|

시장보고서

상품코드

1852012

바이탈 사인 모니터링 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Vital Sign Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

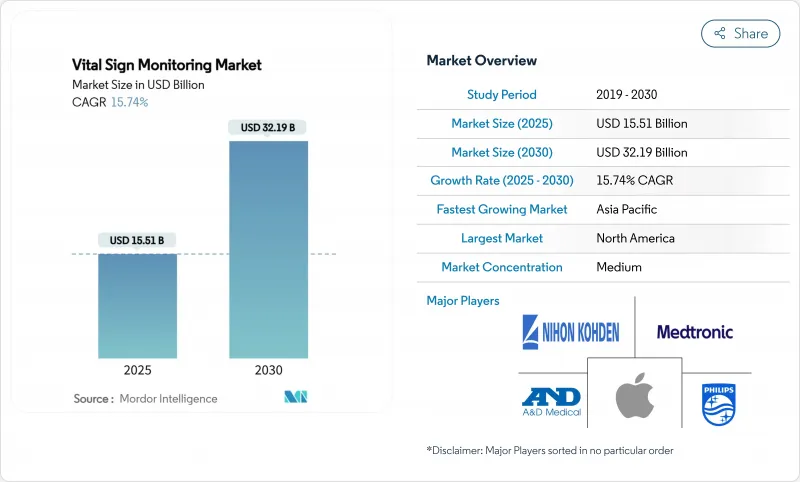

바이탈 사인 모니터링 시장 규모는 2025년에 155억 1,000만 달러, 2030년에는 321억 9,000만 달러에 이르고, CAGR 15.74%를 나타낼 것으로 예측됩니다.

이 급속한 궤도는 응급 입원을 피하고 재입원을 억제하기 위한 지속적인 생리학적 모니터링에 의존하는 예방적이고 데이터 중심의 케어 모델로의 건강 관리 섹터의 이동을 반영합니다. 센서의 소형화, 인공지능 알고리즘의 성숙, 5G의 광범위한 커버리지로 대기시간은 50밀리초 이하로 단축되어 병원, 외래, 재택의 각 환경에서 실시간 임상 개입이 가능해지고 있습니다. 특히 미국과 유럽의 일부에서는 디지털 건강 진료 보상이 확대되고 의료 제공업체의 구매 의욕이 높아지고 있습니다. 한편, 웨어러블 의료 등급의 지표가 소비자에게 받아들여짐으로써, 프로용 기기와 소비자용 전자 기기 사이의 역사적인 격차가 해소되어, 기기 제조업체에 새로운 수익원이 태어나고 있습니다.

세계의 바이탈 사인 모니터링 시장 동향과 인사이트

만성 질환과 생활 습관병의 유병률 상승

심혈관 질환으로 인한 사망률은 2020년부터 2024년에 걸쳐 세계에서 18.6% 상승했으며, 의료 시스템은 지속적인 심장 모니터링 도구로 자원을 이동해야 합니다. 미국에서는 성인의 48%가 어떤 심장병을 앓고 있기 때문에 부정맥과 야간 고혈압을 포착하는 외래 모니터링 솔루션이 우선적으로 자금을 모으고 있습니다. 당뇨병의 유병률은 2024년 성인 5억 3,700만 명에 이르며 혈압과 심박수와 함께 포도당을 추적하는 멀티파라미터 모니터 수요가 높아졌습니다. 지불자는 연간 4조 1,000억 달러의 만성 질환 부담에 직면하고 있으며, 결과 개선을 입증하는 원격 모니터링 플랫폼에 보상을 주고 통합 생체 사인 솔루션의 조달을 가속화하고 있습니다. 이러한 역학적 요인은 바이탈 사인 모니터링 시장의 장기적인 확장을 지원합니다.

가속화된 원격 의료 및 원격 환자 모니터링 채택

메디케어는 2024년 16개의 원격 모니터링 청구 코드(수익자 1인당월수입 188달러에 해당)를 환불하기로 결정했으며 공급자의 경제성을 재구성했습니다. UnitedHealthcare는 2025년에 웨어러블 디바이스의 적용 범위를 확대하여 이에 이어 예방 의료를 중심으로 하는 지불자의 제휴를 보여줍니다. 의료 시스템은 현재 EHR에 모니터링 대시보드를 통합하여 전체 집단의 계층화 및 실시간 경고를 지원합니다. 엣지 컴퓨팅과 5G 네트워크는 50ms 이하의 데이터 전송을 가능하게 하여 임상의가 악화된 이후가 아니라 초기 에피소드 중에 개입할 수 있도록 합니다. 진료 보상이 굳어지고 인프라가 성숙함에 따라, 의료 제공업체는 바이탈 사인의 지속적인 피드를 일상적인 만성기 치료 경로에 통합하여 바이탈 사인 모니터링 시장의 지속적인 수요를 부추기고 있습니다.

데이터 프라이버시 및 사이버 보안 문제

2024년에는 헬스케어 침해로 1억 3,300만 건의 기록이 유출되어 7,500만 달러의 HIPAA 벌칙이 부과되었습니다. 커넥티드 모니터링 디바이스는 공격 대상 영역을 확대했으며 IoMT의 취약성은 전년 대비 45% 증가했습니다. 유럽의 의료기기 규제에서는 사이버 보안 감사를 통해 승인에 6-12개월이 걸리며 출시가 지연됩니다. 온보드 인포 보안에 익숙하지 않은 공급자는 지속적인 스트리밍 장치의 배포를 망설이고 주문이 부진합니다. 보안 바이 디자인 아키텍처가 표준화되기 전까지는 데이터 유출에 대한 우려가 바이탈 사인 모니터링 시장의 보급 속도를 완화시킬 것으로 보입니다.

부문 분석

2024년 바이탈 사인 모니터링 시장 점유율은 의료기기가 45.32%를 차지하며 입증된 정밀도 기준과 병원 구매 기준에 뒷받침되었습니다. 혈압계는 여전히 수익의 기둥이며 공식적인 진료 보상 체계와 정착한 임상 프로토콜의 혜택을 받고 있습니다. 산소포화도 측정기의 매출은 호흡기 건강에 대한 경계가 다시 높아짐에 따라 상승하고, 마시모에 의한 FDA 인가의 시판 모델은 소비자의 접근을 넓히고 있습니다. 체온과 호흡 모듈은 현재 원격 의료 소프트웨어와 통합되어 임상 가치 제안을 강화하고 있습니다.

소비자용 웨어러블은 CAGR 17.65%로 진보하고 있으며, 스마트 워치 주도의 ECG, SPO2, 혈압 추정이 규제 당국에 받아들여지고 있음을 반영하고 있습니다. Apple의 Series 10은 심사 테스트를 통해 진단 수준의 ECG 일치를 달성했으며, 14일 동안 부착 가능한 스마트 패치는 가장 성장률이 높은 하위 그룹으로 부상하고 있습니다. 임상 검증이 진행됨에 따라 디바이스 제조업체는 웰빙과 의료 영역을 융합시킨 알고리즘을 크로스 라이선스를 하고 있습니다. 이 두 가지 카테고리의 융합은 기존과는 다른 참가자를 끌어들이고 바이탈 사인 모니터링 시장 전체를 확대하고 있습니다.

2024년 매출액의 52.34%는 병원이 차지했는데, 이는 치명타 케어에의 도입과 주술기 모니터링에 의한 것입니다. 그러나 입원기간의 단축을 요구하는 지불자의 압력에 의해 모니터링의 책임을 외래환자에게 맡기는 움직임이 가속되고 있습니다. 외래센터에서는 소형 모니터를 활용해 당일 퇴원을 서포트하는 한편, AI를 활용한 대시보드가 조기 악화에 플래그를 세워 케어팀의 개입을 촉구하고 있습니다.

메디케어 어드밴티지나 민간지급기관이 RPM 번들로 환불을 하기 때문에 재택 케어 환경은 CAGR 18.76%를 나타낼 전망입니다. 소비자는 Wi-Fi와 휴대폰 연결 장비를 직접 설치하고 임상의는 원격 위치의 데이터를 전자 의료 기록에 캡처합니다. 이 기세는 분산 케어 모델을 견고하게 해 바이탈 사인 모니터링 시장을 병동이 아닌 환자의 거주지 주변에 재구축하고 있습니다.

지역 분석

북미는 2024년 매출액의 42.45%를 차지했으며, 메디케어 상환과 연간 291억 달러의 디지털 헬스 인프라 지출을 뒷받침했습니다. 1인당 지출이 높고 EHR의 보급이 성숙해 원격 모니터링 통합이 용이합니다. 캐나다는 농촌 지역의 의료 종사자 부족을 완화하기 위해 원격 모니터링을 도입했으며 멕시코는 보험 회사의 적용 범위가 제한되어 있음에도 불구하고 도시 지역의 중산 계급이 스마트 시계의 보급을 촉진하고 있습니다.

아시아태평양은 CAGR 16.54%로 가장 빠르게 성장하는 지역입니다. 중국의 Healthy China 2030 계획은 마을 낙원 원격 의료 허브를 포함한 의료 IT 확대에 8,500억 달러를 계상. 일본의 초고령화에 의해 자립한 생활을 서포트하는 홈 모니터에 수요가 높아집니다. 인도의 Ayushman Bharat Digital Mission은 14억 명의 시민을 전자 건강 ID에 연결시켜 엄청난 잠재 고객을 창출하지만 장비 가격은 현지 소득 수준에 맞추어야 합니다.

유럽에서는 GDPR(EU 개인정보보호규정)과 MDR의 엄격한 규제가 어려우면서도 소비자의 신뢰를 높이고 꾸준한 성장을 이루고 있습니다. 독일의 디지털 헬스케어 방법은 의사가 환불된 헬스 앱을 처방할 수 있게 해주며, 프랑스에서는 고혈압의 원격 모니터링 번들이 시험적으로 도입되었습니다. 중동에서는 석유 잉여를 스마트 병원 프로젝트에 투자하고 있지만, 아프리카에서는 인프라 격차가 가정으로의 보급을 억제하고 있습니다. 남미의 기세의 중심은 브라질로, 관민 컨소시엄이 AI에 의한 심장 모니터링의 시험을 실시했습니다. 지역 역학은 바이탈 사인 모니터링 시장의 수익 의존도를 다양화하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 만성 질환과 생활 습관병 증가

- 가속하는 텔레헬스와 원격 환자 모니터링의 도입

- 센서와 커넥티비티 기술에 있어서 끊임없는 기술 진보

- 재택치료와 자기 관리에의 기호 고조

- 의료비 증가와 인프라의 디지털화

- 정부의 지원 정책과 상환 틀

- 시장 성장 억제요인

- 데이터 프라이버시와 사이버 보안의 과제

- 높은 자본 비용과 가격 압력

- 엄격한 규제 준수 및 승인 스케줄

- 웨어러블 계측에 있어서 정밀도와 신뢰성에 대한 우려

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 소비자용 웨어러블

- 스마트 워치

- 피트니스 및 활동 추적기

- 스마트 패치

- 기타 웨어러블

- 의료기기

- 혈압 모니터(아날로그 및 디지털)

- 산소포화도 측정기(손가락형, 핸드헬드, 기타)

- 체온 모니터링 기기

- 호흡수 모니터

- 소비자용 웨어러블

- 최종 사용자별

- 병원 및 클리닉

- 외래 및 건강 센터

- 홈케어

- 형태별

- 핸드헬드 기기

- 탁상/침대 옆 모니터

- 손목 착용형 웨어러블

- 패치 기반 기기

- 링/기타 소형화 형태

- 유통 채널별

- 병원 및 클리닉 조달

- 소매 약국

- 온라인/E커머스

- 소비자 직접 판매(DTC)

- OEM/ODM B2B 판매

- 지리

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Medtronic plc

- Apple Inc.

- Masimo Corporation

- Contec Medical Systems

- GE HealthCare

- iRhythm Technologies

- BioBeat Technologies

- Nihon Kohden Corporation

- Omron Healthcare

- A&D Company

- Mindray

- Koninklijke Philips NV

- Hill-Rom/Baxter

- Nonin Medical

- Welch Allyn/Hill-Rom

- Microlife Corp.

- SunTech Medical

- Smiths Medical

- Abbott Laboratories

- Vivalink

제7장 시장 기회와 향후 전망

KTH 25.11.18The vital signs monitoring market size stands at USD 15.51 billion in 2025 and is projected to reach USD 32.19 billion by 2030, advancing at a 15.74% CAGR.

This rapid trajectory reflects the healthcare sector's shift toward preventive, data-driven care models that rely on continuous physiologic surveillance to avert emergency admissions and curb readmissions. Pervasive sensor miniaturization, the maturation of artificial-intelligence algorithms, and broad 5G coverage are lowering latency to sub-50 milliseconds, enabling real-time clinical interventions across hospital, ambulatory, and home settings. Digital health reimbursement expansions, especially in the United States and parts of Europe, are reinforcing purchasing confidence among providers. Meanwhile, consumer acceptance of medical-grade metrics in wearables is dissolving the historic divide between professional devices and consumer electronics, opening fresh revenue streams for device makers.

Global Vital Sign Monitoring Market Trends and Insights

Rising Prevalence of Chronic and Lifestyle Diseases

Cardiovascular mortality climbed 18.6% globally between 2020 and 2024, prompting health systems to shift resources to continuous cardiac surveillance tools. As 48% of U.S. adults now live with some form of heart disease, ambulatory monitoring solutions that capture arrhythmia and nocturnal hypertension are gaining priority funding. Diabetes prevalence reached 537 million adults in 2024, reinforcing demand for multi-parameter monitors that track glucose alongside blood pressure and heart rate. Payers face a USD 4.1 trillion annual chronic-disease burden and are rewarding remote monitoring platforms that demonstrate outcome improvements, accelerating procurement of integrated vital-sign solutions. Collectively, these epidemiologic forces underpin the long-run expansion of the vital signs monitoring market.

Accelerating Adoption of Telehealth and Remote Patient Monitoring

Medicare's 2024 decision to reimburse 16 remote-monitoring billing codes-worth roughly USD 188 in monthly revenue per beneficiary-has reshaped provider economics. UnitedHealthcare followed by broadening wearable-device coverage in 2025, signaling payer alignment around preventive care. Health systems now embed monitoring dashboards within EHRs to support population-wide stratification and real-time alerts. Edge computing and 5G networks permit sub-50 millisecond data transmission, letting clinicians intervene during early episodes rather than after deterioration. As reimbursement solidifies and infrastructure matures, providers are embedding continuous vital-sign feeds into routine chronic-care pathways, fueling sustained demand within the vital signs monitoring market.

Data Privacy and Cybersecurity Challenges

Healthcare breaches exposed 133 million records in 2024, triggering USD 75 million in HIPAA penalties. Connected monitoring devices expand attack surfaces, and IoMT vulnerabilities rose 45% year over year. Europe's Medical Device Regulation adds six to twelve months to approvals due to cybersecurity audits, delaying launches. Providers lacking in-house infosec depth hesitate to implement continuous streaming devices, dampening orders. Until secure-by-design architectures become standard, data-leak fears will moderate the adoption speed of the vital signs monitoring market.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Advancements in Sensor and Connectivity Technologies

- Growing Preference for Home Healthcare and Self-Management

- High Capital Costs and Pricing Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medical devices accounted for 45.32% of the vital signs monitoring market share in 2024, underpinned by proven accuracy standards and hospital purchasing norms. Blood-pressure monitors remain the revenue anchor, benefiting from formal reimbursement grids and entrenched clinical protocols. Pulse-oximeter sales climbed after renewed respiratory-health vigilance, and FDA-cleared over-the-counter models by Masimo are widening consumer access. Temperature and respiratory-rate modules now integrate with telehealth software, strengthening the clinical value proposition.

Consumer wearables are advancing at a 17.65% CAGR, reflecting evolving regulatory acceptance of smartwatch-driven ECG, SPO2, and blood-pressure estimates. Apple's Series 10 achieved diagnostic-level ECG concordance in peer-reviewed trials, and smart patches that remain adhered for 14 days are emerging as the highest-growth sub-group. As clinical validation mounts, device-makers are cross-licensing algorithms, blending wellness and medical domains. The convergence of the two categories is drawing non-traditional entrants and expanding the overall vital signs monitoring market.

Hospitals controlled 52.34% of revenue in 2024, owing to critical-care deployments and peri-operative monitoring. However, payer pressure to shorten inpatient stays is accelerating the hand-off of monitoring responsibilities to outpatient settings. Ambulatory centers leverage compact monitors to support same-day discharge, while AI-augmented dashboards flag early deterioration for care-team intervention.

Home-care settings are growing at an 18.76% CAGR as Medicare Advantage and private payers reimburse RPM bundles. Consumers increasingly self-install Wi-Fi or cellular-connected devices, and clinicians accept remote data into electronic charts. This momentum is cementing distributed care models, reshaping the vital signs monitoring market around the patient's residence rather than the hospital ward.

The Vital Signs Monitoring Market Report is Segmented by Product (Consumer Wearables and Medical Devices), End-User (Hospitals & Clinics, and More), Form Factor (Hand-Held Devices, and More), Distribution Channel (Hospital & Clinic Procurement, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.45% of revenue in 2024, propelled by Medicare reimbursement and USD 29.1 billion in annual digital-health infrastructure outlays. High per-capita spending and mature EHR penetration simplify remote-monitoring integration. Canada deploys telemonitoring to alleviate rural-provider shortages, while Mexico's urban middle class drives smartwatch uptake despite limited insurer coverage.

Asia-Pacific is the fastest-growing region at a 16.54% CAGR. China's Healthy China 2030 plan earmarks USD 850 billion for health IT expansions, including village telehealth hubs. Japan's super-aged demographic propels demand for home monitors that support independent living; Nihon Kohden's subscription bundles lower capital hurdles. India's Ayushman Bharat Digital Mission links 1.4 billion citizens to electronic health IDs, creating a vast prospective pool, though device pricing must align with local income levels.

Europe posts steady growth as stringent GDPR and MDR regulations, although challenging, build consumer trust. Germany's Digital Healthcare Act allows physicians to prescribe reimbursed health apps, and France is piloting remote-monitoring bundles for hypertension. The Middle East invests oil surpluses into smart-hospital projects, but infrastructure gaps restrain pervasive home adoption in Africa. South American momentum centers on Brazil, where public-private consortia trial AI-assisted cardiac monitoring. Collectively, regional dynamics diversify revenue dependencies for the vital signs monitoring market.

- Medtronic

- Apple

- Masimo

- Contec Medical Systems

- GE Healthcare

- iRhythm Technologies

- BioBeat Technologies

- Nihon Kohden

- OMRON

- A&D Company

- Mindray

- Koninklijke Philips

- Hill-Rom / Baxter

- Nonin Medical

- Welch Allyn / Hill-Rom

- Microlife Corp.

- SunTech Medical

- Smiths Group

- Abbott Laboratories

- Vivalink

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic and Lifestyle Diseases

- 4.2.2 Accelerating Adoption of Telehealth and Remote Patient Monitoring

- 4.2.3 Continuous Technological Advancements in Sensor and Connectivity Technologies

- 4.2.4 Growing Preference for Home Healthcare and Self-Management

- 4.2.5 Increasing Healthcare Expenditure and Infrastructure Digitization

- 4.2.6 Supportive Government Policies and Reimbursement Frameworks

- 4.3 Market Restraints

- 4.3.1 Data Privacy and Cybersecurity Challenges

- 4.3.2 High Capital Costs and Pricing Pressure

- 4.3.3 Stringent Regulatory Compliance and Approval Timelines

- 4.3.4 Accuracy and Reliability Concerns in Wearable Measurements

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat Of New Entrants

- 4.6.2 Bargaining Power Of Buyers

- 4.6.3 Bargaining Power Of Suppliers

- 4.6.4 Threat Of Substitutes

- 4.6.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Consumer Wearables

- 5.1.1.1 Smartwatches

- 5.1.1.2 Fitness & Activity Trackers

- 5.1.1.3 Smart Patches

- 5.1.1.4 Other Wearables

- 5.1.2 Medical Devices

- 5.1.2.1 Blood Pressure Monitors (Analog & Digital)

- 5.1.2.2 Pulse Oximeters (Fingertip, Hand-Held & Others)

- 5.1.2.3 Temperature Monitoring Devices

- 5.1.2.4 Respiratory-Rate Monitors

- 5.1.1 Consumer Wearables

- 5.2 By End-User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Ambulatory & Health Centres

- 5.2.3 Home-Care Settings

- 5.3 By Form Factor

- 5.3.1 Hand-Held Devices

- 5.3.2 Table-Top / Bedside Monitors

- 5.3.3 Wrist-Worn Wearables

- 5.3.4 Patch-Based Devices

- 5.3.5 Ring / Other Miniaturised Form Factors

- 5.4 By Distribution Channel

- 5.4.1 Hospital & Clinic Procurement

- 5.4.2 Retail Pharmacies

- 5.4.3 Online / E-Commerce

- 5.4.4 Direct-To-Consumer

- 5.4.5 OEM / ODM B2B Sales

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Apple Inc.

- 6.3.3 Masimo Corporation

- 6.3.4 Contec Medical Systems

- 6.3.5 GE HealthCare

- 6.3.6 iRhythm Technologies

- 6.3.7 BioBeat Technologies

- 6.3.8 Nihon Kohden Corporation

- 6.3.9 Omron Healthcare

- 6.3.10 A&D Company

- 6.3.11 Mindray

- 6.3.12 Koninklijke Philips N.V.

- 6.3.13 Hill-Rom / Baxter

- 6.3.14 Nonin Medical

- 6.3.15 Welch Allyn / Hill-Rom

- 6.3.16 Microlife Corp.

- 6.3.17 SunTech Medical

- 6.3.18 Smiths Medical

- 6.3.19 Abbott Laboratories

- 6.3.20 Vivalink

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment