|

시장보고서

상품코드

1851394

고속 카메라 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)High Speed Cameras - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

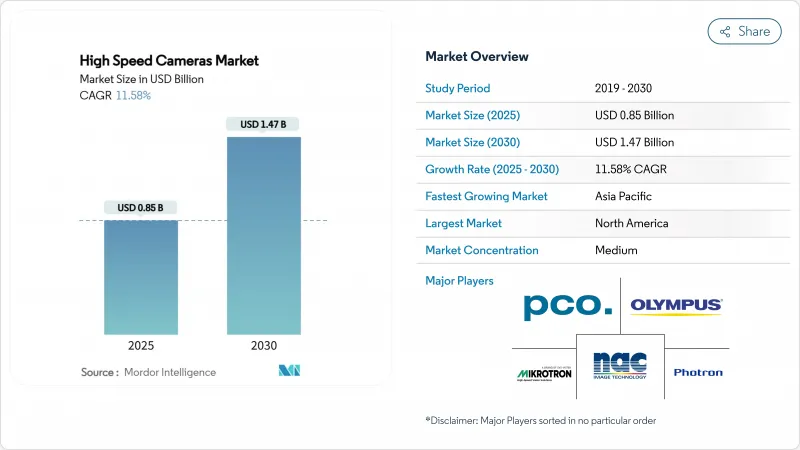

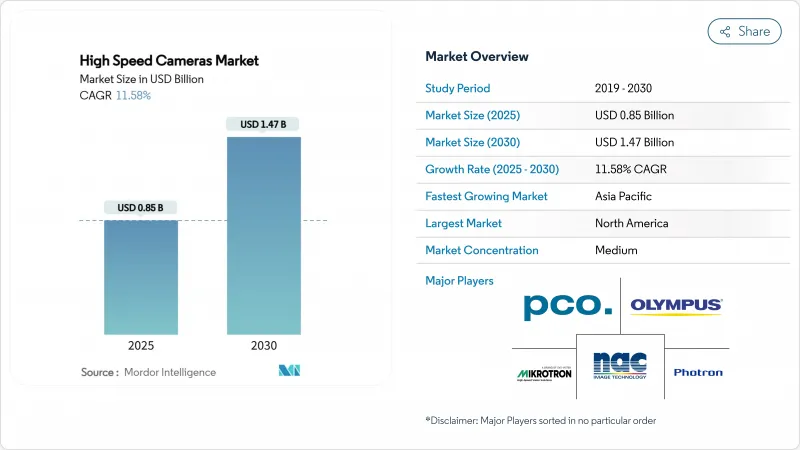

세계의 고속 카메라 시장 규모는 2025년에 8억 5,000만 달러, 2030년에는 14억 7,000만 달러로 확대될 것으로 예측되고, CAGR은 11.58%로 예상됩니다.

강력한 보급의 배경은 충돌 시험의 미세 변형에서 극초음속의 충격파 전파에 이르기까지 한때 측정이 어려웠던 현상을 해명하는 초고속 화상 처리의 능력이 있습니다. 반도체 웨이퍼 검사, 자율주행차의 안전성 검증, 8K 스포츠 중계 등에서는 각각 1,000 FPS를 훨씬 넘는 프레임 레이트가 요구되고, 종종 10만 FPS를 넘는 경우도 있습니다. 에지 스토리지 비용 절감, AI 중심의 비전 분석 통합, 대여 액세스 확대로 고객 기반이 더욱 확대되고 있습니다. 아시아태평양의 팹과 방위 기관이 투자를 확대하는 한편, 북미는 방위 R&D와 프리미엄 스포츠 생산을 통해 리더십을 유지하고 있습니다.

세계의 고속 카메라 시장 동향과 통찰

충돌 시험실에서 AI 기반 비전 분석 급증

충돌 테스트 프로그램은 현재 마이크로초 단위의 변형, 에어백의 연기 전파, 센서의 융합 이벤트를 분석하는 머신러닝 알고리즘에 의존하고 있습니다. 독일과 일본의 시설은 신경망 훈련에 필요한 데이터 밀도를 제공하기 위해 50,000 FPS 이상의 프레임 속도를 요구하고 있으며, 극단적인 속도에서도 저잡음을 유지할 수 있는 플래그십 카메라에 대한 수요가 가속화되고 있습니다. 자율주행차의 검증에서는 모든 합성 충돌 시나리오를 세밀한 시간 레이어로 기록할 필요가 있기 때문에 그 필요성은 더욱 높아집니다. 고속 이미지 처리와 AI의 공진화는 선순환을 생성합니다. 즉, 더 풍부한 데이터가 모델을 개선하여 프레임 속도 임계값을 높입니다. Tier-1 공급업체는 이미 슬레드 내에 고속 모듈을 통합하여 직접 데이터 로깅을 허용합니다. 규제 당국이 패시브 세이프티 기준을 강화함에 따라, 고속 카메라 시장에 대한 운전자의 중기적 영향은 강해집니다.

반도체 웨이퍼 검사용 SWIR 고속 카메라의 보급

5nm 이하의 첨단 로직 노드에서는 가시광 카메라로는 실현할 수 없는 결함 검출이 요구됩니다. 종종 InGaAs 기반의 SWIR 이미저는 초당 수천 프레임으로 작동하면서 실리콘 층을 투과하여 리소그래피 중 보이드, 패턴 붕괴 및 미세 오염을 인라인으로 감지할 수 있습니다. 한국과 대만 공장에서는 여러 공정에 걸쳐 이러한 카메라를 통합하여 스크랩을 줄여 라인 수율을 향상시키고 있습니다. SWIR 업그레이드의 자본 효율성은 중국 본토 및 싱가포르 주조소가 유사한 기능을 추가하는 등 프리미엄 공장 이외의 조달 기준에도 영향을 미치고 있습니다. 액체 금속 히트 스프레더 및 독특한 렌즈 코팅과 같은 열 관리 혁신은 고속에서 양자 효율을 유지하는 데 도움이 됩니다. 이러한 요인은 시장 성장 촉진요인의 단기적인 중석입니다.

CoaXPress 컴포넌트 수입 관세 BOM 비용 상승

특수 CoaXPress 칩셋과 케이블에 대한 무역 관세의 상승은 미국 어셈블러의 시스템 비용을 상승 시켰습니다. CoaXPress는 동축 링크에서 25Gbps를 전송하는 데 다른 추종을 허용하지 않으므로 대체품이 제한되어 있습니다. 벤더는 추가 요금의 일부를 흡수하고 있지만, 여전히 전체 시스템은 8-12% 높습니다. 이더넷 기반 대체품을 위한 재설계는 점차 진행되고 있지만, 대기 시간과 결정성에 대한 우려는 여전히 남아 있습니다. 통합자는 관세 변동을 헤지하기 위해 재고를 추가하고 운전 자금을 압박합니다. 정책이 해제될 가능성은 있지만, 고속 카메라 시장에 대한 단기적인 발목은 눈에 띄고 있습니다.

부문 분석

이미지 센서는 2024년 매출의 34%를 차지하며, 고속 카메라 시장 규모를 논의하는데 중요한 위치를 차지하고 있습니다. 그러나 메모리 서브시스템은 10만 FPS 버스트 시 버퍼링 수요가 폭발적으로 증가하기 때문에 CAGR 13.8%로 상승합니다. 제조업체 각 회사는 스택형 DRAM을 센서 근처에 집적하여 트레이스 길이를 단축하여 대기 시간을 줄입니다. 병렬 NVMe 어레이는 UHD 출력을 드롭 프레임 없이 기록하고, FPGA는 즉석 압축을 수행합니다. 냉각 플레이트와 진동 감쇠 섀시가 진화하여 여분의 열 부하를 방산하여 암전류를 억제합니다.

엣지 스토리지가 합리적인 가격으로 ASEAN의 중소기업은 지금까지 수작업으로 QC에 한정된 공장 라인에 고속 화상 처리를 도입할 수 있게 되었습니다. 전원 모듈도 이에 따라, 리튬 유황 팩은 다운홀 프로브의 무제한 가동 시간을 연장하고 있습니다. 한편, 렌즈 제조업체는 SWIR 투과용으로 코팅된 저분산 광학 부품을 개선하여 반도체 검사의 급증을 보완하고 있습니다. 전반적으로 고속 카메라 시장에서 경쟁사와의 차별화를 지원하는 것은 부품의 기술 혁신입니다.

2-5MP의 레이어가 42%의 점유율을 차지하고, 충분한 공간 디테일과 유지 가능한 데이터 레이트를 조합해, 현재의 고속 카메라 시장 점유율의 최대의 슬라이스를 주고 있습니다. 그러나 5MP를 넘는 센서는 픽셀 아키텍처의 양자 효율과 읽기 속도가 향상됨에 따라 CAGR 14.8%로 상승하고 있습니다. 12MP를 넘는 카메라는 현재 반도체 웨이퍼를 촬영하고 AI 결함 분류 장치가 라인을 정지시키지 않고 서브 미크론의 이상을 검출할 수 있게 되어 있습니다.

신흥 세계 셔터 CMOS 기술은 CoaXPress-12 링크를 통해 71 FPS에서 65 MP를 지원합니다. 스포츠 분석에도 비슷한 장점이 있습니다. 8K 슬로우 모션 클립은 이전에 보이지 않았던 생체역학적 미묘함을 보여줍니다. 호스트 PC가 PCIe 5.0을 채택함에 따라 메가픽셀의 상한이 상승하고 고속 카메라 시장의 상향 전환이 강화됩니다.

고속 카메라 보고서는 컴포넌트별(이미지 센서, 프로세서, 바디와 섀시, 기타), 해상도별(2MP 미만, 2-5MP, 기타), 프레임 속도별(250-1K, 1-5K, 5-20K, 기타), 스펙트럼별(가시, 적외선, X선, 기타), 용도별(신품, 렌탈, 중고), 용도별(자동차) 시장 예측은 금액(달러)으로 제공됩니다.

지역 분석

북미는 극초음속 연구개발, 8K 스포츠 방송 파이프라인, 정착한 렌탈 에코시스템이 견인해 2024년 매출의 33%를 유지했습니다. 미국 방어 연구소는 플라즈마 유도 충격을 연구하기 위해 100,000 FPS 이상의 카메라를 가동하고 캐나다 항공우주 시설은 복합재 날개에 착빙의 영향을 평가합니다. 멕시코의 자동차 회랑은 안정적인 충돌 시험 수요를 초래합니다. 지역 공급업체는 CoaXPress 보드를 이중으로 조달하여 관세 위험을 헤지하고 공급망의 탄력성을 유지합니다.

아시아태평양은 CAGR 13%로 가장 가파른 경사가 예상됩니다. 한국과 대만의 팹은 5nm 이하의 경쟁에 휘말려 리소그래피 트랙 전체에 SWIR 고속 어레이를 도입했습니다. 중국은 방위 예산을 초고속 옵틱스에 돌리기 위해 수입 센서에 대한 의존을 축소했습니다. 일본은 밀리초 수준의 피드백을 필요로 하는 조립 라인에 로봇과 이미징을 융합시켰고 인도는 PLI 방식으로 국내 전자기기 검사 능력을 자극하고 있습니다.

유럽은 데이터 네트워크의 타성에도 불구하고 꾸준히 성장하고 있습니다. 독일 OEM은 머신 비전과 디지털 트윈을 결합한 AI 강화형 크래시 로키를 선도합니다. 영국에서는 항공우주 터보 팬의 연구가 진행되고 프랑스에서는 철도의 판타그래프 감시에 고속 화상 처리를 통합했습니다. 중동에서는 튼튼한 배터리 구동 카메라가 150℃의 유정을 내려 장애물을 진단하고 가혹한 환경에서도 고속 촬영이 가능하다는 것을 증명하고 있습니다. 아프리카와 남미는 아직 발전도상이지만 광산 폭풍 해석과 대학 연구 프로그램이 증가하고 있어 고속 카메라 시장의 보급을 예감시킵니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 자동차 충돌 시험 실험실에서 초고 프레임 레이트 화상 처리를 필요로 하는 AI 기반의 비전 분석이 급증(독일, 일본)

- 반도체 웨이퍼 검사용 SWIR 고속 카메라의 보급(한국, 대만)

- 극초음속 무기 테스트를 우선하는 국방예산이 100k FPS 수요를 견인(미국과 중국)

- 렌탈 보급을 가속하는 8K 스포츠 중계(북미와 EU)

- 다운홀 진단용 고내구성 배터리 구동 카메라(중동)

- 온보드 에지 스토리지의 가격 하락이 중소기업의 도입을 촉진(ASEAN)

- 시장 성장 억제요인

- CoaXPress 컴포넌트의 수입 관세가 BOM 비용을 견인(미국)

- 휴대용 기계를 제한하는 50k FPS 이상의 열 잡음과 냉각 요구

- 훈련을 받은 고속 화상 기술자의 부족(신흥 시장)

- 레거시 팩토리 네트워크에 의한 데이터 스트림의 병목(10Gbps 이상)(유럽)

- 가치/공급망 분석

- 규제 전망

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자분석

제5장 시장 규모와 성장 예측

- 컴포넌트별

- 이미지 센서

- 프로세서 및 컨트롤러

- 렌즈

- 메모리 시스템(온보드 및 외장)

- 바디 및 섀시

- 냉각 시스템

- 배터리 및 파워 모듈

- 기타(케이블, 액세서리, 소프트웨어)

- 해상도별

- 2MP 미만

- 2-5 MP

- 5-12 MP

- 12MP 이상

- 프레임 레이트별

- 250-1,000 fps

- 1,001-5,000 fps

- 5,001-20,000 fps

- 20,001-100,000 fps

- 100,000FPS 이상

- 스펙트럼 유형별

- 가시(RGB)

- 적외선(NIR 및 MWIR)

- 단파장 적외선(SWIR)

- X선

- 자외선(UV)

- 사용 유형별

- 신품 카메라

- 렌탈 카메라

- 중고 및 재생 카메라

- 용도별

- 자동차 및 운송 충돌 시험

- 항공우주 및 방위(풍동, 탄도학)

- 산업용 제조업 - 일렉트로믹스 및 반도체

- 공업제조 - 일반기계

- 조사 및 설계 - 대학 및 연구소

- 미디어 및 엔터테인먼트 제작

- 스포츠 분석 및 방송

- 헬스케어 및 의료진단

- 소비자용 전자기기 시험

- 기타(에너지, 광업)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Vision Research Inc.

- Photron Ltd.

- Olympus Corporation

- nac Image Technology Inc.

- Mikrotron GmbH

- PCO AG

- Optronis GmbH

- Weisscam GmbH

- Fastec Imaging Corp.

- AOS Technologies AG

- Del Imaging Systems LLC

- IX Cameras Inc.

- Motion Capture Technologies LLC

- Teledyne DALSA Inc.

- Sony Group Corp.

- Grass Valley USA LLC

- Chronos Imaging Inc.

- High-Speed Vision GmbH

- Ametek Inc.(Phantom Brand)

- Red Digital Cinema LLC

제7장 시장 기회와 장래의 전망

JHS 25.11.13The high-speed camera market size is valued at USD 0.85 billion in 2025 and is projected to advance to USD 1.47 billion by 2030, translating to an 11.58% CAGR.

Strong uptake stems from the ability of ultra-fast imaging to unravel phenomena that once escaped measurement-ranging from crash-test micro-deformations to hypersonic shock-wave propagation. Semiconductor wafer inspection, autonomous-vehicle safety validation, and live 8K sports broadcasting each demand frame rates well above 1,000 FPS, and often beyond 100,000 FPS. Edge storage cost declines, integration of AI-driven vision analytics, and widening rental access further broaden the customer base. Regional dynamics are shifting as Asia-Pacific fabs and defense agencies scale investment, while North America preserves leadership through defense R&D and premium sports production.

Global High Speed Cameras Market Trends and Insights

Surge in AI-Based Vision Analytics for Crash-Test Labs

Crash-test programs now rely on machine-learning algorithms that dissect micro-second deformation, airbag plume propagation, and sensor fusion events. German and Japanese facilities require frame rates beyond 50,000 FPS to deliver the data density that feeds neural-network training, accelerating demand for flagship cameras able to maintain low noise at extreme speeds. Autonomous-vehicle validation compounds the need as every synthetic crash scenario must be documented in granular temporal layers. The co-evolution of high-speed imaging and AI creates a virtuous cycle: richer data improves models, which in turn push frame-rate thresholds higher. Tier-1 suppliers are already embedding high-speed modules inside sleds to ensure direct datalogging. As regulatory bodies tighten passive-safety standards, the driver's medium-term impact on the high-speed camera market strengthens.

Proliferation of SWIR High-Speed Cameras for Semiconductor Wafer Inspection

Advanced logic nodes below 5 nm demand defect detection that visible-light cameras cannot deliver. SWIR imagers, often based on InGaAs, penetrate silicon layers while operating at thousands of frames per second, allowing inline detection of voids, pattern collapse, and micro-contamination during lithography. South Korean and Taiwanese fabs have integrated these cameras across multiple process steps, reducing scrap and elevating line yield. The capital efficiency of SWIR upgrades has influenced procurement standards beyond premium fabs, with foundries in mainland China and Singapore adding similar capability. Thermal-management innovations-liquid-metal heat spreaders and proprietary lens coatings-are helping maintain quantum efficiency at high speeds. These factors underpin the driver's immediate, short-term weight on market growth.

Import Tariffs on CoaXPress Components Raising BOM Costs

Escalating trade duties on specialized CoaXPress chipsets and cables inflate system costs for U.S. assemblers. CoaXPress remains unrivaled for carrying 25 Gbps over coaxial links, so substitution is limited. Vendors absorb part of the surcharge, yet full systems still list 8-12% higher. Incremental redesign toward Ethernet-based alternatives inches forward, but latency and determinism concerns persist. Integrators queue additional stock to hedge tariff swings, straining working capital. While policy could unwind, its short-term drag on the high-speed camera market is tangible.

Other drivers and restraints analyzed in the detailed report include:

- Defense Budgets Prioritizing Hypersonic Weapon Testing

- Live 8K Sports Broadcast Accelerating Rental Uptake

- Thermal Noise & Cooling Needs Above 50 k FPS Limiting Portables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Image sensors captured 34% of 2024 revenue, underscoring their centrality to any high-speed camera market size discussion. Yet memory subsystems are the flashpoint for future gains, climbing at a 13.8% CAGR as buffering demand explodes during 100,000 FPS bursts. Manufacturers integrate stacked DRAM closer to the sensor, shortening trace lengths and lowering latency. Parallel NVMe arrays now log UHD output without dropped frames, while FPGAs conduct on-the-fly compression. Cooling plates and vibration-damped chassis evolve to dissipate the extra thermal load, keeping dark current in check.

Edge storage affordability lets SMEs in ASEAN deploy high-speed imaging on factory lines previously limited to manual QC. Power modules follow suit; lithium-sulfur packs yield longer untethered runtime for down-hole probes. Meanwhile, lens manufacturers refine low-dispersion optics coated for SWIR transmission, complementing the surge in semiconductor inspection. Overall, component innovation sustains competitive differentiation inside the high-speed camera market.

The 2-5 MP tier held 42% share, pairing adequate spatial detail with maintainable data rates, giving it the largest slice of current high-speed camera market share. However, sensors above 5 MP are rising at a 14.8% CAGR as pixel architectures gain quantum efficiency and read-out speeds. Cameras exceeding 12 MP now film semiconductor wafers, enabling AI defect classifiers to spot sub-micron anomalies without halting the line.

Emergent global-shutter CMOS tech supports 65 MP at 71 FPS, routed over CoaXPress-12 links. Sports analytics similarly benefits: 8K slow-motion clips reveal biomechanical subtleties once invisible. As host PCs adopt PCIe 5.0, the ceiling on megapixels will climb, reinforcing upward migration within the high-speed camera market.

The High-Speed Camera Report is Segmented by Component (Image Sensors, Processors, Body and Chassis, and More), Resolution (Less Than 2 MP, 2-5 MP, and More), Frame Rate (250-1K, 1-5K, 5-20K, and More), Spectrum (Visible, Infrared, X-Ray, and More), Usage (New, Rental, Used), Application (Automotive and Transportation, Industrial, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 33% of 2024 revenue, driven by hypersonic R&D, 8K sports broadcast pipelines, and an entrenched rental ecosystem. U.S. defense laboratories run cameras beyond 100,000 FPS to study plasma-induced shock, while Canadian aerospace facilities evaluate icing impacts on composite wings. Mexico's automotive corridor brings steady crash-test demand. Regional suppliers hedge tariff risk by dual-sourcing CoaXPress boards, keeping supply chains resilient.

Asia-Pacific presents the steepest trajectory at a 13% CAGR. South Korean and Taiwanese fabs, locked in sub-5 nm competition, deploy SWIR high-speed arrays across lithography tracks. China channels defense budgets into ultra-fast optics, shrinking reliance on imported sensors. Japan fuses robotics and imaging for assembly lines requiring millisecond-level feedback, while India's PLI schemes incentivize domestic electronics inspection capacity.

Europe grows steadily despite data-network inertia. German OEMs lead AI-enhanced crash loci, combining machine vision with digital twins. The United Kingdom advances aerospace turbofan research, and France integrates high-speed imaging into rail pantograph monitoring. In the Middle East, rugged, battery-powered cameras descend oil wells at 150 °C to diagnose obstructions, proving high-speed viability in harsh zones. Africa and South America remain embryonic but show upticks in mining blast analysis and university research programs, foreshadowing broader penetration of the high-speed camera market.

- Vision Research Inc.

- Photron Ltd.

- Olympus Corporation

- nac Image Technology Inc.

- Mikrotron GmbH

- PCO AG

- Optronis GmbH

- Weisscam GmbH

- Fastec Imaging Corp.

- AOS Technologies AG

- Del Imaging Systems LLC

- IX Cameras Inc.

- Motion Capture Technologies LLC

- Teledyne DALSA Inc.

- Sony Group Corp.

- Grass Valley USA LLC

- Chronos Imaging Inc.

- High-Speed Vision GmbH

- Ametek Inc. (Phantom Brand)

- Red Digital Cinema LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in AI-based Vision Analytics Requiring Ultra-High Frame-Rate Imaging in Automotive Crash Test Labs (Germany and Japan)

- 4.2.2 Proliferation of SWIR High-speed Cameras for Semiconductor Wafer Inspection (South Korea and Taiwan)

- 4.2.3 Defense Budgets Prioritizing Hypersonic Weapon Testing Boosting 100 k FPS Demand (U.S. and China)

- 4.2.4 Live 8K Sports Broadcast Accelerating Rental Uptake (North America and EU)

- 4.2.5 Rugged Battery-Powered Cameras for Down-hole Diagnostics (Middle East)

- 4.2.6 On-board Edge Storage Price Declines Enabling SME Adoption (ASEAN)

- 4.3 Market Restraints

- 4.3.1 Import Tariffs on CoaXPress Components Raising BOM Costs (U.S.)

- 4.3.2 Thermal Noise and Cooling Needs Above 50 k FPS Limiting Portables

- 4.3.3 Shortage of Trained High-speed Imaging Technicians (Emerging Markets)

- 4.3.4 Data-Stream Bottlenecks (greater than 10 Gbps) with Legacy Factory Networks (Europe)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Image Sensors

- 5.1.2 Processors and Controllers

- 5.1.3 Lens

- 5.1.4 Memory Systems (On-board and External)

- 5.1.5 Body and Chassis

- 5.1.6 Cooling Systems

- 5.1.7 Battery and Power Modules

- 5.1.8 Others (Cables, Accessories, Software)

- 5.2 By Resolution

- 5.2.1 Less than 2 MP

- 5.2.2 2 - 5 MP

- 5.2.3 5 MP - 12 MP

- 5.2.4 Greater than 12 MP

- 5.3 By Frame Rate

- 5.3.1 250 - 1,000 FPS

- 5.3.2 1,001 - 5,000 FPS

- 5.3.3 5,001 - 20,000 FPS

- 5.3.4 20,001 - 100,000 FPS

- 5.3.5 Greater than 100,000 FPS

- 5.4 By Spectrum Type

- 5.4.1 Visible (RGB)

- 5.4.2 Infrared (NIR and MWIR)

- 5.4.3 Short-Wave Infrared (SWIR)

- 5.4.4 X-ray

- 5.4.5 Ultraviolet (UV)

- 5.5 By Usage Type

- 5.5.1 New Cameras

- 5.5.2 Rental Cameras

- 5.5.3 Used / Refurbished Cameras

- 5.6 By Application

- 5.6.1 Automotive and Transportation Crash Testing

- 5.6.2 Aerospace and Defense (Wind-Tunnel, Ballistics)

- 5.6.3 Industrial Manufacturing - Electronics and Semiconductor

- 5.6.4 Industrial Manufacturing - General Machinery

- 5.6.5 Research and Design - Universities and Labs

- 5.6.6 Media and Entertainment Production

- 5.6.7 Sports Analytics and Broadcast

- 5.6.8 Healthcare and Medical Diagnostics

- 5.6.9 Consumer Electronics Testing

- 5.6.10 Others (Energy, Mining)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Vision Research Inc.

- 6.4.2 Photron Ltd.

- 6.4.3 Olympus Corporation

- 6.4.4 nac Image Technology Inc.

- 6.4.5 Mikrotron GmbH

- 6.4.6 PCO AG

- 6.4.7 Optronis GmbH

- 6.4.8 Weisscam GmbH

- 6.4.9 Fastec Imaging Corp.

- 6.4.10 AOS Technologies AG

- 6.4.11 Del Imaging Systems LLC

- 6.4.12 IX Cameras Inc.

- 6.4.13 Motion Capture Technologies LLC

- 6.4.14 Teledyne DALSA Inc.

- 6.4.15 Sony Group Corp.

- 6.4.16 Grass Valley USA LLC

- 6.4.17 Chronos Imaging Inc.

- 6.4.18 High-Speed Vision GmbH

- 6.4.19 Ametek Inc. (Phantom Brand)

- 6.4.20 Red Digital Cinema LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment