|

시장보고서

상품코드

1693653

전기자동차 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Electric Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

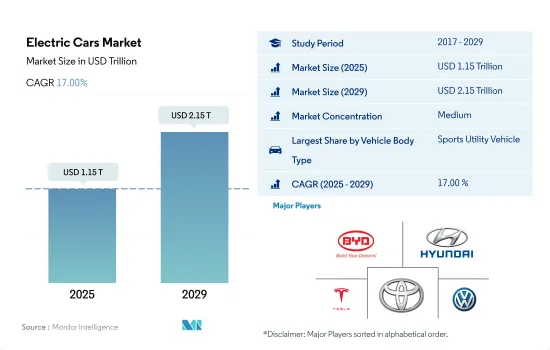

전기자동차 시장 규모는 2025년에 1조 1,500억 달러로 추정되고, 2029년에는 2조 1,500억 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR은 17.00%를 나타낼 것으로 예측됩니다.

화석 연료와 관련된 부정적인 환경 영향을 완화하는 차량에 대한 수요가 증가하면서 시장의 성장이 촉진되고 있습니다.

- 자동차 산업은 코로나19 팬데믹으로 인한 전 세계적인 칩 부족과 공급망 중단으로 큰 영향을 받았습니다. 그럼에도 불구하고 Tesla는 제조 관행과 생산 차량 모두에서 기후 변화에 기여한다는 비판에 직면했습니다.

- 전 세계 자동차 시장은 지난 한 해 동안 코로나19 팬데믹으로 인해 상당한 영향을 받았습니다. 팬데믹에 대응하여 전 세계적으로 여행 제한 조치가 취해지면서 자동차 업계는 여러 가지 어려움에 직면했습니다. 2020년 전 세계 자동차 판매량은 6,380만 대에 달했습니다.

- 2021년 전 세계 승용차 판매량은 약 5,640만 대에 달해 전년 대비 5% 가까이 증가했습니다. 중국은 2,150만 대를 조금 밑도는 최대 지역 시장으로 부상했습니다. 자동차 시장은 향후 10년 동안 큰 변화를 맞이할 것으로 예상됩니다. 2030년에는 전기차가 전 세계 신차 판매량의 약 26%를 차지할 것으로 예상됩니다. 2022년에는 약 5,800만 대의 자율주행차가 전 세계에 보급될 것입니다.

- 2020년 전 세계 소비자들의 전기차에 대한 지출은 1,200억 달러에 달했으며, 각국 정부는 전기차 판매 장려를 위해 140억 달러에 가까운 예산을 배정했습니다. 이러한 노력은 성과를 거두어 2019년 전기차 판매량이 유럽에서 인센티브 강화에 힘입어 25%나 급증했습니다. 자동차 배터리 생산량도 크게 증가하여 2020년에는 33% 증가한 160GWh를 기록했습니다. 동시에 배터리 평균 가격은 13% 하락한 137달러/kWh로 떨어졌습니다.

- 플러그인 전기자동차의 보급을 촉진하기 위해 많은 정부 정책에서 전기자동차 구매에 대한 여러 가지 매력적인 인센티브를 제공하고 있습니다. 예를 들어, 2011년 3,000개에 불과했던 노르웨이의 충전소는 현재 16,000개 이상으로 늘어났습니다. 노르웨이 정부는 전 세계에서 가장 높은 고속 충전소를 포함하여 모든 주요 노선에 50km마다 고속 충전소를 설치했습니다.

- 전 세계적으로 전기자동차에 대한 매우 매력적인 인센티브가 몇 가지 있습니다. 전반적으로 많은 국가가 2030년까지 온실가스 배출량을 40% 감축하는 파리 기후 정책 목표에 서명했으며, 자동차 정책이 이를 뒷받침하고 있습니다. 2030년까지 완전 무공해 자동차 판매를 포함한 국가 차량 목표는 이미 2017년에 국가 교통 계획에 의해 수립되었습니다.

세계의 전기자동차 시장 동향

세계 수요 증가와 정부 지원으로 전기차 시장 성장 촉진

- 전기자동차(EV)는 에너지 효율성을 높이고 온실가스 및 공해 배출을 줄일 수 있는 잠재력에 힘입어 자동차 산업에서 필수 불가결한 존재가 되었습니다. 이러한 급증은 주로 환경에 대한 관심이 높아지고 정부의 지원 노력에 기인합니다. 특히 전 세계의 전기차 판매량은 2021년에 비해 2022년에 10.82%의 견고한 성장세를 보였습니다.

- 런던 경찰청 및 소방청과 같은 선도적인 제조업체와 기관들은 전기 모빌리티 전략을 적극적으로 추진하고 있습니다. 예를 들어, 이들은 2025년까지 무공해 차량 목표를 설정하고 2030년까지 밴의 40%를 전기화하고 2040년까지 완전 전기화를 달성한다는 목표를 세웠습니다.

- 아시이평양과 유럽은 배터리 기술 및 차량 전기화의 발전에 힘입어 전기차 생산을 주도할 것으로 보입니다. 2020년 5월, 기아자동차 유럽은 전기화로의 전략적 전환을 알리는 '플랜 S'를 발표했습니다. 이 결정은 유럽에서 기아자동차의 전기차 판매량이 기록적으로 증가한 이후 내려진 것입니다. 기아는 2025년까지 승용차, SUV, MPV 등 다양한 부문에 걸쳐 11개의 전기차 모델을 전 세계에 출시한다는 야심찬 계획을 세우고 있습니다.

전기자동차 산업 개요

전기자동차 시장은 적당히 통합되어 있으며 상위 5개 기업이 44.50%를 점유하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 아프리카

- 아시이평양

- 유럽

- 중동

- 북미

- 남미

- 1인당 GDP

- 아프리카

- 아시이평양

- 유럽

- 중동

- 북미

- 남미

- 자동차 구입을 위한 소비 지출(CVP)

- 아프리카

- 아시이평양

- 유럽

- 중동

- 북미

- 남미

- 인플레이션율

- 아프리카

- 아시이평양

- 유럽

- 중동

- 북미

- 남미

- 자동차 대출 금리

- 공유 차량 서비스

- 전기화의 영향

- EV 충전소

- 배터리 팩 가격

- 아프리카

- 아시이평양

- 유럽

- 중동

- 북미

- 남미

- Xev 신모델 발표

- 중고차 판매

- 연료 가격

- OEM 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차량 구성

- 승용차

- 다목적 차량

- 승용차

- 연료 카테고리

- BEV

- FCEV

- HEV

- PHEV

- 지역

- 아프리카

- 남아프리카

- 아시이평양

- 인도

- 유럽

- 체코 공화국

- 영국

- 중동

- 아랍에미리트(UAE)

- 북미

- 멕시코

- 남미

- 브라질

- 아프리카

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- BYD Auto Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Hyundai Motor Coportaion

- Nissan Motor Co. Ltd.

- Stellantis NV

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Electric Cars Market size is estimated at 1.15 trillion USD in 2025, and is expected to reach 2.15 trillion USD by 2029, growing at a CAGR of 17.00% during the forecast period (2025-2029).

Increasing demand for vehicles mitigating the negative environmental impacts associated with fossil fuels is boosting the growth of the market

- The automotive industry was significantly impacted by the global chip shortages and supply chain disruptions stemming from the COVID-19 pandemic. Despite this, Tesla faced criticism for its perceived contributions to climate change, both in its manufacturing practices and the vehicles it produces. Notably, EU consumers are increasingly opting for vehicles that mitigate the negative environmental impacts associated with fossil fuels.

- The global automotive market witnessed significant repercussions from the COVID-19 pandemic in the past year. As travel restrictions were imposed worldwide in response to the pandemic, the industry faced several setbacks. In 2020, global car sales reached 63.8 million units. While a modest recovery was anticipated in 2021, and around 66 million cars were expected to be sold, major players like Toyota and the Volkswagen Group saw their deliveries decline by over a million units.

- In 2021, global passenger car sales reached approximately 56.4 million units, marking a nearly 5% increase from the previous year. China emerged as the largest regional market, accounting for just under 21.5 million units. The automotive landscape is poised for significant transformation in the coming decade. By 2030, it is projected that electric vehicles will make up around 26% of global new car sales. By 2022, around 58 million self-driving cars joined the global fleet. Such technological advancements are reshaping the automotive supply chain, particularly in the realm of automotive electronics. With the rise of automation and electrification, the future of the automotive market looks promising.

- In 2020, global consumer spending on electric cars reached USD 120 billion, while governments worldwide allocated nearly USD 14 billion to incentivize electric vehicle sales. These efforts paid off, with electric vehicle sales surging by 25% in 2019, largely driven by enhanced incentives in Europe. The production of automotive batteries also saw a significant uptick, rising by 33% to reach 160 GWh in 2020. Simultaneously, the average cost of these batteries dropped by 13% to USD 137/kWh. Governments globally, under their National EV Policies, exempt electric vehicle buyers and lessees from purchase tax, VAT, and even annual road traffic insurance charges.

- In order to boost the fleet of plug-in electric cars, many government policies have been established to offer several enticing incentives for buying electric vehicles. For instance, there are currently more than 16,000 charging stations in Norway, up from just 3,000 in 2011. On all important routes, including the highest fast-charging station in the entire world, the Norwegian government erected fast-charging stations every 50 km. EV charging stations appear to have a promising future in Norway.

- There are several highly attractive incentives for electric vehicles globally. Overall, many countries signed Paris Climate Policy targets, which call for a 40% decrease in greenhouse gas emissions by 2030, supported by the automobile policy. National vehicle targets, including the sale of entirely zero-emission cars by 2030, were already established by the National Transport Plan in 2017. Norway has also committed to reducing greenhouse gas emissions by at least 40% by 2030. These factors are all expected to boost the growth of the Norwegian electric car market.

Global Electric Cars Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Cars Industry Overview

The Electric Cars Market is moderately consolidated, with the top five companies occupying 44.50%. The major players in this market are BYD Auto Co. Ltd., Hyundai Motor Company, Tesla Inc., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.9.1 Africa

- 4.9.2 Asia-Pacific

- 4.9.3 Europe

- 4.9.4 Middle East

- 4.9.5 North America

- 4.9.6 South America

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Multi-purpose Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 India

- 5.3.3 Europe

- 5.3.3.1 Czech Republic

- 5.3.3.2 UK

- 5.3.4 Middle East

- 5.3.4.1 UAE

- 5.3.5 North America

- 5.3.5.1 Mexico

- 5.3.6 South America

- 5.3.6.1 Brazil

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler AG (Mercedes-Benz AG)

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 Groupe Renault

- 6.4.6 Hyundai Motor Company

- 6.4.7 Nissan Motor Co. Ltd.

- 6.4.8 Stellantis N.V.

- 6.4.9 Tesla Inc.

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록