|

시장보고서

상품코드

1693640

스페인의 경상용차 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Spain Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

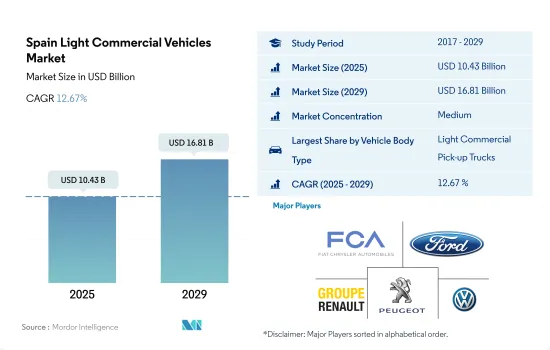

스페인의 경상용차(LCV) 시장 규모는 2025년에 104억 3,000만 달러로 추정되고, 2029년에는 168억 1,000만 달러에 이를것으로 예측되며, 예측 기간(2025-2029년)의 CAGR은 12.67%를 나타낼 것으로 예측됩니다.

스페인의 경상용차 부문 다양화에 대한 전략적 초점은 효율성을 높이고 보다 지속 가능한 경제로 전환하는 과정에서 기업의 특정 요구를 충족시킬 것입니다.

- 스페인의 경상용차(LCV) 시장은 다양한 부문의 특정 요구 사항을 충족하는 다양한 차종을 자랑합니다. 여기에는 패널 밴, 픽업 트럭, 소형 트럭이 포함됩니다. 패널 밴은 다양한 상업 활동 전반에 걸친 적응성과 다용도성 덕분에 스페인 LCV 시장에서 최고의 자리를 차지하고 있습니다. 좁은 도심 도로에서 기동성이 뛰어나고 특히 배달 및 서비스 제공업체에서 상품을 안전하게 운송할 수 있어 인기가 높습니다.

- 픽업 트럭은 틈새 시장이지만 시장에서 중요한 역할을 담당하고 있습니다.

- 패널 밴이나 픽업 트럭보다 더 높은 적재 능력과 넓은 공간을 제공하는 소형 트럭은 물류, 건설, 무역 중심의 중소기업에 생명줄과 같은 존재입니다.

스페인의 경상용차 시장 동향

스페인의 전기자동차 수요 증가는 정부 보조금과 노력에 의해 주도되고 있습니다.

- 스페인 자동차 산업은 지난 몇 년 동안 지속적으로 성장해 왔으며, 특히 2020년 이후 전기자동차에 대한 수요가 최근 몇 년 동안 크게 증가했습니다. 2021년 3월 스페인 정부는 무브스 II 보조금 프로그램의 예산을 1억 유로에서 1억 2,000만 유로로 확대하는 등 다양한 정부 보조금 정책을 시행하고 있습니다. 이 프로그램에 따라 경 상용차는 3,630유로의 보조금을, 대형 상용차 구매자는 6,000유로의 보조금을 받을 수 있습니다.

- 스페인의 전기자동차 산업도 최근 몇 년 동안 엄청나게 성장했습니다. 정부의 규범과 보조금 제공의 영향은 전기차 판매 증가에 기여했습니다. 이러한 요인들은 소비자들이 전기차를 선택하도록 장려했습니다.

- 스페인을 포함한 유럽에서 '무브스 3' 계획을 도입했습니다. 정부는 전기차에 대해 폐차 시 4,500유로, 폐차 시 7,000유로의 보조금을 지급하며, 이 계획은 2023년 12월 31일까지 시행됩니다. 이러한 혜택은 2024년부터 2030년까지 스페인의 전기차 수요를 가속화할 것으로 예상됩니다.

스페인의 경상용차 산업 개요

스페인의 경상용차 시장은 적당히 통합되어 있으며 상위 5개 기업이 60.77%를 점유하고 있습니다. 이 시장의 주요 업체는 Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Peugeot S.A. 및 Volkswagen AG(알파벳 순 정렬)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 GDP

- 차량 구매를 위한 소비자 지출(CVP)

- 인플레이션율

- 자동차 대출 금리

- 전기화의 영향

- EV 충전소

- 배터리 팩 가격

- Xev 신모델 발표

- 물류성능지수

- 연료 가격

- OEM 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차량 부문

- 상용차

- 경상용 픽업 트럭

- 경상용 밴

- 상용차

- 추진 부문

- 하이브리드 자동차 및 전기자동차

- 연료 카테고리별

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 연료 카테고리별

- 천연가스

- 디젤

- 가솔린

- LPG

- 하이브리드 자동차 및 전기자동차

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- Groupe Renault

- IVECO SpA

- Mercedes-Benz

- Peugeot SA

- Toyota Motor Corporation

- Volkswagen AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Spain Light Commercial Vehicles Market size is estimated at 10.43 billion USD in 2025, and is expected to reach 16.81 billion USD by 2029, growing at a CAGR of 12.67% during the forecast period (2025-2029).

Spain's strategic focus on diversifying light commercial vehicle types will boost efficiency and meet the specific needs of businesses in transitioning to a more sustainable economy

- The Spanish light commercial vehicles (LCV) market boasts a diverse range of vehicle types tailored to meet the specific needs of different sectors. These include panel vans, pickup trucks, and small trucks. Panel vans reign supreme in the Spanish LCV market, owing to their adaptability and versatility across a wide range of commercial activities. Their maneuverability in narrow urban streets and ability to securely transport goods, especially for deliveries and service providers, make them highly sought-after. The growth in e-commerce has further fueled the demand for panel vans, highlighting the need for efficient urban logistics solutions.

- Pickup trucks, though occupying a niche, play a crucial role in the market. They find favor among businesses in agriculture, construction, and utilities, owing to their durability and ability to handle diverse terrains. Their versatility, coupled with off-road capabilities, makes them indispensable for businesses operating in rural areas or those requiring transportation to less accessible sites.

- Small trucks, offering higher payload capacities and more space than panel vans or pickups, are a lifeline for logistics, construction, and trade-focused small and medium-sized enterprises (SMEs). While sustainability is gaining traction across segments, the introduction of electric and hybrid small trucks is still limited. Factors like cost and charging infrastructure pose challenges to their wider adoption.

Spain Light Commercial Vehicles Market Trends

Increasing demand for electric vehicles in Spain is driven by government subsidies and initiatives

- The Spanish automobile industry has been growing continuously over the past few years, and the demand for electric vehicles has grown significantly in recent years, especially after 2020. Various government practices in terms of rebates, such as in March 2021, the government of Spain expanded the budget for the Moves II subsidy program from EUR 100 million to EUR 120 million. Under the program, the light commercial vehicle will be subsidized by EUR 3,630, and heavy commercial vehicle buyers are eligible for a subsidy of EUR 6,000. As a result, electric commercial vehicles witnessed an annual growth of 51.06% in 2021 compared to 2020 across Spain.

- The electric car industry in Spain has also grown tremendously in recent years. In 2020, the government of Spain announced a target of having at least 5 million electric vehicles by 2030. The impact of government norms and subsidies offered has contributed to the growth in the sales of electric cars. Such factors have encouraged consumers to opt for EVs. As a result, the country witnessed a growth in the sale of electric cars by 17.90% in 2022 over 2021.

- The government and various companies are making efforts through various projects that are going to accelerate electric mobility in Spain. In March 2023, the government introduced the Moves 3 plan in Europe, including Spain. The government offered subsidies of EUR 4,500 (without scrapping) and EUR 7,000 (with scrapping) for electric vehicles; the plan was offered until December 31, 2023. Such offerings are expected to accelerate the demand for electric cars in Spain between 2024 and 2030.

Spain Light Commercial Vehicles Industry Overview

The Spain Light Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 60.77%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Peugeot S.A. and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 IVECO S.p.A

- 6.4.5 Mercedes-Benz

- 6.4.6 Peugeot S.A.

- 6.4.7 Toyota Motor Corporation

- 6.4.8 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms