규제 프레임워크

- 이탈리아

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 헬스케어

- 기타 최종 사용자 산업

- 수지

- 아크릴

- 에폭시

- 폴리우레탄

- 실리콘

- 기타 수지

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Dow

- Henkel AG & Co. KGaA

- MAPEI SpA

- NPT Srl

- RPM International Inc.

- Sika AG

- Soudal Holding NV

- Torggler Srl

- Wacker Chemie AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업의 개요

- 개요

- Porter's Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 저해요인, 기회

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Italy Sealants Market size is estimated at 190.55 million USD in 2024, and is expected to reach 239.95 million USD by 2028, growing at a CAGR of 5.93% during the forecast period (2024-2028).

With new construction and renovation of old buildings demand for sealants will rise

- The Italian sealants market is majorly driven by the construction industry, followed by the other end-user industries segment due to the diverse applications of sealants in building and construction activities, such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. The Italian construction industry accounted for nearly 8% of the country's GDP. In 2018, Italy registered more than 490,000 companies in construction and related works. Due to the adverse impacts of the COVID-19 pandemic, the Italian construction industry's growth declined by 10.1% in 2020.

- A variety of sealants are widely used in electronics and electrical equipment manufacturing for potting and protecting applications. The Italian electronics market registered significant growth mostly due to the high demand for large household appliances, consumer electronics, and telephony. This is expected to foster the demand for sealants from the other end-user industries segment. A range of applications of sealants in the locomotive and DIY industries is expected to boost the demand for sealants by 2028.

- Sealants have diverse applications in the healthcare industry, and Italy has achieved significant development in the manufacturing of medical equipment over the decades. Sealants are used for healthcare applications such as assembling and sealing medical device parts. The country counted nearly 4,323 companies in the medical device and technology market. The Italian government also announced plans to invest EUR 1.18 billion to upgrade 3,133 devices at the end of 2024. Thus, such a trend is expected to augment the demand for medical-grade sealants over the coming years.

Italy Sealants Market Trends

Increasing government policies and investments in the infrastructure sector to propel the construction industry

- In Italy, the Budget Law 2017 was introduced to boost public and private investments in the public infrastructure sectors. A budget of USD 53 billion was also allotted for the development of government infrastructure in the country for the period 2017-2032. In 2019, the Municipality of Florence also approved land to develop a new stadium as part of the larger urban redevelopment plan. The stadium is likely to hold a capacity of 40,000 seats; it is expected to be completed by 2023.

- However, in 2020, the Italian construction market contracted by 23%, as Italy was one of the worst-hit nations during the COVID-19 pandemic. In 2021, the Italian construction market registered the highest growth rate of 16.59%. According to the European Commission, the Italian government announced several initiatives to promote the residential/housing market. Under its 2021 Budget Law, Italy extended the timeline for the super bonus, 110% deduction up to June 30, 2022. The Italian government has been promoting construction subsidies to invest a minimum of USD 20,000 per house in some cities to promote the population of the city by providing sponsorship for stay. This is expected to boost house construction in the future, as construction in Italy is significantly cheaper than in many other parts of Europe, especially for vacation homes.

- The Italian construction market is expected to register a CAGR of 3.2% during the forecast period (2022-2028). As the government focuses on improving commercial infrastructure and other civil engineering activities across the country, changes in government policies for foreign direct investments and tax deductions are expected to drive the construction industry in the country, which, in turn, is expected to drive the market.

Rising electric vehicles demand is likely to boost automotive production

- Italy is one of the major automotive manufacturers in Europe. Compared to 2017, automotive vehicle production in the country contracted by 9.26% in 2018 and 22.2% in 2019, as in 2018 and 2019, factors like the fallout from Brexit, the implementation of more complex environmental regulations, and the tensions between the United States and China negatively affected the market for automotive vehicles in Italy.

- The automotive vehicle production volume contracted by 20% in 2020 compared to the same period in 2019. The COVID-19 pandemic resulted in disruptions in car manufacturing and had a negative impact on the whole supply chain. Many suppliers additionally suffer from increased raw material costs (e.g., for steel, plastics, and resin) and higher energy prices, affecting the automotive market in the country.

- In 2020, the country's electric vehicle growth further increased. Registrations for pure EVs in the first six months of 2020 were up by 86% compared to 2019. Almost 31,000 pure EVs were sold in 2020 till the end of June. Total sales of all plug-in vehicles rose to 50,500 units. The average pure-electric market share also increased significantly, driving the market for adhesives and sealants in the country.

- Similarly, the year 2021 witnessed continued growth in the Italian EV market. In recent years, electric vehicle sales increased by six-fold in just three years. Similarly, the market share of electric vehicles increased to 4.6% in 2021. Thus, it is expected to improve the market for adhesives and sealants in the country.

Italy Sealants Industry Overview

The Italy Sealants Market is moderately consolidated, with the top five companies occupying 63.07%. The major players in this market are 3M, Henkel AG & Co. KGaA, MAPEI S.p.A., Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Italy

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Dow

- 6.4.3 Henkel AG & Co. KGaA

- 6.4.4 MAPEI S.p.A.

- 6.4.5 NPT Srl

- 6.4.6 RPM International Inc.

- 6.4.7 Sika AG

- 6.4.8 Soudal Holding N.V.

- 6.4.9 Torggler S.r.l.

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록