|

시장보고서

상품코드

1693706

아시아태평양의 민간 항공기 객실 좌석 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia-Pacific Commercial Aircraft Cabin Seating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

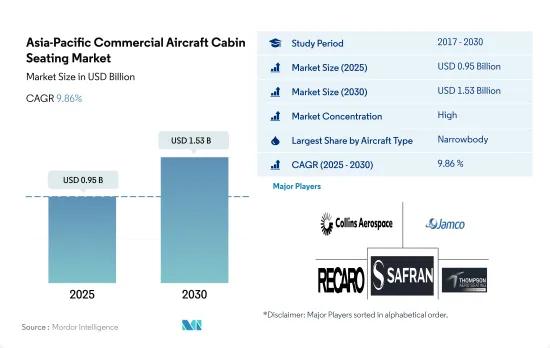

아시아태평양의 민간 항공기 객실 좌석 시장 규모는 2025년에 9억 5,000만 달러로 추정되고, 2030년에는 15억 3,000만 달러에 달할 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR 9.86%로 성장할 전망입니다.

아시아태평양 항공사의 장거리 노선에서 좁은 바디 기계 채용 증가

- 바디 유형별로 보면, 여객기는 협폭동체와 광폭동체로 구분됩니다. 협폭동체와 광폭동체를 포함한 여객기 카테고리 전체에서 이 지역에서 35%의 감소가 나타났습니다.

- 아시아태평양 항공사는 장거리 노선에서 좁은 바디 기계의 사용 빈도를 높이고 있으며, 이 시장에서 인체공학을 기반으로 한 시트의 도입을 촉진하고 있습니다. 예를 들어, Asiana Airlines와 Korean Air은 인체공학을 기반으로 한 디자인, 개별적으로 조정가능한 카프레스트, 프라이버시 기능을 도입하여 비행 중 편안함과 전반적인 체험 수준을 높이기 위해 노력하고 있습니다. 또한, 한국 최초의 하이브리드 항공사인 Air Premier는 광폭동체에 의한 풀 서비스의 어메니티와 저비용의 빈 여행을 제공합니다. 이 항공은 B787-9형 기계에 Recaro의 PL3530 프리미엄 이코노미 클래스와 CL3710 이코노미 클래스의 시트를 장비했습니다. 인도 항공 시장은 IndiGo, SpiceJet 및 Go First와 같은 저렴한 항공사가 지배적이며 협폭동체만을 운항합니다. Air India와 Vistara와 같은 풀 서비스 캐리어는 광폭동체와 협폭동체가 혼합되어 있습니다.

- 더 넓은 공간을 확보한 좌석 구조는 여행자들 사이에서 매우 선호됩니다. 2023-2030년까지 이 지역에서는 약 5,000대 이상의 항공기가 납입될 전망입니다. 협폭동체와 광폭동체의 대량 주문을 통해 이러한 항공사는 예측 기간 동안 민간 항공기 좌석의 성장을 이끌 것으로 예측됩니다.

아시아태평양에서 가장 높은 성장을 이루는 것은 중국

- 아시아태평양은 예측 기간 동안 가장 빠르게 성장하는 민간 항공기 객실 좌석 시장 중 하나가 될 것으로 예측됩니다. 팬데믹이 이 지역 항공산업에 미치는 영향에도 불구하고 국내 항공 여객 수송량은 2021년 완만한 성장세를 보였습니다. 이 지역은 2021년 세계 항공 여객 수송량의 27.5%를 차지했습니다.

- 경제 인프라 개발의 발전으로 인한 1인당 소득 증가는 항공 여객 증가를 뒷받침했습니다. 또한 국내 항공사 및 지역 항공사의 장비 확대 계획도 뒷받침했습니다.

- 지난 몇 년간 중국, 인도, 일본 등 이 지역의 주요 국가는 여객 수송량의 급격한 증가를 목격하여 그 지역에서 운항하는 항공사로부터 신형 항공기의 대량 발주를 받았습니다.

- 신형 민간 여객기의 납입수 증가는 이 지역의 민간 항공기 객실 좌석 시장의 성장을 적극적으로 견인했습니다.

- 최신 세대의 항공기 시트는 연료비를 줄이고 항공기의 지속가능성을 높이기 위해 비금속 재료와 경량 설계로 만들어졌습니다. Thompson Aero Seating은 다기능 접이식 테이블, PED 홀더, 개선된 콘솔 표면 공간을 갖춘 비즈니스 클래스의 차세대 스위트, VantageXL을 발매했습니다.

아시아태평양 민간 항공기 객실 좌석 시장 동향

장거리 협폭동체의 도입이 아시아태평양의 주요 시장 성장 촉진요인

- 아시아태평양의 항공기 신규 배송은 예측 기간 동안 CAGR 11%를 기록할 전망입니다. 항공사는 증대하는 항공 수요에 대응하기 위해 기체 규모의 확대를 도모하고 있으며, 이 지역에서는 신형기에 대한 큰 수요가 발생할 가능성이 있습니다.

- 2017-2022년간 이 지역에서는 총 2,469대의 신조 항공기가 납품되었습니다. 게다가 2023-2030년 사이에, 이 지역에 6,000기의 신형 제트기가 납입될 전망입니다. 과거에 이 지역에서 납품된 항공기는 전 세계 민간 항공기 납품 총수의 42%를 차지했습니다. 경제적이고 소형 항공기 선호, LCC 성공, 장거리 좁은 바디 기계 도입 등 몇 가지 요인으로 인해 예측 기간 동안 더 많은 납품이 예상됩니다.

- Air India, Singapore Airlines, China Southern Airlines, Qantas Airways Limited, Vistara, Korea Airlines 등 이 지역의 주요 항공사는 협폭동체와 광폭동체 모두 제트기를 포함하여 3,500대 이상의 주문 잔여를 보유하고 있습니다. 이 항공사는 COVID-19 팬데믹기간 동안 이익을 유지하기 위해 오래된 모델의 일부를 퇴역시키고 연비 효율이 좋은 새 모델을 구입하기로 결정했습니다. 항공사들은 보다 젊은 기체를 유지하려고 할 수 있기 때문에 아시아태평양 국가에서는 향후 3년간 신형기의 대량 발주가 예상됩니다.

COVID-19 팬데믹 이후 국제 여객 운송량 증가가 시장 수요를 견인하고 있습니다.

- COVID-19 팬데믹 이후 2022년 국경을 넘은 여행이 점차 회복됨에 따라 아시아태평양 항공사는 사람들의 여행 욕망과 2년 격리 기간에 축적된 저축의 현금화에 자극, 쇄도하는 수요에 부응하기 위해 증편을 서둘러 있습니다. 그 결과, 2022년에는 이 지역의 항공 여객 수송량은 다른 지역보다 급속하게 팬데믹으로부터 회복했습니다. 항공 여객 수는 19억명을 기록했으며, 2021년 대비 6%, 2020년 대비 151%의 성장세를 보였습니다. 화를 실시했습니다.중국, 인도, 일본, 인도네시아는 이 지역의 항공 여객 수송량 전체의 70%를 차지하고 있어, 다른 아시아태평양 제국에 비해 신조 항공기에 대한 높은 수요를 낳고 있습니다.

- 아시아태평양 항공사는 또한 세계적으로 경제 상황이 엄격해지고 있음에도 불구하고 여행 수요가 성장을 계속 추진했기 때문에 국제항공 여객 시장의 순조로운 회복을 목격했습니다.

아시아태평양 민간 항공기 객실 좌석 산업 개요

아시아태평양 민간 항공기 객실 좌석 시장은 상당히 통합되어 있으며 상위 5개 기업에서 74.88%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 항공 여객 수송량

- 신규 항공기 납품 수

- 1인당 GDP(현행 가격)

- 항공기 제조업체의 매출액

- 항공기 수주 잔

- 수주 총액

- 공항 건설 지출(계속 중)

- 항공사의 연료비

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 항공기 유형

- 협폭동체

- 광폭동체

- 국가명

- 중국

- 인도

- 인도네시아

- 일본

- 싱가포르

- 한국

- 기타 아시아태평양

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Adient Aerospace

- Collins Aerospace

- Expliseat

- Jamco Corporation

- Recaro Group

- Safran

- STELIA Aerospace(Airbus Atlantic Merginac)

- Thompson Aero Seating

- ZIM Aircraft Seating GmbH

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Asia-Pacific Commercial Aircraft Cabin Seating Market size is estimated at 0.95 billion USD in 2025, and is expected to reach 1.53 billion USD by 2030, growing at a CAGR of 9.86% during the forecast period (2025-2030).

The adoption of narrowbody aircraft in the longer-haul routes by the airlines in Asia-Pacific has increased

- By body type, passenger aircraft have been segmented into narrowbody and widebody. The narrowbody aircraft segment dominated the market in terms of the number of deliveries, with 2,460+ deliveries during 2017-2022. In 2020, the overall passenger aircraft category, including narrowbody and widebody, witnessed a decline of 35% in the region. New aircraft orders were also affected by delays by airline companies due to travel restrictions on domestic and international routes.

- Airlines in Asia-Pacific are using narrowbody aircraft more frequently on longer routes, facilitating the introduction of ergonomic seats in the market. For instance, Asiana Airlines and Korean Air are working to improve the level of comfort and overall experience during the flight by implementing ergonomic design, individually adjustable calf rests, and privacy features. Air Premier, the first hybrid airline in South Korea, also offers full-service amenities and low-cost air travel through its widebody aircraft fleet. The airline equipped its B787-9 fleet with Recaro's PL3530 Premium Economy Class and CL3710 Economy Class seats. The Indian aviation market is dominated by low-cost carriers like IndiGo, SpiceJet, and Go First, which operate a fleet of only narrowbody aircraft. Full-service carriers like Air India and Vistara have a mixed fleet of narrowbody and widebody aircraft.

- An enhanced seating structure with more developed space is becoming highly preferred among travelers. During 2023-2030, around 5,000+ aircraft are expected to be delivered in the region. Through their huge orders for narrowbody and widebody aircraft, these airlines are projected to drive the growth of commercial aircraft seats during the forecast period.

China will witness the highest growth in the Asia-Pacific

- The Asia-Pacific region is expected to become one of the fastest-growing commercial aircraft cabin seating markets during the forecast period. Despite the impact of the pandemic on the region's aviation industry, domestic air passenger traffic witnessed gradual growth in 2021. The region accounted for 27.5% of the global air passenger traffic in 2021.

- The rising per capita income due to increased economic and infrastructure development aided the growth of air passengers. It also supported the fleet expansion plans of domestic and regional airlines.

- In the past few years, major countries in the region, like China, India, and Japan, witnessed a rapid increase in passenger traffic, resulting in large orders for new aircraft from airlines operating in the region. China drives the commercial aviation market in the region, one of the largest global aviation markets.

- The growing number of deliveries of new commercial passenger aircraft positively drove the growth of the region's commercial aircraft cabin seating market. In 2021, Boeing delivered 91 aircraft to the region, while Airbus delivered 30% of its aircraft.

- The latest generation aircraft seats are made from non-metallic materials and lightweight designs to reduce fuel expenses and increase the aircraft's sustainability. The demand for seats with enhanced features and technological convenience is increasing, which may boost the market's expansion in the future. For instance, Thompson Aero Seating launched the next-generation VantageXL, a business-class suite with a multi-function bi-fold table, a PED holder, and improved console surface space.

Asia-Pacific Commercial Aircraft Cabin Seating Market Trends

The introduction of long-range narrowbody aircraft is the key market driver in Asia-Pacific

- New aircraft deliveries in Asia-Pacific are expected to register a CAGR of 11% during the forecast period. Airlines are looking to expand their fleet sizes to cater to the growing demand for air travel, which may generate significant demand for new aircraft in the region. China accounted for 37% of the total air passenger traffic in Asia-Pacific. Hence, the country is anticipated to generate the highest demand for new aircraft compared to other Asia-Pacific countries.

- During 2017-2022, a total of 2,469 new aircraft were delivered in the region. In addition, 6,000 new jets are expected to be delivered to the region between 2023 and 2030. The aircraft deliveries in the region during the historic period accounted for 42% of the total commercial aircraft deliveries worldwide. More deliveries are anticipated during the forecast period due to several factors, such as the preference for economical and smaller aircraft, the success of LCCs, and the introduction of long-range narrowbody aircraft.

- Some major airlines in the region, such as Air India, Singapore Airlines, China Southern Airlines, Qantas, Vistara, and Korea Airlines, have a backlog of over 3,500 aircraft, including a mix of both narrowbody and widebody jets. These airlines, in order to stay profitable during the COVID-19 pandemic, opted to retire some of the old aircraft models and purchase new aircraft that are fuel-efficient. As the airlines may try to maintain a younger fleet, large orders for new aircraft are expected over the next three years across Asia-Pacific countries.

An increase in international passenger traffic post the COVID-19 pandemic is driving market demand

- As cross-border travel was progressively restored in 2022 post the COVID-19 pandemic, the carriers in Asia-Pacific raced to increase their flights to meet runaway demand, stimulated by people's desire to travel and cash in on savings accumulated in the two years of isolation. As a result, in 2022, the air passenger traffic in the region recovered more rapidly from the pandemic than in the other regions. For instance, in 2022, air passenger traffic in the whole of Asia-Pacific was recorded at 1.9 billion, a growth of 6% compared to 2021 and 151% compared to 2020. Airline companies in the region are implementing fleet expansion plans to cater to the growing air passenger traffic in the major countries. China, India, Japan, and Indonesia accounted for 70% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other Asia-Pacific countries.

- Airlines in Asia-Pacific also witnessed a good recovery in international air passenger markets as travel demand continued to fuel growth despite increasingly challenging global economic conditions. For instance, in August 2022, the region recorded 13.1 million international air passenger traffic, an 836% increase compared to August 2021, when it was recorded at 1.4 million. The healthy growth in international passenger traffic in the first eight months of the year showed strong travel demand from business and leisure consumers. The rapid increase in air passenger traffic in the region is expected to drive the air transport industry in the future.

Asia-Pacific Commercial Aircraft Cabin Seating Industry Overview

The Asia-Pacific Commercial Aircraft Cabin Seating Market is fairly consolidated, with the top five companies occupying 74.88%. The major players in this market are Collins Aerospace, Jamco Corporation, Recaro Group, Safran and Thompson Aero Seating (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Indonesia

- 5.2.4 Japan

- 5.2.5 Singapore

- 5.2.6 South Korea

- 5.2.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adient Aerospace

- 6.4.2 Collins Aerospace

- 6.4.3 Expliseat

- 6.4.4 Jamco Corporation

- 6.4.5 Recaro Group

- 6.4.6 Safran

- 6.4.7 STELIA Aerospace (Airbus Atlantic Merginac)

- 6.4.8 Thompson Aero Seating

- 6.4.9 ZIM Aircraft Seating GmbH

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록