|

시장보고서

상품코드

1693422

아시아태평양의 아크릴계 접착제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Asia-Pacific Acrylic Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

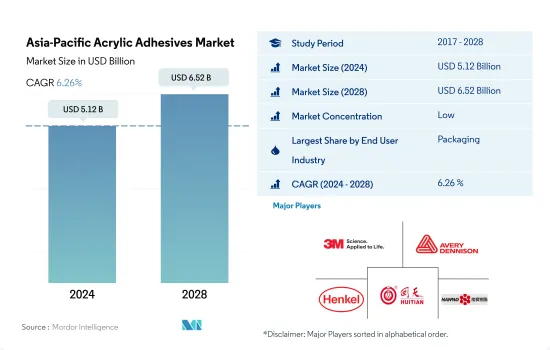

아시아태평양의 아크릴계 접착제 시장 규모는 2024년에는 51억 2,000만 달러로 평가되었고, 예측 기간(2024-2028년) 중 CAGR 6.26%로 성장할 전망이며, 2028년에는 65억 2,000만 달러에 달할 것으로 예측됩니다.

아크릴계 접착제 수요를 촉진하는 지역 전체의 전기자동차 보급 증가

- 아크릴계 접착제는 방수, 내후성 씰, 균열 씰, 접착 등의 용도가 있기 때문에 건설 업계에서 널리 사용되고 있습니다. 중국은 아시아 태평양 지역에서 가장 급성장하고 있는 국가로 2022-2028년 아크릴계 건축용 접착제 소비량의 CAGR은 5%입니다. 이 나라는 2021년 금액 기준으로 4조 6,000억 달러를 기록해 전년 대비 10% 성장한 건설생산고 증가로 건축 및 건설업계에서 사용되는 아크릴계 접착제의 가장 높은 수요를 기록했습니다.

- 아크릴계 접착제는 또한 유리, 금속, 플라스틱, 도장면 등의 표면에의 적용성 때문에 자동차 산업 전체에서 널리 사용되고 있으며, 그 특징은 극단적인 내후성, 내구성, 오래 지속 등 자동차 산업에서 유용합니다. 개발도상국인 아시아에서 EV 에코시스템을 개발하는 것은 아세안 국가들이 소비자 보급을 촉진하고 기후변화 목표를 달성하기 위해 필수적입니다. 미래 EV 에코시스템 구축에는 공급측 및 수요측 모두를 뒷받침함으로써 EV 밸류체인을 대폭 확대할 필요가 있습니다. 아시아 시장에서 전동 4륜차의 보급은, 향후도 현저할 것이라고 전망됩니다. 절대 기반으로는 중국이 최대 EV 시장이 될 것으로 보입니다. 현재 궤도에서 중국의 보급률은 60%에 가까워져 2030년까지 전 세계 EV 신차 판매의 40% 이상을 차지하게 될 것으로 보입니다. 이 때문에 예측 기간(2022-2028년)에는 아크릴계 자동차용 접착제 수요가 증가합니다.

- 아크릴계 접착제는 헬스케어 업계에서 의료기기 부품의 조립 등의 용도에 사용되고 있습니다. 아시아 태평양 지역의 헬스케어 투자 증가는 예측 기간 동안 아크릴 접착제의 수요 증가로 이어집니다.

세계의 제조 거점인 중국이 아크릴계 접착제의 최대 점유율을 차지

- 2017-2021년 아시아태평양에서 생산된 수요는 전 지역 중 가장 높았습니다. 이 지역의 접착제 수요 점유율은 모든 최종 사용자 산업의 제조 능력이 높기 때문에 일관되게 세계 수요의 38-40% 정도를 차지하고 있습니다. 반응성, 수계, 용제계 아크릴 접착제가 이 지역 수요의 대부분을 차지하고 있습니다.

- 2017-2019년 이 지역의 접착제 수요는 CAGR 2.87%를 기록했습니다. 아크릴 접착제 수요가 주춤한 것은 이 지역에서의 건설 활동 감소와 자동차 생산 감소가 원인입니다. 이 기간, 이러한 최종 사용자 산업으로부터의 수요는 각각 -1.68%와 -1.65%의 CAGR로 감소했습니다.

- 2020년에는 운영, 노동력, 원재료, 공급망 및 기타 분야의 제약으로 인해 지역 전체의 모든 최종 사용자 수요가 감소했습니다. 이 지역 모든 국가의 모든 산업 중 호주의 신발 산업은 가장 큰 타격을 받아 수량 기준으로 전년 대비 49.32% 감소했습니다. 경제 침체로 인한 구매력 저하로 인한 내수 감소는 팬데믹 기간 동안 이 산업에 심각한 영향을 미쳤습니다.

- 2021년에는 무역 규제가 완화되었기 때문에 아크릴계 접착제 수요는 급속히 팬데믹 전 수요량으로 회복되었습니다. 인도의 수요는 수량 기준으로 전년 대비 74.54% 증가로 가장 높은 증가세를 보였습니다. 아시아태평양 지역 전체의 수요는 예측 기간 동안 수량 기준으로 CAGR 5.13%를 기록할 것으로 예상됩니다. 이러한 수요 성장은 예측 기간 동안 이 지역의 건설, 포장, 자동차 산업에 의해 견인됩니다.

아시아태평양의 아크릴계 접착제 시장 동향

개발도상국에서 전자상거래 산업의 급성장으로 업계가 확대

- 포장은 주로 보호, 봉쇄, 정보 제공, 실용성, 프로모션에 사용됩니다. 따라서 포장은 대부분의 산업에 필수적인 요소입니다. 2017년에는 종이와 판지, 플라스틱 포장을 포함한 포장 사용량이 25억 톤을 차지했습니다. 2020년에는 코로나19 대유행으로 공급망 혼란, 포장 자재 부족, 상품 수출입 제한, 공장 저능력 조업 등으로 시장은 7.4%의 마이너스 성장률을 기록했습니다.

- 중국과 인도네시아는 해양플라스틱 폐기물의 제1위와 제2위의 배출국이기 때문에 아시아 각국의 정부는 플라스틱의 사용을 삭감하기 위한 조치를 강구하고 있습니다. 중국은 과잉 포장에 관한 새로운 규제를 발표하고 모든 식품 및 화장품 제조업체에 대해 제품에 비례하여 허용되는 포장의 양을 결정하는 특정 가이드라인을 준수하도록 요구했습니다. 인도네시아 정부에 의한 확대 생산자 책임(EPR) 규제는, 생산자와 소매업자에 대해, 재활용 가능한 재료의 비율을 높이도록 제품 포장을 재설계하는 것을 의무화하는 것입니다.

- 2021년 시장은 8%의 플러스 성장을 기록했으며, 27억 톤의 포장 재료가 다양한 목적으로 사용되었습니다. 중산층의 증가, 공급망 개선, 전자상거래 활동의 활발화로 포장 산업은 앞으로도 계속 성장할 것으로 예상되며, 상품의 출하에는 특수한 포장이 필요하기 때문에 최근 몇 년 사이에 포장 산업을 크게 뒷받침하고 있습니다. 성장하는 아시아 시장은 포장 이용을 촉진하여 예측 기간(2022-2028년) 중 CAGR 5.7%를 기록할 것으로 기대됩니다.

인프라 활동 확대를 위한 투자 증가로 업계 규모 확대

- 아시아태평양은 중국, 일본, 인도 등 세계의 주요 경제국에 의해 견인되고 있습니다. 중국은 지속적인 도시화 프로세스를 추진 중이며 2030년 목표율은 70%입니다. 도시화의 진전으로 도시 지역에서 필요로 하는 거주 공간이 증가하고, 도시 지역의 중간 소득층이 생활 환경의 개선을 원하게 됨으로써 주택 시장에 영향을 주고, 그로 인해 국내 주택 건설이 증가할 가능성이 있습니다.

- 비주택 인프라는 크게 확대될 가능성이 높습니다. 중국 정부는 2019년에 약 1,420억 달러에 해당하는 26개의 인프라 프로젝트를 승인하고 2023년에 완료할 예정입니다. 이 나라는 세계 최대의 건설 시장을 가지고 있으며, 전세계 건설 투자의 20%를 차지하고 있습니다. 2030년까지 정부는 13조 달러를 넘는 건설 투자를 계획하고 있습니다. 이에 따라 건설 시장은 예측 기간(2022-2028년) 중 4.48%의 CAGR로 추이할 것으로 예상됩니다.

- 건설 산업은 아시아태평양 최대의 산업 중 하나이며, 2019년에는 유망한 성장을 기록했습니다. 이 지역은 베트남, 말레이시아, 인도네시아, 타이, 그 외의 남아시아 제국등 많은 신흥국을 구성하고 있기 때문에, 동산업은 성장을 계속하고 있습니다. 그러나 코로나19 팬데믹 때문에 건설 부문은 인도, 중국, 일본, 아세안 국가를 포함한 개발도상국에 심각한 영향을 준 지역 전체 정부에 의한 봉쇄 때문에 큰 폭의 감소를 보였습니다.

- 아시아태평양에서도 건설 분야에 대한 해외 투자자의 관심이 높아지고 있습니다. 개발도상국들이 투자자들에게 더 나은 이익과 기회를 제공하기 위해 건설 개발 분야에 대한 외국인 직접투자(FDI)가 증가하고 있습니다.

아시아태평양의 아크릴계 접착제 산업 개요

아시아태평양의 아크릴계 접착제 시장은 세분화되어 있으며 상위 5개 기업에서 15.23%를 차지하고 있습니다. 이 시장의 주요 기업은 다음과 같습니다. 3M, AVERY DENNISON CORPORATION, Henkel AG & Co. KGaA, Hubei Huitian New Materials and NANPAO RESINS CHEMICAL GROUP(알파벳순 정렬)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사의 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 포장

- 규제 프레임워크

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 말레이시아

- 싱가포르

- 한국

- 태국

- 밸류체인 및 유통 채널 분석

제5장 시장 세분화

- 최종 사용자 산업별

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 헬스케어

- 포장

- 기타 최종 사용자 산업

- 기술별

- 반응성

- 용제계

- UV 경화형 접착제

- 수계

- 국가별

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 말레이시아

- 싱가포르

- 한국

- 태국

- 기타 아시아태평양

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Arkema Group

- AVERY DENNISON CORPORATION

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Kangda New Materials(Group) Co., Ltd.

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업의 개요

- 개요

- Porter's Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 억제요인 및 기회

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Asia-Pacific Acrylic Adhesives Market size is estimated at 5.12 billion USD in 2024, and is expected to reach 6.52 billion USD by 2028, growing at a CAGR of 6.26% during the forecast period (2024-2028).

The rising adoption of electric vehicle across the region to foster the demand for acrylic adhesives

- Acrylic adhesives are widely used in the construction industry because of their applications, such as waterproofing, weather-sealing, cracks sealing, and bonding. China is the fastest-growing country in the Asia-Pacific region, with a CAGR of 5% during the period 2022 to 2028 in terms of consumption of acrylic construction adhesives. The country registered the highest demand for acrylic adhesives used in the building and construction industry owing to rising construction output which registered USD 4.6 trillion by value in 2021, showing 10% growth compared to the previous year.

- Acrylic adhesives are also widely used across the automotive industry because of their applicability to surfaces such as glass, metal, plastic, and painted surfaces, and their features are helpful in the automotive industry, such as extreme weather resistance, durability, and long-lasting. Developing an EV ecosystem in developing Asia is critical for ASEAN nations to expedite consumer adoption and meet their climate targets. Creating tomorrow's EV ecosystems entails significantly expanding the EV value chain by boosting both the supply and demand sides of the equation. The adoption of electric four-wheelers in the Asian markets will continue to be significant. In absolute terms, China will become the largest EV market. On its current trajectory, China's adoption rate will approach 60%, and the country will account for more than 40% of global new EV sales by 2030. This will increase demand for acrylic automotive adhesives in the forecast period (2022-2028).

- Acrylic adhesives are used in the healthcare industry for applications such as assembling medical device parts. The increase in healthcare investments across Asia-Pacific will lead to an increase in their demand in the forecast period.

Being a manufacturing hub of the world China holds largest acrylic adhesive share

- From 2017 to 2021, the demand generated from Asia-Pacific was the highest among all regions. This region's share of adhesive demand has consistently occupied around 38-40% of the global demand because of its high manufacturing capacity of all end-user industries. Acrylic adhesives with reactive, water-borne, and solvent-borne technologies account for most of the demand in the region.

- From 2017 to 2019, the demand for adhesives from this region recorded a CAGR of 2.87%. The slow growth in the demand for acrylic adhesives was due to a decrease in construction activities and a decrease in automotive production in the region. During this period, the demand from these end-user industries declined with a CAGR of -1.68% and -1.65%, respectively.

- In 2020, the demand from all end users across the region declined due to constraints in operations, labor, raw material, supply chain, and other areas. Among all industries from all countries in the region, the footwear industry in Australia took the worst hit, declining by 49.32% y-o-y in volume terms. The decrease in domestic demand because of low purchasing power resulting from a weak economy severely affected this industry during the pandemic.

- In 2021, the demand for acrylic adhesives quickly rebounded to pre-pandemic demand volumes as trade restrictions eased. The demand from India witnessed the highest y-o-y growth of 74.54% in volume terms. The overall demand from the Asia-Pacific region is expected to record a CAGR of 5.13% in volume terms during the forecast period. This demand growth will be driven by the region's construction, packaging, and automotive industries during the forecast period.

Asia-Pacific Acrylic Adhesives Market Trends

Fast paced growth of e-commerce industry in developing nations to augment the industry

- Packaging is mainly used for protection, containment, information, utility, and promotion. This makes packaging an integral part of most industries. In 2017, packaging usage accounted for 2.5 billion ton of packaging, including paper and paperboard and plastic packaging. In 2020, due to the COVID-19 pandemic, the market registered a negative growth rate of 7.4% due to disruptions in the supply chain, shortage of packaging material, restrictions on the import and export of goods, and factories operating at low capacity.

- Governments of different Asian countries have taken steps to reduce the use of plastic, as China and Indonesia are the first and second-largest contributors to plastic waste in the ocean. China has announced new restrictions on excessive packaging, requiring all food and cosmetics producers to adhere to specific guidelines determining the volume of packaging allowed in proportion to a product. The extended producer responsibility (EPR) regulation imposed by the Indonesian government will oblige producers and retailers to redesign their product packaging to include a higher proportion of recyclable material.

- In 2021, the market registered a positive growth of 8%, with 2.7 billion ton of packaging material used for various purposes. The packaging industry is expected to keep growing due to the rising middle-income population, improvement of supply chains, and rising e-commerce activities, which have significantly boosted the packaging industry in the past few years as special packaging is required for shipping goods. The growing Asian market is expected to boost packaging usage, enabling it to register a CAGR of 5.7% during the forecast period (2022-2028).

Raising investment to expand infrastructural activities will augment the industry size

- Asia-Pacific is driven by the world's major economies, such as China, Japan, and India. China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increased living spaces required in the urban areas resulting from increasing urbanization and the desire of middle-income urban residents to improve their living conditions may impact the housing market and, thereby, increase the residential constructions in the country.

- Non-residential infrastructure is likely to expand significantly. The Chinese government approved 26 infrastructure projects worth approximately USD 142 billion in 2019, with completion due in 2023. The country has the largest construction market globally, accounting for 20% of all worldwide construction investments. By 2030, the government plans to spend over USD 13 trillion on construction. Thus, the construction market is expected to register a 4.48% CAGR during the forecast period (2022-2028).

- The construction industry is one of the largest industries in Asia-Pacific and recorded promising growth in 2019. The industry continues to grow as the region constitutes many developing countries such as Vietnam, Malaysia, Indonesia, Thailand, and other South Asian countries. However, due to the COVID-19 pandemic, the construction sector witnessed a significant decline owing to lockdowns by governments across the region, which severely affected developing countries, including India, China, Japan, and ASEAN countries.

- The Asia-Pacific region is also witnessing significant interest from international investors in the construction space. Foreign Direct Investment (FDI) in the construction development sector is increasing as developing countries provide better returns and opportunities for investors.

Asia-Pacific Acrylic Adhesives Industry Overview

The Asia-Pacific Acrylic Adhesives Market is fragmented, with the top five companies occupying 15.23%. The major players in this market are 3M, AVERY DENNISON CORPORATION, Henkel AG & Co. KGaA, Hubei Huitian New Materials Co. Ltd and NANPAO RESINS CHEMICAL GROUP (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 Solvent-borne

- 5.2.3 UV Cured Adhesives

- 5.2.4 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Hubei Huitian New Materials Co. Ltd

- 6.4.7 Kangda New Materials (Group) Co., Ltd.

- 6.4.8 NANPAO RESINS CHEMICAL GROUP

- 6.4.9 Pidilite Industries Ltd.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms