|

시장보고서

상품코드

1693403

말레이시아의 실란트 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Malaysia Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

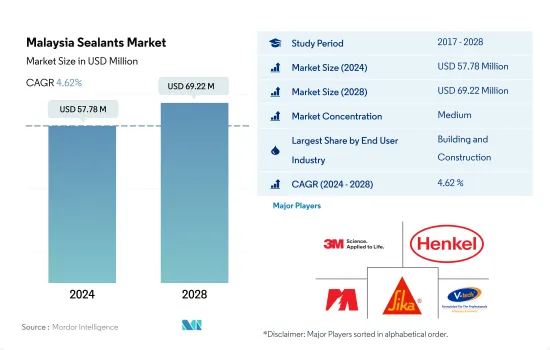

말레이시아의 실란트 시장 규모는 2024년 5,778만 달러, 2028년에는 6,922만 달러에 이르고, 예측 기간 중(2024-2028년) CAGR 4.62%로 성장할 것으로 예측됩니다.

말레이시아 아웃소싱 목적지 및 의료기기 제조 허브로서의 대두가 실란트 수요를 크게 밀어 올립니다.

- 말레이시아의 실란트 시장은 주로 건설 업계가 견인하고 있으며, 방수, 내후성 실링, 균열 실링, 조인트 실링 등, 건축 및 건설 활동에 있어서의 실란트의 용도가 다양하기 때문에 기타 최종사용자 산업 부문이 그 뒤를 잇고 있습니다..건설 산업은 말레이시아 경제에 있어 중요한 역할을 하고 있습니다.

- 실란트는 의료 산업에서 상당한 용도가 있으며 주로 의료기기 부품의 조립 및 씰링에 사용됩니다. 의료 등급 실란트는 유리, 금속, 플라스틱, 도장면 등 다양한 기재에 독자적인 적용성을 가지고 있으며, 내후성, 내열성, 노화 방지 등의 중요한 기능이 실란트 수요를 밀어 올릴 가능성이 높습니다. 말레이시아는 동남아시아 지역의 제조업체들에게 아웃소싱 목적지 및 의료기기 제조의 허브로 부상하고 있습니다. 이 때문에 예측기간 동안 이 나라의 실란트 수요를 끌어올릴 것으로 보입니다.

- 기타 최종 사용자 산업 분야는 전자 및 전기기기 제조업에 있어서의 포팅이나 보호재 등의 다양한 용도에 의해 말레이시아의 실란트 시장에서 일정한 쉐어를 획득할 가능성이 높습니다. 실란트는 센서나 케이블 등의 밀봉에 사용됩니다. 게다가 전자상거래 활동의 급성장과 소비자 일렉트로닉스 분야의 강력한 시장 포지셔닝이 말레이시아 실란트 시장을 추진할 것으로 보입니다.

말레이시아 실란트 시장 동향

민간 및 산업계의 투자와 미래의 메가 건설 프로젝트가 업계 규모를 확대

- 말레이시아의 건설 업계는 2022년부터 2028년의 예측기간 동안 약 3.37%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예측되고 있습니다. 2019년 말레이시아의 건설 생산량은 약 1,463억 7,000만 MYR로 2018년부터 약간의 성장을 보였습니다. 2019년 말레이시아 건설 부문은 부채 금액을 다루기 위해 여러 프로젝트가 정체되어 성장이 둔화되었습니다. 2019년 건설 업계는 2019년 건설업체가 거의 정체된 채로 남아 있었습니다.

- 2020년 말레이시아 건설 부문은 토목, 비주택 및 주택의 부정적인 성장으로 13.9% 감소했습니다. 말레이시아의 건설 활동은 2021년 12월기에 전년 동기 대비 12.9% 축소되었습니다. 2021년 3분기와 비교하면 주택이 감소했고 비주택과 토목이 감소했습니다. 2021년까지 이 나라의 건설 생산량은 5% 감소했습니다.

- 말레이시아는 민간 건설과 산업 건설에 많은 투자를 하고 추진하고 있습니다. 2022년 민간 및 산업건설 예측에 따르면 주택부문은 2021년 6.08% 증가한 226억 2,800만 MYR을 기록해 공급 과잉 우려가 길어짐에 따라 2022년 상반기에는 1.67% 감소할 것으로 예상됐습니다. 예측 기간 동안 전국에서 건설 개발이 확대됩니다.

전기자동차 수요 증가가 이 나라의 자동차산업에 영향을 미

- 말레이시아는 다국적 자동차 제조업체에게 매력적인 거점이기도 합니다. Honda, Toyota, Nissan, Mercedes-Benz, BMW는 증가하는 고객 수요에 대응하기 위해 말레이시아에 진출하는 세계 자동차 회사 중 하나입니다. 자동차 산업은 말레이시아의 산업 부문에서 중요한 위치를 차지하고 있으며, GDP의 4% 이상을 차지하고 있으며, 아세안 3위의 자동차 시장이기도 합니다. 말레이시아에는 현재 승용차, 상용차, 오토바이, 스쿠터, 자동차 부품, 부품 제조 및 조립 공장이 28개 있습니다.

- 이 산업이 엔지니어링, 보조 부문, 지원 부문의 성장에 공헌하고 있는 것은 틀림없습니다. 동차 생산 대수는 약 57만 1,632대였지만, 2020년에는 48만 5,186대로 격감해, COVID-19의 유행에 의해 15% 감소했습니다. 2019년부터 2021년까지 자동차 생산 대수의 변동은 약 -16%였지만, 2020년부터 2021년까지는 -1%를 기록했습니다.

- 전기자동차(EV)는 국내 자동차 산업의 로드맵에서 자동차 전력 시스템의 미래에 중요한 기술로 인식되고 있습니다.

말레이시아 실란트 산업 개요

말레이시아의 실란트 시장은 적당히 통합되어 있으며 상위 5개사에서 45.69%를 차지하고 있습니다. 시장 주요 기업은 3M, Henkel AG & Co. KGaA, Mohm Chemical Sdn. Bhd., Sika AG and VITAL TECHNICAL SDN BHD(알파벳순)가 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 규제 프레임워크

- 말레이시아

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 헬스케어

- 기타 최종 사용자 산업

- 수지

- 아크릴

- 에폭시

- 폴리우레탄

- 실리콘

- 기타 수지

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Arkema Group

- Dow

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Mohm Chemical Sdn. Bhd.

- Sika AG

- Soudal Holding NV

- VITAL TECHNICAL SDN BHD

- Wacker Chemie AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제와 실링제 산업의 개요

- 개요

- Porter's Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 저해요인, 기회

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Malaysia Sealants Market size is estimated at 57.78 million USD in 2024, and is expected to reach 69.22 million USD by 2028, growing at a CAGR of 4.62% during the forecast period (2024-2028).

Malaysia's growing emergence as an outsourcing destination and medical device manufacturing hub to substantially boost the sealants demand

- The Malaysian sealants market is primarily driven by the construction industry, followed by the other end-user industries segment due to the diverse applications of sealants in building and construction activities, such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Construction sealants are designed for longevity and ease of application on different substrates. The construction industry plays a vital role in the Malaysian economy. However, construction activities decreased in 2020 due to the COVID-19 pandemic-induced restrictions and scarcity of raw materials, which was restored in 2021, thus, boosting the sealants demand across the country.

- Sealants have considerable applications in the healthcare industry and are primarily used for assembling and sealing medical device parts. Medical-grade sealants have unique applicability to various substrates, such as glass, metal, plastic, painted surfaces, etc., and significant features such as weather-proofing, heat resistance, and anti-aging are likely to boost the demand for sealants. Malaysia is emerging as an outsourcing destination and medical device manufacturing hub for manufacturers in the Southeast Asian region. This, in turn, is expected to boost the sealants demand in the country over the forecast period.

- The other end-user industries segment is likely to obtain a decent share in the Malaysian sealants market owing to the diverse applications in the electronics and electrical equipment manufacturing industry for potting and protecting materials. They are used for sealing sensors and cables, etc. Moreover, the rapid growth of e-commerce activities, along with the strong market positioning of the consumer electronics segment, is likely to propel the Malaysian sealants market.

Malaysia Sealants Market Trends

Private and industrial investments along with the upcoming mega-construction projects will augment the industry size

- The Malaysian construction industry is expected to record a CAGR of about 3.37% during the forecast period from 2022 to 2028. In 2019, the construction output in Malaysia stood at approximately MYR 146.37 billion, exhibiting a slight growth from 2018. Malaysia's construction sector grew slower in 2019, as a few projects were stalled to cover the debt values. Owing to a halt in several mega-construction projects and an increasing inventory of unsold housing stocks, the construction industry remained almost stagnant in 2019.

- In 2020, the Malaysian construction sector contracted by 13.9% due to negative growth in civil engineering, non-residential, and residential buildings. Malaysia's construction activity contracted 12.9% Y-o-Y in the December quarter of 2021. Decreasing numbers were seen in residential buildings compared to the third quarter of 2021, with a decrease in non-residential buildings and civil engineering. By 2021, the construction output fell by 5% in the country.

- Malaysia promotes and makes significant investments in private and industrial construction. As per the 2022 construction forecast for private and industrial construction, the residential sector was expected to record a 6.08% increase to MYR 22,628 million in 2021 and a decline by 1.67% in the first half of 2022 as concerns over the supply overhang linger. The growing construction developments across the country over the forecast period.

Growing demand for electric vehicles will influence the country's automotive industry

- Malaysia remains an appealing base for multinational automakers. Honda, Toyota, Nissan, Mercedes-Benz, and BMW are among the global automobile corporations that have established operations in the country to capitalize on growing customer demand. The industry is a crucial part of the country's industrial sector, contributing above 4% of its GDP and remaining the third-largest automotive market in ASEAN. Malaysia currently has 28 manufacturing and assembly plants for passenger vehicles, commercial vehicles, motorcycles, and scooters, as well as automotive parts and components.

- The industry has undoubtedly aided the growth of engineering, auxiliary, and supporting sectors. It also helps with skill development and the advancement of technology and engineering capabilities. The automotive industry in Malaysia will not be immune to the global trend of digitalization and the advent of new business models. In 2019, the country produced about 5,71,632 units of vehicles, which drastically reduced to 4,85,186 units in 2020, with a 15% decline due to the COVID-19 pandemic. Due to this, the variation in automotive production between 2019 and 2021 was about -16%, whereas it was recorded at -1% between 2020 and 2021.

- The electric vehicle (EV) is recognized as a critical technology for the future of automotive power systems in the country's automotive industry's roadmaps. EVs have just recently emerged as a significant influence in Malaysia. However, in Malaysia, the absence of EV infrastructure and the country's heavy reliance on fossil fuels creates a considerable obstacle.

Malaysia Sealants Industry Overview

The Malaysia Sealants Market is moderately consolidated, with the top five companies occupying 45.69%. The major players in this market are 3M, Henkel AG & Co. KGaA, Mohm Chemical Sdn. Bhd., Sika AG and VITAL TECHNICAL SDN BHD (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Malaysia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Illinois Tool Works Inc.

- 6.4.6 Mohm Chemical Sdn. Bhd.

- 6.4.7 Sika AG

- 6.4.8 Soudal Holding N.V.

- 6.4.9 VITAL TECHNICAL SDN BHD

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록