|

시장보고서

상품코드

1693940

유럽의 우주 추진 시장(2025-2030년) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측Europe Space Propulsion - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

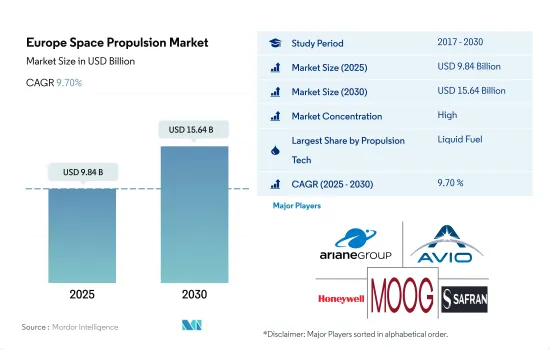

유럽의 우주 추진 시장 규모는 2025년에 98억 4,000만 달러로 추정되고, 2030년에는 156억 4,000만 달러에 이를 전망이며 예측 기간(2025-2030년) 동안 CAGR 9.70%를 보일 것으로 예측됩니다.

예측 기간 동안 가스 추진력 이용이 급증할 전망

- 유럽 우주 추진 시장에서 가스 추진 시스템은 간편성, 신뢰성 및 신속한 응답 시간이 중요한 소형에서 중형 위성에 지속적으로 널리 사용되고 있습니다. 가스 추진 시스템은 통신, 지구 관측, 과학 연구 등 다양한 위성 임무에서 널리 사용됩니다.

- 전기 추진 시스템은 연료 효율과 운영 수명 연장으로 유럽 위성 시장에서 각광받고 있습니다. 이 기술은 높은 비율의 추력을 제공하므로 위성은 더 적은 추진제로 더 많은 페이로드를 운반할 수 있습니다. 또한 전기 추진 시스템은 장시간의 미션과 정밀한 궤도 제어가 가능합니다. 정지 위성, 심우주 임무, 그리고 지구 전지역을 커버하는 위성 별자리에 적합합니다.

- 액체 추진 시스템은 주로 히드라진과 사산화질소와 같은 이원 추진제를 기반으로 하며 유럽의 위성에서 주 추진과 대규모 궤도 제어에 널리 채용되고 있습니다., 유독하고 부식성이 있는 추진제는 취급에 주의가 필요하며 전기나 가스를 이용한 시스템에 비해 추진제의 질량이 커집니다.

추진기술의 제품 혁신이 성장을 뒷받침할 전망

- 우주 추진이란 우주선과 인공위성을 가속시키는 데 사용되는 방법입니다. 현재의 우주 추진 시스템에는 주로 2개의 솔루션이 있습니다.

- 우주 제조 산업은 틈새 시장이며, 최종 수익은 72억 5,000만 유로를 차지하고 3만 8,000명의 첨단 기술 고용을 창출하고 있습니다.

- 유럽우주국(ESA)의 미래 우주 운송 프로그램은 추진 시스템의 기술적 성숙도를 통해 과제를 해결하고 솔루션을 제공하기 위한 주요 발사 시스템 기술을 식별하고 있습니다. 이 지역에는 많은 정부계, 상업계, 기타 참가기업이 존재하기 때문에 위성 제조 산업 수요는 플러스 성장을 나타냈습니다.

유럽 우주 추진 시장 동향

유럽 우주 추진 시장 투자 기회 수요 견인

- 유럽 국가들은 우주 부문에서 다양한 투자의 중요성을 인식하고 있습니다. 세계 우주 산업에서 경쟁과 혁신을 유지하기 위해 우주 프로그램과 기술 혁신에 대한 지출을 늘리고 있습니다. 2022년 11월, ESA는 지구 관측 분야에서 선두를 유지하기 위해 향후 3년간 우주 자금을 25% 증액할 것을 발표했습니다.

- 2022년 11월, 독일은 다양한 우주 관련 활동에 약 23억 7,000만 유로를 할당한다고 발표했습니다. 2022년 12월, 영국 우주국은 13개의 초기 단계 기술 프로젝트에 270만 유로를 투입한다고 발표했습니다. European Astrotech는 크세논 또는 크립톤을 사용하는 전기 추진 시스템을 탑재한 위성을 정비하기 위한 추진제 충전 카트(GSE)에 대해 5만 4,000유로를 지급받았습니다.

유럽 우주 추진 산업 개요

유럽의 우주 추진 시장은 상당히 통합되어 있으며 상위 5개 기업에서 77.76%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 우주 개발에의 지출

- 규제 프레임워크

- 프랑스

- 독일

- 러시아

- 영국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 추진 기술

- 전기

- 가스

- 액체 연료

- 국가명

- 프랑스

- 독일

- 러시아

- 영국

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Ariane Group

- Avio

- Honeywell International Inc.

- Moog Inc.

- OHB SE

- Safran SA

- Sitael SpA

- Space Exploration Technologies Corp.

- Thales

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Europe Space Propulsion Market size is estimated at 9.84 billion USD in 2025, and is expected to reach 15.64 billion USD by 2030, growing at a CAGR of 9.70% during the forecast period (2025-2030).

The utilization of gas-based propulsion is expected to surge during the forecast period

- In the European space propulsion market, gas-based propulsion systems continue to be widely used for small to medium-sized satellites, where simplicity, reliability, and quick response times are crucial. They are widely utilized in various satellite missions, including telecommunications, Earth observation, and scientific research.

- Electric propulsion systems have gained prominence in the European satellite market due to their fuel efficiency and extended operational lifespan. This technology provides higher specific impulses, enabling satellites to carry more payload while utilizing less propellant. In addition, electric propulsion systems offer the capability for long-duration missions and precise orbital maneuvers. They are well-suited for geostationary satellites, deep space missions, and satellite constellations for global coverage.

- Liquid propulsion systems, predominantly based on bipropellants like hydrazine and nitrogen tetroxide, have been widely employed in European satellites for primary propulsion and large orbital maneuvers. Liquid propulsion systems offer the flexibility to perform complex orbital transfers and rendezvous maneuvers. However, they require careful handling of toxic and corrosive propellants and necessitate a higher propellant mass compared to electric or gas-based systems. Between 2023 and 2029, the market is expected to surge by 81%, and gas-based propulsion is expected to dominate the market.

The product innovation in propulsion technology is expected to boost the growth

- Space propulsion is a method used to accelerate spacecraft or artificial satellites. The current space propulsion system includes two main solutions. Uses of an electric motor (EP) accelerates the ionized propellant, and chemical repulsion (CP) uses the propeller itself as the power source for thrust force.

- The space manufacturing industry is a niche sector, accounting for EUR 7.25 billion in final revenue and creating 38,000 highly qualified jobs. Despite its small size, the space sector enables a wide range of services and applications and is highly strategic for governments and businesses in the region.

- ESA's Future Space Transport Program identifies key launch system technologies to address the challenges and deliver solutions through technology-ready maturity for propulsion systems. Key technologies are designed at both the component and subsystem levels before being integrated into the propulsion demonstration engine and tested in the right environment. Due to the presence of many governmental, commercial, and other players in the region, demand in the satellite manufacturing industry witnessed positive growth. Based on this, during 2017-2022, more than 570 satellites were launched in the area. Of the more than 570 satellites produced and launched, nearly 90% are for commercial use.

Europe Space Propulsion Market Trends

Investment opportunities in the European space propulsion market is driving the demand

- European countries are recognizing the importance of various investments in the space domain. They are increasing their spending on space programs and innovation to stay competitive and innovative in the global space industry. In November 2022, ESA announced that it had proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services and remain a partner in exploration with the United States. The ESA has asked its 22 nations to support a budget of EUR 18.5 billion from 2023 to 2025. Likewise, in September 2022, the French government announced that it plans to allocate more than USD 9 billion to space activities, an increase of about 25% over the past three years.

- In November 2022, Germany announced that about EUR 2.37 billion were allocated for various space-related activities. In April 2023, Dawn Aerospace was awarded a contract to conduct a feasibility study with DLR (German Aerospace Center) to increase the performance of a nitrous-oxide-based green propellant for satellites and deep-space missions. In December 2022, the UK Space Agency announced EUR 2.7 million for 13 early-stage technology projects. European Astrotech received EUR 54,000 for a propellant loading cart (GSE) to service satellites with electric propulsion systems using xenon or krypton. SmallSpark Space Systems received EUR 76,000 for the development and maturation of SmallSpark's dual-firing mode propulsion system, the S4-NEWT-A2, which will form part of the architecture of its S4-SLV in-space logistics vehicle and as a candidate system for upper-stage launch vehicles.

Europe Space Propulsion Industry Overview

The Europe Space Propulsion Market is fairly consolidated, with the top five companies occupying 77.76%. The major players in this market are Ariane Group, Avio, Honeywell International Inc., Moog Inc. and Safran SA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Spending On Space Programs

- 4.2 Regulatory Framework

- 4.2.1 France

- 4.2.2 Germany

- 4.2.3 Russia

- 4.2.4 United Kingdom

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Propulsion Tech

- 5.1.1 Electric

- 5.1.2 Gas based

- 5.1.3 Liquid Fuel

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Russia

- 5.2.4 United Kingdom

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Ariane Group

- 6.4.2 Avio

- 6.4.3 Honeywell International Inc.

- 6.4.4 Moog Inc.

- 6.4.5 OHB SE

- 6.4.6 Safran SA

- 6.4.7 Sitael S.p.A.

- 6.4.8 Space Exploration Technologies Corp.

- 6.4.9 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록