|

시장보고서

상품코드

1693413

중국의 접착제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

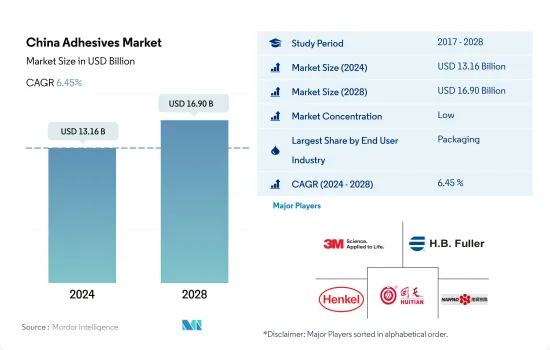

중국의 접착제 시장 규모는 2024년에 131억 6,000만 달러로 추정되고, 2028년에는 169억 달러에 이를 전망이며, 예측 기간(2024-2028년) 중 CAGR 6.45%로 성장할 것으로 예측됩니다.

건설 시장 발흥과 연포장 동향의 진전이 중국의 접착제 소비를 밀어올릴 것으로 예측

- 중국의 접착제는 용도에 따라 분류됩니다. 건설 및 포장은 중국에서 가장 중요한 소비자이며 중국에서 가장 빠르게 발전하는 산업 덕분에 전체 접착제 사용자의 약 54%를 차지합니다. 2020년 중국의 접착제 소비량은 COVID-19의 영향으로 감소했습니다. 수량 기준으로 2019년과 같은 해의 수요는 약 8% 감소했습니다. 중국에서 접착제 생산 및 소비 감소의 주요 원인은 약 반년간 국가의 봉쇄로 인한 생산 시설의 운영 중단과 인력 부족을 포함합니다.

- 신중국 성립 이전에는 포장업계는 보조를 맞출 수 없었지만 신중국 성립에 따라 상황은 즉시 전면적으로 변화했습니다. 중국의 포장 산업은 작은 것에서 거대한 것까지, 약한 것에서 강한 것까지 선진해, 완전히 현대적인 포장 시스템을 구축했으며, 세계의 포장 대국이 되었습니다. 2021년 중국 포장업계의 요구 규모 이상의 기업수는 약 8831사에 달했고, 2020년부터 648사 증가했습니다.

- 중국은 세계 최대의 건설 시장으로, 2022-2030년 연평균 8.6%의 성장률이 예측되고 있습니다. 그러나 레버리지가 커서 정부는 토지 판매에 의존한 경제에서 벗어나기 위한 노력을 진행하고 있습니다. 동시에 이 분야는 고령화 및 전반적인 경기 침체의 영향을 받고 있습니다. 중국의 최근 설계 및 건축 동향은 지역 커뮤니티, 젊은 층, 문화에 관련된 프로젝트를 중시하고 있습니다. 이러한 요인들은 모두 이 나라의 접착제 수요를 증가시키는 경향이 있습니다.

중국의 접착제 시장 동향

식음료 산업의 급성장과 가볍고 유연한 포장 수요 증가가 중국의 포장 수요를 밀어 올립니다.

- 포장은 제품의 안전과 긴 수명을 보호하고 강화하는 디자인과 기술면에서 급성장하는 산업 중 하나입니다. 식음료 부문은 중국 포장 업계의 주요 점유율에 기여하고 있습니다. 식음료 부문은 2019년에 전년 대비 7.8% 이상 높은 약 5950억 달러를 기록했습니다. 그 높은 생산 능력 덕분에, 중국은 세계의 식음료의 주요 수출국으로서 자리매김하고 있습니다.

- COVID-19 팬데믹으로 인해 범국가적인 봉쇄 및 제조 시설의 일시 폐쇄로 인해 공급망 혼란이나 수출입 거래 등 몇 가지 문제가 발생했습니다. 그 결과, 이 나라 포장 생산량은 2020년에 전년 대비 8% 감소하여 시장에 큰 영향을 주었습니다. 이 나라의 포장 생산은 주로 플라스틱 포장이 견인하고 있으며, 2021년에 생산되는 포장의 약 79%를 거의 차지했습니다. 다양한 용도를 위해 가볍고 유연한 패키징에 대한 수요가 증가함에 따라 플라스틱 생산 부문은 예측 기간 동안 CAGR 약 6.58%의 가장 빠른 성장을 기록할 것으로 보입니다.

- 중국에서 포장 산업의 성장은 주로 수년간의 중간층 인구 증가, 공급망 시스템 개선, 전자상거래 활동의 대두로 인한 것입니다. 더욱이 전국적인 팬데믹 이후 먹거리 안전성과 품질에 대한 관심이 높아지는 것은 식품가공업계를 견인하고 향후 수년간 포장 수요에 더욱 기여할 것으로 보입니다.

정부 정책에 따라 중국의 EV 수요가 증가하고 자동차 생산을 촉진할 가능성이 높습니다.

- 중국의 승용차 시장은 세계 최대로, 2021년에는 2,141만대를 차지했으며, 일본, 미국, 독일 등 다른 주요 세계 기업과 비교됩니다. 중국 전기차 업체인 BYD는 전 세계 전기차 생산량의 8.84%를 차지하고 있습니다.

- COVID-19 팬데믹의 진원지인 중국은 전국적인 조업 정지, 공급 체인의 혼란, 인재 부족 등을 일으켜 2020년 자동차 산업에서 막대한 손실을 목격했습니다. 이것이 2020년 중국의 전년 대비 성장률이 마이너스가 된 이유입니다.

- 중국 정부에 의한 전기자동차 소유자에 대한 기간 한정의 구입 보조금, 교통 규제의 면제, 충전 리베이트 등의 정책은 중국에 있어서의 전기자동차의 판매와 수요를 촉진했습니다. 전기차 판매량은 2027년 752만 6,000대에 이를 것으로 예상됩니다. 중국의 EV 생산량은 2019년 100만 대에서 2021년 350만 대로 증가하였고, 예측 기간(2022-2028년) CAGR 15.07%를 기록할 것으로 예상됩니다.

- 상하이 기차공업공사는 생산 대수로 중국 최대의 자동차 회사입니다. SAIC가 생산하는 승용차와 상용차의 대수의 성장은 현저하게, 2019년의 약 200만 대에서 2021년에는 700만 대로 증가했습니다. 이 성장 동향은 중국 자동차 시장이 예측 기간 동안 안정적으로 성장할 것으로 예상된다는 것을 보여줍니다.

중국의 접착제 산업 개요

중국의 접착제 시장은 세분화되어 있으며 상위 5개사에서 11.81%를 차지하고 있습니다. 이 시장의 주요 기업은 다음과 같습니다. 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Hubei Huitian New Materials and NANPAO RESINS CHEMICAL GROUP(알파벳순 정렬)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사의 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 포장

- 목공 및 건구

- 규제 프레임워크

- 중국

- 밸류체인 및 유통 채널 분석

제5장 시장 세분화

- 최종 사용자 산업별

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 헬스케어

- 포장

- 목공 및 건구

- 기타 최종 사용자 산업

- 기술별

- 핫멜트

- 반응성

- 용제계

- UV 경화형 접착제

- 수계

- 수지별

- 아크릴계

- 시아노아크릴레이트

- 에폭시

- 폴리우레탄

- 실리콘

- VAE 및 EVA

- 기타 수지

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Arkema Group

- Beijing Comens New Materials Co., Ltd.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Kangda New Materials(Group) Co., Ltd.

- NANPAO RESINS CHEMICAL GROUP

- Sika AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업의 개요

- 개요

- Porter's Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 억제요인, 기회

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The China Adhesives Market size is estimated at 13.16 billion USD in 2024, and is expected to reach 16.90 billion USD by 2028, growing at a CAGR of 6.45% during the forecast period (2024-2028).

Emerging construction market and evolving trend of flexible packaging expected to boost the consumption of adhesives in China

- Adhesives in China are categorized according to their application. Construction and packaging are the most important consumers in the country, accounting for roughly 54% of total adhesive users, owing to China's fastest-developing industries. China's adhesives consumption declined in 2020 due to the impact of COVID-19. In terms of volume, demand declined by approximately 8% in the same year as in 2019. The country's lockdown for around half a year, which prompted production facilities to shut down, and personnel unavailability are two of the primary reasons for the reduction in adhesives production and consumption in China.

- Before the establishment of New China, the packaging industry failed to keep pace, but the situation immediately and fully altered with the establishment of New China. China's packaging industry has advanced from tiny to huge and weak to strong, creating a fully modern packaging system and becoming the world's packaging power. The number of companies over the required size in China's packaging sector reached about 8,831 in 2021, an increase of 648 from 2020.

- China is the world's largest construction market, with an annual average growth rate of 8.6% projected between 2022 and 2030. However, it is heavily leveraged, and the government is enacting efforts to wean the economy off its reliance on land sales. At the same time, the sector is being impacted by an aging population and a general economic slump. Recent design and building trends in China emphasize local communities, younger people, and culturally relevant projects. All such factors tend to increase the demand for adhesives in the country.

China Adhesives Market Trends

Rapid growth of the food and beverage industry and rising demand for lightweight and flexible packaging to boost the China packaging demand

- Packaging is one of the fast-growing industries in terms of design and technology for protecting and enhancing products' safety and longevity. The food and beverage sector contributes a major share of the packaging industry in China. The food and beverage sector registered nearly USD 595 billion in 2019, more than 7.8% higher than the previous year. Owing to its high production capacity, China has positioned itself as a major exporter of food and drinks worldwide.

- Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including supply chain disruptions and imports and exports trade. As a result, the country's packaging production declined by 8% in 2020 compared to the previous year, significantly affecting the market. Packaging production is majorly driven by plastic packaging in the country, which nearly accounted for around 79% of the packaging produced in 2021. With the growing demand for lightweight and flexible packaging for a variety of applications, the plastic production segment is likely to register the fastest growth of around 6.58% CAGR during the projected period.

- The growth of the packaging industry in China is mainly attributed to the rising middle-class population, improvement of the supply-chain system, and emerging e-commerce activities over the years. Furthermore, the growing attention to food safety and quality in post-pandemic times across the nation is likely to drive the food processing industry, which will further contribute to the packaging demand in the coming years.

Owing to government policies, EVs demand in China is rising and is likely to propel the automotive production

- China's automotive market for passenger vehicles is the largest in the world, as it accounted for 21.41 million units in 2021 compared to other major global players such as Japan, the United States, and Germany. This number is expected to grow at the same pace because of the increasing production capacity of automotive companies post-pandemic in China, as BYD, which is a local electric vehicle manufacturer in China, holds 8.84% of total electric vehicle production in the world.

- China, being the epicenter of the COVID-19 pandemic, witnessed huge losses in the automotive industry in 2020 as it led to nationwide lockdowns, supply chain disruptions, lack of human resources availability, etc. This was the reason for the negative Y-o-Y growth rate in China in 2020.

- The Chinese government's policies for electric vehicle owners, such as time-limited purchase subsidies, traffic regulations waivers, and charging rebates for EV owners, have encouraged the sale and demand for EVs in China. The sales of electric vehicles are expected to reach 7,526 thousand in 2027. EV production in China increased from 1 million units in 2019 to 3.5 million units in 2021, and it is expected to record a 15.07% CAGR in the forecast period (2022-2028).

- Shanghai Automotive Industry Corporation is China's largest automotive company in terms of production. The growth in the number of both passenger and commercial vehicles manufactured by SAIC is significant, as it increased from nearly 2 million units in 2019 to 7 million units in 2021. This growth trend shows that the Chinese automotive market is expected to grow steadily during the forecast period.

China Adhesives Industry Overview

The China Adhesives Market is fragmented, with the top five companies occupying 11.81%. The major players in this market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Hubei Huitian New Materials Co. Ltd and NANPAO RESINS CHEMICAL GROUP (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 China

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Beijing Comens New Materials Co., Ltd.

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Hubei Huitian New Materials Co. Ltd

- 6.4.7 Huntsman International LLC

- 6.4.8 Kangda New Materials (Group) Co., Ltd.

- 6.4.9 NANPAO RESINS CHEMICAL GROUP

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms