|

시장보고서

상품코드

1637851

전사적 자원 계획 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Enterprise Resource Planning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

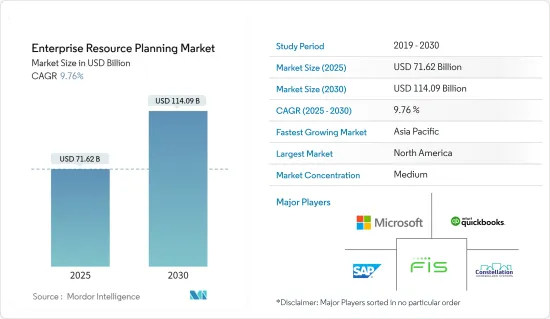

전사적 자원 계획 시장 규모는 2025년 716억 2,000만 달러, 2030년 1,140억 9,000만 달러로 추정되며, 예측 기간(2025-2030년) CAGR은 9.76%에 달할 것으로 예측됩니다.

주요 하이라이트

- ERP 소프트웨어는 조직의 재무 계획, 예산 조직, 예측 및 결산 보고를 지원합니다. 세계 기업 수가 급증하고 클라우드 기반 ERP 플랫폼에 대한 요구는 공급업체 관계 관리와 고객 관계 관리 요구를 증가시켜 시장 성장을 가속하고 있습니다.

- 혁신적이고 진보적인 기술 채택이 증가함에 따라 기존 ERP 시스템의 가치가 확대되고 타사 의존성이 최소화되고 고도로 보호되는 리소스를 사용할 수 있습니다. 재무 시스템이 진보하는 등 특히 클라우드 기반 ERP 소프트웨어 수요를 촉진하는 두드러진 요인이되었습니다.

- 고객 중심 전략의 필요성이 증가함에 따라 ERP 시장을 뒷받침하고 있습니다. 고객 만족도, 충성도 및 비즈니스 전반의 성공을 높이기 위해 고객을 비즈니스 중심에 두는 것이 얼마나 중요한지를 기업은 점점 더 인식하고 있습니다. ERP 시스템은 기업이 생산성을 향상시키고 워크플로우를 최적화하며 더 나은 고객 서비스를 제공할 수 있도록 모든 통합 용도을 제공하므로 이러한 목적을 달성하는 데 필수적입니다.

- 모바일 장치의 보급으로 모바일 친화적인 ERP 솔루션에 대한 수요가 증가하고 있습니다. 이동 중에 워크플로 승인, 중요한 기업 데이터에 대한 액세스, 의사 결정을 내릴 수 있게 함으로써 모바일 ERP 용도는 운영 민첩성을 향상시킵니다. 예를 들어, 스마트폰이나 태블릿 사용자는 SAP ERP 모바일 앱을 사용하여 필수 ERP 기능에 액세스할 수 있습니다. 이에 따라 실시간 의사결정이 용이해지고, 팀워크가 향상되어 변화하는 기업 요구에 대한 적응성이 높아지고 있습니다.

- 유연성이 부족한 ERP 시스템은 비즈니스 변화와 확장에 맞추어 진화하거나 적응하기 어려울 수 있습니다. 이러한 제약으로 인해 기업이 새로운 제품 라인을 도입하고, 새로운 시장에 진입하거나, 조직 구조의 변화에 적응하는 것이 어려워질 수 있습니다. 예를 들어, 급성장하는 비즈니스에서는 ERP 시스템을 확장하여 더 많은 양의 트랜잭션을 처리하기가 어려워지고 성능에 문제가 있거나 비즈니스에 병목 현상이 발생할 수 있습니다.

- COVID-19 이후 시대의 '비즈니스 온라인' 컨셉의 상승은 비접촉 거래에 대한 수요를 높이고, 제조업의 중소기업을 경쟁에 고전시키고 있습니다. 이 때문에 모든 활동을 실시간으로 실행할 수 있도록 하는 제조업용 ERP의 필요성이 탄생하고 있습니다.

전사적 자원 계획 시장 동향

중소기업 부문이 시장에서 가장 높은 성장을 이룰 전망

- 중소기업이란 직원 규모가 250명 이하인 기업을 말합니다. ERP의 도입으로 중소기업은 비즈니스 프로세스의 자동화와 통합을 보다 간단하고 저렴한 비용으로 이용할 수 있게 되었습니다. 확장 가능하고 유연한 ERP 소프트웨어는 중소기업에 고도로 통합된 용도에 대한 액세스를 설명합니다. 중소기업용 ERP 시스템은 비용 절감과 업무 개선에 직접적인 영향을 주어 원하는 비즈니스 성과 달성을 지원합니다.

- 중소기업은 디지털 스케줄링 및 분석 등 ERP 자동화로 빠르게 전환하고 있습니다. 지난 10년간 ERP 소프트웨어 및 서비스가 등장하여 업무가 쉬워졌습니다. 중소기업은 공정의 간소화와 자동화를 위해 ERP 소프트웨어를 채택하여 수동 입력의 필요성을 제거해 왔습니다.

- 워크플로우의 간소화, 납기의 단축, 높은 생산 능력 등의 이점이 투명성을 가져, 관리자는 보다 좋은 통찰을 얻어 효과적인 의사 결정을 할 수 있습니다. 중소기업에 실시간 재무 데이터를 제공함으로써 경쟁 우위를 확보하고 비용 절감을 실현합니다.

- 2024년 5월 유럽의 중견 및 중소기업용 ERP 소프트웨어 제공업체인 Forterro는 엔트리 레벨 클라우드 기반 ERP 솔루션인 Fortee의 영국 출시를 발표했습니다. 바로 사용할 수 있는 SaaS 솔루션으로 설계된 Fortee는 ERP 도입이 최초의 기업을 대상으로 하고 있습니다. Fortee는 Forterro의 클라우드 ERP 인 Sylob의 기반을 기반으로 조달, 생산, CRM, 공급망 관리 등 주요 기능을 전문으로 설계되었습니다.

- 세계 중소기업이 디지털 전환의 이점을 인식하고 있으며, 예산과 비즈니스 요구에 맞추어 클라우드 기반 ERP 솔루션으로 전환하고 있습니다. 복잡한 프로세스를 간소화하고 고객의 요구에 신속하게 대응하는 수요가 증가함에 따라 조사 대상 부문 시장 도입이 뒷받침되고 있습니다.

북미가 시장에서 가장 큰 점유율을 차지할 전망

- 미국에서 가장 인기 있는 ERP 솔루션에는 Oracle NetSuite, Oracle ERP Cloud, Microsoft Dynamics 365 등이 있습니다. 미국에서 ERP 소프트웨어의 도입이 증가하고 있는 배경에는 Oracle이나 마이크로소프트 등의 대기업이 있어, 부문을 통합함으로써 시장에서의 경쟁을 높이고 싶다는 기업의 요구가 있습니다.

- 또한, 이들 기업은 재무 및 운영과 같은 복잡한 기능을 지원하기 위해 중견 및 대기업을 위해 구축된 ERP 소프트웨어 솔루션을 제공합니다. 많은 공급자는 수십 년의 전문 지식과 산업 지식 덕분에 성숙한 ERP 솔루션을 제공하고 미국에서 이러한 솔루션에 대한 수요를 촉진하고 있습니다.

- Oracle Netsuite, Oracle ERP Cloud, Microsoft D365, Acumatica와 같은 ERP 솔루션은 기본 회계 시스템을 업그레이드하고 디지털 변환으로 진화하려는 중소기업을 대상으로 합니다. 또한 시장에서 돌출한 틈새를 정의하는 기업도 있어 제조업의 유통 조직에 초점을 맞추어 투자 수익률(ROI)이 매우 높은 비용 효율적인 솔루션을 제공합니다.

- 게다가 2023년 7월 샌프란시스코에 본사를 둔 Evergreen Services Group은 프라이빗 자금 지원을 받은 매니지드 IT 솔루션 기업 패밀리로, Microsoft의 골드 클라우드 파트너이자 Microsoft의 ERP 시스템 리셀러인 Western Computer를 인수했습니다. 이 인수는 미국 전역에서 B2B 서비스 기업을 인수하는 Evergreen Services Group의 전략의 일환이었습니다.

- ERP 소프트웨어는 비즈니스 프로세스를 통합하여 중복 데이터 입력을 줄이고 캐나다 조직에 이익을 줍니다. 시간을 단축하고 부서의 정확성을 높이고자 하는 고객의 요구가 커짐에 따라 캐나다에서 ERP 솔루션의 필요성이 높아지고 있습니다. 토론토와 몬트리올은 캐나다의 비즈니스 및 기술 발전을 위한 중심 허브로 상승하고 있습니다. 이 지역에서는 지역 ERP 시장에서 많은 기존 및 신흥 진출기업이 있습니다.

전사적 자원 계획 산업 개요

전사적 자원 계획(ERP) 시장은 많은 지역과 세계 진출 기업이 존재하고 반고체화하고 있습니다. 시장 벤더는 해외 고객 기반 확대에 주력하고 전략적 협업 이니셔티브를 활용하여 시장 점유율과 수익성을 높이고 있습니다. 진출기업으로는 SAP SE, Intuit, Microsoft Corporation, Constellation Software 등을 들 수 있습니다.

- 2024년 5월 Amazon Web Services(AWS)와 SAP는 비즈니스 포트폴리오 전체의 기능에 통합할 수 있는 생성형 AI 기능을 도입하기 위해 기존 제휴 관계를 확대했습니다. 이러한 확장으로 Zappos와 같은 SAP 소프트웨어를 사용하는 기업은 클라우드 기반 ERP(Enterprise Resource Planning) 플랫폼 내에서 생성된 AI 툴 세트를 활용할 수 있습니다.

- 2024년 4월 Nuvei는 가맹점이 기업 자원 계획(ERP) 시스템을 통해 송장 재무 솔루션에 직접 액세스할 수 있는 서비스를 도입했습니다. 이 통합을 통해 총계정원장의 대출 및 상환 항목이 시스템에서 자동으로 반영되어 각 대출 대상 송장과 일치합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- COVID-19 팬데믹 후유증 및 기타 거시경제 요인이 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 고객 중심주의에 대한 수요 증가

- 클라우드와 모바일 애플리케이션의 급증

- 데이터 집약형 접근법과 의사결정 채용 증가

- 시장의 과제

- 유연성의 부족과 통합의 과제

- 유지 보수 비용

- 생태계 분석

- 가격 설정과 가격 모델의 분석

제6장 시장 세분화

- 서비스별

- 솔루션

- 서비스별

- 기능별

- 인사

- 공급망

- 금융

- 마케팅

- 기타

- 전개별

- 온프레미스

- 하이브리드

- 조직 규모별

- 중소기업

- 대기업

- 산업별

- BFSI

- 이용 사례

- IT 및 통신

- 이용 사례

- 정부기관

- 이용 사례

- 소매업 및 전자상거래

- 이용 사례

- 제조업

- 이용 사례

- 석유 및 가스 에너지

- 이용 사례

- 기타 산업별 사례

- 이용 사례

- BFSI

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- SAP SE

- Intuit

- Microsoft Corporation

- Constellation Software

- FIS

- Oracle Corporation

- IBM Corporation

- Infor Inc.

- Adobe Inc.

- Sage Group PLC

제8장 벤더 점유율 분석

제9장 지역별 벤더 랭킹

제10장 투자 분석

제11장 투자 분석 시장의 미래

JHS 25.02.06The Enterprise Resource Planning Market size is estimated at USD 71.62 billion in 2025, and is expected to reach USD 114.09 billion by 2030, at a CAGR of 9.76% during the forecast period (2025-2030).

Key Highlights

- ERP software aids in planning, budgeting, forecasting, and reporting an organization's financial results. Due to a steep surge in the number of businesses worldwide and the requirement for cloud-based ERP platforms, the growing need for supplier-relationship management and customer-relationship management is augmenting the market's growth.

- The increasing adoption of innovative and advancing technologies is broadening the value of existing ERP systems, minimizing third-party dependencies, advancing highly secured resources, and advancing financial systems, among other notable factors driving the demand for ERP software, especially cloud-based.

- The growing need for a customer-centric strategy partly drives the enterprise resource planning (ERP) market. Businesses increasingly realize how crucial it is to put the customer at the heart of their operations to increase customer satisfaction, loyalty, and overall business success. ERP systems are essential to reaching this objective because they offer a full range of integrated applications that let businesses increase productivity, optimize workflows, and provide better customer service.

- Demand for mobile-friendly ERP solutions has increased due to the widespread use of mobile devices. By enabling people to approve workflows, access vital company data, and make decisions while on the move, mobile ERP apps help improve operational agility. For instance, users of smartphones or tablets can access essential ERP capabilities with SAP ERP mobile apps. This facilitates real-time decision-making, improves teamwork, and increases adaptability to shifting company needs.

- ERP systems that aren't flexible may find it difficult to evolve and adapt as businesses alter or expand. This restriction may make it more difficult for companies to introduce new product lines, enter new markets, or adapt to organizational structure changes. For instance, a business that is expanding quickly could find it difficult to scale its ERP system to handle higher transaction volumes, which could cause problems with performance and create bottlenecks in the business.

- The rise of the" business online" concept in the post-COVID-19 era increases the demand for contactless transactions, making manufacturing SMEs struggle to compete. This has created the need for ERP for manufacturing companies to enable them to run all activities in real time.

Enterprise Resource Planning Market Trends

The Small and Medium-sized Enterprises Segment is Expected to Witness Highest Growth in the Market

- SMEs are enterprises that have an employee size of fewer than 250 employees. ERP implementations have made it easier and less expensive for small and medium-sized businesses to use business process automation and integration. Scalable and flexible ERP software gives small and medium enterprises access to highly integrated applications. The ERP system for SMEs directly impacts cost savings and operational improvements, helping them achieve desired business outcomes.

- Small businesses rapidly shift to ERP automation, including digital scheduling and analysis. The emergence of ERP software and services over the last decade has made business operations easier. SMEs have been embracing ERP software to streamline and automate processes, eliminating the need for manual input.

- Benefits like ease of workflow, less turnaround time, and high production capability provide transparency, allowing managers to gain better insights and make effective decisions. It provides SMEs with real-time financial data that offers a competitive advantage and helps ensure cost savings.

- In May 2024, Forterro, a European ERP software provider for the industrial mid-market, announced the UK launch of Fortee, its entry-level cloud-based ERP solution. Designed as an out-of-the-box SaaS solution, Fortee targets organizations new to ERP adoption. Drawing from the foundation of Forterro's cloud ERP, Sylob, Fortee is tailored to focus on key functionalities for its intended audience, including procurement, production, CRM, and supply chain management.

- Small and medium enterprises across the world acknowledge the benefits of digital transformation, which drives the transition to cloud-based ERP solutions to meet their budget and business needs. The increasing demand to streamline complex processes and respond to customer demands more quickly would likely boost market adoption in the segment studied.

North America is Expected to Hold the Largest Share in the Market

- The most popular ERP solutions in the United States include Oracle NetSuite, Oracle ERP Cloud, and Microsoft Dynamics 365. The increasing adoption of ERP software in the United States is attributed to large enterprises such as Oracle and Microsoft and the need for businesses to gain a competitive edge in the market by integrating business functions.

- Moreover, these companies provide ERP software solutions built for mid and large-sized companies to assist them in complex functions such as finance and operations. Many providers offer mature ERP solutions owing to their decades of expertise and industry knowledge, promoting demands for such solutions in the United States.

- ERP solutions such as Oracle Netsuite, Oracle ERP Cloud, Microsoft D365, and Acumatica target small and mid-market companies looking to upgrade their basic accounting system and evolve through digital transformation. Others have defined a prominent niche in the marketplace, focusing on manufacturing distribution organizations and offering cost-effective solutions with a very high return on investment (ROI).

- Moreover, in July 2023, San Francisco-based Evergreen Services Group, a private equity-backed family of managed IT solutions companies, acquired Western Computer, a Microsoft Gold Cloud partner and reseller of Microsoft's ERP systems. The acquisition was part of Evergreen Services Group's strategy to acquire B2B services companies across the United States.

- ERP software benefits Canadian organizations by reducing duplicated data entry by integrating business processes. Increasing customer demand to reduce time and increase the accuracy of business functionalities is driving the need for ERP solutions in Canada. Toronto and Montreal are rising as central hubs for business and tech advancements in Canada. These areas are witnessing many established and emerging players in the regional ERP market.

Enterprise Resource Planning Industry Overview

The enterprise resource planning (ERP) market is semi-consolidated, with many regional and global players. Market vendors focus on expanding their customer base across foreign countries and leveraging strategic collaborative initiatives to increase the market's share and profitability. Some players include SAP SE, Intuit, Microsoft Corporation, and Constellation Software.

- May 2024: Amazon Web Services (AWS) and SAP expanded their existing partnership to introduce generative AI capabilities that can integrate into functions across entire business portfolios. The expansion will allow companies using SAP software like Zappos to access generative AI toolsets within the cloud-based enterprise resource planning (ERP) platform.

- April 2024: Nuvei introduced a service allowing merchants to directly access its invoice financing solutions via enterprise resource planning (ERP) systems. This integration ensures that the system automatically mirrors loan and repayment entries in the general ledger, aligning them with the respective financed invoice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 The Impact of Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Customer Centric Approach

- 5.1.2 Rapid Increase in Cloud and Mobile Application

- 5.1.3 Increase in Adoption of Data-intensive Approach and Decisions

- 5.2 Market Challenges

- 5.2.1 Lack of Flexibility and Integration Challenges

- 5.2.2 Maintenance Costs

- 5.3 Ecosystem Analysis

- 5.4 Analysis of Pricing and Pricing Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Function

- 6.2.1 HR

- 6.2.2 Supply Chain

- 6.2.3 Finance

- 6.2.4 Marketing

- 6.2.5 Other Functions

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Hybrid

- 6.4 By Organization Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By Industry Verticals

- 6.5.1 BFSI

- 6.5.1.1 Use Cases

- 6.5.2 IT and Telecom

- 6.5.2.1 Use Cases

- 6.5.3 Government

- 6.5.3.1 Use Cases

- 6.5.4 Retail and E-commerce

- 6.5.4.1 Use Cases

- 6.5.5 Manufacturing

- 6.5.5.1 Use Cases

- 6.5.6 Oil, Gas, and Energy

- 6.5.6.1 Use Cases

- 6.5.7 Other Industry Verticals

- 6.5.7.1 Use Cases

- 6.5.1 BFSI

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Intuit

- 7.1.3 Microsoft Corporation

- 7.1.4 Constellation Software

- 7.1.5 FIS

- 7.1.6 Oracle Corporation

- 7.1.7 IBM Corporation

- 7.1.8 Infor Inc.

- 7.1.9 Adobe Inc.

- 7.1.10 Sage Group PLC