|

시장보고서

상품코드

1694042

에너지 및 전력 산업 시험, 검사, 인증(TIC) 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Testing, Inspection, And Certification (TIC) In The Energy And Power Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

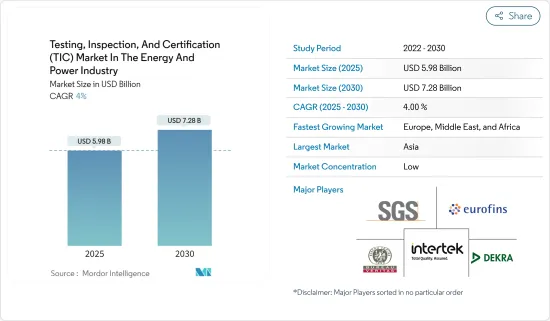

에너지 및 전력 산업 시험, 검사, 인증(TIC) 시장은 2025년 59억 8,000만 달러, 2030년에는 72억 8,000만 달러로 성장할 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 4%를 나타낼 전망입니다.

주요 하이라이트

- 시험, 검사, 인증(TIC) 기업의 주요 역할은 고객 제품의 건강, 안전, 품질 요구 사항을 유지하는 것입니다.

- 시험, 검사, 인증(TIC)은 서비스, 인프라, 제품이 품질과 안전 기준을 충족하는 것을 보장합니다.

- 에너지전력산업은 세계경제를 뒷받침하고 있습니다. 에너지성장을 유지하고 환경지원을 제공하기 위해 에너지전력 프로젝트를 효율적이고 효과적으로 운영할 필요성이 높아지고 있습니다.

- 신재생에너지에 대한 수요가 높아지고, 정부의 엄격한 규제, 환경오염을 억제하기 위한 환경문제에 대한 대처, 전력부문에 있어서의 선진기술이나 디지털기술의 채용 증가 등은 시장의 성장을 가속하는 주요인 중 하나입니다. 2050년까지 세계 최초의 기후 중립 대륙이 되는 목표는 저탄소의 미래를 채용하도록 산업을 뒷받침하고 있습니다.

- 규제기관이나 정부에 의한 엄격한 규제, 특히 하이엔드의 산업기기 인증은 에너지 전력 섹터 기업에 시험, 검사, 인증(TIC) 서비스의 아웃소싱 도입을 강요합니다.

- 독일에서는 기술 검사 기관(TUV) 그룹을 포함한 많은 민간 적합성 평가 기관이 존재합니다. Deutsche Akkreditierungsstelle GmbH-DAkkS)는 독일에서 가장 중요한 인증 기관입니다.

- 에너지전력산업에서 TIC시장에 영향을 미치는 거시경제 요인은 세계적 및 지역적 전체적인 경제 성장입니다.

시험, 검사, 인증(TIC) 시장 동향

현저한 성장을 확인하는 발전

- 발전부문은 다양한 산업과 일상생활에 필요한 에너지를 공급하여 세계 경제개발에 있어서 기본적인 역할을 하고 있습니다.

- 규제 준수는 발전 부문에서 TIC 서비스의 주요 시장 성장 촉진요인 중 하나입니다.

- 이러한 규제는 발전소 운영자에게 지정된 기준을 충족하기 위해 종합적인 검사, 검사, 인증을 받을 것을 요구하고 있습니다.

- 발전 부문에는 복잡한 기계, 고전압 및 위험물이 포함되어 있으므로 안전성이 최우선 과제입니다. 이러한 서비스에는 전기 시스템, 기계 부품, 화재 안전성, 방사선 피폭 등이 포함됩니다.

- 또한 발전 시설은 자본 집약적인 투자이며 효율적인 운영은 에너지 수요를 충족시키는 데 매우 중요합니다. 라의 결함, 고장, 비효율성을 파악하는 데 도움이 됩니다. 이를 통해 발전소 운영자는 문제를 신속하게 수정하고 성능을 최적화하며 전반적인 신뢰성을 향상시킬 수 있습니다.

아시아가 가장 큰 시장 점유율을 차지

- 중국은 아시아태평양에서 급속히 경제 성장을 이루고 있는 국가 중 하나이며 TIC 시장의 번영에 매력적인 장소가 되고 있습니다.

- CEC에 따르면, 중국에서는 2023년 시점에서 약 2,920기가와트의 발전 용량이 설치되어 있으며, 2022년의 약 3,000기가와트에서 증가하고 있습니다. EC에 따르면, 2023년 중국의 총 전력 소비량은 약 9,220테라와트시였습니다.

- 인도는 아시아태평양에서 가장 급속히 상승한 경제권 중 하나이며, 검사 시장으로서는 가장 역동적인 시장 중 하나입니다. 가와트 이상의 설비 용량이 있습니다.이 나라의 발전량의 약 70%는 화력 발전소에 의한 것입니다.

- COVID-19의 제2파가 유행하는 가운데, UL은 인도의 태양광 발전(PV) 인버터 제조업자용으로 검사 서비스를 개시한다고 발표했습니다. 국가 인증 위원회는 시험 및 교정 연구소(NABL)를 인증합니다.

- 일본 국내에서의 생산량이 적기 때문에 일본 정부는 항상 안정된 발전 공급을 확보하기 위해 세계적으로 탐사 및 개발 프로젝트를 늘리도록 에너지 기업에 일해 왔습니다.

- 2023년 11월, 일본의 오키나와 전력(9511.T)은 이산화탄소(CO2) 배출량 감축을 목표로, 상용 가스 화력 발전소에서 수소의 혼소를 검사적으로 개시하는 새로운 탭 계획을 발표했습니다. 오키나와 본섬 남부의 요시노우라 화력발전소의 35메가와트(MW) 유닛으로 수소혼소율 30%를 목표로 합니다. 수소혼소기술의 확립은 재생가능에너지의 확대와 CO2 배출량의 삭감이라는 두 가지 목표를 달성하기 위한 중요한 대처입니다.

시험, 검사, 인증(TIC) 산업 개요

에너지 전력 산업의 TIC 시장은 세분화되고 있으며, SGS SA, Eurofins Scientific SE, Bureau Veritas SA, Intertek Group PLC, DEKRA SE, DNV Group AS 등 주요 기업이 참가하고 있습니다. 조사 대상 시장 진출 기업은 제품 제공을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

- 2023년 9월 - Intertek은 프랑스의 독립계 검사·엔지니어링 스페셜리스트인 Emitech Group과 제휴. EN 17025 및 EN 17065 인증을 받고 노티파이드 바디, CB 체계에 참여하는 Emitech Group은 다양한 최종 사용자 산업에서 활동하는 조직에 교육, 검사 및 엔지니어링 전문 지식을 제공합니다. 이 전략적 제휴는 에미텍 그룹과 인터텍의 유럽 고객들에게 첨단 장비와 범위를 확대해 줍니다.

- 2023년 6월 -Applus는 프랑스를 거점으로 하는 저명한 재료 검사 및 연구개발 기술 파트너인 Rescoll의 전체 주식을 인수했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- COVID-19 후유증과 기타 거시경제 요인이 시장에 미치는 영향

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자, 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 향후 수요가 전망되는 주요 규격/인증과 서비스 유형

제5장 시장 역학

- 시장 성장 촉진요인

- 제품의 안전성과 환경 보호를 확보하기 위한 정부 규제와 의무화

- 에너지 효율화 프로세스에 대한 투자 증가와 에너지 전력 부문에 있어서의 스마트 그리드의 이용 증가

- 시장 성장 억제요인

- 다양한 규격이 존재하기 때문에 비인슈언트 기업이 컴플라이언스를 확보하기 어려움

제6장 시장 세분화

- 서비스 유형별

- 검사

- 인증

- 지역별

- 중국

- 미국

- 인도

- 일본

- 브라질

- 캐나다

- 한국

- 독일

- 프랑스

- 사우디아라비아

- 용도별

- 발전

- 저장

- 유통 및 판매

제7장 경쟁 구도

- 기업 프로파일

- DNV Group AS

- SGS SA

- Bureau Veritas SA

- Applus Services SA

- Intertek Group PLC

- DEKRA SE

- Eurofins Scientific SE

- Advanced Technology Group,spol.s ro

- TUV SUD AG

- Element Materials Technology Group Limited

제8장 벤더의 시장 점유율 분석

제9장 시장 전망

SHW 25.05.15The Testing, Inspection, And Certification Market In The Energy And Power Industry is expected to grow from USD 5.98 billion in 2025 to USD 7.28 billion by 2030, at a CAGR of 4% during the forecast period (2025-2030).

Key Highlights

- The primary role of TIC (testing, inspection, and certification) companies is to sustain the health, safety, and quality requirements of their client's products. Moreover, testing, inspection, and certification vendors are engaged in verification, inspection, testing, and certification services to help improve productivity and also help local manufacturers comply with global standards.

- Testing, inspection, and certification (TIC) ensure that services, infrastructure, and products meet quality and safety standards. This is especially crucial in industries like power and energy, where regular inspections are required. The TIC services market is expected to grow consistently regardless of industrial seasonality.

- The energy and power industry feeds the world's economy. There is a rising need to efficiently and effectively operate energy and power projects to sustain energy growth and provide environmental support. Increasing urbanization and people migrating from rural areas to urban areas are driving the development of the TIC market in the energy and power industry.

- The growing demand for renewable energy, the government's stringent regulation, environmental concerns initiative for controlling environmental pollution and increasing adoption of advanced and digital technologies in the power sector are some of the major factors driving the market's growth. The European power and energy sector is rapidly reinventing itself, where digitalization and interconnection are the new norms. The goal of becoming the world's first climate-neutral continent by 2050 is pushing the industry to adopt a low-carbon future. TIC services enable the competitiveness and asset's safety and compliance with stringent environmental standards.

- Stringent regulations from regulatory bodies and government, especially in high-end industrial equipment certification, compel energy and power sector companies to adopt outsourced testing, inspection, and certification (TIC) services. The power generation vendors may also be reluctant to outsource TIC services as they pose several risks related to privacy and security, as it involves sharing confidential supply chain information with third parties. Hence, adopting TIC services might take a lot of work due to these restraining factors.

- In Germany, there are many private conformity assessment bodies, including the group of Technical Inspection Agencies (TUV). Accreditation ensures that customers can trust in conformity assessment. Accreditation bodies attest to the technical competence of conformity assessment bodies and their objectivity. Conformity bodies in the EU require just one accreditation issued by their national accreditation body, which is recognized across the single market. The German Accreditation Body (Deutsche Akkreditierungsstelle GmbH - DAkkS) is the foremost accreditation body in Germany.

- The macroeconomic factors impacting the TIC market in the energy and power industry is the overall economic growth, both globally and regionally, as it plays a significant role in driving the demand for energy and power infrastructure, products, and services. Higher economic activity typically leads to increased investment in energy projects, which, in turn, drives the demand for TIC services to ensure compliance, safety, and reliability.

Testing, Inspection, and Certification (TIC) Market Trends

Power Generation to Witness Significant Growth

- The power generation sector plays a fundamental role in global economic development, providing the energy required for various industries and everyday life. With the rising demand for sustainable and reliable power, practical testing, inspection, and certification (TIC) services have become paramount.

- Regulatory compliance is one of the primary market drivers for TIC services in the power generation sector. Governments globally have implemented stringent regulations to ensure power generation facilities' safety, reliability, and environmental sustainability.

- These regulations require power plant operators to undergo comprehensive testing, inspection, and certification to meet the specified standards. Failure to comply with the stringent rules can result in severe legal consequences, penalties, and reputational damage for power generation companies. The demand for TIC services has thus increased significantly as power plants seek to comply with these regulations and maintain their operations smoothly.

- The power generation sector involves complex machinery, high voltages, and hazardous materials, making safety a top priority. Testing, inspection, and certification (TIC) services are crucial in identifying potential safety risks and ensuring that power generation facilities operate within acceptable safety standards. These services include electrical systems, mechanical components, fire safety, radiation exposure, and more. The market demand for TIC services in the power generation sector is driven by the need to mitigate risks, prevent accidents, and safeguard the well-being of workers and surrounding communities.

- Moreover, power generation facilities are capital-intensive investments, and their efficient operation is crucial for meeting energy demands. Testing, inspection, and certification services help ensure that the equipment and systems used in power generation meet the required quality standards. By conducting rigorous testing and inspections, TIC services help identify defects, malfunctions, or inefficiencies in the power generation infrastructure. This enables power plant operators to rectify issues promptly, optimize performance, and improve overall reliability. The need for quality assurance and operational excellence thus drives the market demand for TIC services in the power generation sector.

Asia Holds the Largest Market Share

- China is among the rapidly growing economies in the Asia-Pacific area, making it an appealing location for the TIC (testing, inspection, and certification) market to thrive. Increasing consumer knowledge about product safety and quality is also anticipated to spur growth in sectors like equipment testing in the energy and power field.

- According to CEC, approximately 2,920 gigawatts of electricity generation capacity had been installed in China as of 2023, up from some 3,000 gigawatts in 2022. Most thermal power is coal-based and is the energy source with the country's most significant power generation capacity. Moreover, according to CEC, China had a total electricity consumption of around 9,220 terawatt hours in 2023. This was a notable increase compared to 2022, when consumption amounted to approximately 8,640 terawatt hours. This increase in electricity consumption will drive the studied market in the country.

- India is one of the most dynamic markets for testing and inspection in the Asia-Pacific region, as it is one of the fastest emerging economies in the region. According to CEA, India's highest energy capacity came from thermal energy, amounting to an installed capacity of over 236 thousand megawatts as of February 2023. Approximately 70% of the country's electricity generation was from thermal power plants. Coal dominated power supply with a contribution of over 86% through thermal power plants. Along with coal, thermal power is generated from lignite, diesel, and gas.

- During the second wave of the COVID-19 pandemic, UL announced the launch of testing services for India's solar photovoltaic (PV) inverter manufacturers. UL has expanded its facility in Bengaluru to help manufacturers comply with the requirements of the standards mandated by the Ministry of New and Renewable Energy (MNRE). The National Accreditation Board accredits the laboratory for Testing and Calibration Laboratories (NABL). The BIS recognizes it under the Compulsory Registration Scheme (CRS) to conduct testing of solar PV inverters based on testing of representative models.

- Owing to low domestic production in the country, the Japanese government always encouraged its energy companies to increase exploration and development projects globally to secure a stable power generation supply. These initiatives make Japan one of the major exporters of energy-sector capital equipment, making it one of the primary adopters of TIC services.

- In November 2023, Japan's Okinawa Electric Power (9511.T) opened new tab plans to start co-firing hydrogen on a trial basis at a commercial gas-fired power plant in a bid to reduce carbon dioxide (CO2) emissions. The utility aims to achieve a hydrogen co-firing rate of 30% at the 35 megawatts (MW) unit of its Yoshinoura thermal power station in the southern island of Okinawa. Establishing hydrogen co-firing technology is a critical initiative to help achieve two goals: expanding renewable energy and slashing CO2 emissions.

Testing, Inspection, and Certification (TIC) Industry Overview

The TIC market in the energy and power industry is fragmented, with major players like SGS SA, Eurofins Scientific SE, Bureau Veritas SA, Intertek Group PLC, DEKRA SE, and DNV Group AS. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance product offerings and gain sustainable competitive advantage.

- September 2023 - Intertek partnered with Emitech Group, the French independent testing and engineering specialist. Accredited to EN 17025 and EN 17065, a notified body, and a participant in the CB scheme, the Emitech Group offers its expertise in training, testing, and engineering to organizations operating across a diverse range of end-user industries. This strategic alliance will bring advanced facilities and expanded coverage to Emitech Group and Intertek's European customers.

- June 2023 - Applus+ acquired the entire share capital of Rescoll, a prominent materials testing and research and development technological partner based in France. Rescoll has approximately 170 employees and an annual revenue of over EUR 21 million. Its well-equipped laboratories, experts, and diverse capabilities are claimed to support the development of the energy, medical, aerospace, and industry sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Standards/Certifications and Type of Services that Might be in Demand in the Future

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 5.1.2 Rising Investments in Energy Efficiency Process and Increasing Usage of Smart Grids in the Energy and Power Sector

- 5.2 Market Restraints

- 5.2.1 The Presence of Diverse Standards Makes It Complicated for Non-incumbents to Ensure Compliance

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Testing and Inspection

- 6.1.2 Certification

- 6.2 By Geography

- 6.2.1 China

- 6.2.2 United States

- 6.2.3 India

- 6.2.4 Japan

- 6.2.5 Brazil

- 6.2.6 Canada

- 6.2.7 South Korea

- 6.2.8 Germany

- 6.2.9 France

- 6.2.10 Saudi Arabia

- 6.3 By Application

- 6.3.1 Power Generation

- 6.3.2 Storage

- 6.3.3 Distribution and Sales

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DNV Group AS

- 7.1.2 SGS SA

- 7.1.3 Bureau Veritas SA

- 7.1.4 Applus Services SA

- 7.1.5 Intertek Group PLC

- 7.1.6 DEKRA SE

- 7.1.7 Eurofins Scientific SE

- 7.1.8 Advanced Technology Group,spol.s r.o.

- 7.1.9 TUV SUD AG

- 7.1.10 Element Materials Technology Group Limited