|

시장보고서

상품코드

1693577

유럽의 비즈니스 제트기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Business Jet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

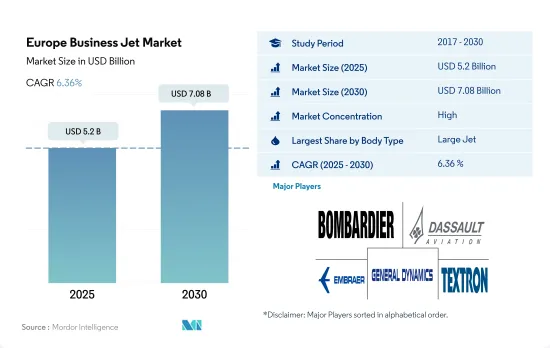

유럽의 비즈니스 제트기 시장 규모는 2025년 52억 달러로 추정되며, 2030년에는 70억 8,000만 달러에 이를 것으로 예상되며, 예측 기간 중(2025-2030년) CAGR 6.36%를 나타낼 것으로 예측됩니다.

유행 후 출장 비행 시간이 증가해 비즈니스 제트기에 대한 높은 수요가 발생합니다.

- 비즈니스 제트기는 유럽의 경영진 및 기업에게 소규모 공항에 직접 액세스하여 민간 항공편과 관련된 시간 소모적인 프로세스를 피합니다. 이러한 제트기로 바쁜 경영진은 생산성을 극대화하고 출장과 관련된 혼란을 줄일 수 있습니다. COVID-19의 유행은 이 지역의 비즈니스 제트기 납품에 부정적인 영향을 미쳤으며, 2020년에는 2021년 대비 26% 감소했습니다. 이 지역의 부유층 사이에서는 보다 안전한 이동 수단으로서의 자가용 비행기로의 시프트를 볼 수 있어, 비즈니스 제트기의 조달을 뒷받침하고 있습니다. 그러나 시장은 팬데믹에서 점차 회복해 2022년에는 2020년 대비 34%의 성장을 기록했습니다.

- 납품 실적에서는 2017년부터 2022년까지 대형 제트기 부문이 53%의 점유율을 차지했고 소형 제트기가 35%, 중형 제트기가 12%였습니다. 동기간에 비즈니스 제트기를 가장 많이 납품한 OEM은 Embraer로, 이 지역에서 납품된 제트기 전체의 11%를 차지했으며 Cessna가 10%, Bombardier가 9%, Gulfstream이 7%였습니다.

- 2022년 12월 기준 유럽 비즈니스 제트기 보유량에서 Cessna가 30%, Bombardier가 19%, Dassault가 14%로 뒤를 이었습니다. 이 지역의 UHNWI(초고액자산가)가 급증하면서 2023년부터 2030년까지 약 1,244대의 항공기가 인도될 것으로 예상되며, 이는 비즈니스 제트기 부문의 성장을 견인할 것으로 보입니다.

이 지역의 신규 회원 증가와 HNWI(부유층) 증가가 이 지역의 비즈니스 제트기 수요를 견인하고 있습니다.

- 세계 금융, 상업, 관광의 허브로서 유럽의 역동적인 비즈니스 환경은 비즈니스 제트기가 제공하는 효율성, 유연성, 고급스러움에 크게 의존하고 있습니다.

- 2023년 에어차터 서비스 제공업체는 유럽에서의 높은 수요와 비즈니스 에비에이션의 신규 가입의 급증을 목격했습니다. 연간 비행 시간이 25시간에서 49시간인 플렉서블한 스케줄을 가지는 여행자를 대상으로 하며, 3년간의 정액제로 제공되는 VJ25는 주력 제품인 초장거리기 Bombardier Global 7500을 포함한 세계 360기 이상의 비스타 항공기를 온디맨드로 확실히 이용할 수 있습니다.

- 유럽의 비즈니스 제트기 수요는 COVID-19 팬데믹과 러시아 우크라이나 분쟁의 영향을 받고 있으며, 특히 중장거리 노선에서는 2022년의 대부분의 기간, 많은 지역이나 국가로의 여행 제한이 계속되었습니다. 장거리용 제트기나 초경량 제트기가 증가하고 있는 것은 유럽의 항공사가 유럽역내나 역외에의 비행으로 비즈니스 제트기를 사용하는 수요가 증가하고 있는 것의 나타납니다입니다.

유럽 비즈니스 제트기 시장 동향

HNWI 인구 증가는 시장의 주요 성장 촉진요인

- HNWI(부유층)와 UHNWI(초부유층)는 개인 여행이나 출장을 위해 프라이빗 제트를 소유하는 경우가 많습니다. 2022년 유럽의 UHNWI 수는 2021년에 비해 5% 증가했습니다.

- HNWI의 수와 자산 측면에서 유럽이 주도적인 지위를 차지하는 것은 주로 독일, 프랑스, 영국에 기인합니다. HNWI 인구는 독일이 350만명으로 가장 많았고, 이어 프랑스가 307만명, 영국이 290만명이었습니다. 영국은 아프리카, 아시아, 중동으로부터의 부유층을 안정적으로 매료하고 있습니다. HNWI 인구 성장이 가장 적은 것은 러시아로, 2%를 기록했습니다. 이것은 지난 10년간, 부유층이 매년 러시아 국외에 유출하고 있기 때문에 러시아가 현재 직면하고 있는 문제의 나타난 것입니다. 경제, 특히 인플레이션과 금융시장에 리스크를 가져왔습니다. 그러나 시장은 예측기간 동안 회복될 것으로 예상됩니다.

유럽 비즈니스 제트기 산업 개요

유럽의 비즈니스 제트기 시장은 상당히 통합되어 있으며 상위 5개사에서 98.05%를 차지하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 개인 부유층(HNWI)

- 규제 프레임워크

- 밸류체인 분석

제5장 시장 세분화

- 바디 유형

- 대형 제트기

- 소형 제트기

- 중형 제트기

- 국가명

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 튀르키예

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Bombardier Inc.

- Cirrus Design Corporation

- Dassault Aviation

- Embraer

- General Dynamics Corporation

- Pilatus Aircraft Ltd

- Textron Inc.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Europe Business Jet Market size is estimated at 5.2 billion USD in 2025, and is expected to reach 7.08 billion USD by 2030, growing at a CAGR of 6.36% during the forecast period (2025-2030).

Increase in business travel flight hours after the pandemic generated a high demand for business jets

- Business jets offer European executives and corporations direct access to smaller airports and avoid the time-consuming processes associated with commercial flights. These jets enable busy executives to maximize their productivity and reduce travel-related disruptions. The COVID-19 pandemic adversely impacted business jet deliveries in the region, with a decline of 26% in 2020 compared to 2021. There has been a shift toward private flying as a safer mode of transportation among the HNWI population in the region, aiding in procuring business jets. However, the market gradually recovered from the pandemic, and in 2022, the region recorded 34% growth compared to 2020.

- In terms of deliveries, during 2017-2022, the large jet segment dominated the region with 53% of the share, followed by light and mid-size jets with 35% and 12%, respectively. During the same period, the OEM that delivered most of the business jets was Embraer, with 11% of the total jets delivered in the region, followed by Cessna with 10% of jets delivered, Bombardier delivered 9% of the jets, and Gulfstream delivered 7% of the jets.

- Cessna was the leading OEM, with 30% of the current operational fleet size, followed by Bombardier and Dassault, with 19% and 14%, respectively, in the European business jet fleet as of December 2022. The surge in UHNWI individuals in the region is expected to aid the business jet segment. Around 1,244 aircraft are expected to be delivered between 2023 and 2030.

An increase in new memberships and rising HNWI wealth in the region is driving the demand for business jets in the region

- As a hub for global finance, commerce, and tourism, Europe's dynamic business landscape relies heavily on the efficiency, flexibility, and luxury that business jets provide. As of December 2022, Europe accounted for around 12% of the global business jet fleet, with Germany leading the region with 18% of the total European business jet fleet, followed by the United Kingdom and France, with around 11% and 9%. There has been a shift toward private flying as a safer mode of transportation among the HNWI population in the region, aiding in procuring business jets. However, with the rapid vaccination rates and opening of borders, in 2022, a growth of 28% was recorded compared to 2020.

- In 2023, air charter service providers witnessed high demand in the European region and a surge in new memberships for business aviation. In May 2023, VistaJet International recently introduced its VJ25 program to Europe, the Middle East, and Africa. Aimed at travelers with flexible schedules flying 25 to 49 hours per year and offered as a three-year subscription, VJ25 provides guaranteed on-demand access to the Vista fleet of more than 360 aircraft worldwide, including its flagship ultra-long-range Bombardier Global 7500.

- Business jet demand in Europe continued to be affected by the COVID-19 pandemic and the Russia-Ukraine conflict, especially for medium and long-haul flights, as travel restrictions to many regions and countries remained in place during much of 2022. The Y-o-Y fleet growth and an increasing number of long-range and very light jets are signs of increased demand for European operators to use business jets inside Europe and on flights to destinations outside the region. During the forecast period, around 1,244 jets are expected to be procured.

Europe Business Jet Market Trends

Rise in the HNWI population acting as the major growth driver for the market

- HNWIs and UHNWIs often own private jets for personal or business travel. Europe is home to a multitude of scenic and exclusive destinations that may not be easily accessible through commercial flights. Business jets provide the opportunity for HNWIs to fly directly to remote locations, avoiding congested airports and time-consuming connections. In 2022, the number of UHNWIs in Europe increased by 5% compared to 2021. This was because the Eurozone utilities, tech stocks, and luxury goods sectors performed well, registering solid gains. Europe recorded the third significant rise in the ultra-wealthy population, which recorded 67% of the global HNWI population during 2017-2022.

- The leading position of Europe in terms of the number and assets of HNWIs is mainly attributed to Germany, France, and the United Kingdom. In 2022, these three countries alone recorded 67% of the total HNWIs in Europe. Germany led the HNWI population with 3.5 million HNWIs, followed by France with 3.07 million and the United Kingdom with 2.9 million. The United Kingdom attracts a steady stream of high-net-worth individuals from Africa, Asia, and the Middle East. Russia saw the least growth in the HNWI population, which recorded 2%. This was because well-off people have been moving out of Russia every year for the past 10 years, a sign of the current issues the country is facing. The crisis in Ukraine posed risks to the global economy, especially to inflation and financial markets. However, the market is expected to recover during the forecast period. In 2030, the HNWI population is expected to grow by 18.4 million.

Europe Business Jet Industry Overview

The Europe Business Jet Market is fairly consolidated, with the top five companies occupying 98.05%. The major players in this market are Bombardier Inc., Dassault Aviation, Embraer, General Dynamics Corporation and Textron Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 High-net-worth Individual (hnwi)

- 4.2 Regulatory Framework

- 4.3 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Large Jet

- 5.1.2 Light Jet

- 5.1.3 Mid-Size Jet

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Italy

- 5.2.4 Netherlands

- 5.2.5 Russia

- 5.2.6 Spain

- 5.2.7 Turkey

- 5.2.8 UK

- 5.2.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bombardier Inc.

- 6.4.2 Cirrus Design Corporation

- 6.4.3 Dassault Aviation

- 6.4.4 Embraer

- 6.4.5 General Dynamics Corporation

- 6.4.6 Pilatus Aircraft Ltd

- 6.4.7 Textron Inc.

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록