|

시장보고서

상품코드

1693570

북미의 군용기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Military Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

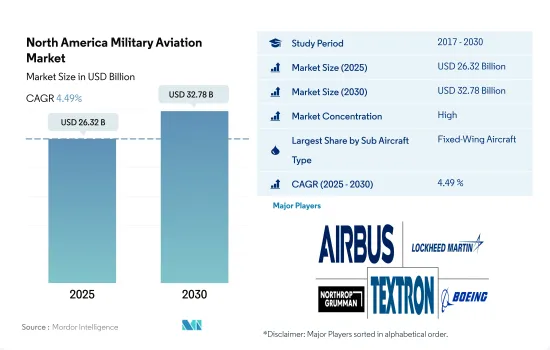

북미의 군용기 시장 규모는 2025년 263억 2,000만 달러로 추정되고, 2030년에는 327억 8,000만 달러에 이를 것으로 예상되며, 예측 기간 중(2025-2030년) CAGR 4.49%를 나타낼 것으로 예측됩니다.

지정학적 분쟁, 진행중의 조달, 근대화 계획이 군용기 및 회전익기 조달의 촉진요인

- 북미의 군용기 시장은 항공기의 유형별로 고정익기와 회전익기로 구분됩니다. 2022년 이 지역의 국방비는 총 9,120억 달러에 달했습니다.

- 보유수에서는 북미는 세계의 고정익기 전체의 25%를 차지하고 있습니다. 고정익기 중, 멀티롤 기체가 63%를 차지하고 이어 수송기가 20%, 기타 고정익기가 17%가 되고 있습니다.

- 현재 진행 중인 조달과 근대화 계획에 따라 미국은 계속 시장을 선도하고, 신형기에 대한 큰 수요를 창출할 것으로 보입니다. 2023년 미국은 CH-47 Chinook, UH-60 Black Hawk, CH-53K, AH-1Z를 포함한 119대의 회전익기의 구입을 계획했습니다. 전체적으로는 예측 기간 중에 합계 2,476기가 조달될 전망입니다.

지속적인 조달과 현대화 계획이 지역 시장을 밀어올릴 것으로 예상

- 북미 국가, 특히 미국은 지정 학적 분쟁에 대항하기 위해 선진적인 헬리콥터를 신속하게 개발해 왔습니다. 2022년 이 지역의 국방비는 총액 9,120억 달러에 이르렀습니다.

- 2023년 미국은 CH-47 Chinook, UH-60 Black Hawk, CH-53K, AH-1Z를 포함한 119대의 회전익 항공기 구매를 계획했습니다.

- 북미 국가, 특히 미국은 세계 안보와 세력 확대에 있어 매우 중요한 역할을 하고 있습니다. 기름 유조선을 신속하고 효율적으로 배치하는 능력은 이들 국가가 새로운 위협에 대응하고 국제 작전에 효과적으로 참여할 수 있게 합니다. 현재 진행중인 조달과 근대화 계획에 의해 미국이 계속 시장을 리드할 가능성이 있습니다.

북미 군용기 시장 동향

지정학적 위협이 이 지역의 방위비 증가의 주요 요인

- 2022년 미국은 세계 국방지출의 39%를 차지하는 군사지출은 2022년에 8,770억 달러(0.7%) 증가했습니다. 2023년도 예산 요구 금액은 약 202억 달러로, 2022년 요구 금액에서 11.7% 증가한 약 1,940억 달러로 추정되었습니다. 2023년도의 자금에는 F-35 61기, F-15EX 24기, 병참 지원기 79기, 회전익기 119기, UAV/UAS 12기의 구입이 포함됩니다.

- 지난 몇 년간 캐나다는 안전보장 우려의 고조에 대처하고 군비를 근대화하기 위해 국방 지출을 늘리는 헌신도 보여 왔습니다. 캐나다의 2022년 군사비는 269억 달러로 전년 대비 3.0% 증가했습니다. 정부 지출 전체 중 군사비에 할당된 비율은 1.2%입니다.

- 멕시코에서는 범죄 행위에 대항하기 위한 군사력의 사용이 서브리전에서의 군사 지출의 주요 원동력이 되고 있습니다. 국가 경비대에 대한 지출은 2021년에 35% 증가해, 군사비 전체의 16%를 차지했습니다.

함대의 근대화와 항공기의 근대화 요구 증가가 북미의 촉진요인

- 2022년 12월 현재 북미에서는 13,676대의 항공기와 헬리콥터가 활약하고 있습니다. 이 함대의 상당한 부분은 전투 헬리콥터(42%)와 전투기(21%)로 이뤄져 있습니다. 한편, 훈련기와 헬리콥터는 20%를 차지하고, 운송기는 7%에 그쳤습니다.

- 2022년 말 캐나다는 약 356대의 항공기와 회전익기를 보유하게 됐습니다. 멕시코는 2022년 12월 현재 468기의 항공기를 보유하고 있습니다.

북미 군용기 산업 개요

북미의 군용기 시장은 상당히 통합되어 있으며 상위 5개사에서 104.92%를 차지하고 있습니다. 시장 주요 기업은 Airbus SE, Lockheed Martin Corporation, Northrop Grumman Corporation, Textron Inc., The Boeing Company입니다(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 국내총생산

- 액티브 플릿 데이터

- 국방 지출

- 규제 프레임워크

- 밸류체인 분석

제5장 시장 세분화

- 서브 항공기 유형

- 고정익기

- 멀티롤 항공기

- 훈련용 항공기

- 수송기

- 기타

- 회전익기

- 멀티미션 헬리콥터

- 수송용 헬리콥터

- 기타

- 고정익기

- 국가명

- 캐나다

- 멕시코

- 미국

- 기타 북미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Airbus SE

- Leonardo SpA

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Textron Inc.

- The Boeing Company

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The North America Military Aviation Market size is estimated at 26.32 billion USD in 2025, and is expected to reach 32.78 billion USD by 2030, growing at a CAGR of 4.49% during the forecast period (2025-2030).

Geopolitical conflicts, ongoing procurements, and plans of modernization are the driving factors in procuring military aircraft and rotorcraft

- The North American military aviation market is segmented by aircraft type into fixed-wing and rotorcraft. Geopolitical conflicts, the rising threat of terrorism and war, and the modernization plans to replace the aging military aircraft played a major role in the procurement of next-generation military aircraft. In 2022, the region's defense expenditure totaled USD 912 billion. North America's military expenditure was largely accounted for by the United States, with 96%, followed by Canada and Mexico, with 3% and 1%, respectively.

- In terms of active fleet size, North America holds 25% of the total fixed-wing in the world. In 2022, out of the total aircraft deliveries around 56% were fixed-wing aircraft. Among the fixed-wing aircraft around 63% of the total aircraft were multirole aircraft, followed by 20% of transport aircraft and 17% of other fixed-wing aircraft. As of 2022, in terms of active fleet size, North America held approximately 29% of the total rotorcraft worldwide.

- With the ongoing procurements and plans of modernization, the US will continue to lead the market and generate significant demand for new aircraft. The US will also focus on new aircraft programs through R&D for future warfare during the forecast period. During 2023-2030, around 2,330 fixed-wing aircraft are expected to be delivered. In 2023, the US planned to purchase 119 rotorcraft, including the CH-47 Chinook, the UH-60 Black Hawk, the CH-53K, and the AH-1Z. In addition, the Mexican government ordered 11 helicopters (four H225M and seven UH-60M) for the Mexican Air Force. Overall, a total of 2,476 aircraft are expected to be procured during the forecast period.

Ongoing procurements and modernization plans are expected to boost the regional market

- Countries in North America, particularly the United States, have been among the first to develop advanced helicopters to counter geopolitical conflicts. Nearly 94% of the military expenditures in the region come from North America. In 2022, the region's defense expenditure totaled USD 912 billion. North America's military expenditures were largely accounted for by the United States (96%), followed by Canada and Mexico, with 3% and 1%, respectively.

- The increased military budgets of various countries in the region may facilitate the expansion of military rotorcraft procurement in the future. In 2023, the United States planned to purchase 119 rotorcraft, including the CH-47 Chinook, the UH-60 Black Hawk, the CH-53K, and the AH-1Z. The Mexican government ordered 11 helicopters (four H225M and seven UH-60M) for the Mexican Air Force.

- North American countries, especially the United States, play a crucial role in global security and power projection. Maintaining a strong military aviation fleet is essential for projecting force and safeguarding national interests abroad. The ability to deploy fighter jets, bombers, and aerial refueling tankers quickly and efficiently enables these countries to respond to emerging threats and participate in international operations effectively. For instance, according to the US military, the F-35 purchase plan for FY 2024 is to purchase 83 aircraft, i.e., 48 for the Air Force, 19 for the Navy, and 16 for the Marine Corps. Over the next five years, 113 KC-46A, 100 B-21, 12 P-8A, 5 E-11A, and 17 MC-130J are expected to be delivered. With the ongoing procurements and modernization plans, the United States may continue to lead the market. During the forecast period, a total of 2,476 aircraft are expected to be procured by the country.

North America Military Aviation Market Trends

Geopolitical threats are the main reason behind the increase in defense spending in the region

- In 2022, the US accounted for 39% of global defense spending military spending increased by USD 877 billion in 2022, or 0.7%. The total includes military assistance to Ukraine, estimated at USD 19.9 billion. In 2022, the US released the Department of the Air Force budget, which outlined that for FY 2023, the budget request is approximately USD 194.0 billion, a USD 20.2 billion or 11.7% increase from the FY 2022 request. This funding includes aircraft R&D, aircraft acquisition, initial spares, and aircraft support equipment. The funding for FY 2023 includes the purchase of 61 F-35, 24 F-15EX, 79 logistics and support aircraft, 119 rotary wing aircraft, and 12 UAV/UAS.

- Over the past few years, Canada also has demonstrated a commitment to increase defense spending to address growing security concerns and modernize its military equipment. The country recognizes the need to adapt to emerging threats, such as cyber warfare and asymmetric challenges, while maintaining conventional defense capabilities. Canada spent USD 26.9 billion on its military in 2022, which was 3.0 % higher than the previous year. Out of the total government spending, the country has allocated 1.2% of its share to the military. As per the Budget 2022, the announcement government will offer more than USD 8 billion for new funding to Canada's national defense over the next five years.

- In Mexico, the use of military forces to combat criminal activity remains the primary driver of military spending in the sub-region. Mexico's defense spending in 2022 was USD 8.5 billion, a decrease of 9.7% compared to 2021. Spending on the National Guard increased by 35% in 2021, accounting for 16% of total military spending. The country's defense expenditure was 0.6% of its GDP in 2022.

Fleet modernization and the rising need for modernization of aircraft are the driving factors in North America

- As of December 2022, North America had an active fleet of 13,676 aircraft and helicopters. Competition in technology is accelerating between China and the United States as both countries are increasingly focused on the R&D of emerging technologies to prepare for future warfare. The United States has the biggest fleet of military aircraft in the region and globally, with a total of 13,300 operational fleets. A considerable chunk of this fleet is made up of combat helicopters (42%) and combat planes (21%). In contrast, training planes and helicopters account for 20%, while transport planes make up only 7%. Meanwhile, tankers and special mission aircraft each represent 5% of the fleet.

- By the end of 2022, Canada had an active fleet of about 356 aircraft and rotorcraft. Of these total 356 aircraft, the most procured fleet is training aircraft/helicopters, accounting for 132, followed by 120 combat helicopters, 63 combat aircraft, 28 transport aircraft, 27 special mission aircraft, and 6 tanker aircraft. Canada has selected F-35s to replace its CF-18 fighter jets, which are scheduled to retire by 2032. If the F-35 deal is finalized, Canada plans to start procuring the new jets in 2025. Mexico had an active fleet of 468 aircraft as of December 2022. Of these total 468 aircraft, the most procured fleet is training aircraft, and helicopters accounted for 203 aircraft, followed by 157 combat helicopters, 46 transport aircraft, 25 special mission aircraft, and 36 combat aircraft. As transnational criminal organizations and drug cartels largely occupy the country, the country utilizes military helicopters to fight drug traffickers.

North America Military Aviation Industry Overview

The North America Military Aviation Market is fairly consolidated, with the top five companies occupying 104.92%. The major players in this market are Airbus SE, Lockheed Martin Corporation, Northrop Grumman Corporation, Textron Inc. and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.2 Active Fleet Data

- 4.3 Defense Spending

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Aircraft Type

- 5.1.1 Fixed-Wing Aircraft

- 5.1.1.1 Multi-Role Aircraft

- 5.1.1.2 Training Aircraft

- 5.1.1.3 Transport Aircraft

- 5.1.1.4 Others

- 5.1.2 Rotorcraft

- 5.1.2.1 Multi-Mission Helicopter

- 5.1.2.2 Transport Helicopter

- 5.1.2.3 Others

- 5.1.1 Fixed-Wing Aircraft

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 United States

- 5.2.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Leonardo S.p.A

- 6.4.3 Lockheed Martin Corporation

- 6.4.4 Northrop Grumman Corporation

- 6.4.5 Textron Inc.

- 6.4.6 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms