|

시장보고서

상품코드

1850154

정형외과용 기기 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Orthopedic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

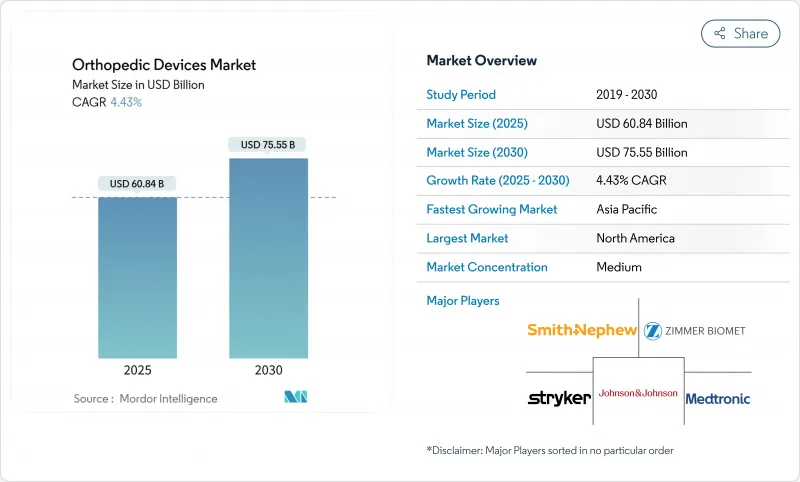

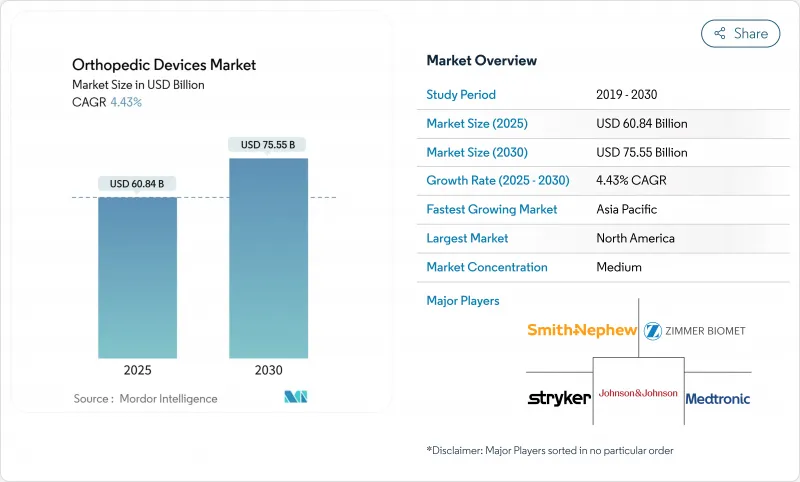

정형외과용 기기 시장의 2025년 시장 규모는 608억 4,000만 달러, 2030년에는 755억 5,000만 달러에 이르고, CAGR은 4.43%를 나타낼 전망입니다.

수요 성숙화, 상환 정책 엄격화, 가치 기반 구매에 대한 축족을 반영하여 성장 곡선은 급속하지 않고 꾸준합니다. 인구 고령화를 배경으로 관절 재건술은 계속 확대되고 AI를 활용한 수술 계획과 로봇 지침에 의해 임상 정밀도가 향상되고 회복까지의 기간이 단축됩니다. 제조업체는 또한 기존 금속의 한계를 극복하기 위해 3D 프린터와 생체 흡수성 임플란트에 투자하고 환자 전용 솔루션 파이프라인을 지원합니다. 동시에 정형외과용 기기 시장은 복잡한 승인 경로나 외과의사의 진료 보수 삭감에 의한 압력을 느끼고 있어 인구 동태가 양호함에도 불구하고 가속을 억제하는 요인이 되고 있습니다.

세계 정형외과용 기기 시장 동향과 통찰

고령화가 변형성 관절 치환술을 촉진

미국의 인공 고관절 치환술은 2030년까지 63만 5,000건, 인공 슬관절 치환술은 128만 건에 이를 것으로 예측되고 있으며, 장수화에 의해 수요가 대형 관절 임플란트로 이동하는 것을 나타내고 있습니다. 콜롬비아에서는 2050년까지 3만 9,270건의 다리 인공관절 치환술이 이루어졌고, 독일에서는 2040년까지 인공 슬관절 전치환술이 55% 증가할 것으로 예측되고 있습니다. 또한, 젊고 활동적인 사람들은 조기 수술을 선택하고 임플란트의 수명을 연장하며 값 비싼 재료 사용에 박차를 가하고 있습니다. 따라서 의료 시스템은 수술 능력을 확대하고, 재활 네트워크를 강화하고, 수술 급증을 효율적으로 관리하기 위해 결과 추적을 표준화해야합니다.

3D 프린터와 생체 흡수성 임플란트의 기술적 진보

적층 성형은 현재 오세오 통합을 가속화하고 수술 시간을 단축하는 환자와 일치하는 모양을 제공합니다. 2024년에 최초의 PEEK제 두개 임플란트가 FDA의 인가를 받은 것으로, 3D 프린터로 제조된 폴리머가 하중을 지지하는 적응증으로 규제 당국에 받아들여지는 것이 증명되었습니다. 앨라배마에 있는 산업 규모의 프린터는 이미 폐기물을 최소화하면서 척추 케이지를 생산할 수 있어 비용 경쟁력을 보여줍니다. 생체 흡수성 기구는 영구적인 하드웨어가 불필요한 스포츠나 외상의 사례에 대응하는 것으로, 생물학적 치유를 촉진하는 혈소판을 풍부하게 포함한 혈장 시스템의 최근의 FDA 인가에 의해 그 능력이 강화되었습니다. 이러한 기술 혁신은 공급업체를 차별화하고 재치환 부담을 장기적으로 완화하는 재생 경로를 여는 것입니다.

까다로운 여러 지역의 규제 승인

2024년에 완전 시행된 유럽 의료기기 규제에서는 증거 역치가 늘어나고 심사 사이클이 연장되었기 때문에 제품의 상시가 늦어 개발 예산이 팽창했습니다. 새로운 코팅 지침 및 변경 관리 계획을 포함한 FDA의 병렬 변경으로, 특히 항균제 및 표면 변형 임플란트의 문서화 레이어가 추가되었습니다. 기업은 현재 다시설 임상시험을 실시하고 시판후 조사시스템을 유지해야 하지만, 이는 중소의 혁신자 자원을 압박하고 기술의 보급을 늦출 수 있습니다.

부문 분석

관절 재건 임플란트는 2024년 정형외과용 기기 시장 점유율의 37.16%를 차지했으며, 고관절 치환술과 무릎 관절 치환술의 수량이 지난 10년간 계속 증가할 것으로 전망됩니다. 제조업체는 오래 지속되는 폴리에틸렌 라이너, 다공성 티타늄 발판, 임상의에게 하중 데이터를 전달하는 스마트 센서에 주력하고 있습니다. 정형생물공학은 규모가 작은 것, CAGR 5.86%로 가장 급성장하고 있는 그룹이며, 연골수복 매트릭스와 성장인자 강화 이식편이 그 추진력이 되고 있습니다. 이 경향은 CARTIHEAL AGILI-C가 4년 후 인공 슬관절 전치환술로의 전환을 87% 감소시켰기 때문에 분명합니다.

스포츠 의학 기구와 관절경은 예방 수리를 요구하는 젊은층으로부터 혜택을 받으며, 척추 기구는 회복을 단축하는 저침습 기술로부터 이익을 흡수하고 있습니다. 외상기구는 안정된 사고율 덕분에 회복력을 유지합니다. 따라서 벤더는 광범위한 개발 품목을 관리하고 대량 생산이 가능한 재건용 주력 임플란트와 특수 생물학적 제제의 균형을 맞추면서 정형외과용 기기 시장의 상품화된 부문에서의 상환의 좁히기를 헤지하고 있습니다.

2024년 정형외과용 기기 시장 규모의 42.84%를 티타늄과 그 합금이 차지하고 있으며, 이는 강도 대 중량의 우위성과 입증된 생체적합성 덕분입니다. 그러나 공급 체인의 불안정성으로 인해 티타늄 비용은 정제 등급에 따라 파운드당 6-30달러의 폭이 있기 때문에 대체품 탐구가 추진되고 있습니다. 생체흡수성 폴리머와 복합재료는 CAGR 6.58%에서 가장 빠르게 성장하며, 스포츠 외상과 소아의 골절에 특이한 치유가 완료되면 용해되는 일시적인 고정을 제공합니다.

PEEK는 아티팩트가 없는 영상 진단이 가능하고 뼈와의 탄성률의 적합성도 우수하기 때문에 척추 케이지 분야에서 확고한 지위를 구축하고 있습니다. 세계 1,500만 개 이상의 PEEK 의료기기가 내장되어 있습니다. 니오븀과 지르코늄을 포함한 첨단 베타 티타늄 합금은 응력 차폐를 제한하기 위해 탄성률의 불일치를 줄이고 마그네슘 기반 재흡수물은 시험을 통해 전진하고 있습니다. 이러한 변화는 영구적인 금속 하드웨어에서 점진적으로 이동하고 있음을 보여 주며, 정형외과용 기기 시장은 보다 재생 가능하고 수명주기를 중시하는 치료법으로 자리 잡고 있습니다.

정형외과용 기기 시장은 기기 유형별(관절 재건 임플란트, 외상 고정 기기, 기타), 소재별(티타늄 및 티타늄 합금, 스테인리스 스틸, 기타), 용도별(고관절 정형외과 수술, 무릎 관절 정형외과 수술, 기타), 최종 사용자별(병원, 정형외과 및 전문 클리닉 등), 지역별(북미, 유럽, 아시아태평양 등)으로 분류됩니다.

지역별 분석

북미는 2024년 정형외과용 기기 시장 수익의 44.62%를 차지했습니다. 보험 적용이 견고하고, 로봇 공학의 조기 도입이 프리미엄 임플란트의 보급을 가속시켰기 때문입니다. CMS는 2025년에 인공관절 치환술에 새로운 환자 보고 결과 지표를 도입하고, 상환을 기능 개선과 관련시키고, 공급자를 근거에 근거한 가격 설정으로 유도하고 있습니다. 한편, 이 지역에서는 ASC의 정비가 진행되고 있어 향후 10년간에 정형외과의 외래 환자수는 21% 증가할 전망으로, 벤더는 비용 대 가치의 제안을 보다 선명하게 할 필요에 육박되고 있습니다.

CAGR 7.23%로 성장하는 아시아태평양은 중간 소득층 증가, 수술용 로봇에 대한 정부 투자, 퇴행성 척추 질환의 이환율이 급증하는 등 이익을 얻고 있습니다. 중국만으로는 2025년까지 2,100억 달러의 의료기기 시장을 목표로 하고 있으며, 지역의 생산 거점이 티타늄과 PEEK를 공급하고, 리드 타임을 단축해 수입 관세를 삭감하고 있습니다. 현지 기업은 다국적 기업과 제품을 공동 개발하고 기술 이전을 서두르고 몸집이 작은 환자를 위해 기능을 사용자 정의하고 있습니다.

유럽에서는 의료기기 규제 장애물이 승인주기를 연장하고 있음에도 불구하고 꾸준한 확대가 나타납니다. 독일에서는 인공 슬관절 전치환술의 이환율이 2040년까지 55% 상승할 것으로 예측하고 있으며, 병원이 임플란트 벤더를 통합하는 가운데 내구성 있는 기준선 수요가 창출됩니다. 중동 및 아프리카와 남미는 아직 개발 도상이지만 매력적인 시장입니다. 걸프 국가의 정형외과 투어리즘은 급성기 수술의 수를 늘리고 브라질의 거시 경제 회복은 외상과 스포츠 의학 재고를위한 자본 예산을 보장합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고령화가 관절 변형 수술 증가를 촉진

- 대관절 재건 수술 증가

- 3D 프린팅 및 생체 흡수성 임플란트의 기술 진보

- 정형외과적 외상 및 사고 발생률 상승

- AI 주도의 수술 계획과 로봇 공학이 수술 결과를 개선

- 가치 기반 케어가 모듈식의 비용 효율적인 임플란트를 촉진

- 시장 성장 억제요인

- 엄격한 복수 지역의 규제 승인

- 불리한 상환과 숙련 외과의의 부족

- 티타늄 및 PEEK 재료공급 체인 불안정성

- 외래환자로의 이행이 입원환자의 임플란트 마진을 침식한다

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력/소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기기 유형별

- 관절 재건 임플란트

- 외상 고정 장치

- 척추 수술용 장치

- 두개턱 안면 기기

- 스포츠 의학 및 관절경 검사 장치

- 오소 바이오 로직

- 기타 정형외과용 기기

- 재료별

- 티타늄 및 티타늄 합금

- 스테인레스 스틸

- 고분자 생체 재료

- 생체 흡수성 및 복합재료

- 기타

- 용도별

- 고관절 정형외과 수술

- 무릎 정형외과 수술

- 척추 정형외과 수술

- 외상 고정

- 기타 용도

- 최종 사용자별

- 병원

- 정형외과 및 전문클리닉

- 외래수술센터(ASC)

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- DePuy Synthes(Johnson & Johnson)

- Zimmer Biomet Holdings Inc.

- Stryker Corporation

- Smith & Nephew plc

- Medtronic plc

- Enovis Corporation(DJO)

- B. Braun SE

- Arthrex Inc.

- Globus Medical Inc.

- NuVasive Inc.

- ATEC Spine Inc.

- Ossur hf.(Embla Medical hf.)

- CTL Amedica

- CONMED Corporation

- MicroPort Orthopedics

- SeaSpine Orthopedics Corporation(Orthofix Medical Inc.)

- Integra LifeSciences

- Exactech Inc.

제7장 시장 기회와 장래의 전망

SHW 25.11.17The orthopedic devices market is valued at USD 60.84 billion in 2025 and is forecast to reach USD 75.55 billion by 2030, advancing at a 4.43% CAGR.

The growth curve is steady rather than rapid, reflecting maturing demand, stricter reimbursement policies, and a pivot toward value-based purchasing. Joint reconstruction volumes continue to expand on the back of population aging, while AI-assisted surgical planning and robotic guidance improve clinical precision and shorten recovery windows. Manufacturers are also investing in 3-D printed and bioabsorbable implants to overcome limitations of traditional metals, supporting a pipeline of patient-specific solutions. At the same time, the orthopedic devices market feels pressure from complex approval pathways and surgeon reimbursement cuts, factors that temper acceleration despite favorable demographics.

Global Orthopedic Devices Market Trends and Insights

Aging Population Driving Degenerative-Joint Procedures

Hip replacements in the United States are projected to reach 635,000 cases and knee replacements 1.28 million by 2030, illustrating how longevity shifts demand toward large-joint implants. Similar trajectories appear worldwide; Colombia expects 39,270 lower limb arthroplasties by 2050 and Germany projects a 55% rise in total knee arthroplasty by 2040. Younger, active individuals are also opting for surgery earlier, extending implant duty cycles and fueling premium material uptake. Health systems must therefore expand surgical capacity, reinforce rehabilitation networks, and standardize outcome tracking to manage procedure surges efficiently.

Technological Advances in 3-D Printed & Bioabsorbable Implants

Additive manufacturing now delivers patient-matched geometries that speed osseointegration and cut operating time. FDA clearance for the first PEEK cranial implant in 2024 demonstrated regulatory acceptance of 3-D printed polymers in load-bearing indications. Industrial-scale printers in Alabama can already fabricate spine cages with minimal waste, signaling cost competitiveness. Bioabsorbable devices address sports and trauma cases where permanent hardware is unnecessary, a capability strengthened by recent FDA authorizations of platelet-rich plasma systems that encourage biologic healing. These innovations differentiate suppliers and open regenerative pathways that may reduce revision burdens long term.

Stringent Multi-Region Regulatory Approvals

Europe's Medical Device Regulation, enforced fully in 2024, raised evidence thresholds and extended review cycles, delaying product launches and inflating development budgets. Parallel changes at the FDA, including new coating guidance and change-control plans, add additional documentation layers, particularly for antimicrobial or surface-modified implants. Firms must now conduct multi-center clinical studies and maintain post-market surveillance systems that stretch smaller innovators' resources and may slow technology diffusion.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Surgical Planning & Robotics Improve Outcomes

- Rising Orthopedic Trauma & Accident Incidence

- Unfavorable Reimbursement & Shortage of Skilled Surgeons

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Joint reconstruction implants held 37.16% of orthopedic devices market share in 2024, anchored by hip and knee replacement volumes that will keep rising well into the next decade. Manufacturers focus on long-wearing polyethylene liners, porous titanium scaffolds, and smart sensors that relay load data to clinicians. Orthobiologics, though smaller, is the fastest-growing group at a 5.86% CAGR, propelled by cartilage repair matrices and growth-factor-enriched grafts. The orthopedic devices market continues to shift toward combination products that blend mechanics with biology, a trend underscored by CARTIHEAL AGILI-C's 87% reduction in conversion to total knee arthroplasty at four years.

Sports-medicine instrumentation and arthroscopes benefit from younger cohorts seeking preventive repairs, while spine devices absorb gains from minimally invasive techniques that shorten recovery. Trauma sets remain resilient thanks to steady accident rates. Vendors therefore manage a broad development slate, balancing high-volume reconstructive workhorse implants with specialized biologics to hedge against reimbursement squeezes in commoditized segments of the orthopedic devices market.

Titanium and its alloys accounted for 42.84% of the orthopedic devices market size in 2024, thanks to strength-to-weight advantages and proven biocompatibility. Supply-chain volatility, however, drives exploration of alternatives as titanium costs range from USD 6 to USD 30 per pound depending on refinement grade. Bioabsorbable polymers and composites grow fastest at 6.58% CAGR, offering temporary fixation that dissolves once healing completes, a property prized in sports injuries and pediatric fractures.

PEEK maintains a foothold in spine cages because it yields artifact-free imaging and modulus compatibility with bone; more than 15 million PEEK devices are implanted worldwide. Advanced beta-titanium alloys with niobium and zirconium reduce modulus mismatch to limit stress shielding, while magnesium-based resorbables advance through trials. These shifts indicate a gradual transition away from permanent metallic hardware, positioning the orthopedic devices market for more regenerative, life-cycle-oriented therapies.

The Orthopedic Devices Market is Segmented by Device Type (Joint Reconstruction Implants, Trauma Fixation Devices, and More), by Material (Titanium and Titanium Alloys, Stainless Steel, and More), by Application (Hip Orthopedic Procedures, Knee Orthopedic Procedures, and More), by End User (Hospitals, Orthopedic and Specialty Clinics, and More), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America controlled 44.62% of orthopedic devices market revenue in 2024 as robust insurance coverage and early adoption of robotics accelerated premium implant uptake. CMS has introduced new patient-reported outcome measures for joint arthroplasty in 2025, linking reimbursement to functional improvement and nudging suppliers toward evidence-based pricing. Meanwhile, the region's ASC build-out is slated to lift outpatient orthopedic volumes by 21% over the next decade, pressuring vendors to sharpen cost-to-value propositions.

Asia-Pacific, growing at 7.23% CAGR, gains from rising middle-class incomes, government investment in surgical robotics, and soaring incidence of degenerative spinal disease. China alone targets a medical-device market of USD 210 billion by 2025, and regional production hubs supply titanium and PEEK, shortening lead times and reducing import tariffs. Local companies co-develop products with multinationals, hastening technology transfer and customizing features for smaller stature patients.

Europe posts steady expansion despite Medical Device Regulation hurdles that extend approval cycles. Germany projects total knee arthroplasty incidence will climb 55% by 2040, creating durable baseline demand even as hospitals consolidate implant vendors. Middle East-Africa and South America remain nascent but attractive; orthopedic tourism in the Gulf boosts high-acuity procedure volumes, while macro-economic recovery in Brazil unlocks capital budgets for trauma and sports-medicine inventory.

- Johnson & Johnson

- Zimmer Biomet

- Stryker

- Smiths Group

- Medtronic

- Enovis Corporation (DJO)

- B. Braun

- Arthrex

- Globus Medical

- NuVasive

- ATEC Spine Inc.

- Ossur hf. (Embla Medical hf.)

- CTL Amedica

- Conmed

- MicroPort Orthopedics

- SeaSpine Orthopedics Corporation (Orthofix Medical Inc.)

- Integra LifeSciences

- Exactech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population driving degenerative-joint procedures

- 4.2.2 Increasing number of large-joint reconstruction surgeries

- 4.2.3 Technological advances in 3-D printed & bioabsorbable implants

- 4.2.4 Rising orthopedic trauma & accident incidence

- 4.2.5 AI-driven surgical planning & robotics improve outcomes

- 4.2.6 Value-based care boosting modular cost-efficient implants

- 4.3 Market Restraints

- 4.3.1 Stringent multi-region regulatory approvals

- 4.3.2 Unfavorable reimbursement & shortage of skilled surgeons

- 4.3.3 Supply-chain volatility in titanium & PEEK materials

- 4.3.4 Outpatient migration eroding inpatient implant margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Joint Reconstruction Implants

- 5.1.2 Trauma Fixation Devices

- 5.1.3 Spine Surgery Devices

- 5.1.4 Craniomaxillofacial Devices

- 5.1.5 Sports Medicine & Arthroscopy Devices

- 5.1.6 Orthobiologics

- 5.1.7 Other Orthopedic Devices

- 5.2 By Material

- 5.2.1 Titanium & Titanium Alloys

- 5.2.2 Stainless Steel

- 5.2.3 Polymeric Biomaterials

- 5.2.4 Bioabsorbable & Composite Materials

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Hip Orthopedic Procedures

- 5.3.2 Knee Orthopedic Procedures

- 5.3.3 Spine Orthopedic Procedures

- 5.3.4 Trauma Fixation

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Orthopedic & Specialty Clinics

- 5.4.3 Ambulatory Surgical Centers (ASCs)

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 DePuy Synthes (Johnson & Johnson)

- 6.3.2 Zimmer Biomet Holdings Inc.

- 6.3.3 Stryker Corporation

- 6.3.4 Smith & Nephew plc

- 6.3.5 Medtronic plc

- 6.3.6 Enovis Corporation (DJO)

- 6.3.7 B. Braun SE

- 6.3.8 Arthrex Inc.

- 6.3.9 Globus Medical Inc.

- 6.3.10 NuVasive Inc.

- 6.3.11 ATEC Spine Inc.

- 6.3.12 Ossur hf. (Embla Medical hf.)

- 6.3.13 CTL Amedica

- 6.3.14 CONMED Corporation

- 6.3.15 MicroPort Orthopedics

- 6.3.16 SeaSpine Orthopedics Corporation (Orthofix Medical Inc.)

- 6.3.17 Integra LifeSciences

- 6.3.18 Exactech Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment