|

시장보고서

상품코드

1686619

웨어러블 온도 센서 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Wearable Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

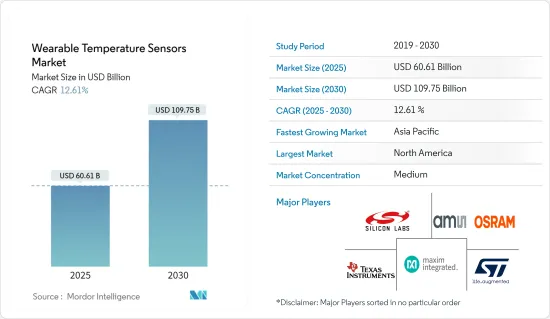

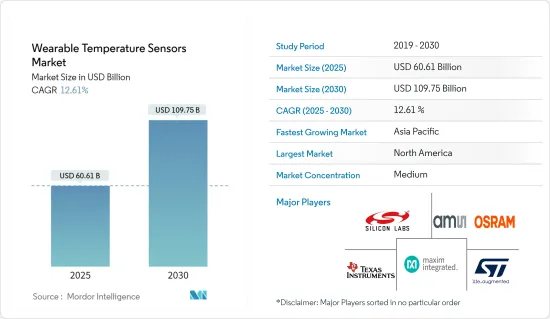

웨어러블 온도 센서 시장 규모는 2025년에 606억 1,000만 달러, 2030년에는 1,097억 5,000만 달러에 달할 것으로 예측됩니다. 예측 기간 중(2025-2030년) CAGR은 12.61%를 나타낼 것으로 예상됩니다.

웨어러블 온도 센서는 사람의 체온을 측정하는 데 단독으로 사용되는 휴대용 센서입니다. 이 센서는 심박수, 체온, 맥박수를 모니터링하기 위해 웨어러블 장비와 인체에 직접 통합됩니다. 웨어러블 센서는 혈압, 심박수, 체온 등 몇 가지 매개 변수가 매우 중요한 의료 및 진단 업계에서 인기를 얻고 있습니다.

주요 하이라이트

- 가전제품에 대한 지출도 웨어러블 디바이스의 성장을 자극합니다. 도시화의 진전과 인구 증가에 의한 라이프 스타일의 변화에 의해 건강과 안전에 대한 의식이 높아지고 있습니다. 이것은 피트니스 트래커, 이어웨어, 스마트 워치 등의 웨어러블 디바이스의 성장을 자극하는 큰 요인이 되고 있습니다.

- 스마트 라이프의 급속한 동향과 연결 장비 증가는 웨어러블 온도 센서 시장을 강화할 것으로 예상됩니다. 이러한 웨어러블 온도 센서는 모든 연령대의 사람들의 피트니스와 건강에 대한 인식을 높이고 웨어러블 센서의 성장을 가속합니다.

- 또한 웨어러블 센서 장치는 운동 선수가 매일 루틴을 보호하는 데 도움을 주고 모니터링하도록 프로그래밍된 매개변수에 대한 중요한 정보를 제공하기 때문에 스포츠 산업의 중요한 부분으로 부상하고 있습니다. 게다가 보다 작고 스마트하며 저비용 센서로 구성된 고급 웨어러블 디바이스의 출현은 AI와 IoT 채택의 확대와 함께 웨어러블 디바이스 시장의 성장을 더욱 확실하게 할 것으로 예측되고 있으며, 웨어러블 온도 센서 시장에 긍정적인 영향을 미칠 것으로 예측되고 있습니다.

- 소비자의 스마트 웨어러블에 대한 추세가 증가함에 따라 장치 가격도 부품 비용이 증가함에 따라 상승하고 시장에서의 채용이 제한되고 있습니다. 스마트 워치와 피트니스 트래커는 소비자의 큰 관심을 모으는 저렴한 가격의 부문을 가지고 있습니다. 그러나, 기술의 보급에 따라, 양말, 안경, 바디웨어 제품과 같은 다른 장치는 높은 가격이며 채용률이 낮습니다.

웨어러블 온도 센서 시장 동향

건강 관리가 모든 최종 사용자 분야에서 가장 빠른 성장을 기록할 것으로 예상

- 웨어러블 온도 센서는 의료 분야에서 체온을 실시간으로 모니터링하는 데 많이 사용됩니다. 예를 들어, 발열 감지, 환자의 지속적인 모니터링, 특정 병리학을 가진 개인의 체온 변화 추적 등입니다.

- 웨어러블 온도 센서는 개인의 체온을 지속적으로 모니터링할 수 있어 비정상적인 체온 변화의 조기 발견에 도움이 됩니다. 이 실시간 데이터는 특히 감염과 만성 질환에서 시기 적절한 개입을 수행하는 데 매우 중요합니다. 웨어러블 센서는 또한 건강 파라미터를 추적하는 비침습적이고 편리한 방법을 제공하여 환자의 편안함과 모니터링 프로토콜의 준수를 향상시킵니다.

- 이러한 센서는 호흡수, 혈중 산소 농도, 체온 등의 생체 신호를 추정하여 생리적·생화학적 마커를 검출하는 원격 건강 모니터링의 신기술로 대두해 왔습니다. 웨어러블 온도 센서는 COVID-19를 포함한 여러 질병의 비침습적 및 조기 진단에 엄청난 가능성을 제공합니다.

- 노년 인구 증가와 건강 관리에서 웨어러블 디바이스의 장점 증가는 예측 기간 동안 시장 확대를 가속화할 것으로 예상됩니다. 인구문제연구소에 따르면 인구의 약 25%가 15세 미만, 10%가 65세 이상입니다.

아시아태평양이 현저한 성장을 이룰 전망

- 아시아태평양의 큰 점유율은 건강 관리 분야의 응용 분야 성장에 기인합니다. 중국, 한국, 인도의 신흥 경제국에서 수요 증가는 이러한 웨어러블 온도 센서의 지역 수요에 크게 기여할 것으로 예상됩니다.

- 아시아태평양은 예측 기간 동안 큰 성장을 이룰 것으로 예상됩니다. 성장을 지원하는 주요 요인은 의료 인프라에 대한 투자 증가, 연구, 혁신 센터, 정부 프로그램, 건강 관리 장비 및 장치 시장을 우대하는 정책 등입니다.

- 아시아태평양은 만성 질환의 유병률이 증가하고 의료 센서에 대한 개인의 의식이 높아짐에 따라 시장 점유율이 확대될 것으로 예상됩니다. 이러한 지역에서의 웨어러블 온도 센서 시장의 성장은 최근 의료 센서의 개발에 중점을 두고, 건강 관리 인프라를 강화하고 질병의 조기 발견에 기인하고 있습니다.

- 고령화가 진행되는 이 지역에서는 의료기기 및 설비 분야에서 항상 기술 혁신의 여지가 있어 외자계 기업에 투자 기회를 제공합니다. 예를 들어, 2023년 7월 보트는 건강과 피트니스 추적 기능을 갖춘 스마트 링의 출시를 발표했습니다. 이 링에는 사용자의 체온 측정, 심박수 추적, 수면 모니터링, 여성의 월경주기 매핑 등 다양한 건강 센서가 탑재되어 있습니다.

웨어러블 온도 센서 산업 개요

웨어러블 온도 센서 시장은 반고체화되고 있습니다. 이 시장의 세계 주요 기업으로는 Silicon Laboratories Inc., Maxim Integrated Products Inc., STMicroelectronics NV, Texas Instruments Inc., AMS-OSRAM AG 등이 있습니다. 이러한 기업들은 시장 확대 및 인수, 제품 출시, 기술 업그레이드에 주력함으로써 사업을 지속적으로 확대하고 있습니다.

- 2024년 2월 GreenTEG와 WITHINGS의 제휴는 건강 모니터링에 혁명을 가져올 것으로 예상됩니다. 이 제휴는 체온 모니터링을 위해 설계된 GreenTEG의 최첨단 센서 CALERA를 최신 WITHINGS Scanwatch NOVA에 통합합니다.

- 2024년 2월 선도 센서 제조업체인 센실리온은 헝가리의 데브레첸에 위치한 생산 시설을 5,000제곱미터 확장할 계획을 밝혔습니다. 이 이전은 센실리온의 생산 능력을 특히 센서 모듈 분야에서 강화할 것입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 업계 밸류체인, 공급체인 분석

- 거시 경제 요인과 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 모든 연령층에 있어서의 건강 의식의 고조

- 웨어러블 디바이스의 기술 진보

- 시장의 과제

- 높은 제품 비용

제6장 시장 세분화

- 용도별

- 바디웨어

- 안경

- 양말

- 리스트웨어

- 기타 용도

- 업계별

- 헬스케어

- 스포츠, 피트니스

- 산업

- 기타 업계별

- 지역별

- 북미

- 유럽

- 아시아

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Silicon Laboratories Inc.

- Maxim Integrated Products Inc.

- STMicroelectronics NV

- Texas Instruments Inc.

- AMS-OSRAM AG

- Melexis

- Analog Devices Inc.

- GreenTEG

- TE Cnnectivity Ltd

- Sensirion AG

제8장 투자 분석

제9장 시장의 미래

SHW 25.04.01The Wearable Temperature Sensors Market size is estimated at USD 60.61 billion in 2025, and is expected to reach USD 109.75 billion by 2030, at a CAGR of 12.61% during the forecast period (2025-2030).

Wearable temperature sensors are portable sensors that are used independently to measure human temperature. These sensors are directly integrated into wearable devices or the human body to monitor heart rate, body temperature, and pulse rate. Wearable sensors have gained popularity in the healthcare and diagnosis industry, where several parameters are of vital importance, namely blood pressure, heart rate, and body temperature.

Key Highlights

- Spending on consumer electronic products is also stimulating the growth of wearable devices. The increasing urbanization and changing lifestyle of the growing population have increased health and safety awareness. This is a major factor stimulating the growth of wearable devices, such as fitness trackers, earwear, and smartwatches.

- The rapidly increasing trend of smart living and the growing number of connected devices are expected to enhance the wearable temperature sensors market. These wearable temperature sensors increase awareness regarding fitness and health in people of all age groups, driving the growth of wearable sensors.

- Also, wearable sensor devices have emerged as a significant part of the sports industry since they help athletes stick to their daily routines and provide important information about the parameters they are programmed to monitor. Moreover, the advent of advanced wearable devices that comprise smaller, smarter, and low-cost sensors, together with the growing adoption of AI and IoT, is further projected to ensure the growth of the wearable devices market, which is anticipated to create a positive impact on the wearable temperature sensors market.

- With the growing propensity of consumers toward smart wearables, the prices of devices are also soaring along with the growing cost of components, which limits adoption in the market. Smartwatches and fitness trackers have low-cost segments that drive significant attention from consumers. However, with the proliferation of technology, other devices such as footwear, eyewear, and body wear products are highly priced and have lower adoption rates.

Wearable Temperature Sensors Market Trends

Healthcare is Expected to Register the Fastest Growth Among All End-user Verticals

- Wearable temperature sensors are significantly used in the healthcare sector to monitor body temperature in real time. Examples include fever detection, continuous monitoring of patients, and tracking temperature variations for individuals with certain medical conditions.

- They enable the continuous monitoring of an individual's body temperature, aiding in the early detection of abnormal variations. This real-time data is crucial for timely intervention, especially in infections or chronic conditions. Wearable sensors also provide a non-invasive and convenient way to track health parameters, enhancing patient comfort and compliance with monitoring protocols.

- These sensors are emerging as a new technology for remote health monitoring to detect physiological and biochemical markers by estimating vital signs such as respiratory rate, blood oxygen level, and body temperature; wearable temperature sensors offer immense potential for the non-invasive and early diagnosis of multiple diseases, including COVID-19.

- The growing geriatric population and the increasing number of advantages of wearable devices in healthcare are projected to accelerate the expansion of the market during the forecast period. According to the Population Reference Bureau, about 25% of the population is under 15 years of age, and 10% is over 65 years of age.

Asia-Pacific is Expected to Register Significant Growth

- The major share of the Asia-Pacific region can be attributed to the growth in application areas of the healthcare sector. The escalating demand in the emerging economies of China, South Korea, and India is expected to greatly contribute to the regional demand for such wearable temperature sensors.

- The Asia-Pacific region is expected to witness significant growth during the forecast period. Major factors supporting growth are increasing investments in medical infrastructure, research and innovation centers, government programs, and policies favoring the healthcare equipment and devices markets.

- The Asia-Pacific region is anticipated to experience market share growth due to the increasing prevalence of chronic disorders and the rising awareness of medical sensors among individuals. The growth of the wearable temperature sensors market in these regions is attributed to the increased emphasis on the development of medical sensors in recent years, the enhancement of healthcare infrastructure, and the early detection of diseases.

- Given the region's aging population, there is always room for innovation in the field of medical devices and equipment, which provides opportunities for foreign companies to invest in the country. For instance, in July 2023, Boat announced the release of its smart ring with health and fitness tracking features. The ring has various health sensors, such as measuring the user's body temperature, heart rate tracking, sleep monitoring, female menstrual cycle mapping, etc.

Wearable Temperature Sensors Industry Overview

The wearable temperature sensors market is semi-consolidated. Some of the global key players in this market are Silicon Laboratories Inc., Maxim Integrated Products Inc., STMicroelectronics NV, Texas Instruments Inc., and AMS-OSRAM AG. These firms have been continuously expanding their operations by focusing on market expansions and acquisitions, product launches, and technological upgrades.

- February 2024: GreenTEG's collaboration with WITHINGS is expected to revolutionize health monitoring. The partnership involves integrating GreenTEG's cutting-edge CALERA sensor, designed for core body temperature monitoring, into the latest WITHINGS Scanwatch NOVA.

- February 2024: Sensirion, a leading sensor manufacturer, revealed plans to expand its production facility in Debrecen, Hungary, by an additional 5,000 sq. m. The expansion is set to be executed in two phases, with the first phase slated for completion in Q4 2024 and the second phase expected to be wrapped up by Q1 2025. This move is poised to bolster Sensirion's production capabilities, particularly in the realm of sensor modules.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Factors and COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Health Awareness Among all Age Groups

- 5.1.2 Technological Advancement in Wearable Devices

- 5.2 Market Challenges

- 5.2.1 High Product Cost

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Body Wear

- 6.1.2 Eye Wear

- 6.1.3 Foot Wear

- 6.1.4 Wrist Wear

- 6.1.5 Other Applications

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Sports/Fitness

- 6.2.3 Industrial

- 6.2.4 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silicon Laboratories Inc.

- 7.1.2 Maxim Integrated Products Inc.

- 7.1.3 STMicroelectronics NV

- 7.1.4 Texas Instruments Inc.

- 7.1.5 AMS-OSRAM AG

- 7.1.6 Melexis

- 7.1.7 Analog Devices Inc.

- 7.1.8 GreenTEG

- 7.1.9 TE Cnnectivity Ltd

- 7.1.10 Sensirion AG