|

시장보고서

상품코드

1693631

일본의 상용차 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Japan Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

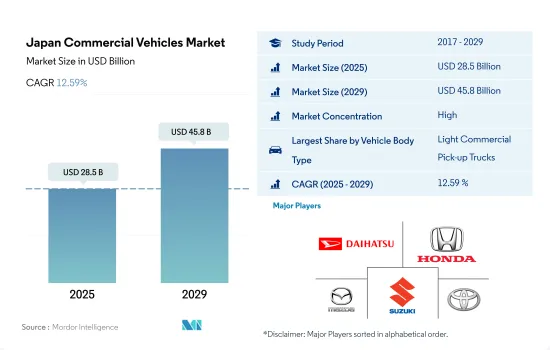

일본의 상용차 시장 규모는 2025년에 285억 달러로 추정되고, 2029년에는 458억 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR은 12.59%를 나타낼 전망입니다.

2050년까지 탄소 중립을 달성하겠다는 일본 정부의 야심찬 목표와 친환경 투자에 대한 인센티브가 코로나19 팬데믹으로 인한 어려움에도 불구하고 일본 내 전기차(EV)의 빠른 도입을 이끌고 있습니다.

- 2020년 일본 정부는 2050년까지 탄소 배출 제로를 목표로 하는 '탄소 중립' 목표를 설정했습니다. 코로나19 팬데믹으로 인한 어려움에도 불구하고 하우스텐보스는 순수 전기 버스를 도입하여 환경 목표를 향해 한 걸음 나아갔습니다. 플러그인 하이브리드, 연료전지 전기차, 배터리 전기차를 포함한 대체 자동차 시장은 최근 몇 년 동안 괄목할 만한 성장세를 보이고 있습니다.

- 코로나19 팬데믹으로 인해 많은 분야가 혼란에 빠졌지만, 전기자동차(EV) 시장은 전 세계적인 채택률 증가에 힘입어 주목할 만한 확장 궤도에 올라섰습니다. 팬데믹의 여파로 소비자들은 점점 더 비용 효율적인 옵션을 찾고 있습니다. 그러나 일본 전체 배출량의 19%를 차지하는 일본의 운송 산업은 2019년에 무려 11억 1,100만 톤의 CO2를 배출했습니다. 이에 따라 자동차 업계에서는 차세대 차량의 보급을 늘리고 연비를 향상시키는 등 CO2 배출량을 줄이기 위한 노력을 적극적으로 강화하고 있습니다.

- 일본 정부는 경제 성장을 촉진하기 위해 2030년까지 친환경 투자와 판매를 통해 연간 90조 엔(8,700억 달러), 2050년까지 무려 190조 엔(1조 8,000억 달러)의 매출을 목표로 세금 감면과 재정적 인센티브를 제공하고 있습니다.

일본의 상용차 시장 동향

정부와 업계의 협력으로 점진적으로 성장하는 일본 전기자동차 시장

- 일본의 전기차 산업은 점진적으로 성장하고 있으며, 2035년까지 모든 신차 판매의 전기화를 목표로 하는 정부의 규범과 목표는 일본을 전기 모빌리티로 전환하고 있습니다. 또한 보조금과 리베이트에 대한 정부의 노력도 일본 전기자동차 시장을 견인하고 있습니다. 2021년 11월 일본 정부는 전기자동차에 보조금을 지급한다고 발표하였습니다.

- 다양한 기업들이 일본 전역의 다양한 분야에서 전기 이동성을 강화하기 위해 파트너십과 벤처를 체결하고 있습니다. 2022년 6월, 기술 기업 소니와 일본 자동차 제조업체 혼다는 전기 모빌리티를 함께 연구하기 위한 조인트 벤처를 체결했습니다. 이 벤처의 목표는 2025년까지 일본에서 전기차를 생산 및 판매하는 것입니다. 또한 혼다는 2030년까지 30종의 전기차를 출시하고 연간 200만 대의 전기차를 생산하겠다고 발표했습니다.

- 2022년 4월, 미국의 자동차 제조업체 제너럴 모터스는 혼다와 전기자동차 생산을 위한 파트너십을 확대한다고 발표했습니다. 파트너십 확장의 일환으로 두 회사는 자동차를 포함한 새로운 저렴한 전기자동차를 개발할 예정입니다. 차량 생산은 2027년 초에 시작될 예정입니다. 또한, 이러한 국제적인 확장은 새로운 디자인과 향상된 자동차를 개발할 것으로 예상되며, 이는 2024-2030년 일본 내 전기자동차 판매를 더욱 증가시켜 일본 전역의 배터리 팩 수요도 가속화할 것으로 예상됩니다.

일본의 상용차 산업 개요

일본의 상용차 시장은 상위 5개 기업이 81.27%를 점유하는 등 상당히 통합되어 있습니다. 이 시장의 주요 업체는 Daihatsu Motor Co. Ltd., Honda Motor Co. Ltd., Mazda Motor Corporation, Suzuki Motor Corporation, Toyota Motor Corporation(알파벳 순 정렬)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 GDP

- 차량 구매를 위한 소비자 지출(CVP)

- 인플레이션율

- 자동차 대출 금리

- 전기화의 영향

- EV 충전소

- 배터리 팩 가격

- Xev 신모델 발표

- 물류성능지수

- 연료 가격

- OEM 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차량 부문

- 상용차

- 버스

- 대형 상용 트럭

- 경상용 픽업 트럭

- 경상용 밴

- 중형 상용 트럭

- 상용차

- 추진 부문

- 하이브리드 및 전기자동차

- 연료 카테고리별

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 연료 카테고리별

- 천연가스

- 디젤

- 가솔린

- 하이브리드 및 전기자동차

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Daihatsu Motor Co. Ltd.

- Honda Motor Co. Ltd.

- Isuzu Motors Limited

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Renault-Nissan-Mitsubishi Alliance

- Stellantis NV

- Subaru Corporation

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Japan Commercial Vehicles Market size is estimated at 28.5 billion USD in 2025, and is expected to reach 45.8 billion USD by 2029, growing at a CAGR of 12.59% during the forecast period (2025-2029).

The Japanese government's ambitious goal of carbon neutrality by 2050, coupled with incentives for green investments, is driving the rapid adoption of electric vehicles (EVs) in Japan, despite challenges posed by the COVID-19 pandemic

- In 2020, the Japanese government set a 'carbon neutral' target, aiming for zero carbon emissions by 2050. Despite the challenges posed by the COVID-19 pandemic, Huis Ten Bosch took a step toward its environmental objectives by introducing all-electric buses. The market for alternative vehicles, including plug-in hybrids, fuel cell electric vehicles, and battery electric vehicles, has witnessed a remarkable surge in recent years.

- While the COVID-19 pandemic disrupted numerous sectors, the electric vehicles (EVs) market has been on a notable expansion trajectory, driven by a rising global adoption rate. In the wake of the pandemic, consumers are increasingly seeking more cost-effective options. However, Japan's transportation industry, which accounted for 19% of the nation's total emissions, contributed to a staggering 1.11 billion tons of CO2 emissions in 2019. In response, the automotive sector is actively bolstering efforts to reduce CO2 emissions, ramping up the supply of next-gen vehicles and enhancing fuel efficiency.

- The Japanese government is actively endorsing the use of ethanol in gasoline. By the mid-2030s, the policy aims to phase out gasoline-powered vehicles, favoring a shift toward electric vehicles, including hybrids and fuel cells. To drive economic growth, the government is offering tax exemptions and financial incentives, targeting a boost of JPY 90 trillion (USD 870 billion) annually through green investments and sales by 2030, and a staggering JPY 190 trillion (USD 1.8 trillion) by 2050. This heightened emphasis on battery electric and full hybrid vehicles is poised to shape the market's growth in the coming years.

Japan Commercial Vehicles Market Trends

Japan's electric vehicle market grows gradually due to government and industry partnerships

- The electric vehicle industry in Japan is growing gradually, and the government's norms and targets to electrify all new car sales by 2035 are shifting the country toward electric mobility. Moreover, government efforts in terms of subsidies and rebates are driving the country's electric vehicle market. In November 2021, the government of Japan announced that it would provide subsidies on electric vehicles, i.e., up to USD 7200 per vehicle. However, hybrid vehicles are not included in the subsidy program. Such factors contribute to the growth of electric vehicles (passenger cars) by 11.11% in 2022 over 2021.

- Various companies are signing partnerships and ventures to enhance electric mobility in various sectors across Japan. In June 2022, the technology company Sony and the Japanese automaker Honda signed a joint venture to work on electric mobility together. The objective of the venture is to produce and sell electric cars in Japan by 2025. Moreover, Honda has announced the launch of 30 electric vehicles and the production of 2 million vehicles annually by 2030. Each company has invested approximately USD 37.52 million in the venture. Such factors are expected to impact electric mobility positively.

- In April 2022, the US-based automaker General Motors announced an expand its partnership with Honda to produce electric vehicles. As part of the expansion, the companies will develop new affordable electric vehicles, including cars. The production of the vehicles is expected to start in early 2027. Moreover, such international expansions are expected to develop new designs and enhanced cars, which further is expected to raise the sales of electric cars During the 2024-2030 period in Japan, which will also accelerate the demand for battery packs across Japan.

Japan Commercial Vehicles Industry Overview

The Japan Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 81.27%. The major players in this market are Daihatsu Motor Co. Ltd., Honda Motor Co. Ltd., Mazda Motor Corporation, Suzuki Motor Corporation and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daihatsu Motor Co. Ltd.

- 6.4.2 Honda Motor Co. Ltd.

- 6.4.3 Isuzu Motors Limited

- 6.4.4 Mazda Motor Corporation

- 6.4.5 Mitsubishi Motors Corporation

- 6.4.6 Renault-Nissan-Mitsubishi Alliance

- 6.4.7 Stellantis N.V.

- 6.4.8 Subaru Corporation

- 6.4.9 Suzuki Motor Corporation

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms