|

시장보고서

상품코드

1850058

디지털 서명 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Digital Signatures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

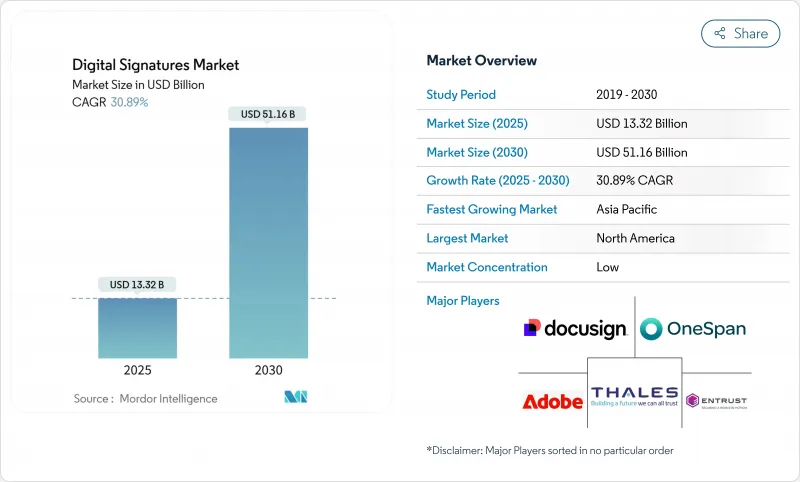

디지털 서명 시장 규모는 2025년에 133억 2,000만 달러, 2030년에는 511억 6,000만 달러에 이를 것으로 예상되며, CAGR은 30.89%를 나타낼 전망입니다.

지속적인 기세는 엄격한 세계 컴플라이언스의 의무화, 기업의 본격적인 디지털화 프로젝트, 그리고 다가오는 내양자암호의 필요성에서 비롯됩니다. 클라우드 배포는 여전히 기본 아키텍처이며 원격 근무으로 거래량이 급증하고 API(Application Programming Interface)의 통합으로 서명은 일상적인 비즈니스 프로세스에서 눈에 띄지 않는 단계가 됩니다. 이제 벤더 차별화는 기본 서명 기능보다 포스트 양자 로드맵과 크로스 플랫폼 상호 운용성에 달려 있습니다. 동시에, 단편화된 데이터 주권체제와 신흥 시장의 대역폭 제약은 첨단 서명기술의 급속한 세계 전개를 억제하고 있습니다.

세계의 디지털 서명 시장 동향과 인사이트

EU의 적격 전자 서명(eIDAS 2.0) 규정 준수 의무화 가속화

2024년 5월에 발효된 eIDAS 2.0 규정은 모든 회원국이 1년 이내에 적어도 하나의 유럽 디지털 ID 지갑을 시작하도록 의무화하고, 민간 서비스 제공업체에게 강력한 사용자 인증을 위해 이 지갑을 수락하도록 요구하고 있습니다. 조직은 2025년 5월까지 TLv5에서 TLv6 트러스트 목록으로 마이그레이션해야 하며 서명 장치 및 검증 서비스 업그레이드가 가속화됩니다. 자격을 갖춘 전자 서명은 골드 표준이 되어 하드웨어 보안 모듈(HSM) 및 다중 요소 인증에 대한 투자를 촉진합니다. 따라서 EU 전역에서 사업을 전개하는 다국적 기업은 법적 위험을 피하기 위해 세계 서명 스택을 EU 가이드라인에 동기화시킵니다. 턴키 지갑 준비 솔루션을 제공하는 공급업체는 기업이 준수를 겨냥한 경쟁을 펼치는 동안 조기에 우위를 차지할 수 있습니다.

APAC의 공공 부문 워크플로우에서 대규모 디지털화 프로그램

중국, 인도, 일본, 베트남의 각 정부는 페이퍼리스 거버넌스를 급속히 진행하고 있으며, 시민용 포털의 디지털 서명 거래 건수가 증가하고 있습니다. 2024년 후반에 급증한 베트남의 디지털 서명은 공공 부문의 지침이 민간 부문 도입에 어떻게 불이 붙었는지를 명확하게 보여주었습니다. 인도 디지털 인디아의 전자 서명 이니셔티브는 eMudhra가 국가 증명서 발행의 35%를 차지하는 것과 유사한 네트워크 효과를 보여줍니다. 수백만 명의 공무원이 온라인으로 거래하는 동안 표준화된 신뢰 프레임워크는 공급업체, 은행 및 보험 회사에 대한 사실적인 요구 사항이 되었습니다. 또한 급격한 거래량이 증가함에 따라 공급업체는 저지연으로 모바일 퍼스트 경험을 제공해야 합니다.

국경을 넘어서는 효과를 막는 국가별 데이터 현지화 규칙

40개국에 이르는 약 100개의 현지화 대책이 기밀 데이터를 국내 클라우드에 보관할 것을 의무화하고, 인프라를 단편화하고, 컴플라이언스 비용을 밀어 올리고 있습니다. 디지털 서명 제공업체는 세계 검증 체인을 유지하면서 키 저장소, 감사 로그 및 타임스탬프 서비스를 규제 관할 구역별로 복제해야 합니다. 다통화 거래 문서를 다루는 금융 기관은 불필요한 대기 시간과 감사의 복잡성을 가지고 있으며 가장 부담을 느낍니다. 설문 조사에 따르면 데이터 현지화는 ISO 27002의 14개 보안 관리 중 13개를 약화시켜 위협 발견과 위기 대응을 약화시킬 수 있습니다. 그 결과, 기술이 풍부하고 이익률이 높은 분야 이외에의 도입이 늦어지게 됩니다.

부문 분석

클라우드 솔루션은 2024년 90억 6,000만 달러를 창출해 디지털 서명 시장 점유율의 68%를 차지했습니다. CAGR 33.5%로 가속화를 계속하는 클라우드는 2030년까지 총 증가 수익의 절반을 초과할 것으로 예상됩니다. ID-as-a-서비스 플랫폼과의 긴밀한 통합, 즉각적인 기능 전개, 탄력적인 스케일링은 신속한 수익을 요구하는 기업의 공감을 불러옵니다. 클라우드 제공업체는 FIPS 140-3 인증을 받은 내 탬퍼성이 높은 HSM 클러스터를 통합하여 키 에스크로 및 멀티테넌시에 대한 과거의 우려를 완화하고 있습니다. 결과적으로, 조달 팀은 자본 지출이 포함된 설치가 아니라 구독 라이선스를 선택해야 합니다.

On-Premise 배포는 하드웨어 소유권을 양도할 수 없는 방어, 코어 뱅킹, 소블린 클라우드 요구 사항을 견딜 수 있습니다. 중국, 러시아, 인도에서는 데이터 거주에 관한 법령이 제정되어 로컬 데이터센터는 선호에서 요건으로 승격하고 On-Premise 솔루션의 수익 점유율은 32%에 그칩니다. 2025년부터 2030년까지는 하이브리드 아키텍처가 실용적인 브리지 역할로 등장하여 루틴 트랜잭션을 SaaS에 오프로드하면서 "자격" 또는 기밀 서명을 사내 HSM 랙에 확보합니다. 이 듀얼 트랙 모델을 통해 규제 대상 기업은 주권 관리를 잃지 않고 API가 풍부한 생태계를 활용할 수 있습니다. 따라서 디지털 서명 산업에서 통합업체는 두 환경에 걸쳐 통합된 정책 오케스트레이션에 중점을 둡니다.

디지털 서명 시장은 배포(On-Premise, 클라우드), 제공 제품(소프트웨어, 하드웨어, 서비스), 최종 사용자 산업(은행, 금융서비스 및 보험(BFSI), 정부, 헬스케어, 석유 및 가스, 군 및 방위, 물류 및 운송 등), 지역(북미, 남미, 유럽, 아시아태평양, 중동 및 아프리카)으로 구분됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

북미의 수익 점유율은 34%로 2024년에는 45억 3,000만 달러에 달했습니다. 이는 E-SIGN 하에서 규제의 조기 명확화, 성숙한 클라우드의 보급, ISV 및 리셀러 파트너의 밀집된 생태계를 반영합니다. 업계별로는 BFSI와 기술 업계가 소비의 대부분을 차지하고 있지만, 주 수준의 디지털 정부 프로그램이 새로운 볼륨을 추가하고 있습니다. 사례 연구는 모바일 앱에 서명을 통합한 후 소매 은행이 온라인 대출 성약을 두 배로 늘렸다는 것을 보여줍니다. 또한 이 지역은 유력 벤더의 본거지이기도 하고, 인재와 파트너십의 우위성을 확보하고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 35.5%로 가장 성장률이 높은 지역입니다. 인도, 중국, 일본의 대규모 정부 디지털화는 민간 조달에 연결되는 수요 급증을 지원합니다. 인도의 Aadhaar와 연동한 e-Sign은 거래당 본인 확인 비용을 낮추고 풀뿌리 은행과 보험층에서 디지털 서명 시장의 채용을 촉진합니다. 중국의 사이버 보안법은 HSM의 현지 조달을 유발하여 자체 공급망 패턴을 형성합니다.

eIDAS 2.0의 전개 후, 유럽에서의 채용이 가속. 독일, 프랑스, 영국은 특히 건강 관리, 금융 및 법률 서비스에서 기업 지출을 이끌고 있습니다. 유럽 디지털 ID 지갑은 마찰이 없는 국경을 넘어 인증을 약속하지만 레거시 통합은 여전히 장애물입니다. TLv6 트러스트 리스트 관리 및 원격 인증 서명을 지원하는 공급업체는 RFP 채택이 확대되고 있습니다.

중동 및 아프리카는 걸프 협력 이사회의 전자 정부 노력에 힘입어 10% 대 중반의 건전한 성장을 이루고 있습니다. 아랍에미리트(UAE)에서는 원격 서명을 인정하는 국가 신탁 체계가 시행되어 외국인 투자자의 온보딩이 간소화됩니다. 남아프리카의 금융 부문은 요하네스버그와 케이프타운에 있는 이중화된 데이터센터를 활용하여 전력 및 네트워크 제약이 산발적으로 발생함에도 불구하고 클라우드 솔루션을 채택하고 있습니다.

남미에서는 브라질, 아르헨티나, 칠레가 법적 승인법을 제정하고 수요가 높아지고 있습니다. 브라질의 CertiSign은 국경을 넘어서는 무역문서에 대한 증명서 발행을 확대하고 수출업체 조달에 박차를 가하고 있습니다. 이 지역의 성장은 여전히 이질적인 세제 및 공증 규제와 싸우고 있기 때문에 클라우드 벤더는 Mercosole의 무역 레인을위한 컴플라이언스 템플릿을 미리 포장하도록 촉구하고 있습니다. 모든 지역에서 디지털 서명 시장은 안전한 디지털 경제를 목표로 정부의 지속적인 뒷받침에서 이익을 얻고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- EU에 있어서의 적격 전자 서명의 컴플라이언스 의무의 가속(eIDAS 2.0)

- 아시아태평양의 공공 부문 워크플로우에서의 대규모 디지털화 프로그램

- 엔터프라이즈 SaaS 제품군(Microsoft 365, Salesforce)에 내장된 전자 서명 API

- 내양자암호 증명서 스택을 향한 갱신 사이클

- ESG와 관련된 페이퍼리스 거래와 스코프 3의 탄소 삭감 추진

- 시장 성장 억제요인

- 국경을 넘은 유효성을 방해하는 국가 고유의 데이터 현지화 규칙

- 단편화된 세계의 신뢰 서비스 인정 제도

- 저대역폭의 모바일 네트워크에 있어서의 생체 인증 서명의 UX 갭

- 중소기업에 있어서 HSM 베이스의 적격 서명의 높은 비용

- 규제 전망

- 기술의 전망

- 거시 경제 요인의 영향 평가

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 투자분석

제5장 시장 규모와 성장 예측

- 배포별

- On-Premise

- 클라우드

- 제공별

- 소프트웨어

- 하드웨어

- 서비스

- 최종 사용자 업계별

- BFSI

- 정부

- 헬스케어

- 석유 및 가스

- 군사 및 방어

- 물류 및 운송

- 기타(연구 및 교육, 부동산, 제조, 법률, IT, 통신)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 칠레

- 페루

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주

- 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 아프리카

- 남아프리카

- 케냐

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 전략적 발전

- 시장 점유율 분석

- 공급업체 포지셔닝 분석

- 기업 프로파일

- DocuSign Inc.

- Adobe Inc.(Adobe Sign)

- OneSpan Inc.

- Thales Group(SafeNet)

- Entrust Corporation

- Nitro Software Ltd.

- airSlate Inc.(SignNow)

- Dropbox Inc.(HelloSign)

- Box Inc.(SignRequest)

- SIGNiX Inc.

- Ascertia Limited

- GlobalSign GMO

- Signeasy

- PandaDoc Inc.

- RPost Communications Ltd.

- CertiSign Certificadora Digital

- Kofax Ltd.

- Digicert Inc.

- Signicat AS

- Zoho Corporation(Zoho Sign)

제7장 시장 기회와 향후 전망

KTH 25.11.04The digital signatures market size stands at USD 13.32 billion in 2025 and is forecast to climb to USD 51.16 billion by 2030, advancing at a 30.89% CAGR.

Sustained momentum comes from stringent global compliance mandates, full-scale enterprise digitization projects, and the looming need for quantum-resistant cryptography. Cloud deployment remains the default architecture, remote work drives soaring transaction volumes, and application programming interface (API) integration turns signatures into an invisible step inside everyday business processes. Vendor differentiation now rests on post-quantum roadmaps and cross-platform interoperability rather than on basic signing features. At the same time, fragmented data-sovereignty regimes and bandwidth constraints in emerging markets temper the otherwise rapid global roll-out of advanced signing technologies.

Global Digital Signatures Market Trends and Insights

Accelerated compliance mandates for qualified e-signatures in EU (eIDAS 2.0)

The eIDAS 2.0 regulation, effective May 2024, obliges every Member State to launch at least one European Digital Identity Wallet within a year and compels private service providers to accept those wallets for strong user authentication. Organizations must shift from TLv5 to TLv6 trust lists by May 2025, prompting accelerated upgrades to signature creation devices and validation services. Qualified electronic signatures become the gold standard, driving investment in Hardware Security Modules (HSMs) and multi-factor authentication. Multinationals with pan-EU operations, therefore, synchronize global signing stacks to EU guidelines to avoid legal exposure. Vendors offering turnkey, wallet-ready solutions gain early-mover advantage as enterprises race to comply.

Mega-scale digitisation programmes in APAC public sector workflows

Governments in China, India, Japan, and Vietnam are fast-tracking paperless governance, propelling digital signature transaction counts across citizen-facing portals. Vietnam's late-2024 surge in digital signatures underscored how public-sector mandates ignite private-sector adoption. India's e-Sign initiative under Digital India shows similar network effects, with eMudhra holding 35% of national certificate issuance. As millions of civil servants transact online, standardized trust frameworks become de facto requirements for suppliers, banks, and insurers. The sudden volume also pressures vendors to deliver low-latency, mobile-first experiences.

Country-specific data-localisation rules hindering cross-border validity

Roughly 100 localisation measures across 40 countries require sensitive data to stay in domestic clouds, fragmenting infrastructure and driving up compliance costs. Digital signature providers must replicate key stores, audit logs, and timestamp services in every regulated jurisdiction while preserving global validation chains. Financial institutions handling multi-currency trade documents feel the burden most, incurring extra latency and audit complexity. Studies show data localisation can weaken 13 of 14 ISO 27002 security controls, undermining threat hunting and crisis response. The resulting overhead slows deployment outside technology-rich, high-margin sectors.

Other drivers and restraints analyzed in the detailed report include:

- Embedded e-signature APIs in enterprise SaaS suites (Microsoft 365, Salesforce)

- Renewal cycle toward post-quantum cryptography certificate stacks

- UX gaps for biometric signatures on low-bandwidth mobile networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud solutions generated USD 9.06 billion in 2024, translating into 68% of the digital signatures market share. Continued acceleration at a 33.5% CAGR positions cloud to exceed half of the total incremental revenue through 2030. Tight integration with identity-as-a-service platforms, instantaneous feature roll-outs, and elastic scaling resonate with enterprises seeking rapid returns. Cloud providers embed tamper-resistant HSM clusters certified to FIPS 140-3, alleviating past fears about key escrow and multi-tenancy. As a result, procurement teams routinely default to subscription licensing rather than capital expenditure installations.

On-premise deployments endure in defense, core banking, and sovereign-cloud mandates where hardware ownership is non-negotiable. Data-residency statutes in China, Russia, and India elevate local data centers from preference to requirement, ensuring a persistent 32% revenue share for on-premise solutions. During 2025-2030, hybrid architecture emerges as a pragmatic bridge, offloading routine transactions to SaaS yet reserving "qualified" or classified signatures for in-house HSM racks. This dual-track model allows regulated enterprises to tap API-rich ecosystems without forfeiting sovereign control. The digital signatures industry, therefore, sees integrators focusing on unified policy orchestration that spans both environments.

Digital Signatures Market is Segmented by Deployment (On-Premise, Cloud), Offering (Software, Hardware, Services), End-User Industry (BFSI, Government, Healthcare, Oil and Gas, Military and Defense, Logistics and Transportation, and More), Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 34% revenue share, worth USD 4.53 billion in 2024, reflects early regulatory clarity under E-SIGN, mature cloud penetration, and a dense ecosystem of ISV and reseller partners. BFSI and technology verticals dominate consumption, but state-level digital-government programs add fresh volume. Case studies show retail banks doubling online loan closures after embedding signing inside mobile apps. The region is also home to leading vendors, securing talent and partnership advantages.

Asia-Pacific is the highest-velocity arena with a 35.5% CAGR to 2030. Mega-government digitisation in India, China, and Japan underpins demand spikes that cascade into private-sector procurement. India's Aadhaar-linked e-Sign lowers identity verification cost per transaction, pushing digital signatures market adoption at grassroots banking and insurance tiers. China's Cybersecurity Law triggers local HSM sourcing, shaping unique supply-chain patterns.

Europe's adoption accelerates following the eIDAS 2.0 rollout. Germany, France, and the United Kingdom head enterprise spending, especially in healthcare, finance, and legal services. The European Digital Identity Wallet promises frictionless cross-border recognition, yet legacy integration remains a hurdle. Vendors equipped with TLv6 trust-list management and remote qualified signature support see growing RFP inclusion.

The Middle East and Africa post healthy mid-teen growth anchored by Gulf Cooperation Council e-government efforts. The United Arab Emirates enforces national trust frameworks that recognize remote signatures, streamlining foreign investor onboarding. South Africa's financial sector adopts cloud solutions despite sporadic power and network constraints, leveraging redundant data centers in Johannesburg and Cape Town.

South America witnesses rising demand, with Brazil, Argentina, and Chile enacting legal recognition statutes. Brazil's CertiSign expands certificate issuance for cross-border trade documents, spurring procurement among exporters. Regional growth still contends with heterogeneous tax and notary regulations, prompting cloud vendors to pre-package compliance templates for Mercosur trade lanes. Across all regions, the digital signatures market benefits from sustained governmental push toward secure digital economies.

- DocuSign Inc.

- Adobe Inc. (Adobe Sign)

- OneSpan Inc.

- Thales Group (SafeNet)

- Entrust Corporation

- Nitro Software Ltd.

- airSlate Inc. (SignNow)

- Dropbox Inc. (HelloSign)

- Box Inc. (SignRequest)

- SIGNiX Inc.

- Ascertia Limited

- GlobalSign GMO

- Signeasy

- PandaDoc Inc.

- RPost Communications Ltd.

- CertiSign Certificadora Digital

- Kofax Ltd.

- Digicert Inc.

- Signicat AS

- Zoho Corporation (Zoho Sign)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated compliance mandates for qualified e-signatures in EU (eIDAS 2.0)

- 4.2.2 Mega-scale digitisation programmes in APAC public sector workflows

- 4.2.3 Embedded e-signature APIs in enterprise SaaS suites (Microsoft 365, Salesforce)

- 4.2.4 Renewal cycle toward post-quantum cryptography certificate stacks

- 4.2.5 ESG-linked push for paperless transactions and Scope-3 carbon reduction

- 4.3 Market Restraints

- 4.3.1 Country-specific data-localisation rules hindering cross-border validity

- 4.3.2 Fragmented global trust-service accreditation regimes

- 4.3.3 UX gaps for biometric signatures on low-bandwidth mobile networks

- 4.3.4 High cost of HSM-backed qualified signatures for SMBs

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Assessment of Macroeconomic Factors Impact

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Offering

- 5.2.1 Software

- 5.2.2 Hardware

- 5.2.3 Services

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Government

- 5.3.3 Healthcare

- 5.3.4 Oil and Gas

- 5.3.5 Military and Defense

- 5.3.6 Logistics and Transportation

- 5.3.7 Others (Research and Education, Real Estate, Manufacturing, Legal, IT and Telecom)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Peru

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Australia

- 5.4.4.6 New Zealand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 United Arab Emirates

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 Turkey

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Kenya

- 5.4.5.2.3 Nigeria

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Market Share Analysis

- 6.3 Vendor Positioning Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.4.1 DocuSign Inc.

- 6.4.2 Adobe Inc. (Adobe Sign)

- 6.4.3 OneSpan Inc.

- 6.4.4 Thales Group (SafeNet)

- 6.4.5 Entrust Corporation

- 6.4.6 Nitro Software Ltd.

- 6.4.7 airSlate Inc. (SignNow)

- 6.4.8 Dropbox Inc. (HelloSign)

- 6.4.9 Box Inc. (SignRequest)

- 6.4.10 SIGNiX Inc.

- 6.4.11 Ascertia Limited

- 6.4.12 GlobalSign GMO

- 6.4.13 Signeasy

- 6.4.14 PandaDoc Inc.

- 6.4.15 RPost Communications Ltd.

- 6.4.16 CertiSign Certificadora Digital

- 6.4.17 Kofax Ltd.

- 6.4.18 Digicert Inc.

- 6.4.19 Signicat AS

- 6.4.20 Zoho Corporation (Zoho Sign)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment