|

시장보고서

상품코드

1693591

군용기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Military Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

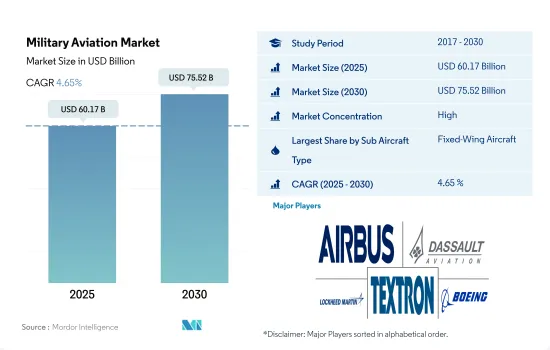

세계의 군용기 시장 규모는 2025년 601억 7,000만 달러로 추정되며, 2030년에는 755억 2,000만 달러에 이? 것으로 예상되고, 예측 기간 중(2025-2030년) CAGR 4.65%로 성장할 것으로 예측됩니다.

군용기 시장은 군이 구형 항공기를 전투기, 대형 수송기, 특수 임무기로 대체함에 따라 확대될 것으로 예측됩니다.

- 세계의 군용기 함대는 대규모의 급속한 업그레이드로 극적인 변화를 목격하고 있습니다. 아, 아랍에미리트(UAE), 중국 등 여러 나라에 의한 차세대 전투기의 조달 증가에 의해 보다 높은 성장이 전망되고 있습니다.

- 헬리콥터 부문에서는 멀티미션 헬리콥터가 예측 기간 동안 가장 높은 성장을 기록할 것으로 예측됩니다. 국가간의 정치적 및 지리적 긴장의 고조에 부추겨진 군사비 증가는 인도, 쿠웨이트, 카타르, 호주, 러시아, 아랍에미리트(UAE) 등의 나라에서 전투 능력을 강화하기 위한 조달을 증가시키고 있습니다.

- 또한 각국이 자국생산에 힘을 쏟고 있는 것도 예측기간 중 세계 군사에 의한 다양한 최신예 항공기와 회전익기의 조달을 뒷받침할 가능성이 높습니다. 사우디아라비아 정부는 비전 2030 계획 하에서 국내 제조를 강화하기 위해 2030년까지 군사 장비의 국산화 지출을 50%로 끌어올릴 계획입니다.

세계의 군사분쟁의 고조가 주요 군사대국의 중점을 재편성하고 있습니다.

- 2022년 러시아와 우크라이나 전쟁은 세계 각국의 국방 예산과 군사 작전 준비 태세를 재평가할 필요성을 더욱 부추겼습니다. 러시아의 우크라이나 침공은 2022년의 지출 증가의 주요인이었습니다.

- 2022년 러시아와 우크라이나 전쟁은 세계 군사의 작전 준비 태세를 재평가할 필요성을 더욱 부추겼습니다.

- 2017년부터 2022년까지 고정익 항공기 보유량은 약 1% 증가했으며, 2017년부터 2022년까지 군용 헬리콥터 조달에서 북미가 전체 헬리콥터 조달의 37%를 차지하며 시장을 장악했습니다. 이는 주로 미국이 주도하고 있으며, 미국은 세계 최대 군용 헬리콥터 보유국으로 세계 점유율의 32%를 차지하고 있습니다. 아시아 태평양 지역도 중요한 시장으로 중국, 인도 등 국가의 국방 예산 증가로 인해 26%의 점유율을 차지하고 있습니다. 유럽은 러시아, 프랑스, 독일, 영국 등의 국가들이 헬리콥터 현대화 프로그램에 투자하면서 20%의 높은 성장세를 보이고 있습니다.

- 무력 분쟁과 국내 안보가 세계의 방위비의 성장을 조장하고 있어 각국은 항공기의 신규 조달로 군비를 강화하고 있습니다.

세계 군사항공시장 동향

국경 간 긴장 증가와 신형 항공기의 필요성으로 국방비 급증

- 아시아태평양의 군사비는 총 5,690억 달러 중국과 인도의 국경 문제 등의 지정학적 분쟁, 국내 안보상의 과제, 해양 모니터링, 대테러 작전은 이 지역의 국가들의 고정익 항공기의 성장을 조장하는 요인의 일부입니다.

- 아시아태평양에는 인도, 중국, 일본, 한국을 비롯한 주요 군사대국이 존재하며, 국방예산도 해마다 증가하고 있습니다. 성장을 견인하고 있습니다. 예를 들어, 인도 정부는 2023년도 예산으로, 신형 전투기 Rafale에의 결제나 Sukhoi-30MKI, Tejas 전투기의 제조를 포함해 인도 공군을 위해서 전회 예산보다 약 10% 증액한 예산을 계상했습니다.

- 아시아태평양의 군사비 증가는 많은 지역 주권 주체와의 남중국해에서의 긴장과 인도·중국 간, 인도·파키스탄 간의 국경 분쟁 등 몇몇 정치적 및 국경적 분쟁에서 우위를 차지하는 것을 목적으로 하고 있습니다.

함대의 근대화와 신규 조달은 아시아태평양의 군사 활동 함대를 개선할 것으로 예측됩니다.

- 2022년 말까지 아시아태평양의 현역 항공기수는 1만 5,543기로 그 중 고정익기가 60%를 차지하고 나머지 항공기수는 회전익기였습니다.

- 2020년 시점에서 아시아태평양의 평균 항공기 보유 연수는 9.5년이었지만, 2030년에는 10.7년이 될 것으로 예측되고 있습니다.

- 중국, 인도, 한국 등의 국가들은 근대전의 요구를 충족하기 위해 항공기 보유수를 확대하고 있습니다.

- 아시아태평양의 현역 항공기 보유수는 2022년에는 2017년 대비 3% 증가했습니다. 태국, 말레이시아, 싱가포르, 인도네시아, 필리핀 등 주요 국가가 135기 이상의 항공기 조달을 계획하고 있기 때문에 항공기 보유수는 증가할 가능성이 있습니다.

군용기 산업 개요

군용기 시장은 상당히 통합되어 있으며 상위 5개 기업에서 72.20%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 국내총생산

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 북미

- 남미

- 액티브 플릿 데이터

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 북미

- 남미

- 국방 지출

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 북미

- 남미

- 규제 프레임워크

- 밸류체인 분석

제5장 시장 세분화

- 서브 항공기 유형

- 고정익기

- 멀티롤 항공기

- 훈련용 항공기

- 수송기

- 기타

- 회전익기

- 멀티미션 헬리콥터

- 수송용 헬리콥터

- 기타

- 고정익기

- 지역

- 아시아태평양

- 호주

- 중국

- 인도

- 인도네시아

- 일본

- 말레이시아

- 필리핀

- 싱가포르

- 한국

- 태국

- 기타 아시아태평양

- 유럽

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 튀르키예

- 영국

- 기타 유럽

- 중동 및 아프리카

- 알제리

- 이집트

- 카타르

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 북미

- 캐나다

- 멕시코

- 미국

- 기타 북미

- 남미

- 브라질

- 칠레

- 콜롬비아

- 기타 남미

- 아시아태평양

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Airbus SE

- Dassault Aviation

- Leonardo SpA

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Pilatus Aircraft Ltd

- Russian Helicopters

- Textron Inc.

- The Boeing Company

- United Aircraft Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Military Aviation Market size is estimated at 60.17 billion USD in 2025, and is expected to reach 75.52 billion USD by 2030, growing at a CAGR of 4.65% during the forecast period (2025-2030).

The market for military aviation is expected to expand as the military replaces older aircraft with fighter, large transport, and special mission aircraft

- The global military aircraft fleet has witnessed some drastic changes with large-scale and rapid upgradation in the military aircraft fleet globally. The fixed-wing aircraft segment accounted for around 57% of global military aircraft deliveries in 2022. The fixed-wing aircraft segment is expected to witness higher growth due to the increasing procurement of next-generation combat aircraft by several countries, such as the United States, Germany, India, Australia, the United Arab Emirates, and China. The overall military aviation market is also expected to be driven by the military forces' plans to replace their aging aircraft fleet with fighter jets, big transport aircraft, and special-mission aircraft.

- In the helicopter segment, multi-mission helicopters are anticipated to register the highest growth during the forecast period. Most countries are planning to procure multi-mission helicopters to enhance their combat capabilities. The increasing military spending, fueled by the growth of political and geographical tensions between the countries, has increased procurement in countries such as India, Kuwait, Qatar, Australia, Russia, and the United Arab Emirates to strengthen their combat capabilities.

- Focus on indigenous manufacturing by various countries is also likely to boost the procurement of various advanced aircraft and rotorcraft by the armed forces worldwide during the forecast period. Under Vision 2030, the Government of Saudi Arabia is planning to increase the local military equipment spending to 50% by 2030 to strengthen its domestic manufacturing. During 2023-2030, over 7,700 military aircraft are expected to be delivered, further driving the market.

The rising military conflicts globally have realigned the emphasis of the major military powers

- In 2022, the war between Russia and Ukraine further fueled the defense budgets across various countries and the need to reassess the operational readiness of the armed forces globally. The world military expenditure rose by 3.7% in 2022 to reach a record high of USD 2240 billion. Russia's invasion of Ukraine was a major driver of the growth in spending in 2022. The five biggest spenders in 2022 were the United States, China, Russia, India, and Saudi Arabia, which together accounted for 63% of world military spending.

- In 2022, the war between Russia and Ukraine further fueled the need to reassess the operational readiness of the global armed forces. NATO nations are undergoing fleet modernization and expansion programs with the procurement of new fixed-wing aircraft.

- The active fleet of fixed-wing aircraft increased by around 1% from 2017 to 2022. In terms of military helicopter procurements during 2017-2022, North America dominated the market with 37% of the total helicopter fleet. This is primarily driven by the United States, which has the largest military helicopter fleet globally, with 32% of the global share. Asia-Pacific is another significant market, with a share of 26%, due to the increasing defense budgets of countries like China and India. Europe has been witnessing a substantial growth of 20%, with countries like Russia, France, Germany, and the UK investing in helicopter modernization programs.

- The armed conflicts and internal security are aiding in the growth of defense expenditure globally, with nations strengthening their armed forces with new procurements of aircraft. With the expansion of aircraft fleets, the global military aviation market is expected to grow during 2023-2030.

Global Military Aviation Market Trends

Increased border tensions and the need for new aircraft has led to a surge in defense expenditure

- Asia-Pacific spent a total of USD 569 billion on military expenditures. Geopolitical conflicts such as border issues between China and India, internal security challenges, maritime surveillance, and counter-terrorism operations are some of the factors aiding the growth of the fixed-wing aircraft fleet of the countries in this region. The rise in military spending in China and India was the main cause of the increase in 2022. The combined military spending of the two nations in the region in 2022 was 66%. The increase in defense spending of the nations over the past ten years was driven by economic growth and territorial disputes.

- Major military powers, including India, China, Japan, and South Korea, are present in the Asia-Pacific region and are yearly growing their defense budgets. This budget includes a significant portion for the improvement and expansion of air superiority, which is driving the growth of military aviation in the region. For instance, in the budget of FY 2023, the Indian government allocated about 10% more for the Indian Air Force compared to the previous budget, including payments for the new Rafale fighters and the manufacturing of Sukhoi-30MKIs and Tejas fighters.

- The increased military spending in the Asia-Pacific region is intended to gain an advantage in several political and border conflicts, such as the tension in the South China Sea with many regional sovereign entities and border conflicts between India-China and India-Pakistan. The defense spending of major countries in China is expected to cross over USD 400 billion by 2030.

Fleet modernization and new procurements are projected to improve the APAC's military active fleet

- By the end of 2022, there were 15,543 active aircraft in the Asia-Pacific region, of which fixed-wing aircraft accounted for 60% while rotorcraft accounted for the remaining fleet. China, India, Japan, and South Korea together accounted for 55% of the total active fleet in the region.

- In 2020, the average aircraft fleet age in Asia-Pacific amounted to 9.5 years, which was projected to increase by 2030, when the average aircraft fleet age across the region was expected to be 10.7 years. The older aircraft, some of which date back to the 1960s, have been slowly phased out by the Indian Air Force. The MiG 21 and MiG 27 have been the backbone of the Indian Air Force (IAF). The average age of these aircraft is around 45 years. Australia's two fighter aircraft, FA-18 and F-35, have been in service for the last 16 years and 8 years, respectively.

- Countries such as China, India, and South Korea are expanding their aircraft fleet size to fulfill the demands of modern warfare. They may continue to produce and acquire next-generation aircraft during the forecast period. The regional armed forces are also enhancing the capabilities of helicopters with cutting-edge technology to obtain military superiority over the external threat.

- Asia Pacific's active fleet increased by 3% in 2022 compared to 2017. Indonesia and Thailand accounted for 63% of the total fleet in Southeast Asia. In the coming years, the aircraft fleet may increase as major countries like Thailand, Malaysia, Singapore, Indonesia, and the Philippines plan to procure over 135 aircraft. The active fleet of the region is expected to expand at a healthy rate during the forecast period.

Military Aviation Industry Overview

The Military Aviation Market is fairly consolidated, with the top five companies occupying 72.20%. The major players in this market are Airbus SE, Dassault Aviation, Lockheed Martin Corporation, Textron Inc. and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.1.1 Asia-Pacific

- 4.1.2 Europe

- 4.1.3 Middle East and Africa

- 4.1.4 North America

- 4.1.5 South America

- 4.2 Active Fleet Data

- 4.2.1 Asia-Pacific

- 4.2.2 Europe

- 4.2.3 Middle East and Africa

- 4.2.4 North America

- 4.2.5 South America

- 4.3 Defense Spending

- 4.3.1 Asia-Pacific

- 4.3.2 Europe

- 4.3.3 Middle East and Africa

- 4.3.4 North America

- 4.3.5 South America

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Aircraft Type

- 5.1.1 Fixed-Wing Aircraft

- 5.1.1.1 Multi-Role Aircraft

- 5.1.1.2 Training Aircraft

- 5.1.1.3 Transport Aircraft

- 5.1.1.4 Others

- 5.1.2 Rotorcraft

- 5.1.2.1 Multi-Mission Helicopter

- 5.1.2.2 Transport Helicopter

- 5.1.2.3 Others

- 5.1.1 Fixed-Wing Aircraft

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 Australia

- 5.2.1.2 China

- 5.2.1.3 India

- 5.2.1.4 Indonesia

- 5.2.1.5 Japan

- 5.2.1.6 Malaysia

- 5.2.1.7 Philippines

- 5.2.1.8 Singapore

- 5.2.1.9 South Korea

- 5.2.1.10 Thailand

- 5.2.1.11 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Germany

- 5.2.2.3 Italy

- 5.2.2.4 Netherlands

- 5.2.2.5 Russia

- 5.2.2.6 Spain

- 5.2.2.7 Turkey

- 5.2.2.8 UK

- 5.2.2.9 Rest of Europe

- 5.2.3 Middle East and Africa

- 5.2.3.1 Algeria

- 5.2.3.2 Egypt

- 5.2.3.3 Qatar

- 5.2.3.4 Saudi Arabia

- 5.2.3.5 United Arab Emirates

- 5.2.3.6 Rest of Middle East and Africa

- 5.2.4 North America

- 5.2.4.1 Canada

- 5.2.4.2 Mexico

- 5.2.4.3 United States

- 5.2.4.4 Rest of North America

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Chile

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Dassault Aviation

- 6.4.3 Leonardo S.p.A

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 Northrop Grumman Corporation

- 6.4.6 Pilatus Aircraft Ltd

- 6.4.7 Russian Helicopters

- 6.4.8 Textron Inc.

- 6.4.9 The Boeing Company

- 6.4.10 United Aircraft Corporation

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록