|

시장보고서

상품코드

1687228

세계의 웨어러블 센서 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

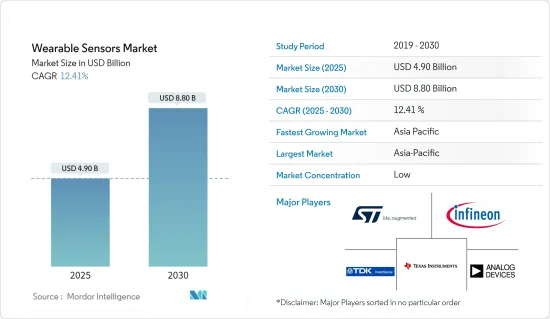

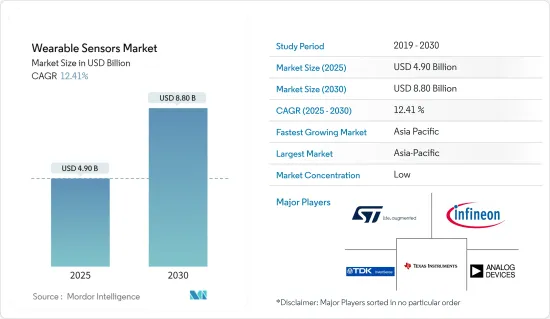

세계의 웨어러블 센서 시장 규모는 2025년 49억 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 12.41%를 나타낼 전망이며, 2030년에는 88억 달러에 달할 것으로 예측됩니다.

전자 산업은 주로 디지털화에 의해 현저하게 번영하고 있으며, 자기 건강 모니터링 용도에 널리 사용되는 웨어러블 기술 장치 수요를 견인하고 있습니다.

주요 하이라이트

- 웨어러블 센서는 보행 카운트 및 보행 거리와 같은 실시간 모션 감지 활동 추적에 대한 소비자의 관심이 증가함에 따라 웨어러블 장치에 매우 중요합니다. 사용자는 생성된 데이터를 분석하여 얻은 구체적인 결과를 활용하여 피트니스 및 건강 목표를 결정할 수 있습니다. 웨어러블 기술은 소비자의 건강과 데이터를 모니터링하고 의미있는 의사 결정을 지원하는 센서에 완전히 의존합니다. 진화하는 센서 기술을 통해 웨어러블은 스마트하고 소비자들 사이에서 인기를 끌고 있습니다.

- 가전제품에 대한 지출도 웨어러블 디바이스의 성장을 자극합니다. 또한 인구 증가로 인한 도시화의 진전과 라이프스타일의 변화로 건강과 안전에 대한 의식이 높아지고 있습니다. 이것은 피트니스 트래커, 이어웨어, 스마트 워치 등의 웨어러블 디바이스의 성장을 자극하는 큰 요인이 되고 있습니다.

- 센서와 관련 부품의 소형화가 진행되고 있는 가운데, 스마트 웨어러블의 고기능 센서의 성장, 배터리 사이즈의 향상, 효율화가 웨어러블 모션 센서 시장을 밀어 올리는 주요 요인이 되고 있습니다.

- 소비자의 스마트 웨어러블 지향이 증가함에 따라 부품 비용이 상승함에 따라 기기 가격도 상승하고 시장 채용이 제한되고 있습니다. 스마트 워치와 피트니스 트래커는 소비자의 큰 관심을 모으는 저렴한 가격 부문을 가지고 있습니다. 그러나, 기술의 보급에 따라, 양말, 안경, 바디웨어 제품과 같은 다른 장치는 높은 가격으로 채용률이 낮아지고 있습니다. 웨어러블 기술의 대부분은 현재 높은 가격이며, 이는 시장 채용에 부정적인 영향을 미칩니다.

- COVID-19 팬데믹은 웨어러블 센서 시장에 긍정적인 영향을 미치고 환자의 원격 모니터링에 디지털 인프라를 활용할 필요성을 부각시켰습니다. 현재 바이러스 검사 및 백신은 개발에 시간이 걸리기 때문에 웨어러블 센서는 질병을 감지하고 개인과 집단의 건강 상태를 추적하는 데 도움이 될 수 있습니다.

웨어러블 센서 시장 동향

스포츠 및 피트니스 분야가 시장 점유율의 대부분을 차지

- 웰니스 모니터와 피트니스 트래커에 대한 수요 증가가 웨어러블 센서의 세계 출하량 증가를 견인하는 중요한 요인이 되고 있습니다. 웰니스 및 피트니스의 원격 모니터링과 같은 이러한 장치가 제공하는 기능에 대한 소비자의 인식이 높아짐에 따라 센서 기반 장치에 대한 수요가 세계적으로 증가하고 있습니다. Cisco Systems에 따르면 2022년 웨어러블 단말기를 사용한 5G 연결이 가장 많았던 것은 북미였습니다. 북미와 아시아의 웨어러블 단말을 합치면 2022년 세계 웨어러블 5G 연결의 약 70%를 차지했습니다.

- 웨어러블 퍼포먼스 디바이스는 일반인 및 운동 팀이 사용할 수 있습니다. 기술의 진보로 개인의 지구력 운동 선수, 스포츠 팀, 의사가 기능적인 움직임, 작업 부하 및 생체 측정 마커를 모니터링하여 성능을 향상시킬 수 있습니다. 성장 증가는 시장을 견인하고 있습니다.

- 기술 조직은 운동 팀을 위한 웨어러블 가젯의 성장과 홍보로 크게 발전하고 있습니다. Zephyr Technology, Viperpod, Smartlife, miCoach, Catapult 등의 기업들은 운동 코치의 의사 결정 방법, 스포츠 활동 플레이 방법, 프로 스포츠 선수의 성능, 건강, 안전을 개혁하고 있습니다. 이러한 기술은 또한 전문 스포츠 분야에서 일반 소비자를 위한 시장으로 빠르게 전환하고 있습니다.

- 2022년 6월, Garmin은 태양광 충전 기능을 갖춘 최초의 러닝 전용 스마트 워치인 Forerunner 955 Solar를 발표했습니다. Forerunner 955 Solar는 Power Glass 태양광 충전 렌즈를 탑재하여 스마트 워치 모드에서 최대 20일 1, GPS 모드에서 최대 49시간 2의 배터리 수명을 선수에게 제공합니다. 이 스마트 워치는 직사 광선 아래에서도 보기 쉬운 상시 가동, 풀 컬러 디스플레이를 탑재하고 있습니다. 응답성이 뛰어난 터치스크린은 전통적인 5 버튼 디자인과 함께 표준 건강 기능에 신속하게 액세스할 수 있으며, 보다 간단한 지도 조작 등을 가능하게 합니다.

- 게다가 2021년 9월, Whoop은 선수에 특화된 피트니스 웨어러블을 위해 2억 달러를 조달했습니다. 시리즈 F의 구형으로 Whoop의 일반 투자액은 약 4억 500만 달러에 달했습니다. SoftBank의 Vision Fund 2를 이용한 구형 시리즈로 평가액은 36억 달러에 달할 전망입니다. 추가 투자자로는 IVP, Cavu Venture Partners, GP Bullhound, Accomplice, NextView Ventures, Animal Capital 등이 있습니다. 그들은 모두 내셔널 풋볼 리그 선수 협회, 잭 도시 및 일부 전문가 스포츠 선수와 함께 한때 후원자의 확대 목록의 일부가되었습니다.

아시아태평양 급성장

- 중국은 오랫동안 칩 산업에서 중요한 역할을 담당해 왔지만, 현재는 칩 미세화의 리더로서 대두되고 있습니다. 중국에서 칩 소형화의 중요한 원동력 중 하나는 보다 미세하고 효율적인 칩 제조를 가능하게 하는 나노기술과 같은 첨단 제조 기술의 개발입니다. 이로 인해 웨어러블 센서 개발에 필수적인 보다 작고 효율적인 칩 생산이 급증하고 있습니다. 또한 중국 정부는 웨어러블 센서를 포함한 디지털 의료 및 의료 기술 개발을 촉진하기 위해 여러 가지 이니셔티브를 시작하고 있습니다.

- 일본은 최근 디지털화가 진행되고 있기 때문에 웨어러블 센서 시장에서 큰 성장이 예상됩니다. 이러한 추세는 디지털 기술의 도입을 촉진하는 정부의 이니셔티브, 디지털 네이티브 소비자 증가, 다양한 산업에서 생산성과 효율성 향상의 필요성 등 몇 가지 요인들에 힘쓰고 있습니다.

- 인도에서는 디지털 기술 채택 증가, 건강 및 피트니스에 대한 관심 증가, 웨어러블 디바이스의 장점에 대한 의식 증가 등 몇 가지 요인에 의해 웨어러블 센서 시장이 급속히 성장하고 있습니다.

- 기타 아시아태평양의 웨어러블 센서 수요는 피트니스 및 웰니스에 대한 관심 증가, 고령화 인구 증가, 기술과 헬스케어의 진보 등을 배경으로 지난 몇 년간 꾸준히 증가하고 있습니다.

- ASEAN Post에 따르면, 늘어나는 노인 인구에 대응하기에는 노인 홈만으로는 충분하지 않습니다. 이러한 시설에서 제공되는 서비스도 불충분하며 생활의 질에 영향을 미치고 입주자들 사이에 고립감을 창출하고 있습니다. 부동산 개발업체도 도시 거주자를 위한 주택을 건설할 때 고령화 사회의 문제를 고려하고 있으며, 웨어러블 센서의 미개척 잠재 시장을 제시하고 있습니다.

웨어러블 센서 산업 개요

웨어러블 센서 시장은 STMicroelectronics NV, Texas Instruments Incorporated, Infineon Technologies AG, Analog Devices Inc., InvenSense Inc.(TDK Corporation) 등의 대기업이 존재하며 경쟁이 심합니다. 시장 기업들은 제품 라인업을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 파트너십, 협업, 혁신, 인수 등의 전략을 채택하고 있습니다.

- 2022년 12월 - Analog Devices, Inc.는 오레곤 건강과학대학(OHSU)과 제휴하여 청소년의 정신건강 위기 증가에 대처하기 위해 주요 정신건강 지표를 감지하는 스마트 워치를 개발했습니다. OHSU는 세계적으로 급증하고 있는 정신건강 위기에 대해 ADI의 혁신적인 기술과 제품을 활용하여 사람들의 삶을 구하고 개선하고 풍요롭게 하는 것을 목표로 하고 있습니다.

- 2022년 12월 - 파나소닉은 90° 렌즈가 장착된 유명한 Grid-Eye 센서 제품군의 새로운 멤버를 발표했습니다. Grid-Eye 90 °는 다른 제품과 마찬가지로 개인의 움직임을 추적하고 계산하기 위해 구축 된 시스템을 개선합니다. 프라이버시를 중시하는 디자이너는 Grid-Eye 제품군의 64픽셀 해상도를 높이 평가합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 건강과 피트니스에 대한 의식 증가

- 스마트 웨어러블 디바이스의 동향 증가

- 시장의 과제

- 가젯 비용 상승

제6장 시장 세분화

- 유형별

- 화학 및 가스

- 압력

- 이미지 및 광학

- 운동

- 기타 센서

- 용도별

- 건강과 복지

- 안전 모니터링

- 스포츠 및 피트니스

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- STMicroelectronics NV

- Texas Instruments Incorporated

- Infineon Technologies AG

- Analog Devices Inc.

- InvenSense Inc.(TDK Corporation)

- AMS OSRAM AG

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd

- Bosch Sensortec GmbH(Robert Bosch GmbH)

제8장 투자 분석

제9장 시장의 미래

JHS 25.04.01The Wearable Sensors Market size is estimated at USD 4.90 billion in 2025, and is expected to reach USD 8.80 billion by 2030, at a CAGR of 12.41% during the forecast period (2025-2030).

The electronics industry has thrived significantly, primarily due to digitalization, which drives the demand for wearable technology devices widely used for self-health monitoring applications.

Key Highlights

- Wearable sensors are crucial to wearable devices due to consumers' growing interest in tracking real-time motion-sensing activities, such as step counting and walking distance covered. Users can define their goals for fitness and health using the specific results provided by analyzing the generated data. Wearable technology completely relies on sensors to monitor consumers' health and data and helps make meaningful decisions. With evolving sensor technology, wearables are becoming smart and gaining popularity among consumers.

- Spending on consumer electronic products is also stimulating the growth of wearable devices. Further, the growing population's increasing urbanization and changing lifestyle have raised its health and safety awareness. This has been the major factor stimulating the growth of wearable devices, such as fitness trackers, ear wears, and smartwatches.

- With the ongoing miniaturization of sensors and related components, the growth of the advanced function sensors in smart wearables, the improvement in the battery sizes, and efficiency are the key drivers boosting the wearable motion sensors market.

- With consumers' growing propensity toward smart wearables, the prices of devices are also soaring along with the growing cost of components, thus limiting adoption in the market. Smartwatches and fitness trackers have low-cost segments that drive significant attention from consumers. However, with the proliferation of technology, other devices such as footwear, eyewear, and body wear products are highly priced and have lower adoption rates. Most wearable technologies are currently highly-priced, which is negatively impacting adoption in the market.

- The COVID-19 pandemic had a favorable effect on the market for wearable sensors and highlighted the necessity of utilizing digital infrastructure for remote patient monitoring. Wearable sensors could help with disease detection and tracking individual and population health since current viral tests and vaccines take a while to develop.

Wearable Sensors Market Trends

Sports and Fitness Segment to Hold Major Market Share

- The increasing demand for wellness monitors and fitness trackers is a crucial factor driving the growth of shipments of wearable sensors globally. Globally, demand for sensor-based devices is increasing as consumers become more aware of the features that these devices provide, such as remote monitoring of wellness and fitness. According to Cisco Systems, North America had the most 5G connections made using wearable devices in 2022. Together, wearables in North America and Asia accounted for around 70% of the wearable 5G connections worldwide in 2022.

- Wearable performance devices are significantly available to the general population and athletic teams. Advancements in technology have allowed individual endurance athletes, sports teams, and physicians to monitor functional movements, workloads, and biometric markers to increase performance. The increased growth is driving the market.

- Technology organizations are making significant strides in growing and advertising wearable gadgets for athletic teams. Companies like Zephyr Technology, Viperpod, Smartlife, miCoach, and Catapult are remodeling how athletic coaches make decisions, how sports activities are played, and professional sports players' performance, health, and safety. These technologies are also moving rapidly from the professional sports arena into markets for the general public.

- In June 2022, Garmin Ltd introduced the Forerunner 955 Solar, the company's first dedicated running smartwatch featuring solar charging. The Forerunner 955 Solar features a Power Glass solar charging lens, providing athletes with up to 20 days of battery life in smartwatch mode1 and up to 49 hours in GPS mode2. The smartwatch features an always-on, full-color display that is easy to read in direct sunlight. The responsive touchscreen, coupled with the traditional 5-button design, allows fast access to standard health features, easier map control, etc.

- Further, in September 2021, Whoop raised USD 200 million for athlete-focused fitness wearables. The Series F spherical brings Whoop's general investment to nearly USD 405 million. The spherical series, with the aid of using SoftBank's Vision Fund 2, places the valuation at USD 3.6 billion valuations. Additional investors include IVP, Cavu Venture Partners, GP Bullhound, Accomplice, NextView Ventures, and Animal Capital. They have all been part of an extended listing of former backers, together with the National Football League Players Association, Jack Dorsey, and some expert athletes.

Asia-Pacific to Register Fastest Growth

- China has been a significant player in the chip industry for many years, and the country is now emerging as a leader in chip miniaturization. One of the critical drivers of chip miniaturization in China is the development of advanced manufacturing techniques, such as nanotechnology, which enable the production of more minor and more efficient chips. This has led to a surge in the production of smaller and more efficient chips, which are essential for developing wearable sensors. In addition, the Chinese government has launched several initiatives to promote the development of digital healthcare and medical technologies, including wearable sensors.

- Japan is expected to observe significant growth in the wearable sensors market as it has experienced increasing digitization in recent years. This trend has been driven by several factors, including government initiatives to promote the adoption of digital technologies, a growing number of digital-native consumers, and the need to improve productivity and efficiency in various industries.

- The market for wearable sensors is rapidly growing in India, driven by several factors, including the increasing adoption of digital technologies, a growing focus on health and fitness, and a rising awareness of the benefits of wearable devices.

- The demand for wearable sensors in the Rest of Asia-Pacific has steadily increased over the past few years, driven by a growing interest in fitness and wellness, a rising aging population, and advancements in technology and healthcare.

- According to the ASEAN Post, nursing homes are not enough to meet the ever-growing aged population. The services provided at these homes are also inadequate, impacting the quality of life and creating isolation among residents. Property developers are also considering the issue of an aging society when creating housing for urban dwellers, thus presenting an untapped potential market for wearable sensors.

Wearable Sensors Industry Overview

The wearable sensors market is competitive with the presence of major players like STMicroelectronics NV, Texas Instruments Incorporated, Infineon Technologies AG, Analog Devices Inc., and InvenSense Inc. (TDK Corporation). Players in the market are adopting strategies such as partnerships, collaborations, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Analog Devices Inc. collaborated with Oregon Health & Science University (OHSU) to develop a smartwatch that detects key mental health indicators to help address the rising mental health crisis in teens. As per the collaboration on the first and one-of-a-kind project, OHSU would leverage ADI's innovative technology and products for the burgeoning worldwide mental health crisis to save, improve, and enrich human lives.

- December 2022 - Panasonic Industries introduced a new member of its famous Grid-Eye sensor family with a 90° lens that provides a broader field of vision (FoV) and reduces the number of sensors needed to cover a given area, enabling people to count and track applications. Grid-Eye 90° will improve systems built to track and count the movement of individuals as well as other applications. Privacy-conscious designers have praised the Grid-Eye family's 64-pixel resolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Awareness of Health and Fitness

- 5.1.2 Increasing Trend of Smart Wearable Devices

- 5.2 Market Challenges

- 5.2.1 Higher Costs Associated with Gadgets

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Chemical and Gas

- 6.1.2 Pressure

- 6.1.3 Image/Optical

- 6.1.4 Motion

- 6.1.5 Other Types of Sensors

- 6.2 By Application

- 6.2.1 Health and Wellness

- 6.2.2 Safety Monitoring

- 6.2.3 Sports and Fitness

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 Texas Instruments Incorporated

- 7.1.3 Infineon Technologies AG

- 7.1.4 Analog Devices Inc.

- 7.1.5 InvenSense Inc. (TDK Corporation)

- 7.1.6 AMS OSRAM AG

- 7.1.7 Panasonic Corporation

- 7.1.8 NXP Semiconductors NV

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Bosch Sensortec GmbH (Robert Bosch GmbH)